PhotonPay Lands DFSA License and Makes Its UAE Move Official

Hey Payments Fanatic!

This one comes straight out of Dubai. 🇦🇪

PhotonPay just secured a Category 3D license from the Dubai Financial Services Authority.

It’s the company’s first license in the UAE and a clear step into one of the most strategic payment corridors globally.

The UAE isn’t just another expansion pin. It’s where cross-border trade, treasury hubs, and regional payments intersect. Being licensed here means local rails, compliant onboarding, and settlement that actually works for enterprises operating across borders.

As Lewison Chen said, Founder & CEO of PhotonPay, this is about scaling global coverage while staying firmly compliance-first.

"The UAE is one of the fastest-growing payment hubs and an essential corridor in global commerce. This license is a pivotal step towards our mission of scaling comprehensive global coverage and reflects our long-standing commitment to compliance", according to him.

From my seat, that’s the real signal. Growth backed by regulators, not shortcuts. Another reminder that in Payments, licenses are still the real unlock.

And staying in Dubai for a second...

There’s also a FinTech Running Club Dubai run happening in mid-February by Marina Beach. These meetups tend to quietly bring together people from Payments, FinTech, and the wider ecosystem already operating in the region.

Not an event. Not a conference. Just an informal moment where real conversations usually happen outside the usual industry settings.

Scroll down to see what else is moving today 👇 Tomorrow, I'll be back here with more updates that you deserve to know firsthand.

Cheers,

PODCAST RECOMMENDATION

🎤 Checkout.com CPO, Meron Colbeci: Invisible Payments, Agentic Commerce, and Globalising Products with Jas Shah. The episode features Colbeci discussing the role of payment service providers as the “invisible force” behind online and in-person commerce. The conversation also explores how FinTechs scale globally and Checkout.com’s role in enabling emerging trends such as agentic commerce. Watch the full interview here

NEWS

🇦🇪 PhotonPay secures new license by Dubai Financial Services Authority to expand global payment network in the UAE. The company said the milestone strengthens its compliance-focused approach and enhances its ability to support businesses operating across the Middle East with improved local payment access, onboarding, and cross-border settlement tools.

🇲🇽 Mexico’s Fincomun partners with Accion and Mastercard to improve the financial resilience of micro and small businesses, leveraging alternative data. Accion will work with Fincomun to develop embedded and digitally-enabled working capital credit for MSEs by crunching alternative data to help maximize eligibility and access.

🇱🇰 ComBank makes history as the first bank in Sri Lanka to enable Google Pay for Mastercard cardholders. Customers can transact seamlessly at contactless-enabled Point-of-Sale terminals across Sri Lanka and at any location globally where Mastercard is accepted, eliminating the need to carry physical cards.

🇨🇴 Bancolombia and Davivienda, the banks that move the most money through Bre-B. With more than 33.9 million customers and 99.2 million registered keys, Bre-B is beginning to consolidate its position in the financial system.

🇸🇦 Simplified Financial Solutions Company secures $20m Series A to scale Saudi Arabia's leading spend management platform. SiFi will deploy the new capital to expand its market presence, deepen AI-powered capabilities for finance teams, and layer additional finance workflows as it evolves into a full-suite finance management platform.

🇮🇪 Zippay vs Revolut: The battle for Ireland’s instant payments. Ireland’s major banks are launching Zippay, an instant payments service built into their mobile apps to rival Revolut. While Zippay will enable easy person-to-person payments, Revolut already has strong traction with around three million Irish users, including a large teenage base.

🇮🇳 Razorpay launches official n8n Node for no-code payment automation. This integration bridges the gap between Razorpay’s robust payment infrastructure and n8n’s visual automation platform, empowering customers to create powerful automations that previously demanded weeks of development time.

🇳🇱 Viva.com and BlueStar EMEA announce strategic partnership to power end-to-end commerce across Europe. This partnership aims to bridge Viva. com’s unified payments and embedded finance platform with BlueStar’s leading hardware and distribution capabilities.

🇲🇾 PM Modi lays out his vision for Indian-Malaysia ties in landmark visit. Prime Minister Narendra Modi announced that India’s digital payments platform UPI will soon be introduced in Malaysia, as he commenced his two-day visit to the Asian nation.

🇰🇿 Singapore's 8B enters the Kazakhstan market. 8B's expansion follows Kazakhstan's introduction of the Unified QR Code, which is expected to become mandatory for banks operating in the country. The company will process settlements with counterparties through Zesta LLP.

🇦🇪 omnispay raises $2m pre-series A led by Infinity Value Capital Group to power an "all-in-one" finance platform for SMEs. The funding accelerates omnispay's evolution from rapid merchant settlements into an AI-native, all-in-one finance platform designed to solve persistent SME cash-flow challenges.

🇦🇺 ByteFederal Australia launches ByteConnect. ByteConnect is a fully integrated, Bitcoin-enabled Payment Terminal and Online Payment Gateway leveraging blockchain technology to enable Australian merchants to accept cryptocurrency payments within a robust compliance and operational framework.

🇺🇸 Bilt customers are getting Wells Fargo cards they didn’t ask for. Wells Fargo’s split with Bilt Technologies sparked confusion after customers who closed their accounts still received Wells Fargo Autograph cards. The cards were mailed before Bilt’s deadline due to production timelines, and both firms said recipients could simply discard inactive cards.

🇺🇸 Adyen and Uber expand global partnership to power new markets, Launch Uber Kiosks. The expanded partnership reflects Uber's growing use of Adyen's global payments platform to enhance performance and offer more alternative payment methods, to support Uber's continued international growth.

🇪🇬 MNT-Halan Partners with Visa to expand its prepaid card offering and accelerate digital payments in Egypt. The partnership with Visa will enable the expansion of card issuance and distribution by leveraging Visa’s robust infrastructure and a suite of value-added services, accelerating everyday usage for digital payments.

🇺🇸 Honor Capital partners with ePayPolicy to offer financing at online checkout. With ePayPolicy's Finance Connect, insurance brokers and agencies that work with Honor Capital can now present simple financing options to payors when they pay online.

🇦🇪 Deem Finance and Biz2X launch POS-based credit solutions for UAE SMEs. Through this partnership, Deem Finance will leverage Biz2X’s AI-driven lending platform to introduce POS-based SME financing solutions, enabling eligible merchants to access credit based on real-time sales and transaction data rather than static balance-sheet assessments.

🇸🇳 Wave, Visa, and Ecobank Senegal launch virtual card to expand online payments. The virtual card enables users to make online payments on international e-commerce platforms, subscription services, ticketing sites, and digital streaming platforms, without requiring a traditional bank account or a physical card.

🇺🇸 Hylaq wins Coinbase and Stripe approval to enable handle-based payment solutions, enabling compliant fiat-to-crypto and crypto-to-fiat transactions. The platform uses human-readable handles instead of wallet addresses to simplify transfers while remaining fully non-custodial, with users retaining control of funds and private keys.

🇸🇬 Ebanx promotes Eduardo de Abreu to CPO and Singapore CEO amid APAC expansion. Credited with being a driving force behind Ebanx's expansion into Africa, India, and the Philippines, Abreu will now relocate to Singapore to oversee the firm's "global product roadmap as the company strengthens its presence in the APAC region", according to a company statement.

GOLDEN NUGGET

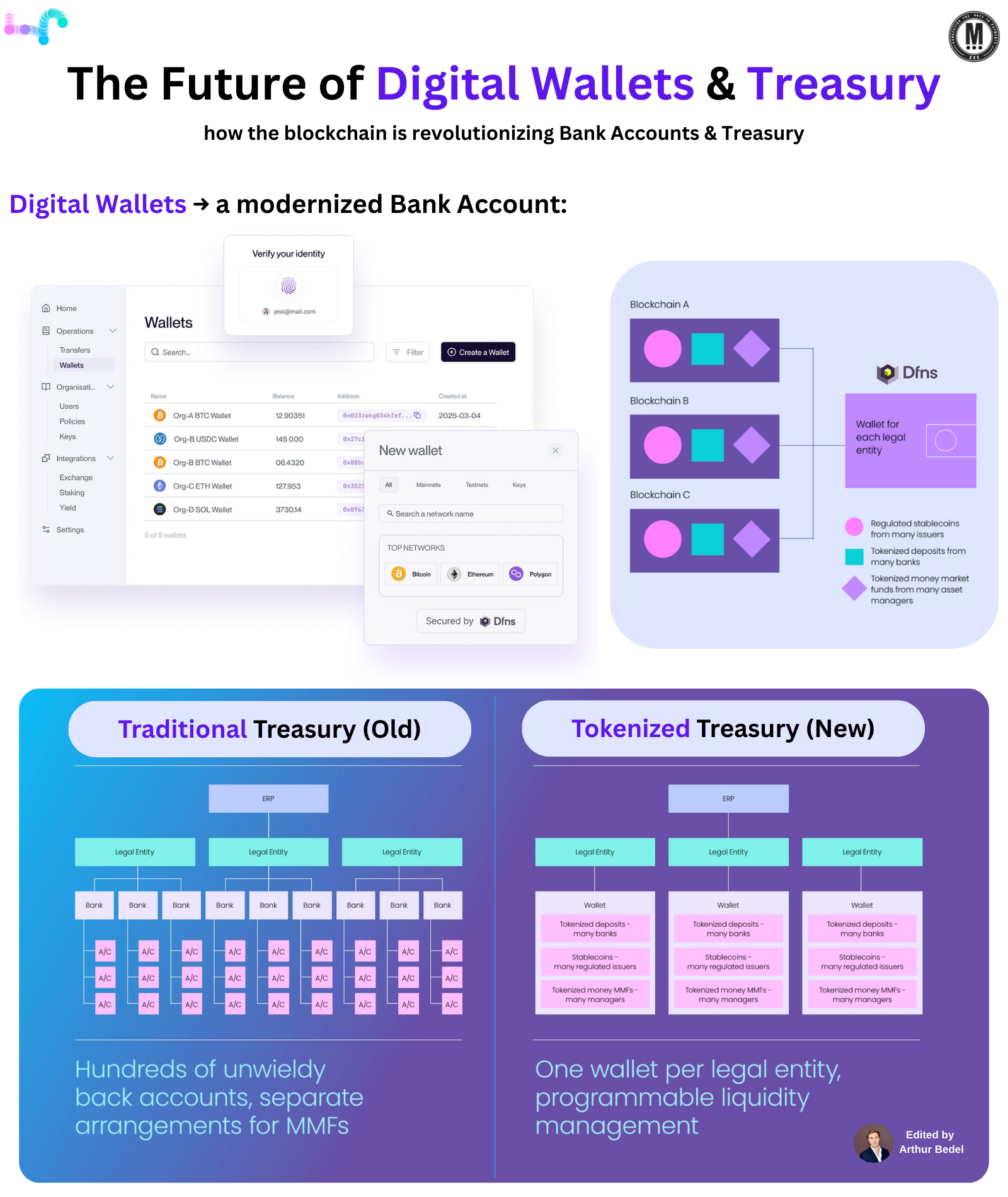

The Future of 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 & 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 — by Finmo, Ubyx Inc. & Dfns👇Created by Arthur Bedel 💳 ♻️

The next chapter of finance isn’t about replacing banks — it’s about upgrading the financial infrastructure with blockchain as the new back-end infrastructure.

1️⃣ Digital Wallets → a modern version of a Bank Account

→ A place to hold funds safely

→ A tool to send & receive money

→ A system that manages balances across entities with financial products

What’s new is not the concept — it’s the technology behind it. Instead of siloed accounts in banks, wallets can hold tokenized deposits, regulated stablecoins, and even tokenized money market funds.

2️⃣ The future of Bank Accounts → Digital Wallets with Programmability & Global Reach

✔ Store assets across issuers (deposits, stablecoins, tokenized funds)

✔ Operate 24/7 with instant settlement

✔ Manage liquidity across multiple entities & regions

✔ Provide transparent audit trails through blockchain

Bank Accounts (old) → Digital Wallets (new)

3️⃣ Treasury: Traditional vs Tokenized

🔹 Traditional Treasury (Old):

→ Hundreds of fragmented bank accounts across legal entities

→ Settlement delays, cut-off times, trapped liquidity

→ Manual reconciliation & heavy admin

🔹 Tokenized Treasury (New):

→ One wallet per entity, programmable liquidity flows

→ Stablecoins + tokenized deposits + MMFs in a unified structure

→ Real-time, automated settlement across jurisdictions

→ Lower costs, reduced friction, global visibility

Traditional Treasury → Tokenized Treasury 2.0

4️⃣ Blockchain is becoming the operating layer of Financial Markets:

→ Banks are joining initiatives like the #Canton blockchain to tokenize assets & move funds

→ Stablecoins (USDC, EURC) are now trusted money-movement rails, on and off-ramped into cards, accounts, and APMs

→ Crypto and tokenized funds enable transactions that don’t touch fiat until the very end — or never at all

Money movement → Stablecoins & Blockchain Rails

5️⃣ The Ecosystem is Ready

→ Banks are issuing tokenized deposits (JPMorganChase, Lloyds Banking Group)

→ Stablecoins are regulated and adopted at scale

→ Asset managers like Franklin Templeton are tokenizing MMFs

Companies like Dfns, Finmo, Ubyx Inc. are creating the modern infrastructure, the digital gateway and banking infrastructure alongside traditional players for enterprises:

→ CFOs will run liquidity through AI-driven wallet infrastructures

→ Settlement will become atomic, global, and programmable

→ Wallets will evolve into the 2nd cash rail for enterprises, as essential as bank accounts

🚨 This isn’t about abandoning banks. It’s about building on top of them — upgrading financial plumbing with blockchain, stablecoins, and tokenization.

→ The question is: how fast will enterprises embrace wallets as the new operating system for money?

Source: Finmo | Ubyx Inc. | Dfns

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()