PhotonPay Teams Up with Stripe to Scale Online Payments Globally

Hey Payments Fanatic!

PhotonPay is scaling its global footprint by partnering with Stripe, and this one is all about execution at scale.

PhotonPay is deepening its Stripe integration to strengthen online acquiring across 20+ markets and 100+ currencies, while keeping a single, unified capital management interface for merchants.

Cards, wallets, local bank transfers, real-time payments, covered, localized, and routed intelligently.

What caught my eye here isn’t just coverage. It’s how this scales. Stripe’s modular tech shortens time to market, while PhotonPay’s AI-driven routing, smart retries, and real-time risk engine work to reduce checkout abandonment.

As Chao Xu, VP of Product at PhotonPay, put it: this is about building a unified and resilient payments layer that actually works across borders...

Also, Mexico’s Payment Infrastructure Keeps Leveling Up 🇲🇽

Tapi just raised US$27M to scale payment and collection rails across the country.

After a breakout 2025, hitting profitability and processing 250M+ annual transactions, this round, led by Kaszek, is about doubling down on interoperability in a market still shaped by cash and fragmented systems.

“In less than 18 months, we grew volume tenfold and reached profitability,” said Tomás Mindlin. The focus now: build the most robust payment network in Mexico, bridging physical and digital rails for recurring and everyday payments.

What else is quietly shifting across Payments today? Scroll down 👇 I'll be back tomorrow with more news from the sector around the world.

Cheers,

INSIGHTS

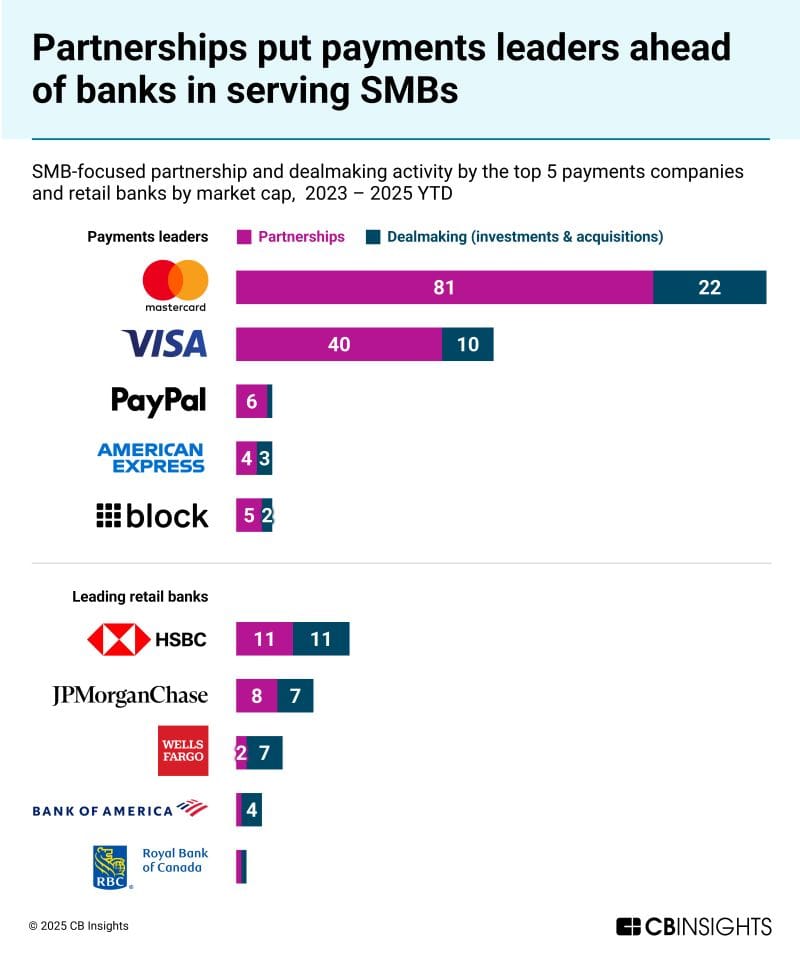

📊 SMB-focused partnership and dealmaking activity by the top 5 payments companies and retail banks by market cap, 2023–2025 YTD 👇

NEWS

🇭🇰 PhotonPay scales global footprint with Stripe to deliver next-gen online payment solutions. By integrating Stripe's robust infrastructure, PhotonPay is elevating its online acquiring capabilities, ensuring merchants can scale seamlessly across multiple regions with unmatched efficiency and reliability.

🌏 Mastercard launches portfolio of fleet solutions in Asia Pacific. The solutions are strategically engineered to support different market maturities and customer segments, from SMEs with small fleets to large logistics operators. Mastercard Fleet: Next Gen unifies payments data, turning transactions into actionable insights embedded across fleet management workflows.

🇨🇳 The European Travel Commission and Mastercard launch a new European travel co-branded card for Chinese visitors. The new card is designed to support seamless and secure payment experiences for Chinese travellers visiting Europe, as demand for long‑haul travel and premium cultural experiences continues to recover.

🇬🇧 Noah and Sumsub partner to deliver the fastest, most scalable compliance and verification engine for modern money. Through the partnership, any client using Noah’s high-speed rails and accounts can now onboard users in seconds, with greater accuracy, fraud protection, and success rates, thanks to Sumsub’s automated verification.

🇦🇪 Equiti Group partners with Checkout.com to expand worldwide payments. Equiti Clients will experience faster funding, smoother withdrawals, and a wider range of payment options, as well as improved transaction speed and reliability for high-value, time-sensitive domestic and cross-border transactions.

🇲🇽 Tapi raises US$27 million to scale Mexican payment infrastructure. Tapi intends to use the new capital to expand its technical team, which constitutes more than 70% of the total structure of the organisation. Read more

🇶🇦 SkipCash raises $4m Series A to expand digital payments across GCC. The funding will be used to scale SkipCash’s payment infrastructure and broaden its footprint across GCC markets as demand for seamless digital transactions continues to rise.

🇺🇸 Visa acceptance platform now supports tap to pay on iPhone, boosting contactless acceptance for merchants. Merchants can accept all forms of contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets, wherever they do business, and the solution supports Visa and other major card networks.

🇦🇺 Vault selects Thredd as strategic issuer processing partner for Australia and UK expansion. The partnership enables Vault to run a diverse portfolio of card programmes leveraging Thredd’s full-stack issuing and processing capabilities, including virtual and physical cards, tokenization, fraud monitoring, 3DS, digital wallet integrations and transaction controls.

🇳🇱 Dutch Minister states Klarna is not registered in the debt collection registry and may be in breach of regulations. Parliamentary responses suggest Klarna falls under the Dutch Debt Collection Quality Act, which would require such registration, prompting questions about whether its activities legally qualify as debt collection.

🇦🇺 Revolut unveils unified payments platform for Australia. The company said Australian businesses can accept payments, settle funds, and manage payment operations through a single platform alongside their business account. Additionally, Revolut Business enters Singapore’s merchant payments market, allowing businesses to accept online and in-person payments from a single platform. The launch brings merchant acquiring into the Revolut Business account, combining account-to-account, online, and in-store payments.

🇦🇺 Finance platform LemFi launches remittance services in Australia as global expansion continues. As an independent remittance platform, LemFi can now directly provide its remittance services to Australian residents, offering competitive exchange rates, fast transfers, and low-cost fees.

🇬🇧 PayPal-backed Modulr banks its first full-year profit. Myles Stephenson, CEO and co-founder, heralded the achievement as an important milestone. He said: “It gives us control over our destiny: the ability to invest in products for our customers, expand globally, and pursue strategic opportunities.”

🇨🇳 China starts paying interest on digital yuan in latest bid to extend its reach, aiming to encourage use as an alternative to the dollar for cross-border transactions. China is focusing on using the digital yuan to expand cross-border transactions by businesses.

🇺🇸 ACH Network Volume hits record highs amid surge in faster payments. B2B payment volume rose nearly 10% in 2025, reaching 8.1 billion payments. Health care claim payments from insurers to medical and dental providers also saw a 7.3% increase, nearing 548 million transactions.

🇮🇪 Bank of Ireland contactless payments reached record levels in Q4. Contactless card transactions, including digital wallets (Apple Pay/Google Pay), increased by 10% when compared to Q4 2024, whilst contactless ‘tap and go’ payment levels rose by 4%.

🇺🇸 Tether retreats from $20bn funding ambitions after investor pushback. Tether CEO Paolo Ardoino has downplayed its planned funding round after investors pushed back on a $500bn valuation. Continue reading

🇺🇸 Bolt expands its SuperApp with embedded investing through Atomic. Through the partnership, Bolt will offer consumers the ability to open brokerage accounts, trade stocks and ETFs and invest through automated managed portfolios directly within the Bolt experience.

🇮🇹 Hype launches SplitHype. The new feature is designed to simplify group expense management and reduce friction, billing, and arguments among friends, families, or roommates. It is integrated directly into the app and is available to all Hype customers, regardless of their plan.

🇳🇬 Nomba acquires licensed Canadian payments firm to power Africa–Canada trade. According to the company, the acquisition, completed in Q2 2025, provides Nomba with regulatory coverage in Canada, enabling it to move money locally within the country and connect Canadian dollar payment flows directly to African markets.

🇧🇷 dLocal partners with DHL Express Brazil to automate Pix payments and accelerate parcel release. The integration replaces manual payment checks with real-time confirmation, improving customer experience and operational efficiency across Brazil.

🇬🇧 Chimera Wallet, in partnership with Wirex, is launching the Chimera Card, a Bitcoin-funded debit card designed for everyday spending while keeping users in control through self-custody. The card can be funded directly from a Bitcoin wallet via on-chain or Lightning payments and used at over 80 million merchants worldwide, converting Bitcoin to fiat at checkout with transparent pricing.

🌍 BBVA joins banking consortium to issue European stablecoin. The aim is to enable faster and cheaper payments, as well as the settlement of digital assets within a regulated environment backed by all the safeguards that a European bank can offer.

GOLDEN NUGGET

𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧-𝐁𝐚𝐜𝐤𝐞𝐝 𝐂𝐚𝐫𝐝𝐬: where liquidity meets everyday payments 👇Created by Arthur Bedel 💳 ♻️

𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 are no longer just a settlement rail or a treasury tool. They’re increasingly becoming a spendable balance, seamlessly connected to cards and accepted anywhere traditional cards are.

This is the 𝐫𝐢𝐬𝐞 𝐨𝐟 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧-𝐛𝐚𝐜𝐤𝐞𝐝 𝐜𝐚𝐫𝐝𝐬 — a powerful bridge between on-chain value and off-chain commerce.

Companies like Pomelo, alongside issuers, processors, and networks, are helping turn digital dollars into everyday payment experiences.

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧-𝐛𝐚𝐜𝐤𝐞𝐝 𝐜𝐚𝐫𝐝𝐬?

They are card products where the underlying source of funds is a stablecoin balance, while the payment experience remains fully familiar:

→ Swipe, tap, or pay online

→ Merchant receives fiat

→ Card networks settle as usual

→ Stablecoins are converted, debited, or reconciled in the background

To the user, it feels like a normal card.

Under the hood, it’s a programmable, blockchain-native money flow.

𝐓𝐡𝐞 𝐤𝐞𝐲 𝐛𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐛𝐥𝐨𝐜𝐤𝐬

1️⃣ 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐛𝐚𝐥𝐚𝐧𝐜𝐞𝐬

Typically USDC or USDT, offering price stability and global liquidity.

2️⃣ 𝐂𝐚𝐫𝐝 𝐢𝐬𝐬𝐮𝐢𝐧𝐠 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞

Virtual or physical cards connected to global networks, abstracting crypto complexity from merchants.

3️⃣ 𝐎𝐧-𝐜𝐡𝐚𝐢𝐧 ↔ 𝐨𝐟𝐟-𝐜𝐡𝐚𝐢𝐧 𝐨𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧

Real-time conversion, authorization logic, and reconciliation between blockchain rails and card rails.

4️⃣ 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 & 𝐜𝐨𝐧𝐭𝐫𝐨𝐥𝐬

KYC, transaction monitoring, limits, and program rules — aligning crypto liquidity with regulated card programs.

5️⃣ 𝐅𝐫𝐨𝐦 𝐁𝐚𝐧𝐤 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐬 𝐭𝐨 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

Funds are available on digital wallets (Dfns), traditional accounts (Chase), cards (Brex), traditional wallets (PayPal) and more.

→ This is what allows stablecoins to behave like money you can actually spend.

𝐖𝐡𝐲 𝐭𝐡𝐢𝐬 𝐦𝐨𝐝𝐞𝐥 𝐢𝐬 𝐠𝐚𝐢𝐧𝐢𝐧𝐠 𝐭𝐫𝐚𝐜𝐭𝐢𝐨𝐧

𝐆𝐥𝐨𝐛𝐚𝐥 𝐚𝐜𝐜𝐞𝐬𝐬

Stablecoin-backed cards work across borders without relying on local banking infrastructure.

𝐅𝐚𝐬𝐭𝐞𝐫 𝐥𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲

Funds move on-chain in minutes, not days — especially powerful for emerging markets and x-border users.

𝐏𝐫𝐨𝐠𝐫𝐚𝐦𝐦𝐚𝐛𝐢𝐥𝐢𝐭𝐲

Cards can be linked to rules, limits, categories, or automated flows — smarter financial products.

𝐔𝐬𝐞 𝐜𝐚𝐬𝐞𝐬

Creators, marketplaces, and fintechs can pay and get paid without ever touching traditional rails.

𝐓𝐡𝐞 𝐛𝐢𝐠𝐠𝐞𝐫 𝐬𝐡𝐢𝐟𝐭

Stablecoin-backed cards aren’t about replacing cards. They’re about redefining what backs them.

We’re moving from:

→ Bank accounts as the default source of funds

to:

→ Tokenized, programmable, globally portable balances on digital wallets - i.e. Dfns!

It's moving.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()