Pix Just Broke TWO Records in One Day 🤯

Hi Payments Fanatic,

Pix is out here speed-running the record books. On Friday (Sept 5), Brazil’s instant payments system 🇧🇷 smashed two all-time highs in a single day 🤯:

- 290 million transactions (previous record: 276.7M in June)

- R$164.8 billion processed (up from R$135.6B in June)

Not bad for a platform that only launched four years ago.

Scroll down for more payments stories that (almost) keep up with Pix 😉

Cheers,

ARTICLE OF THE DAY

🇦🇪 The Power of a Good Gift (Card): Digital Gifting in the UAE. Gift cards plug directly into the payment and loyalty system: they’re as easy to send as a text message but as rewarding as in-person presents. Majid Al Futtaim’s answer is an all-in-one digital gift card linked to the SHARE loyalty program. Explore the full article

NEWS

🎤 How Stablecoins are Transforming the Global Landscape with Tom Warsop, President & CEO at ACI Worldwide. Warsop joins Remy Blaire in the rapidly evolving global payments industry, focusing on the significant role of stablecoins in shaping the future of digital payments.

🇬🇧 Elliptic powers risk intelligence for BVNK’s Layer1, enabling stablecoin payments, trading, and settlement at scale. Customers gain real-time, multi-asset wallet screening across any cryptoasset with tradable value, from stablecoins to ERC-20 tokens and major networks like Bitcoin and Ethereum.

🇧🇷 Pix breaks two records in a single day. Pix broke a new record for transactions, according to the Central Bank: there were 290 million transactions. The previous record was in June of this year, with 276.7 million transactions. Read more

🇬🇧 Lloyds closes in on £120M takeover of FinTech Curve. The financial services giant believes Curve's digital wallet platform will be a valuable asset amid growing regulatory pressure on Apple to open its payment services to rivals. Curve is a provider of digital wallet technology.

🇮🇳 Prosus-backed PayU plans to raise $300 million ahead of proposed IPO. The fundraising plan precedes the company's proposal to list on the stock exchange, with the minority stake sale planned to gauge investor demand and establish a valuation benchmark for the IPO.

🇮🇪 AIB, Bank of Ireland, and PTSB will launch Zippay early next year, a person-to-person mobile payment service that will be available to the retail banks’ 5m customers. Service on banks’ apps will allow customers to send, request, and split payments using contacts' mobile numbers.

🇺🇸 Aiwyn acquires QuickFee's US payments business. This strategic partnership strengthens Aiwyn Payments' positioning as a leading payments and collection platform for technology-driven accounting firms. Through its partnership with QuickFee, Aiwyn is further expanding its product suite.

🇺🇸 Navro acquires money transmitter licence in Washington, D.C. The license underscores Navro’s focus on operating within the most robust regulatory frameworks and delivering the highest levels of compliance required by ambitious international businesses.

🇺🇸 FinTech Wise plans Texas hiring spree ahead of New York listing. Wise is hiring dozens of staff and expanding its office space in Texas as the financial technology firm looks to grow its US business ahead of shifting its main stock listing there. The firm is taking two additional floors of the Domain Tower in Austin’s business district.

🇺🇸 Stripe challenger Rainforest lands $29M Series B. Rainforest bills itself as a “payments-as-a-service” provider. Put simply, it aims to help vertical software companies enable payment processing for their merchants. Keep reading

🇩🇪 PayPal stumbles during reboot, and security chaos endangers trust. A programming error crippled millions of customer accounts in Germany, and banks stopped transactions worth billions. A piece of code was lost during an update, and security filters were disabled for several hours.

🇨🇦 Corpay cross-order named the Official FX Partner of the International Tennis Federation. Through this partnership, the ITF will be able to use Corpay Cross-Border’s innovative solutions to help mitigate foreign exchange exposure in its daily operations.

🇺🇸 Paxos proposes a Hyperliquid-first stablecoin and allocates yield to HYPE buybacks. According to the announcement, 95% of interest earned from USDH reserves would be used to buy back Hyperliquid’s native token HYPE, redistributing it to users, validators, and partner protocols.

🇺🇸 Spinwheel secures strategic investment from Citi Ventures to accelerate the future of the consumer credit ecosystem. The funding will support Spinwheel’s continued go-to-market growth, expand its agentic AI platform, and build out its data sets and product offerings.

🇧🇷 AEON Pay launches crypto scan-to-pay with PIX QR code in Brazil. Brazilian users can now simply scan merchants' PIX QR codes and complete purchases with their crypto assets, and AEON automatically settles the payment to merchants in Brazilian Real (BRL) via PIX, the nation's instant payment network.

🇰🇿 Kazakhstan launches pilot for USD-pegged stablecoin payments. By leveraging stablecoins, the regulator aims to enhance the efficiency and transparency of financial settlements while testing the risks and benefits of integrating digital assets into formal regulatory frameworks.

🇺🇸 equipifi joins Jack Henry to expand BNPL access for banks. The collaboration highlights the increasing significance of BNPL as a vital component of digital banking transformation, aligning with financial institutions’ efforts to provide innovative, customer-centric solutions.

🇺🇸 Marqeta announces appointment of Mike Milotich as CEO. “After completing a thorough search, the Board determined that Mike is the right CEO for Marqeta. With Mike at the helm, Marqeta is well-positioned to execute our strategy and deliver long-term value for our shareholders,” said Judson C. Linville, Chair of the Marqeta Board.

GOLDEN NUGGET

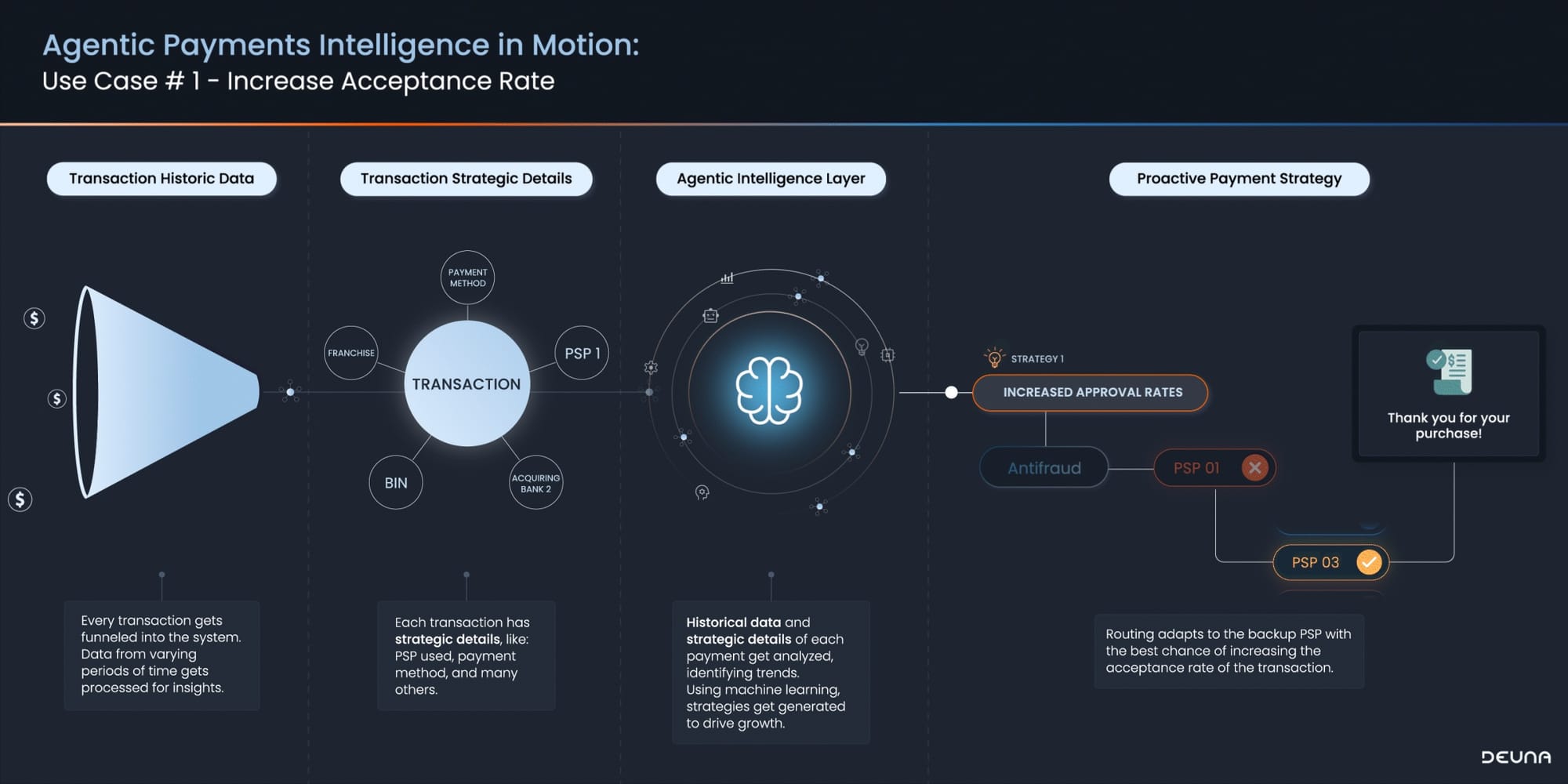

🚨 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐢𝐧 𝐌𝐨𝐭𝐢𝐨𝐧 — How to Increase Acceptance Rates by DEUNA 👇 Created by Arthur Bedel 💳 ♻️

In the modern payments ecosystem, every millisecond and every routing decision can be the difference between a lost sale and a successful transaction.

This use case demonstrates how historical and strategic transaction data — when processed through an Agentic Intelligence Layer — drives proactive, high-impact strategies for performance optimization and growth.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐢𝐧 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 𝐑𝐚𝐭𝐞𝐬

Agentic intelligence transforms payments from a passive process into an active, reasoning system that adapts in real time.

1️⃣ 𝐃𝐞𝐞𝐩 𝐃𝐚𝐭𝐚 𝐂𝐨𝐧𝐭𝐞𝐱𝐭

Historical trends are merged with granular transaction specifics (PSP, payment method, BIN, card franchise, acquirer) to surface patterns that influence approval probability.

→ eBay consolidates multi-market PSP and acquirer data to build a unified acceptance model that identifies the most successful routing combinations per market.

2️⃣ 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐢𝐧 𝐀𝐜𝐭𝐢𝐨𝐧

Increased Approval Rates – Adaptive routing automatically directs a transaction to the PSP with the highest probability of approval, especially during issuer-specific performance drops.

→ Getnet merchants could in LATAM use ATHIA to detect downtime and re-route transactions in milliseconds, avoiding unnecessary declines.

3️⃣ 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫 𝐂𝐨𝐬𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

Selecting the optimal provider not just for approval rates, but also to minimize fees and maximize ROI based on geography, acquirer cost structures, and cross-border rules.

→ Microsoft leverages multi-PSP routing logic to dynamically switch to cost-effective acquirers during high-volume seasonal campaigns.

4️⃣ 𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧

Intelligent allocation of fraud tools based on the transaction’s risk profile, ensuring low-risk customers experience minimal friction.

→ Checkout.com merchants assign lighter authentication flows for repeat low-risk customers while applying stronger controls for first-time high-value purchases.

𝐓𝐡𝐞 𝐑𝐞𝐬𝐮𝐥𝐭 -> Intelligent Growth at Scale:

✅ Higher acceptance rates through real-time routing adaptation

✅ Lower processing costs via optimal provider selection

✅ Reduced false declines without compromising security

✅ Frictionless checkout experiences tailored to risk profile and geography

𝐀𝐈 𝐢𝐧 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐢𝐬 𝐧𝐨 𝐥𝐨𝐧𝐠𝐞𝐫 𝐣𝐮𝐬𝐭 𝐚𝐛𝐨𝐮𝐭 𝐚𝐮𝐭𝐨𝐦𝐚𝐭𝐢𝐧𝐠 𝐭𝐚𝐬𝐤𝐬 — 𝐢𝐭’𝐬 𝐚𝐛𝐨𝐮𝐭 𝐚𝐧𝐭𝐢𝐜𝐢𝐩𝐚𝐭𝐢𝐧𝐠 𝐜𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐚𝐧𝐝 𝐞𝐱𝐞𝐜𝐮𝐭𝐢𝐧𝐠 𝐨𝐩𝐭𝐢𝐦𝐚𝐥 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐞𝐬 𝐛𝐞𝐟𝐨𝐫𝐞 𝐚 𝐥𝐨𝐬𝐬 𝐨𝐜𝐜𝐮𝐫𝐬. With agentic intelligence, merchants can turn acceptance rate optimization into a measurable, scalable growth lever.

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()