Pix Parcelado in Brazil Faces Regulatory Delay… but Guess What’s Putting Millions at Risk?

Hey Payments Fanatics!

Brazil’s Central Bank and major banks just hit a standstill, delaying long-promised rules for Pix Parcelado.

The rules were expected in October to bring clarity to consumers. Nothing came out. And every bank keeps pushing its own version of the product, with zero standardization.

It’s marketed as a simple installment option. In reality, it’s a credit with interest from day one. Rates around 5% a month. CET closer to 8%. Not exactly transparent.

Consumer advocates are worried. More confusion. More friction. More room for over-indebtedness to spike. So, everything is still really unpredictable...

Curious to stay on top of today’s Payments moves? Scroll down and catch the highlights 👇

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🌍 Mollie Capital has provided over €250M in funding to European businesses, enabling them to launch new product lines, expand internationally, run major marketing campaigns, and pursue growth opportunities that traditional banks often slow down with lengthy processes.

🇧🇷 Disagreement between the Central Bank and banks delays Pix installment payment regulation and leaves Brazilians at risk. The delay in regulation is viewed with concern by consumer protection agencies, which warn of the risk of over-indebtedness among the population.

🇺🇸 Elon Musk's X Money searches for a 'payments platform' tech lead, and Solana is eager to help. X Money is looking to hire an engineer who can help oversee the building of a “new payments platform” meant to serve more than 600 million monthly users. The scope of the role suggests X is building its own infrastructure rather than relying primarily on third-party providers.

🇻🇳 Vietnam-China QR-code retail payment connectivity launched. The bilateral QR-code retail payment connectivity will establish a comprehensive cross-border QR payment ecosystem, boosting tourism, trade, and consumer spending between the two countries.

🇬🇧 Navro adds BVNK stablecoin payments for faster global payouts. The capability expands Navro’s one-API platform. The company said the addition of stablecoins aligns with its strategy to offer “the best payment services in every region” through a unified infrastructure.

🇬🇧 Currensea appoints former Amex and Wise exec Enrique Garland as COO. Enrique’s deep knowledge of the rewards space in the UK and Europe will support Currensea’s mission to redefine everyday loyalty. He brings a wealth of experience across both partnerships and operations within the financial services industry.

🇨🇱 Evertec rules out launching its own acquiring network and seeks to grow with Banchile Pagos. The company has invested US$100 million in Chile and in 2026 will focus on payment issuance processing and multi-acquiring in retail. Keep reading

🇮🇳 Pine Labs delivers back-to-back profitable quarters. The firm’s revenue increased by 18% during the second quarter, to Rs 650 crore in Q2 FY26 from Rs 551 crore in the same quarter last year. Read more

🌍 Visa helps launch new digital wallets in Europe, in partnership with BBVA, Klarna, and Vipps MobilePay, and is collaborating with BANCOMAT on a pilot planned for early 2026. These launches reflect Visa’s commitment to supporting local and regional players with the scale, security, and reliability of our global network,” said Mathieu Altwegg, Head of Product & Solutions, Visa Europe.

🇬🇧 OpenPayd to power Altify’s multi-currency on/off ramps. Through the integration, Altify now offers seamless access to GBP, EUR, and USD deposits and withdrawals via SEPA, Faster Payments, and SWIFT, enabling fast and reliable money movement across its global ecosystem.

🇧🇷 Cumbuca launches to help international firms enter the Brazilian payments market. Brazil’s rapidly expanding FinTech market offers strong opportunities but is difficult for international firms to enter due to licensing, geopolitical risks, and dependence on third-party providers; Cumbuca addresses this by acting as a regulated proxy that grants direct central bank access and operational control.

GOLDEN NUGGET

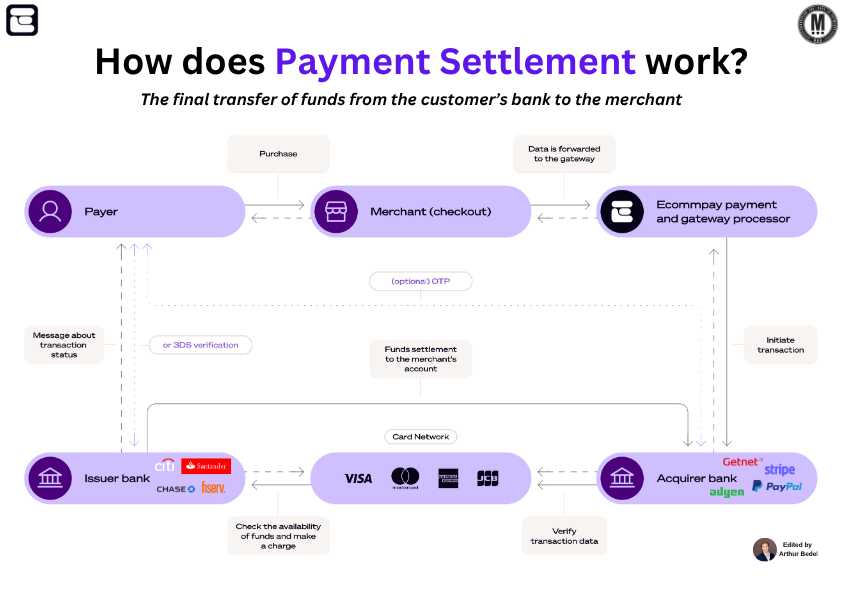

How does 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 actually work? — by Ecommpay 👇Created by Arthur Bedel 💳 ♻️

Behind every tap, swipe, or click lies a coordinated exchange of trust between banks, networks, processors, and merchants.

When a customer pays, it looks instant — but the actual movement of funds happens after a sequence of authorization and verification messages. The “settlement” is the final step that moves money from the customer’s bank to the merchant, ensuring accuracy, security, and compliance.

𝐒𝐭𝐞𝐩-𝐛𝐲-𝐒𝐭𝐞𝐩 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 𝐅𝐥𝐨𝐰

1️⃣ Customer (Payer) initiates a purchase at checkout.

2️⃣ The Merchant Checkout System forwards the transaction data to the Payment Gateway / Processor — for example, Ecommpay.

3️⃣ The Payment Processor sends the authorization request to the Acquiring Bank, such as Getnet, Stripe, Adyen, or PayPal operating in an acquiring role.

4️⃣ The Acquirer passes the request to the Card Network (Visa, Mastercard, American Express, Discover).

5️⃣ The Card Network routes the request to the Issuer Bank (e.g., Santander, Citi, Chase, Fiserv).

6️⃣ The Issuer checks:

→ Card validity

→ Funds or credit availability

→ Risk and authentication (3DS, OTP where required) — then approves or declines the transaction.

7️⃣ The authorization decision travels back through the chain:

Issuer → Card Network → Acquirer → Processor → Merchant → Customer.

8️⃣ Once approved, Settlement occurs later:

→ The issuer transfers funds to the acquirer,

→ The acquirer deposits funds into the merchant’s account,

→ Typically T+1 to T+3 days, depending on region and setup.

This workflow ensures that merchants are paid reliably, customers are protected, and every party in the chain is aligned. It’s less about moving money instantly, and more about moving trust, safely and verifiably, at scale.

And while this system took decades to build, it is now evolving again — with real-time payment rails, tokenization, optimized routing, and intelligent acquiring strategies reshaping how settlement is managed globally.

The tap takes a second. The infrastructure behind it is the result of millions of transactions proving trust, every day.

Source: Ecommpay

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()