Pomelo Strengthens Skrill in Argentina, Bolt Redefines Payments in the US

Hey Payments Fanatic,

From Buenos Aires to San Francisco, wallets are getting an upgrade.

In Argentina, Skrill teamed up with Pomelo to launch a prepaid Mastercard that lets users tap straight into their digital balances for everyday shopping. A simple card, but a big step in making wallets spendable in the real world.

Meanwhile, in the U.S., Bolt just pulled the curtain on its all-in-one SuperApp. A single platform blending banking, crypto, rewards, shopping, and AI-powered commerce.

Instead of juggling half a dozen apps, consumers can now pay, trade, earn, and shop all under one roof.

"The future of money and commerce isn't siloed—it's seamless," said Ryan Breslow, Founder and CEO of Bolt.

Different plays, same trend: whether it’s a single card in Buenos Aires or a one-stop app in San Francisco, the future of payments is all about simplifying how we spend.

Cheers,

INSIGHTS

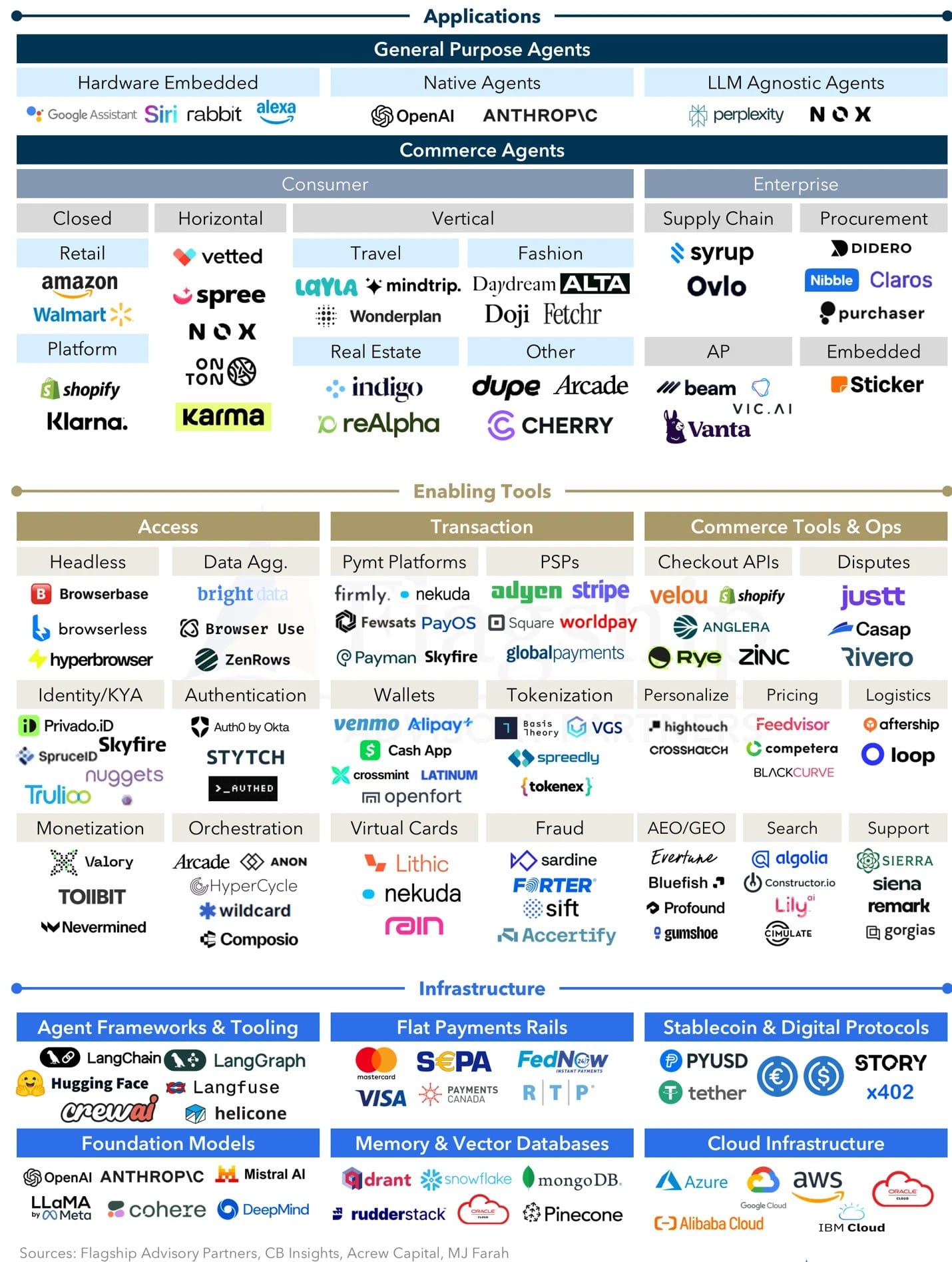

💰 ARK Invest forecasted that AI agents could facilitate nearly $9 trillion‼️ in payments by the end of the decade (25% of ecommerce), growing from basically zero today 🤯

NEWS

🇦🇷 Skrill launches its prepaid card powered by Pomelo in Argentina. This new solution connects users' digital balance to their everyday needs, allowing them to make purchases in physical stores or online merchants nationwide. The card is easy to use, secure, and backed by our world-class infrastructure.

🇺🇸 Sibos Uncorked: a toast to what’s next in payment with ACI Worldwide. ACI Worldwide is offering bold insights and engaging conversations at its exclusive Sibos cocktail hour. Attendees are invited to join on 30 September from 4:30 PM to 6:30 PM at booth C073 to explore the future of payments.

🇪🇸 PagoNxt Explores the A2A payments boom. It highlights the rapid rise of account-to-account (A2A) payments, revealing how evolving technology, regulatory changes, and shifting customer expectations are transforming global money movement. The report outlines key opportunities A2A presents for banks, FinTechs, and corporates, positioning PagoNxt at the forefront of this accelerating payments shift.

🌎 Solidgate partners with EBANX: Simplifying your entry into Latin America and emerging markets. Integrated into the Solidgate orchestration platform, EBANX enables merchants to access local payment methods, accelerate market entry, improve approval rates, and streamline operations across key LatAm countries and beyond, all through a single API connection.

🇸🇦 Qoyod and HALA have announced a strategic partnership to support the growth and success of SMEs in Saudi Arabia. By integrating HALA’s advanced payment technologies with Qoyod’s comprehensive business management platform, the collaboration aims to enhance operational and financial efficiency for SMEs.

🇪🇸 Santander accelerates the signing of alliances in the payments business. The bank is seeking to expand its services and introduce new solutions to its portfolio. In this context, its subsidiary Getnet has just announced an agreement with FinTech company Payrails to leverage its cutting-edge technology.

🇺🇸 Bolt launches SuperApp, combining finance, crypto, and rewards all in one platform. Bridging the fiat-crypto gap and giving users a unified way to shop, spend, save, earn, and invest. The SuperApp now offers crypto trading, peer-to-peer transfers, digital banking, and commerce all in one integrated platform, eliminating the need for multiple standalone apps.

🇪🇺 ECB to conduct new digital euro experiments next year. The European Central Bank announced that it will conduct new experiments next year to explore the potential of a digital euro, marking a further step in a project it views as crucial for preserving the euro zone's financial autonomy from the United States.

🇺🇸 Citi and Dandelion collaborate to transform cross-border payments, enabling full value, near-instant payments into digital wallets across the globe. The collaboration empowers Citi’s institutional clients to deliver near-instant, full-value payments into digital wallets across the globe, with near 24/7 availability.

🇹🇷 Yapı Kredi and Mastercard usher in a new era of digital payments in Turkey. Thanks to this pioneering collaboration, Yapı Kredi customers will be able to complete their transactions in accordance with Yapı Kredi security standards using the card of their choice from any bank.

🌍 Mastercard and Smile ID to scale digital identity across Africa. This partnership will enable banks, FinTechs, mobile money operators, and other enterprises to onboard new customers faster, reducing identity fraud and expanding access to the financial system.

🇧🇪 Swift to set new rules for retail cross-border payments on its network in bold move to further ramp up speed and predictability. The new Swift scheme will require full predictability of price and speed for retail transactions, with no hidden fees, full value transfers, and instant settlement, where domestic infrastructure and regulations allow.

🇺🇸 Cloudflare launches a payments stablecoin to support transactions on the AI-driven Internet. The token is reportedly intended for autonomous software agents, developers, and online creators, enabling automated payments for services and content across borders.

🇨🇭 Crypto giant Tether has appointed Benjamin Habbel as its Chief Business Officer. Habbel, who served as CEO of private equity firm Limestone Capital and held senior roles at Google, will oversee Tether's growth strategy, finance, investment, and portfolio expansion.

🇨🇳 China opens digital Yuan hub in Shanghai to boost global use. The People’s Bank of China’s new digital yuan hub will oversee the development and operation of cross-border payment systems and blockchain infrastructure, while also promoting connectivity between domestic and international financial networks.

🇧🇷 Trump supports Visa and Mastercard and targets the popular payment platform Pix in Brazil. Pix is used daily by tens of millions of Brazilians to pay everything from utility bills to street vendors, and increasingly for transactions previously made with plastic cards. It has become a symbol of sovereignty in the face of the escalating US trade war, which Brasilia vows to resist.

🇨🇴 Colombian FinTech Kamin aims to lead immediate corporate payments with Bre-B. Through a strategic alliance with ACH Colombia, Kamin will enable its clients to send and receive payments in real time, regardless of the financial institution of the payer or recipient, and will enable automatic payment reconciliation.

🇳🇱 Global FinTech Adyen continues to enable digital commerce with flexible payments. It has announced several partnerships in order to enhance payments and checkout experiences via digital commerce platforms. These collaborations demonstrate Adyen’s focus and ability to unify payments across channels, enabling brands to deliver more personalized, efficient customer experiences.

🇧🇷 PicPay triples profits and increases customer base. PicPay tripled its net profit in the first half of 2025, rising from R$61.8 million to R$208.4 million year-over-year. By June of this year, the app reached 64 million accounts, representing annual growth of 13%.

🇧🇷 Batista family to keep injecting capital into its PicPay FinTech. The capital raising comes at a time when PicPay is becoming more profitable because of a broader credit offering, something that also increases demand for capital. Read more

🇬🇧 Once a $40 billion FinTech darling, Checkout.com is now valued at $12 billion. The London-headquartered payments platform said that it plans to launch a share buyback initiative for employees to “provide them with a path to liquidity.” Keep reading

🇺🇸 Fiserv expands advisory services for financial institutions with acquisition of Smith Consulting Group. This acquisition enhances Fiserv’s ability to deliver strategic value to its customers by embedding deeper expertise directly into its service model. By bringing more expertise in-house, the company is expanding its ability to advise earlier and deliver smarter solutions.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()