Rain + Lithic: Taking Stablecoin Cards Global

Hey Payments Fanatic!

Stablecoins just scored another big win.

Rain, the stablecoin-native card infrastructure player powering payments in 150+ countries, is teaming up with card-issuing tech company Lithic.

Why it matters:

By pairing Rain’s stablecoin rails with Lithic’s global processing muscle, the two will make it way easier for FinTechs, platforms, and enterprises to launch and scale card programs — all while giving them more tech choices and faster time-to-market.

Think of it as stablecoin payments meeting enterprise-grade card issuing: global reach, real-time auth, advanced fraud prevention, and Visa acceptance across 150 countries.

Both CEOs (Bo Jiang & Farooq Malik)are calling it a “next chapter of programmable payments” — and with stablecoin-powered cards already gaining traction, this feels like a frontier moment.

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🇿🇦 dLocal integrates Capitec Pay to expand real‑time open banking payments in South Africa. The integration enables secure, instant account‑to‑account (A2A) payments authenticated in the Capitec app, giving global merchants more choice and consumers more control.

🇺🇸 Rain and Lithic Forge's strategic partnership to accelerate the global growth of stablecoin-powered payments. Through this partnership with Lithic, Rain will dramatically expand its reach, making its ground-breaking stablecoin technology available to even more FinTechs, platforms, and enterprises worldwide.

🌎 Clara and Bitso Business partner to launch stablecoin-backed corporate cards for businesses in Latin America. This collaboration enables companies holding stablecoins in Bitso to use those assets as collateral for payment products issued by Clara.

🇮🇳 FinTech Giants PhonePe and Paytm discontinue credit card rent payments after revised RBI Norms. This mode of making rent payments has grown in popularity due to the rewards, cashback, or benefits offered through interest-free credit periods. However, the RBI’s new circular issued on September 15 led to halting this top-growing use case by FinTech players.

🇮🇳 PayU raises stake in Mindgate to 70% as valuation hits $300 million. This is the second fund infusion from PayU into the company, after it acquired 43% in March 2025. The remaining 30% of Mindgate is held by its founders, who will continue to run the business.

🇧🇷 Nubank to test dollar-backed stablecoin payments via Credit Cards. Former Brazilian Central Bank Chief Roberto Campos Neto says stablecoins could reshape finance as Nubank pilots blockchain integration. He emphasized that blockchain will be crucial in linking digital assets with traditional banking, allowing for tokenized deposits while maintaining credit intermediation.

🇸🇬 Alipay+ partners with Grab to make ride-hailing services available to global digital wallet users. The duo said in a statement that this will make local transportation services in Southeast Asia more accessible for users of Alipay+ Voyager, who can now book rides directly from within their digital wallets.

🇫🇮 Vipps MobilePay selects Tink to power Pay by Bank for P2P in Finland. Vipps MobilePay customers in the country can now use Tink's Pay by Bank for peer-to-peer payments, offering a secure and simple way to make payments directly from their bank accounts.

🇺🇸 Google and PayPal forge a multiyear partnership to revolutionize commerce. The collaboration will deliver innovative solutions that transform how businesses and consumers transact across platforms and devices. Combining their expertise and scale, the companies aim to deliver frictionless digital commerce experiences and set a new standard for commerce ecosystem innovation.

🇸🇦 Mastercard and HyperPay join forces to revolutionize SME payments in MENA. The collaboration aims to drive the modernization of business payments across the region, with the two entities joining hands to issue commercial cards in Saudi Arabia and other key markets, including the United Arab Emirates and Qatar.

🇺🇸 Payments firm PayNearMe raises $50M to fuel expansion. The funding will allow PayNearMe to accelerate its expansion into new markets and further develop its payment technology platform. Continue reading

🇨🇦 VoPay expands embedded payments offering with real-time PayPal and Venmo Payouts. Collaboration empowers VoPay customers across North America to send funds instantly to more than 400 million active PayPal and Venmo accounts, thereby expanding access to major digital payment options.

🇮🇪 Stripe alumni launch Seapoint to challenge banks with an AI financial home for startups. The financial platform for European startups has raised $3 million in pre-seed funding. Seapoint found that financial stacks are fragmented, manual, and costly, with companies typically using four to six tools.

🇦🇪 Kamel Pay receives In-Principle approval from the Central Bank of the UAE. This milestone marks a pivotal step in Kamel Pay’s mission to deliver a trusted and inclusive financial ecosystem, powering businesses with transparent, efficient payments and empowering employees with access to financial services.

🇮🇳 PayPal-Backed Pine Labs plans up to $700 million IPO in October. The company has started roadshows for the planned initial share sale, which includes a fresh issue of shares worth 26 billion rupees and a sale of 147.8 million shares by the founder and investors.

GOLDEN NUGGET

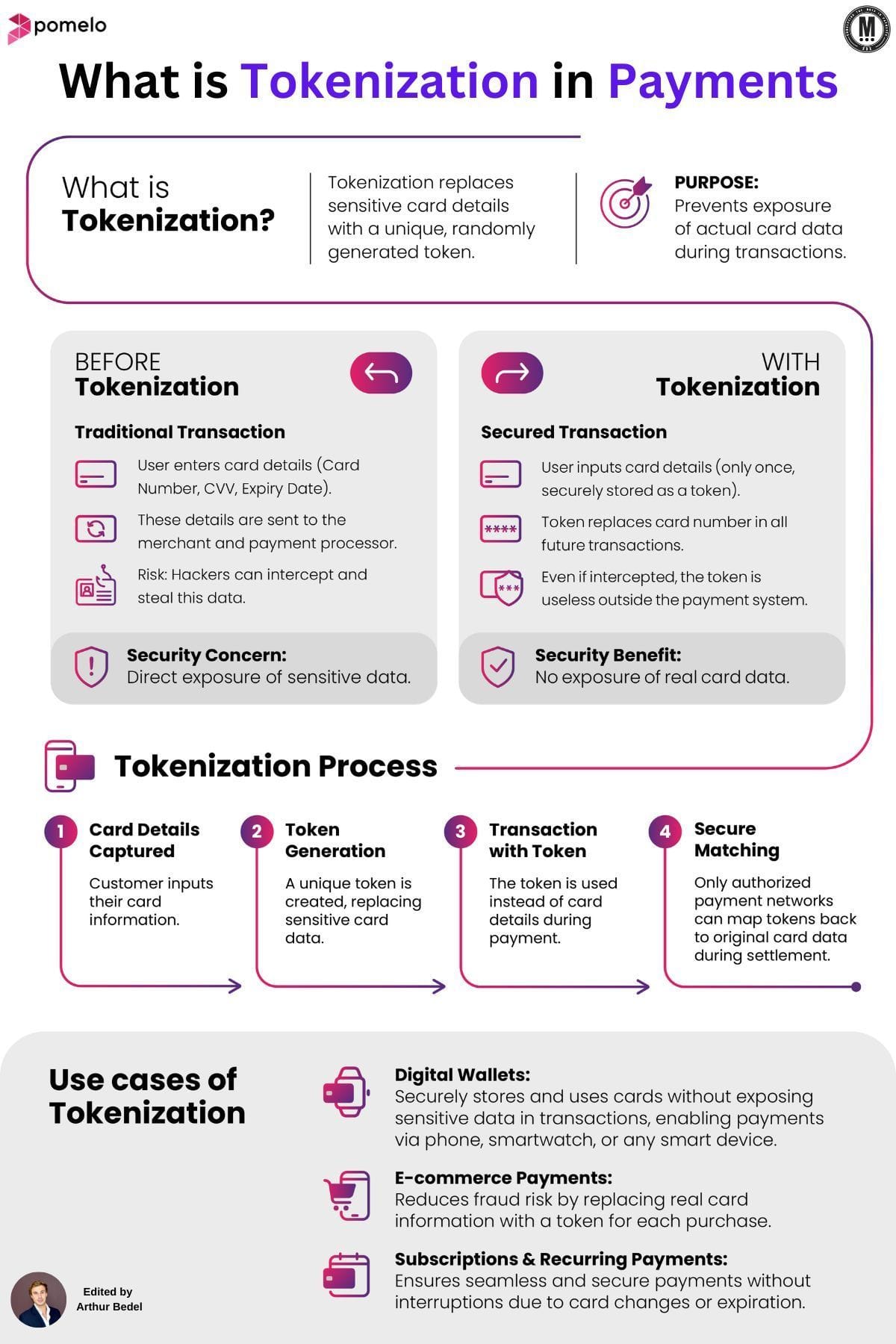

Understanding 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 and 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 by Pomelo👇 Created by Arthur Bedel 💳 ♻️

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

► Tokenization replaces sensitive card details with a unique, randomly generated token, ensuring that actual card data is never exposed during transactions.

𝐏𝐮𝐫𝐩𝐨𝐬𝐞 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

► The main goal of Tokenization is to prevent the exposure of sensitive card details, reducing the risk of fraud and unauthorized transactions.

𝐁𝐞𝐟𝐨𝐫𝐞 𝐚𝐧𝐝 𝐖𝐢𝐭𝐡 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

𝐁𝐞𝐟𝐨𝐫𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 (𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬)

► Users enter card details (Card Number, CVV, Expiry Date).

► These details are sent to the merchant and payment processor.

► Security Concern: Hackers can intercept and steal this data.

𝐖𝐢𝐭𝐡 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 (𝐒𝐞𝐜𝐮𝐫𝐞𝐝 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬)

► Users enter card details only once, which are securely stored as a token.

► The token replaces the card number in all future transactions.

► Even if intercepted, tokens are useless outside the payment system.

► Security Benefit — No exposure of real card data.

𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬

1️⃣ 𝐂𝐚𝐫𝐝 𝐃𝐞𝐭𝐚𝐢𝐥𝐬 𝐂𝐚𝐩𝐭𝐮𝐫𝐞𝐝

► The customer inputs their card information at checkout.

2️⃣ 𝐓𝐨𝐤𝐞𝐧 𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧

► A unique token is created, replacing sensitive card data. There are several type of tokens — Merchant, PSP, Network Tokens etc...

3️⃣ 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐰𝐢𝐭𝐡 𝐓𝐨𝐤𝐞𝐧

► The token is used instead of card details during payment.

4️⃣ 𝐒𝐞𝐜𝐮𝐫𝐞 𝐌𝐚𝐭𝐜𝐡𝐢𝐧𝐠

► Only authorized payment networks can map tokens back to the original card during settlement.

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

► 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 – Securely store and use cards without exposing sensitive data when making payments via phone, smartwatch, or any smart device.

► 𝐄-𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 – Reduces fraud risk by replacing real card details with a token for each transaction.

► 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 & 𝐑𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 – Ensures seamless and secure payments, preventing service interruptions due to card expiration or changes.

Source: Arthur Bedel

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()