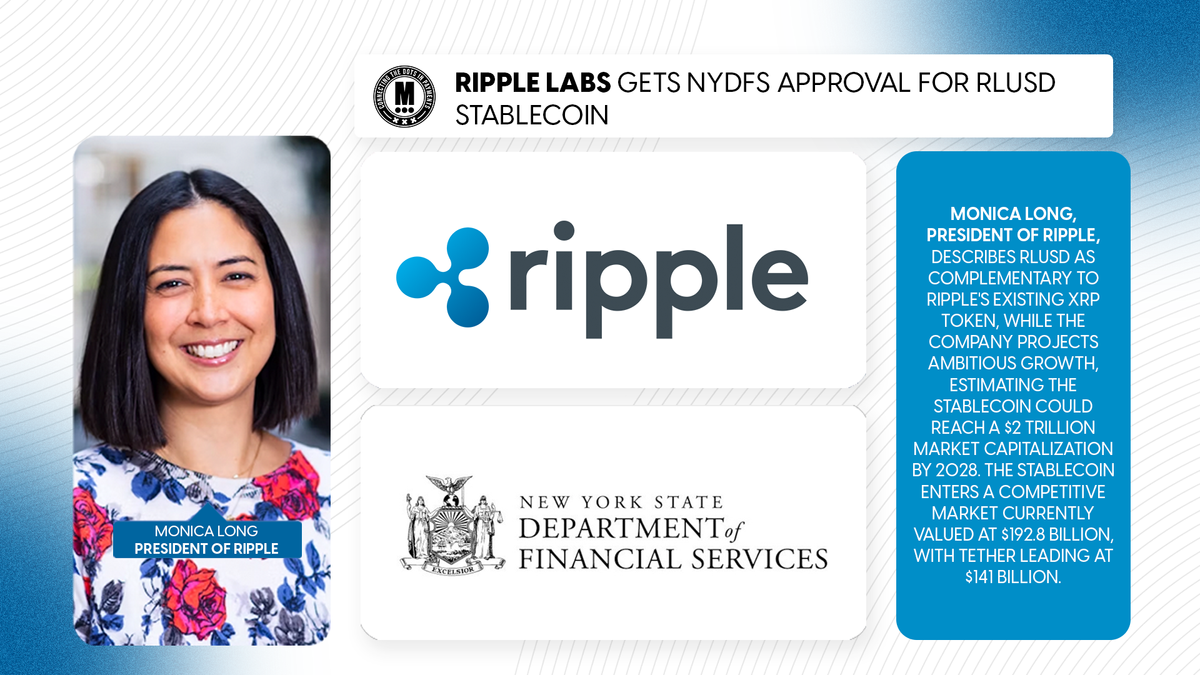

Ripple Labs Gets NYDFS Approval for RLUSD Stablecoin

Hey Payments Fanatic!

Ripple Labs has secured approval from the New York Department of Financial Services (NYDFS) for its RLUSD stablecoin, as announced by CEO Brad Garlinghouse. The stablecoin, pegged 1:1 to the U.S. dollar, will be backed by USD deposits, short-term U.S. Treasury bonds, and other cash equivalents.

Following testing on XRP Ledger and Ethereum mainnets since August, RLUSD will be available on multiple exchanges including Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish. Market makers B2C2 and Keyrock will provide liquidity support for the token.

Monica Long, President of Ripple, describes RLUSD as complementary to Ripple's existing XRP token, while the company projects ambitious growth, estimating the stablecoin could reach a $2 trillion market capitalization by 2028. The stablecoin enters a competitive market currently valued at $192.8 billion, with Tether leading at $141 billion.

Read more global Payments industry updates below 👇 and I'll be back tomorrow!

Cheers,

SPONSORED CONTENT

INSIGHTS

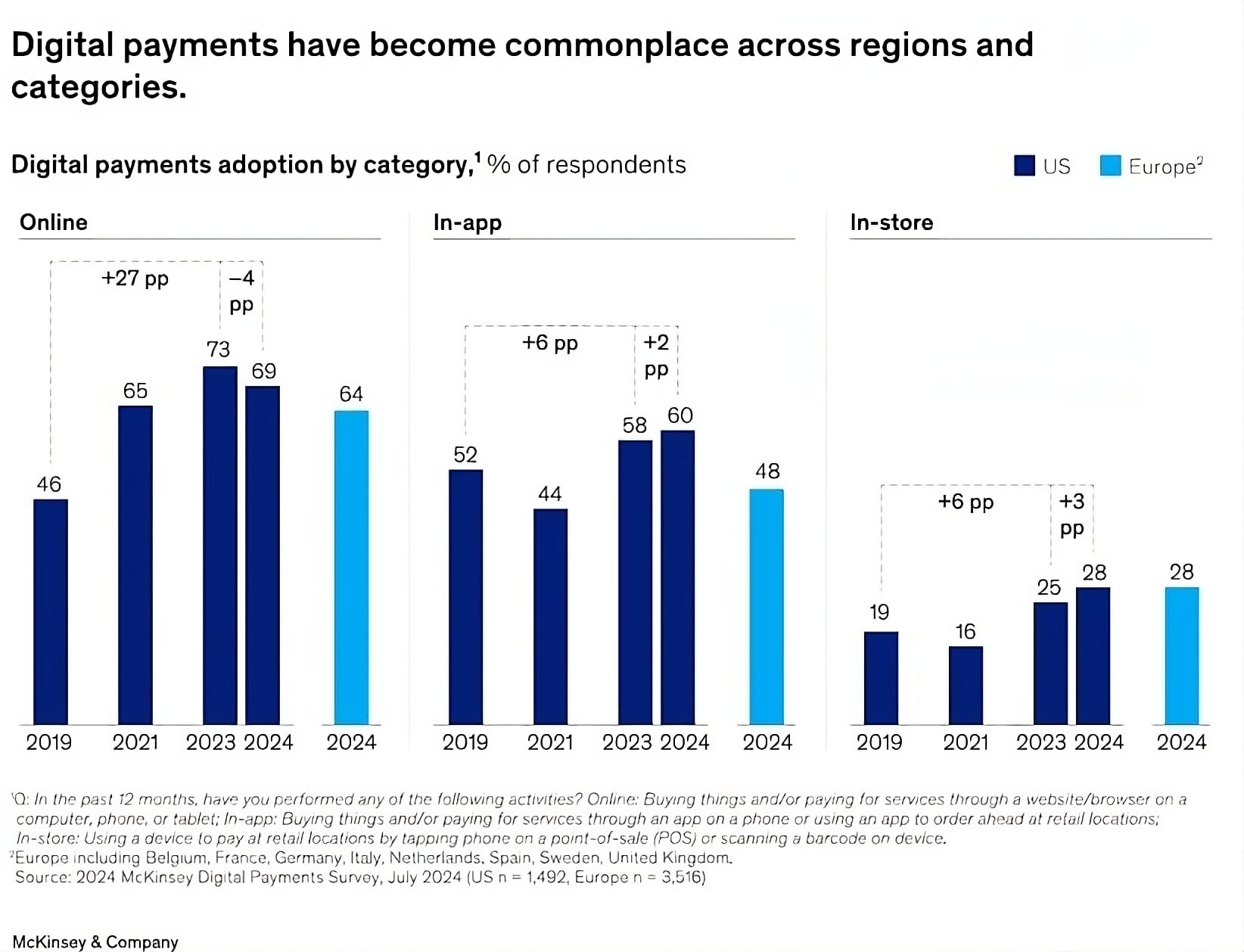

State of consumer digital payments in 2024.

PAYMENTS NEWS

🇬🇧 Revolut stablecoin in doubt. Revolut’s plans to enter the $200bn Stablecoin market has hit some speedbumps and might never materialise. Industry experts question how new entrants can carve out market share. Revolut declined to comment on the status of the project.

🇫🇮 Tietoevry boosts payments with Visa Direct. This collaboration aims to integrate Visa B2B Connect into the Tietoevry Payment Hub, enhancing the payment capabilities of Tietoevry’s client financial institutions. Continue reading

🇺🇸 CARD.com & Visa team up for global payments. The partnership aligns with CARD.com’s mission to provide innovative financial solutions. This expansion marks a significant step in enhancing its international financial services. Continue reading

🇬🇧 A2A Payments face headwinds, Volume raises seed round. The company has raised $6 million in a seed round led by United Ventures. It had previously raised a pre-seed round of $2.4 million in 2022. The company now plans to obtain FCA approval in the U.K. and expand internationally.

🇺🇸 Remote adds USDC payouts for contractors. In partnership with Stripe, Remote supports USDC, a stablecoin pegged to the U.S. dollar, ensuring stability and eliminating cryptocurrency volatility risks. Payments are fast and reliable, avoiding delays common in international transfers.

🇲🇾 Tranglo expands to 10 african markets. With its expansion, Tranglo supports payouts to 25 African nations. The firm assists financial institutions and businesses in making payments through its platform Tranglo Connect, which enables companies to confidently and securely send payments to more than 100 countries. Read more

🇲🇽 Bitso Business exceeds $12B in 2024. Key results include a 90% year-over-year growth in transaction volume, surpassing $12 billion in total transactions. This growth highlights Bitso’s role in accelerating cross-border payments through blockchain technology. Read more

🇸🇪 Hemköp launches co-branded card with Enfuce, SEB, and Humla. This marks the first product from their collaboration, showcasing the potential of embedded finance in Sweden’s food retail sector. The partnership highlights how FinTech and retail are converging to deliver innovative, scalable, and secure financial solutions.

🇳🇱 PayU partners with Google Pay. This integration addresses the increasing market demand for efficient payment solutions, and provides a seamless and secure payment experience for both consumers and online retailers. Continue reading

🇧🇷 KEO World and Amex launch Workeo B2B in Brazil. The collaboration will help medium and large businesses digitize B2B invoice payments, improving cost efficiency and purchasing power. The partnership aims to provide broader access to financing for Brazilian SMEs, addressing gaps in traditional credit.

🇨🇦 Canadian FinTech Paystone acquires Ackroo, for $21 million in an all-cash transaction. The acquisition, set to close in February 2025, includes the purchase of Ackroo’s shares at $0.15 each, a 25% premium over its December 11 closing price. The move aligns with Ackroo's strategic goals given current market conditions.

🇧🇷 AstroPay expands with Multi-Currency Wallet. AstroPay aims to simplify international money transfers, addressing delays and high costs often associated with traditional banking. The company seeks to offer a more efficient solution for global payments.

🇳🇴 Neonomics files complaint with Norwegian Competition Authority to support innovation in payments market. The complaint outlines a series of anti-competitive practices by Norwegian banks, financial services providers, and other entities controlled by Norwegian banks.

🇺🇸 Morgan Stanley partners with Wise for corporate payments. This team-up makes Morgan Stanley the first investment bank to offer these corporate payment solutions via Wise. The solution complements Morgan Stanley's existing foreign exchange services for corporate and institutional clients.

➡️ Shaping the future of payments in 2025. The future of payments will be more digital, flexible, and consumer-driven. Account-to-account (A2A) payments, biometrics, and AI are enhancing security and usability. AI is setting new standards for payment security and user experience. Take a look at the six key trends shaping 2025 payments.

🇬🇧 Crypto startup BVNK raises $50 million. The round values BVNK at around $750 million, according to a source familiar with the deal. CEO Jesse Hemson-Struthers, states that BVNK has an annualized revenue of $40 million and processes $10 billion in annualized transaction volume.

GOLDEN NUGGET

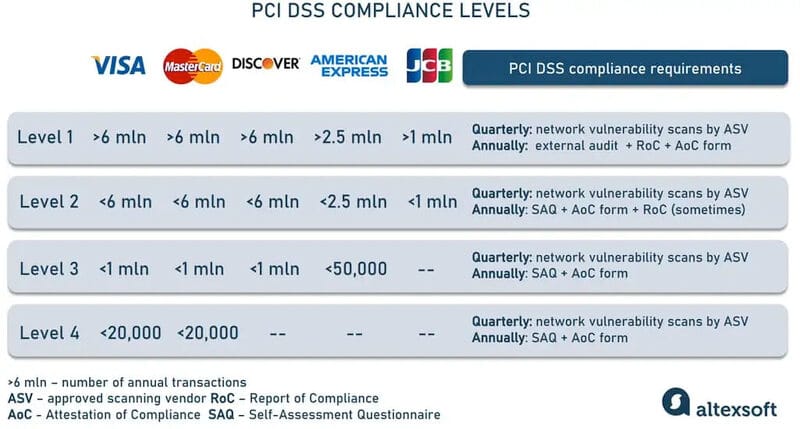

How do you comply to 𝗣𝗖𝗜 𝗗𝗦𝗦 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 requirements?

It largely depends on the number of transactions your business processes during the year. By this parameter, all merchants are divided into 𝗙𝗼𝘂𝗿 𝗟𝗲𝘃𝗲𝗹𝘀:

𝗟𝗲𝘃𝗲𝗹 1️⃣ covers businesses handling more than 6 million Visa, Mastercard, or Discover transactions, more than 2.5 million American Express transactions, or more than a million JCB transactions.

A company will also be consigned to this strictest compliance level if it has recently experienced a data breach, regardless of transaction volumes.

To achieve Level 1 compliance, you must:

► conduct quarterly vulnerability scans, involving approved scanning vendors (ASVs);

► have an onsite audit done by an external auditor who will prepare a Report of Compliance (RoC);

► and complete an Attestation of Compliance (AoC) form.

Businesses that fall under all other levels don’t need to invite third-party auditors for annual onsite checks. Instead, they file an appropriate Self-Assessment Questionnaire (SAQ) that helps companies validate their compliance with PCI DSS.

𝗟𝗲𝘃𝗲𝗹 2️⃣ is for one to six million Visa, Mastercard, or Discover transactions, 50,000 to 2.5 million AmEx transactions, or fewer than a million JCB transactions.

The compliance entails doing quarterly vulnerability scans and completing SAQ and AoC forms. Sometimes they also must have an RoC issued.

𝗟𝗲𝘃𝗲𝗹 3️⃣ ranges from 20,000 to one million Visa, Mastercard, or Discover transactions or fewer than 50,000 AmEx transactions annually.

They still undergo quarterly scanning by an ASV, complete an annual SAQ, and submit an attestation of compliance.

𝗟𝗲𝘃𝗲𝗹 4️⃣ relates to less than 20,000 Visa or Mastercard transactions.

The validation typically involves quarterly network scans by an ASV and completing an annual SAQ and AoC.

I highly recommend the complete deep dive article by AltexSoft for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()