Solaris Bets Big on Instant Payments with ACI Connetic

Hey Payments Fanatic,

Solaris just hit “refresh” on its payments backbone.

The German embedded finance giant is moving all its SEPA instant payments onto ACI Connetic — a cloud-native platform that bundles A2A payments, card processing, and AI-driven fraud protection in one sleek package.

Translation: less spaghetti infrastructure, more speed and scalability.

For Solaris, it’s not just a tech upgrade. It’s a future-proofing play that will help them onboard Banking-as-a-Service clients faster, roll out new products across Europe, and keep regulators happy while unlocking fresh revenue streams.

As CEO Carsten Höltkemeyer put it: this isn’t just migration, it’s a milestone.

Enjoy the rest of today’s FinTech headlines (including some interesting news from Brazil...) below 👇

Cheers,

INSIGHTS

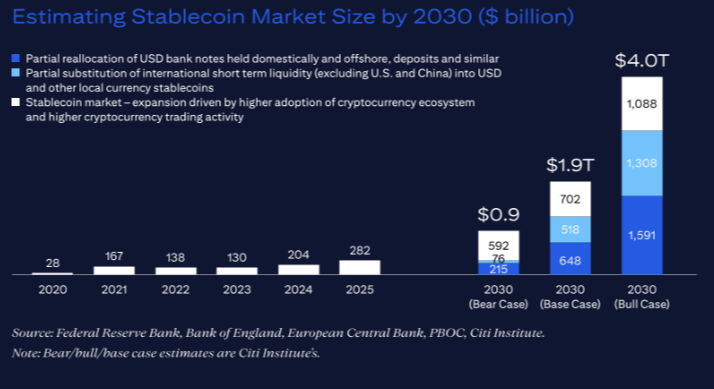

🇺🇸 Citi GPS - Stablecoins 2030. Citi now sees 2025 as blockchain’s "ChatGPT moment," driven by surging stablecoin adoption and institutional interest. Issuance has jumped from $200B to $280B this year, prompting forecast upgrades to $1.9T (base) and $4T (bull case). While stablecoins offer promise, Citi expects bank-issued tokens may ultimately dominate by 2030.

NEWS

🇩🇪 Solaris selects ACI Worldwide Connetic to future-proof payments infrastructure. Migrating its instant payments infrastructure to ACI Connetic enables Solaris to increase the agility and performance of the banking services it offers. Read more

🇬🇧 Card account updater (CAU): How it works, and why businesses need it by Solidgate. Missed payments in SaaS and subscription-based businesses can lead to lost revenue and increased churn. The services address this by automatically refreshing payment information, allowing seamless retries without customer involvement. With 99% of Solidgate merchants using CAU services, the tool has proven effective in reducing payment failures and boosting customer retention.

🇸🇬 Airwallex is seeking problem-solvers with founder-like energy who are driven to make a real impact. Co-founder and President Lucy Yueting Liu emphasizes that mindset is just as important as experience. The company values grit, curiosity, ownership, and the ability to turn ambiguity into action, qualities explored in their latest blog.

🇧🇪 Swift is to add a blockchain-based ledger to its infrastructure stack in a groundbreaking move to accelerate and scale the benefits of digital finance across more than 200 countries and territories worldwide. The ledger will extend Swift's financial communication role into a digital environment, facilitating banks’ trusted and scalable movement of regulated tokenised value across digital ecosystems.

🇧🇷 Central Bank may postpone launch of Pix Installments. The launch schedule was impacted in early September due to hacker attacks on companies that connect the financial system to Pix itself. Continue reading

🇸🇬 Thunes empowers banks to deliver faster cross-border payments to bank accounts via existing SWIFT connectivity. Banks can now leverage their existing SWIFT connectivity to send business and consumer payments via the Thunes Network globally, ensuring fast bank account transfers in over 130 countries. This meets the demand for real-time payments and enhances the customer experience.

🇪🇸 Amazon customers in Spain can now defer their purchases with Santander. Zinia, Santander's consumer financing platform, allows Amazon customers in the country to defer purchases of more than 60 euros for between four and 40 months. This agreement means that Zinia will be available to customers in Spain for the first time.

🇩🇪 Corpay and Mastercard move extend near real-time payments to new markets. Mark Frey, Group President of Corpay Cross-Border Solutions, stated that the company’s expanded collaboration with Mastercard is helping to shape the future of cross-border payments by delivering greater efficiency, affordability, and real-time capabilities.

🇮🇳 PhonePe and Mastercard collaborate to power contactless payments through smartphones for millions of Indians. The collaboration is designed to offer secure and frictionless Tap & Pay experiences at physical retail outlets, while also supporting tokenized e-commerce transactions, all through NFC-capable Android smartphones.

🇺🇸 Visa announces general availability of VCS hub; ushers in a new era of AI-powered commercial payments innovation. The VCS Hub represents a transformational leap forward, engineered to deliver a smarter, more seamless experience for all users.

🇨🇳 Visa appoints Greater China General Manager, Elaine Chang. Chang has more than 30 years of experience in senior leadership positions at Amazon, AWS, and Intel. Continue reading

🇵🇭 GCash shifts cash-in transactions to InstaPay under the Bangko Sentral ng Pilipinas mandate to standardize interoperability and transparency across the digital payments ecosystem. The move is part of the central bank’s effort to enhance the country’s digital finance infrastructure by ensuring faster, safer, and more transparent fund transfers.

🇮🇳 PayNearby plans to tap the IPO market next financial year to fuel expansion. The FinTech firm has already initiated the process and has held talks with three merchant banks, and will soon select a banker to proceed with the IPO process. As part of the expansion, the company aims to recruit around 550-600 new employees by the end of the current fiscal year.

🇱🇹 iDenfy launches a new AI-generated report feature on its Know Your Business (KYB) platform. A new tool embedded within its innovative compliance dashboard should help analysts quickly assess risks, verify legal company data, and spot potential red flags, simplifying Know Your Business (KYB) compliance challenges.

🇺🇸 PayPal’s Head of Capital Markets, David Knox, leaves for a crypto treasury. Knox, 36, said he spent about 1-1/2 years at PayPal, where he was also head of finance for credit and financial services. Before then, he was a vice president at SoFi Technologies Inc. and was a director for asset-backed finance at Cantor Fitzgerald.

🇸🇬 Coinbase and StraitsX partner to bring Singapore dollar stablecoin XSGD to global users. According to Coinbase, the integration of XSGD will empower entrepreneurs, investors, and consumers to participate in faster, cheaper, and more compliant transactions.

🇦🇪 eToro partners with Lean Technologies to enable instant AED bank transfers in the UAE. This partnership makes eToro one of the first global multi-asset investment platforms in the UAE to leverage a locally regulated open-banking provider to offer secure, instant AED funding.

🇺🇸 Fiserv signs definitive agreement to acquire StoneCastle Cash Management. This acquisition enables Fiserv to become a technology-enabled source of billions of dollars of institutional deposits, including from Fiserv’s enterprise customers. This helps financial institutions strengthen their balance sheets by integrating insured deposit products.

🇺🇸 Global Payments announces board additions to enhance shareholder value creation. Global Payments announced the appointment of Patricia “Patty” Watson and Archana “Archie” Deskus as independent Board directors, effective immediately. Both Mses Watson and Mr. Deskus possess deep financial technology and payments industry expertise.

GOLDEN NUGGET

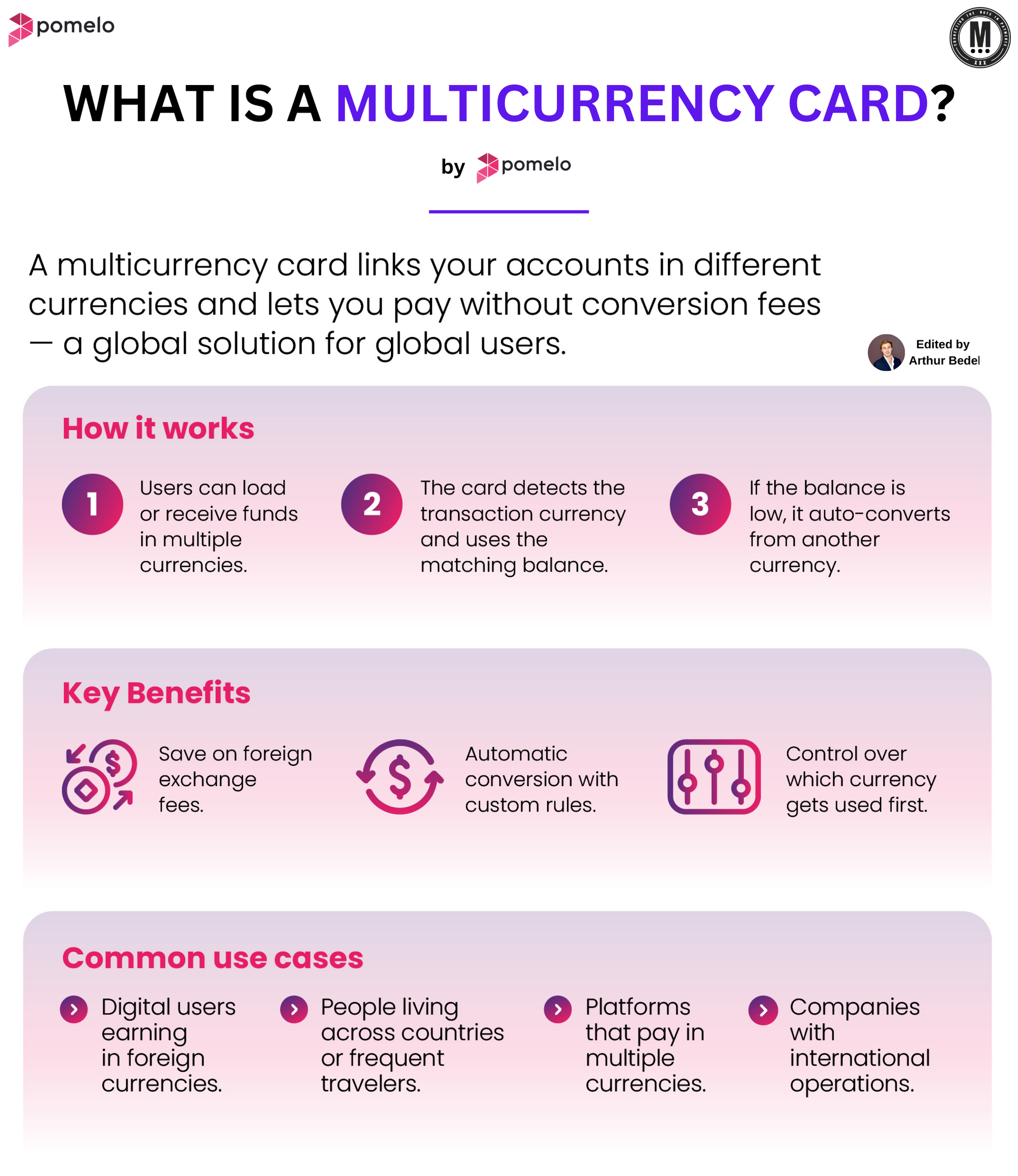

🚨 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐌𝐮𝐥𝐭𝐢-𝐂𝐮𝐫𝐫𝐞𝐧𝐜𝐲 𝐂𝐚𝐫𝐝 — by Pomelo👇 Created by Arthur Bedel 💳 ♻️

As global commerce accelerates, individuals and businesses are increasingly seeking flexible, low-cost payment solutions. Multi-currency cards are shaping up to be a key tool—streamlining cross-border transactions by providing access to multiple currency balances through a single card.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐌𝐮𝐥𝐭𝐢-𝐂𝐮𝐫𝐫𝐞𝐧𝐜𝐲 𝐂𝐚𝐫𝐝?

A multi-currency card holds balances in several currencies and automatically applies the correct one during a transaction—minimizing conversion fees and removing friction from international spending.

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐈𝐭 𝐖𝐨𝐫𝐤?

1️⃣ Users 𝐥𝐨𝐚𝐝 𝐟𝐮𝐧𝐝𝐬 in various currencies or link foreign bank accounts.

2️⃣ At payment, 𝐭𝐡𝐞 𝐜𝐚𝐫𝐝 𝐚𝐮𝐭𝐨-𝐝𝐞𝐭𝐞𝐜𝐭𝐬 𝐭𝐡𝐞 𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐲 and deducts from the matching balance.

3️⃣ If insufficient funds exist, 𝐭𝐡𝐞 𝐬𝐲𝐬𝐭𝐞𝐦 𝐜𝐨𝐧𝐯𝐞𝐫𝐭𝐬 𝐟𝐫𝐨𝐦 𝐚𝐧𝐨𝐭𝐡𝐞𝐫 𝐛𝐚𝐥𝐚𝐧𝐜𝐞, often at competitive rates.

4️⃣ All activity is visible and managed via a consolidated app dashboard.

𝐇𝐨𝐰 𝐓𝐨 𝐒𝐞𝐭 𝐈𝐭 𝐔𝐩

→ 𝐒𝐢𝐠𝐧 𝐔𝐩 & 𝐕𝐞𝐫𝐢𝐟𝐲 𝐢𝐝𝐞𝐧𝐭𝐢𝐭𝐲 with a provider like Pomelo, Wise or Revolut

→ 𝐓𝐨𝐩 𝐔𝐩 balances in desired currencies or link external accounts.

→ 𝐂𝐨𝐧𝐟𝐢𝐠𝐮𝐫𝐞 𝐜𝐨𝐧𝐯𝐞𝐫𝐬𝐢𝐨𝐧 𝐩𝐫𝐞𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 (auto-convert rules, priority currencies).

→ 𝐀𝐜𝐭𝐢𝐯𝐚𝐭𝐞 your physical or virtual card—ready for international use.

𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬 𝐢𝐧 𝐓𝐡𝐞 𝐑𝐞𝐚𝐥 𝐖𝐨𝐫𝐥𝐝

Pomelo Multi-Currency Card — Launched in LATAM; supports multi-currency wallets, automatic denomination matching, and API-enabled FX rules for seamless scaling.

Wise Multi-Currency Card — Balances in 40+ currencies, spend in 160+ countries, mid-market FX rates, and app-based security.

Revolut Multi-Currency Card — 30+ currencies, spend in 150+ countries, real-time controls, and flexible virtual cards.

𝐊𝐞𝐲 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬

✔️ Reduced FX fees compared to traditional banks

✔️ Local-currency payments in markets worldwide

✔️ Unified management of multiple balances in one app

✔️ User-controlled FX rules for transparency and flexibility

Multi-currency cards are more than a convenience—they empower global mobility and cross-border commerce. Whether for digital nomads, SMEs, or global platforms, they simplify how money moves and eliminate geographic barriers.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()