Stablecoins Just Got Serious (and a Little Scary)

Hey Payments Fanatic!

Big moves (and big oops) in stablecoin land today.

ACI Worldwide just announced a partnership with BitPay to bring crypto and stablecoin payments to merchants and PSPs via its Payments Orchestration Platform.

This allows businesses to accept and settle in digital currencies alongside traditional rails — a clear sign that stablecoins are maturing into real payment infrastructure.

With over half of global retailers now exploring crypto acceptance, this move makes the transition from theory to practice.

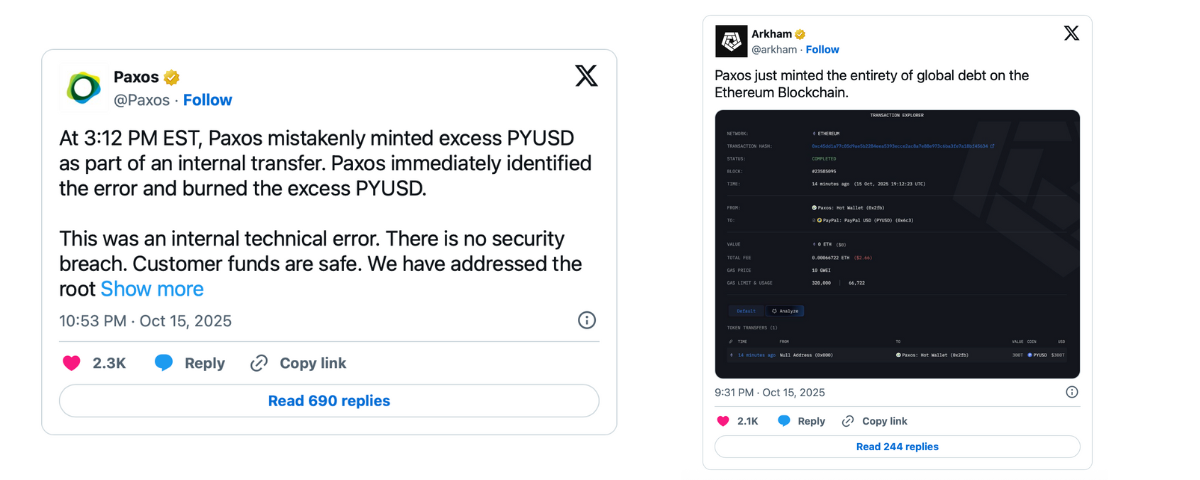

And then there’s the headline that shook crypto Twitter: Paxos mistakenly minted $300 trillion worth of PayPal’s PYUSD stablecoin during an internal transfer before burning the tokens minutes later.

The incident was quickly fixed, but it’s a stark reminder of how much control (and responsibility) stablecoin issuers hold in a system where money can be created or erased with a single command.

One story shows how stablecoins are becoming the next great payments rail.

The other shows why precision and transparency will decide who’s trusted to run it.

Scroll down for more of today’s top payments news, and I'll be back in your inbox on Monday!

Cheers,

INSIGHTS

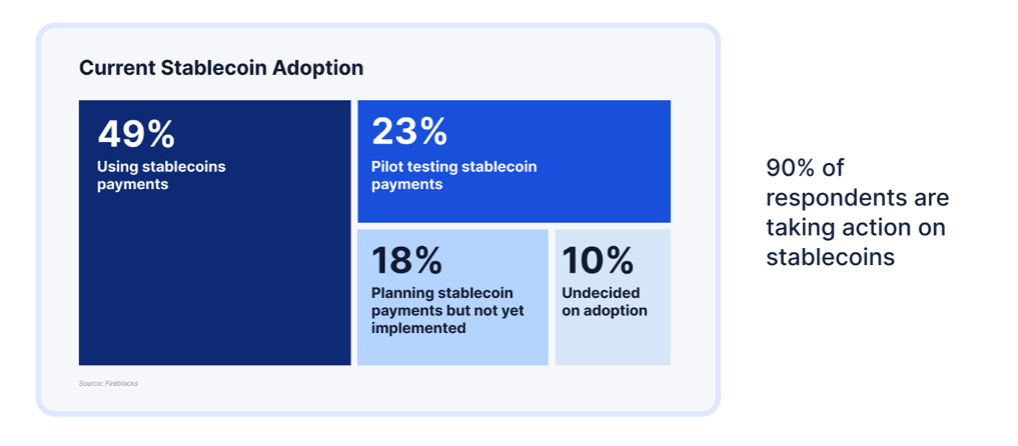

The State of Stablecoins by Fireblocks.

NEWS

🇬🇧 Solidgate has launched Routing 2.0 in Beta, a major upgrade to its payment orchestration engine, designed to give merchants greater control and flexibility over their payment flows. Accessible through the Solidgate HUB, this intuitive interface lets payment teams adjust, test, and optimize routing logic in real time, without needing developer support.

🇺🇸 ACI Worldwide and BitPay partner to power crypto and stablecoin payments for global merchants and payment service providers. By integrating BitPay, ACI further differentiates its Payments Orchestration Platform, enabling seamless acceptance and management of digital currencies, including stablecoins, as a strategic complement to traditional payment rails.

🇺🇸 Paxos mistakenly issues $300 trillion of PayPal stablecoin. Paxos immediately identified the error and burned the excess PYUSD, with the company stating there is no security breach and customer funds are safe. The erroneous transaction was visible on Etherscan and was quietly reversed within minutes.

🇬🇧 Klarna has launched Klarna Balance and the Klarna Card in the UK, expanding into everyday banking. Balance lets users hold e-money and earn rewards, while the Card offers debit payments with optional credit. Following FCA approval and global success, Klarna continues to grow its presence in retail banking.

🌍 YZi Labs leads $50m financing round in Better Payment Network to power global stablecoin payments. The newly raised funds will primarily be used to establish initial on-chain liquidity pools for stablecoin-to-stablecoin corridors and to develop an early market-making ecosystem.

🇺🇸 Brex announces partnership with Oracle as the first FinTech global issuer to power B2B payments in Oracle Fusion Cloud ERP. Leveraging Oracle’s integration with Mastercard, Brex will power Oracle’s global, embedded B2B payments solution in Oracle Cloud ERP, enabling customers to select Brex virtual cards directly from within payables workflows.

🇮🇳 Razorpay revenue jumps 65% in FY25. The company’s audited figures show revenue rising to Rs 3,783 crore from Rs 2,296 crore a year earlier, while gross profit climbed 41% to Rs 1,277 crore. Despite the top-line growth, Razorpay posted a post-ESOP loss of Rs 1,209 crore, which it attributed to restructuring costs and tax payments tied to its redomiciling to India.

🇺🇸 FIS introduces Smart Basket, transforming the shopping experience through real-time purchase intelligence. Smart Basket aims to reshape the future of intelligent commerce, using real-time intelligence to analyze purchase transactions and deliver targeted promotions, bringing greater value and convenience for today’s consumers.

🇫🇷 Mastercard invests €250 million in three new data centres in France. With over a dozen existing data centres across the region, Mastercard aims to ensure always-on payment capabilities, minimize disruptions from natural or geopolitical events, and maintain the high level of security and trust consumers expect every time they use their card.

🇺🇸 Galileo and SoFi’s Tech Platform join the AWS partner network to deliver scalable payments worldwide. “By joining the AWS Partner Network, we’re meeting businesses where they already are, making it faster and easier for them to access our financial technology and bring new financial products to their customers,” said Sandy Weil, Chief Revenue Officer at Galileo.

🇺🇸 Plaid has introduced LendScore, a new credit risk score that uses real-time cash flow data and insights from nearly 1 million daily connections across the Plaid Network. Designed to address gaps in traditional credit assessments, LendScore offers lenders a more accurate, up-to-date view of borrower risk.

🇺🇸 B2B FinTech Yaspa on using its homegrown rebrand to break America. The B2B open banking payments provider, which works primarily within the iGaming (online gambling) sector, is launching into the US with a refreshed brand and visual identity.

🇺🇸 Dash Solutions launches dashClinical, strengthening leadership in clinical trial payments. The launch includes technological updates and strategic senior hires to better support the company’s global customer base of sponsors, site networks, clinical research organizations, and CTMS platforms, now spanning 80 countries and continuing to expand.

🇬🇧 GoCardless appoints Borja Valiente as its new Managing Director for EMEA. In his new role, he will lead the company's revenue growth strategy and customer acquisition in key markets. In addition to the change, the company has appointed Hamish Wood as Vice President of Customer Success for the region, with the mission of promoting a customer-centric culture.

🇺🇸 Quidkey has chosen TransferMate to significantly reduce credit card transaction fees for both domestic and international payments. Through this embedded solution, both companies will harness Open Banking technology to replace costly card rails with a faster, more efficient model of payments.

🇸🇬 MAS launches BLOOM to settle tokenized Liabilities and Stablecoins. The project will deal with operational and financial risks. BLOOM will be dealing with G10 and major Asian currencies. The project aims at home and international settlements. It will also enhance efficiency in the process of corporate and institutional transactions.

GOLDEN NUGGET

Everything you need to know about 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 in Payments

Here's a beginner-friendly step-by-step guide:

Network tokenization has been around for over 7 years, yet many businesses are still missing out on its real potential.

For example, one subscription company cut churn by 8% in just 30 days after adopting network tokens.

𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝘆 𝘁𝗵𝗮𝘁 𝗵𝗮𝗽𝗽𝗲𝗻𝘀:

► Network tokenization replaces sensitive card data (like PANs) with a secure, unique token stored in an encrypted database. This keeps card details secure, never exposing or storing them during or after a transaction

► Network tokens are issued by major card networks like Visa, Mastercard, and American Express.

► Goal→Minimize fraud, streamline PCI compliance, and enable secure, scalable transactions.

𝗛𝗼𝘄 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀 𝗪𝗼𝗿𝗸 𝗦𝘁𝗲𝗽 𝗯𝘆 𝗦𝘁𝗲𝗽:

1️⃣ Merchant (e.g., Spotify, DRESSX)

►Captures the Primary Account Number (PAN) from the customer via the checkout.

2️⃣ Token Vault / PSP / Orchestrator (e.g., Solidgate, AuthorizeNet)

►The PAN is sent to a token vault and replaced with a network-issued token.

3️⃣ Acquirer (e.g., Solidgate, Worldpay, Adyen)

►Receives the network token instead of the original PAN.

4️⃣ Card Network (e.g., Visa, Mastercard, Amex)

►The network token stays within the card network’s secure infrastructure; the actual PAN isn’t exposed.

►The token is updated automatically when the card data is renewed, replaced, or compromised.

5️⃣ Issuer Bank (e.g., JPMorgan Chase, Capital One, HSBC)

►Validates the transaction using the token without needing access to the actual card number.

𝗞𝗲𝘆 𝗕𝗲𝗻𝗲𝗳𝗶𝘁𝘀 𝗼𝗳 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀:

→ Lower Interchange Fees: Tokens reduce card-not-present fees vs. bank tokens.

→ Automatic Token Updates: Tokens auto-update if a card expires, is replaced, or compromised, preventing declines.

→ Reduced Churn: Ensures uninterrupted recurring transactions, boosting subscription retention.

→ Better Conversion Rates: Increases authorization rates by up to 10%, reducing declines.

→ Reduced Fraud Risk: Sensitive data stays protected, minimizing fraud.

→ Improved UX: Frictionless payments and auto-updates improve customer satisfaction.

→ Acquier-independent: Enables multi-processor routing

𝗥𝗲𝗮𝗹 𝗪𝗼𝗿𝗹𝗱 𝗔𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀:

✅ Subscriptions – Platforms like Disney+ & Coursera use network tokens for secure auto-billing.

✅ Mobile Wallets – Apple Pay & Google Pay use network tokens to process payments without exposing actual card details.

✅ E-commerce – Online retailers like Amazon tokenize customer card data to enable one-click checkout.

✅Agentic Commerce – AI agents like ChatGPT, Microsoft Copilot, or Perplexity can complete transactions for users. Network tokens enable this by securely providing a reusable, processor-agnostic token.

✅Cross-Border Payments –Platforms like Solidgate can use network tokens to route payments across multiple regional acquirers.

Source: Solidgate

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()