Stripe Adds Subscriptions Paid in Stablecoins

Hey Payments Fanatic!

One year after launching stablecoin payments, Stripe is now adding support for subscription-based payments in stablecoins, built for the 30% of its businesses with recurring revenue models.

This means that Stripe's businesses can now:

- Accept subscription payments directly from customers’ crypto wallets, with automatic settlement in fiat.

- Manage both fiat and stablecoin subscriptions from one place in the Stripe Dashboard.

- Use stablecoin subscriptions with Stripe’s Checkout and Billing tools.

- Apply stablecoin payment options across all their Stripe products.

The feature is now in private preview for US-based businesses, supporting USDC payments on the Base and Polygon blockchains.

Now, let’s dive into today’s other top payments stories 👇

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇬🇧 Solidgate Treasury joins the global SWIFT network. Solidgate Treasury is designed to simplify the complexities of managing global operations. With direct integration with SWIFT, businesses can now transfer funds globally in multiple currencies with fewer intermediaries, reducing delays, risks, and costs.

🇺🇸 Stripe introduces stablecoin payments for subscriptions. Stripe’s stablecoin payments, launched a year ago, are now adding subscription support, letting businesses accept recurring crypto payments that settle in fiat, manage all billing in one dashboard, and integrate with Stripe’s tools.

🇮🇳 Revolut’s game plan for cracking India’s payments market. Paroma Chatterjee, CEO of Revolut India, talks about the U.K.-based payments company’s foray into the Indian market and its aim to make the process of remittances more transparent. Watch the full interview

🇵🇱 Revolut is preparing to implement Blik transfers to your phone. The new terms and conditions include a note that the FinTech company will allow its customers to send and receive Blik transfers by phone. Stefan Bogucki, responsible for Revolut's communications in Poland, said that this is a preparation for the launch of the service in the Polish market.

🇸🇬 Tiger Global-backed HitPay has partnered with Triple-A to enable stablecoin payments. The initiative aims to reduce merchants' exposure to cryptocurrency price volatility while ensuring compliance with local regulatory requirements. The companies stated that merchants can activate this new feature within minutes.

🇧🇷 Crown raises $8.1M to launch BRLV, a Brazilian real-backed stablecoin. The funding will accelerate the Crown’s product development and market expansion as it seeks to become Brazil’s leading BRL stablecoin issuer. Keep reading

🇦🇺 PayPal launches PayPal Open in Australia to support businesses in managing commerce and development needs. The company states that PayPal Open allows businesses of various sizes, from small and medium enterprises to large organizations, to access a single merchant platform that brings together a suite of PayPal's tools and services.

🇪🇪 Lightspark acquires Striga. Striga’s deep regulatory expertise, licensing framework, and financial services stack, including direct integrations with fiat providers, card networks, and banks, will accelerate Lightspark’s ability to bring compliant, borderless money movement to millions of users and businesses worldwide.

🇦🇪 E& money will become the UAE’s first PayPal-linked digital wallet with instant AED withdrawals. PayPal customers will be able to link their accounts to e& money and move funds into their wallets instantly, converting US dollars to AED at a fixed exchange rate with no hidden fees.

🇺🇸 Tether pays $299.5M to settle Celsius bankruptcy dispute. Tether settled with the Celsius bankruptcy estate for $299.5 million, ending a year-long dispute over alleged improper bitcoin liquidations before Celsius’s 2022 collapse. The payout covers 7% of Celsius’s $4.3 billion claim.

🇺🇸 Plaid Transfer announced Transfer for Platforms, a new solution that combines flexible, multi-rail money movement with Plaid’s trusted user experience and integrated risk tools. It is designed for vertical SaaS platforms to integrate seamless bill payments directly into their products.

🇺🇸 Introducing Ti2: The next generation of Plaid Protect’s Trust Index. Using twice the training data and enhanced behavior analysis, Ti2 detects 30% more fraud and uncovers patterns traditional tools miss. It identifies complex fraud such as synthetic identities, account takeovers, and coordinated attacks, giving fraud teams clearer, faster signals.

🇺🇸 Telcoin raises $25 million to launch a regulated digital Asset Bank. The funding enables Telcoin to meet capital requirements for its conditionally approved Nebraska Digital Asset Depository Institution charter, positioning the company to bridge the $4 trillion blockchain economy with traditional banking.

🇺🇸 Basis Theory raises $33M to power agentic commerce and the next era of merchant payments. The funding validates Basis Theory's strong product-market fit and will accelerate its work with agentic commerce while expanding its enterprise-grade payment vault for merchants worldwide.

🇲🇦 Moroccan FinTech startup Chari raises $12 million Series A and wins a landmark central bank license. With the new license, the company aims to transform its e-commerce marketplace into a merchant super app, allowing shopkeepers to not only restock their shelves but also accept digital payments, pay bills, transfer money, and provide financial services to their communities.

🇦🇪 Emirates NBD scales its cross-border payment network to 40 countries globally, allowing customers to send funds faster and with unprecedented savings. These services include real-time money transfers without delays or uncertainty, the ability to send money anytime, anywhere through the ENBD X Mobile Banking App or Online Banking.

GOLDEN NUGGET

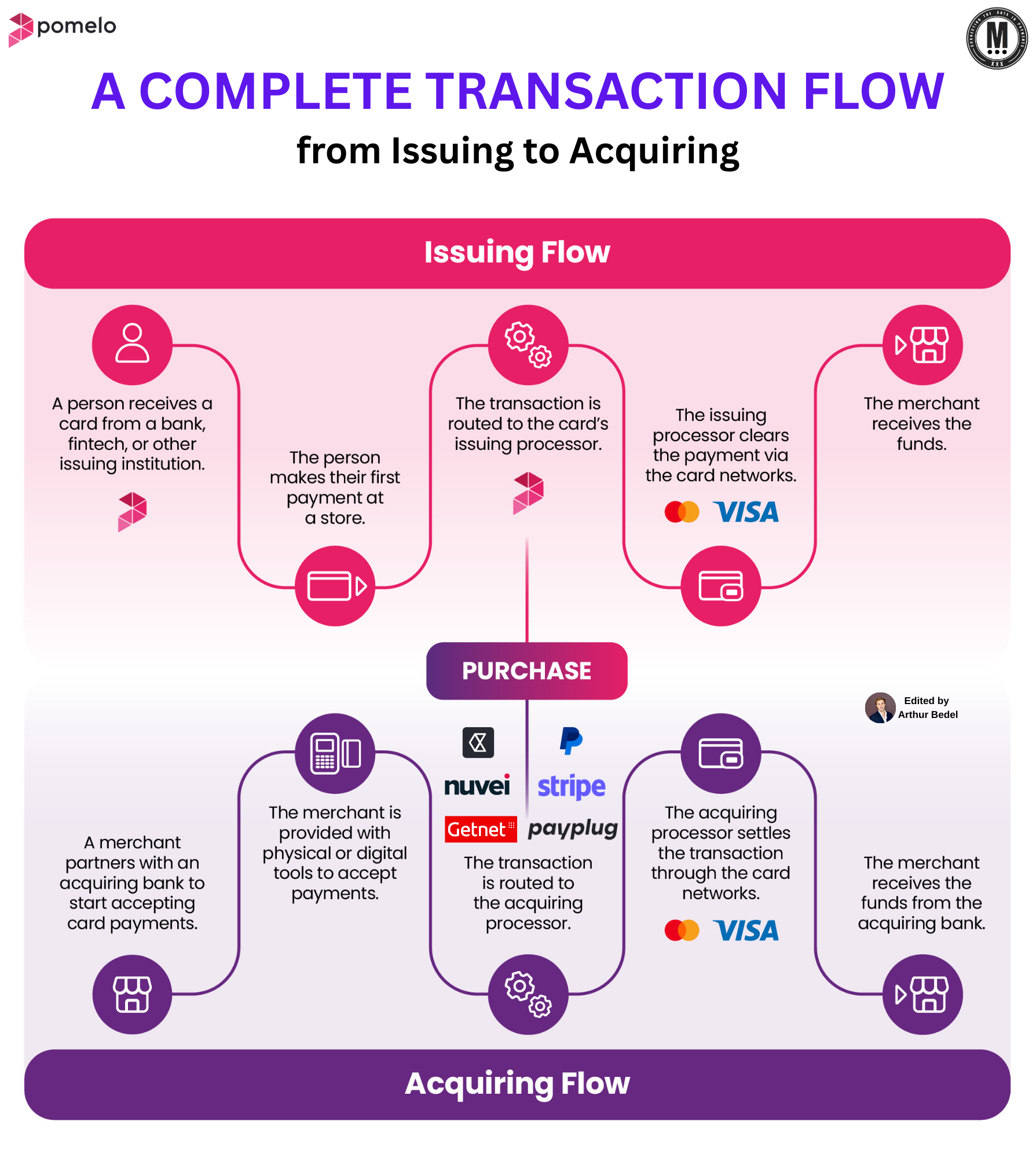

🚨 𝐀 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 — From Issuing to Acquiring by Pomelo👇Created by Arthur Bedel 💳 ♻️

Paying with a card is one of the most common actions in the digital and physical world. Yet behind that simple swipe or click lies a complex chain of technology, players, and processes — all executed within seconds.

Each card payment follows a structured journey: from authentication and authorization, to processing, clearing, and settlement. Understanding these flows helps uncover opportunities to innovate, optimize costs, and build new financial products.

𝐓𝐡𝐞 𝐈𝐬𝐬𝐮𝐢𝐧𝐠 𝐅𝐥𝐨𝐰:

1️⃣ A consumer receives a card from a bank, fintech, or issuing institution.

2️⃣ They make their first purchase at a store or online.

3️⃣ The transaction is routed to the card’s issuing processor.

4️⃣ The issuing processor clears the payment via the card networks (Visa, Mastercard).

5️⃣ The merchant ultimately receives the funds.

𝐓𝐡𝐞 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐅𝐥𝐨𝐰:

1️⃣ A merchant partners with an acquiring bank to accept card payments.

2️⃣ The merchant is provided with the tools (physical terminals or digital gateways).

3️⃣ Transactions are routed to the acquiring processor (Nuvei, Stripe, Getnet, Payplug, Fiserv, Solidgate).

4️⃣ The acquiring processor settles the transaction through the card networks (Visa, Mastercard...).

5️⃣ The acquirer pays out the funds to the merchant.

𝐁𝐞𝐲𝐨𝐧𝐝 𝐓𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞:

✔️ 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 – Checks if the card is valid, funds are sufficient, and security rules are met.

✔️ 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠 – May include FX conversion, fee calculations, or withholdings depending on region and card type.

✔️ 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 – Networks coordinate clearing: issuer → acquirer → merchant. This can take hours or days depending on the model.

Card payments are more than just a transaction — they’re an orchestrated flow involving issuers, acquirers, processors, and networks. By mapping this ecosystem, merchants, fintechs, and banks can identify friction points, optimize operations, and innovate around cost, speed, and customer experience.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()