Stripe and Paradigm Launch Tempo, Their New Stablecoin Payments Blockchain ... and the Partner List Says It All

Hey Payments Fanatics!

Stripe and Paradigm just opened Tempo to the public. Their stablecoin payments blockchain now comes with partners that no one expected this early.

UBS. Deutsche Bank. Cross River. Nubank. Kalshi. Even OpenAI and Anthropic.

When banks and AI labs line up behind a payments chain, you pay attention.

Tempo fixes the part of the crypto rails that never worked for payments. No gas spikes. No memecoin congestion killing settlement times. A clean lane built for actual money movement.

Fixed fees around 0.1 cent. Any USD stablecoin is accepted. Real-time usage billing for AI. Global payouts. Microtransactions suddenly make sense again.

If this works, it becomes one of the strongest pushes yet to bring stablecoins into mainstream commerce.

I shared a few extra thoughts on LinkedIn today 👈, and it might help make the whole Tempo story click if you’re curious.

Curious to stay ahead of the stories shaping the Payments industry? Scroll down and catch what’s next. I'll be back in your inbox tomorrow!

Cheers,

Marcel

INSIGHTS

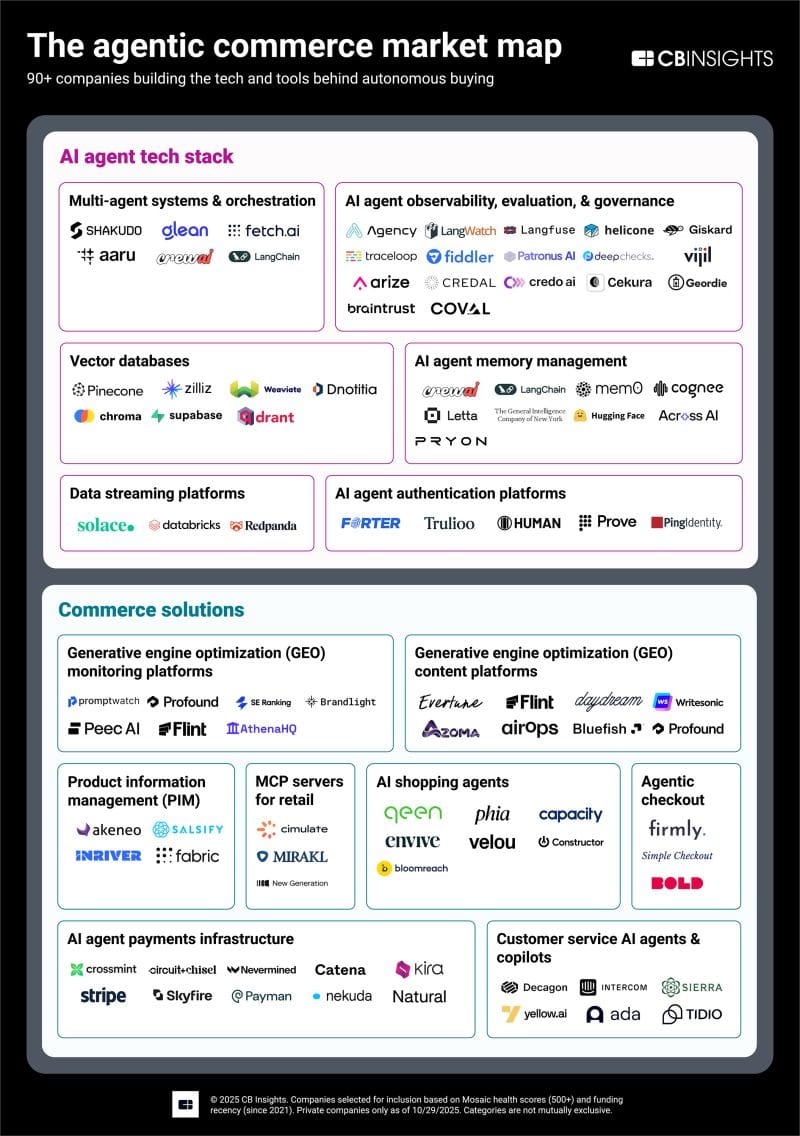

The Agentic Commerce Map by CB Insights is listing 90+ companies 👇

Any companies missing in this overview?

NEWS

🇺🇸 Stripe and Paradigm open Tempo Blockchain to the public, adding Kalshi and UBS as Partners. Tempo seeks to apply a tried-and-true playbook to the world of crypto. The blockchain is designed to facilitate straightforward acceptance of stablecoin payments by such platforms.

🇧🇷 Mastercard and Mubadala work on a deal for embattled Brazilian FinTech. Mubadala is negotiating a deal that would see the sovereign-wealth fund acquire control of Will Bank and inject capital into the FinTech firm. Will Bank also pays a fee to Mastercard for its services.

🇺🇸 Circle stablecoin for ‘banking-level privacy’ to launch on Aleo blockchain. The launch of USDCx comes amid a broader push from the crypto industry to persuade big banks and institutions to use blockchain technology. Read more

🇦🇪 Circle gets Abu Dhabi greenlight amid UAE stablecoin and crypto push. The license enables it to operate as a licensed Money Services Provider as the UAE accelerates its rollout of crypto regulations. This allows the stablecoin issuer to operate as a Money Services Provider in the IFC.

🇿🇦 Capitec buys Walletdoc in R400m deal to boost digital payments. Capitec noted that the acquisition is a strategic step in its ongoing commitment to lowering the cost of payments, broadening access to digital financial services, and promoting financial inclusion in South Africa.

🇮🇱 Payoneer cuts 6% of workforce as profitability pressures mount. Payoneer said: As part of our multi-year transformation to become a product-oriented company, we are making structural changes to our product and technology teams. The changes will affect a small percentage of our team in Israel.

🇺🇸 Ovanti partners with Mastercard’s Finicity as US BNPL strategy takes shape. Finicity enables Ovanti to lend to the 150 million underbanked Americans overlooked by credit score–driven players; with added credibility from Mastercard, merchant reach via Shift4, and cheaper funding from BNPLPay, Ovanti now has the data, distribution, and capital needed to expand in the U.S. market.

🇺🇸 Fiserv faces security issue lawsuit. A lawsuit filed by a credit union last week alleges that payments processor Fiserv deceived its clients about its security protocols. Self-Help stated that Fiserv “represented” it was using two-factor authentication when, in fact, it was not.

🇬🇧 Mangopay names Andy Wiggan Chief Product Officer. The company said Wiggan will lead its global product strategy. His remit covers existing wallet infrastructure, embedded financial services, and future product development for multi-party payment flows.

🌍 UPI accounts for nearly half of global instant payments. The IMF has recognised India’s UPI as the world’s largest retail fast-payment system, now responsible for nearly half of global instant transactions, underscoring its scale, interoperability, and rapid expansion into smaller towns and rural markets.

🌍 Klarna is now available on Apple Pay to customers in France and Italy. With this launch, consumers across eight major markets can now choose to shop with Klarna through Apple Pay’s simple and secure experience, and consumers have more choice and flexibility in how they can pay.

🇺🇸 Tether-backed payments startup Oobit expands into the US. The tap-to-pay solution integrates with non-custodial wallets, enabling users to make purchases from their iOS and Android devices. Merchants receive instant fiat payouts through existing Visa rails.

🇧🇷 Crown is valued at US$90 million after raising US$13.5 million in an investment round that attracted a crypto industry giant. Crown's architecture was designed to meet the needs of financial institutions, exchanges, and tokenization platforms with bank-level rigor.

🇺🇸 Visa partnership boosts OwlPay cash in the US remittance and blockchain payments market. The new application enables users in the United States to send money directly from their mobile devices to bank accounts in multiple international regions.

🇬🇧 ClearBank partners with Finseta to power its multicurrency and cross-border payments services. Under this partnership, Finseta will leverage ClearBank’s virtual IBAN technology to provide GBP and MCCY wallets for its UK customers, allowing Finseta’s customers to move money faster and more efficiently.

🇧🇷 Nubank launches a subscription manager to control recurring payments. The financial institution's goal is to help clients control their spending across various sources. Read more

🇺🇸 Revolut has launched Revolut BillPay, an AI-powered accounts payable automation tool that positions the company to compete in the $20B+ global AP automation and B2B payments market alongside firms. The product is expanding to Australia, Singapore, and the US.

GOLDEN NUGGET

What is Agentic Commerce, and why is everyone talking about it?

Here’s the simplest way to understand it from a merchant's POV:

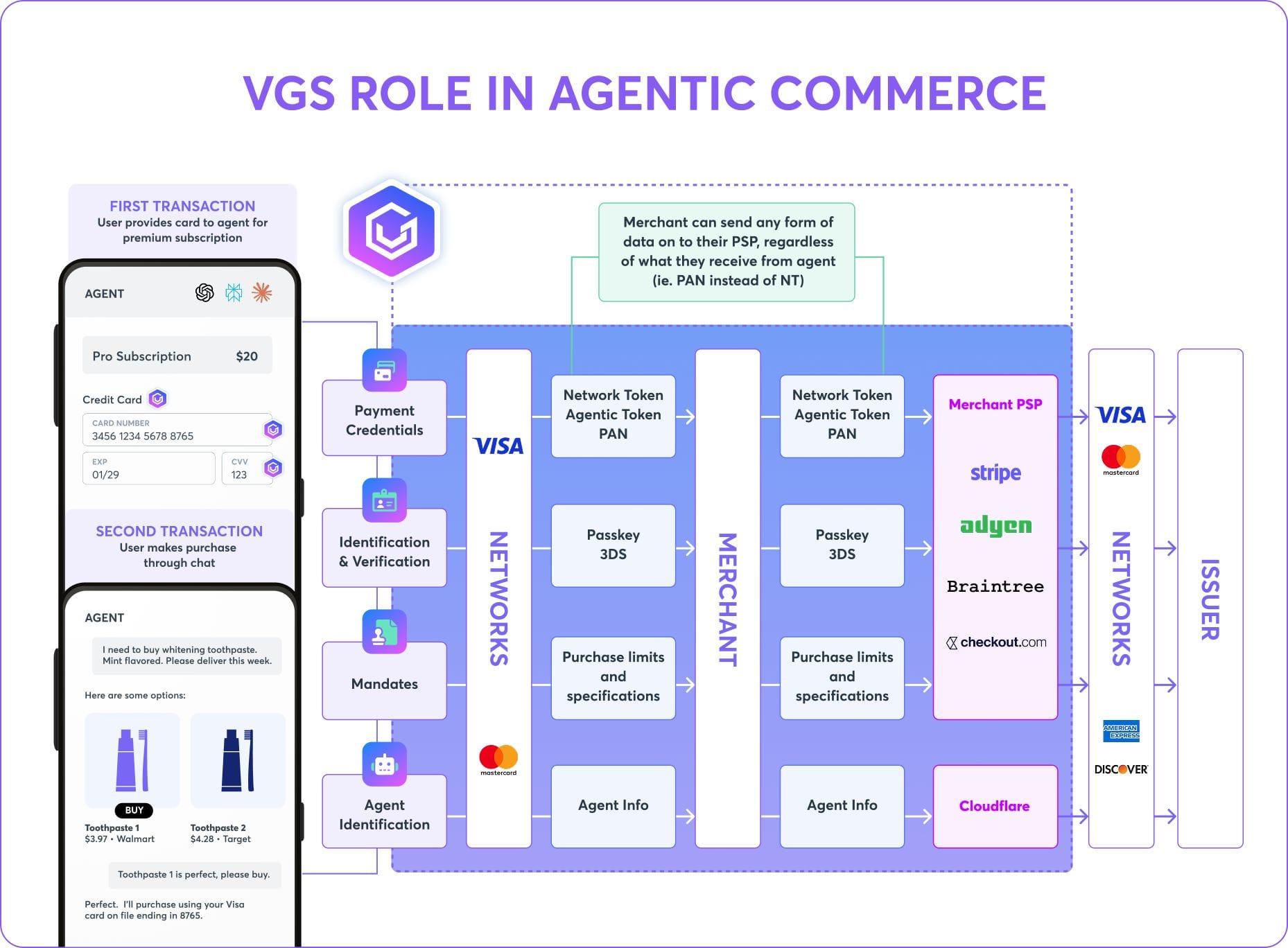

We’re entering a world where AI agents handle the entire customer journey; discovery, comparison, negotiation, checkout, while merchants receive less data than ever before.

And that’s the real issue.

👉 The emerging data gap no one is talking about.

In agent-driven flows:

• Agents collect the identity, mandate, verification, and payment data

• Networks validate and tokenize it

• PSPs authorize it

But by the time the transaction reaches the merchant?

Most of the context that used to power fraud prevention, authorization intelligence, and customer understanding has disappeared.

Merchants see the token.

Agents and networks see everything else.

That’s the blind spot.

👉 Why that matters for the ecosystem

Merchants need more than a token to operate effectively.

They need:

• Who triggered the purchase

• Verification signals

• Mandate details

• Payment credential metadata

• Intent and limits

• Agent identification

Without this, fraud becomes harder, approvals drop, and personalization turns into guesswork.

I found out that’s where VGS bridges the gap (see explainer picture above).

With VGS Agentic Commerce Infrastructure, merchants are no longer cut off from the crucial data, context, and transaction-visibility that they’ve relied on for fraud prevention, authorization intelligence, customer analytics, and more.

VGS sits in the transaction flow (with agent permission) to capture the necessary data elements (agent ID, verification, consumer mandates, and payment credentials) and securely deliver them downstream to both merchants and PSPs.

Learn more about this in this (source) blog post by VGS's CTO Marshall Jones

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()