Stripe Goes Biometric with NEC’s Face Payment Tech

Hey Payments Fanatic!

Stripe is teaming up with NEC — a seasoned player in biometric payments — to let customers pay with their face.

The partnership integrates NEC’s face-recognition technology into the Stripe Reader S700 terminal, with a live demo scheduled at the Singapore FinTech Festival next week.

The goal is secure, hands‑free checkout. Customers simply scan their face.

NEC’s biometric system ranks among the most accurate in the world, based on multiple NIST benchmark tests.

Powered by Stripe Terminal, the solution combines biometric verification with Stripe’s in-store and online payment infrastructure across 25+ countries.

That means faster transactions, less friction, and a smoother experience at the point of sale — no phones, cards, or cash involved.

Now let’s dive into the rest of today’s Payments headlines. 👇

Cheers,

Q&A

📰Building the future of agentic commerce: A conversation with Checkout.com’s Rami Josef. In this Q&A, Arthur Bedel and Rami Josef explore one of the most transformative trends reshaping the payments landscape: agentic commerce. They discuss how artificial intelligence is redefining consumer shopping behavior and how Checkout.com is equipping merchants for this new frontier.

NEWS

🇧🇷 Getnet is simplifying payments at COP30. Through its Multicurrency DCC solution, tourists can pay in their preferred currency, such as USD or EUR, while merchants receive payments in Brazilian reais, ensuring transparency, security, and cashback on each transaction. More than 150 local businesses will use the solution during the event, enhancing their services for international visitors.

🇦🇷 Pomelo has introduced new updates to its card solution, delivering greater control, security, and efficiency from a single platform. Key enhancements include an improved Card Wallet Migrator for seamless client onboarding, Tokenization as a Service to enable secure payments, AI-powered ticket creation for faster support, and automatic compliance screening before first transactions.

🇩🇪 PPRO enables Wero for CTS EVENTIM. This collaboration will see CTS EVENTIM leverage PPRO’s infrastructure to process Wero payment transactions in Germany for ticket purchases across concerts, theatre shows, and sports events. PPRO’s platform will also support additional Wero payment flows as they are introduced in other markets across Europe.

🇯🇵 Stripe and NEC to provide face recognition payment service via Stripe Terminal. The companies aim to provide secure, simple, and convenient hands-free payments, enhancing customer experience value. Stripe and NEC will showcase this face recognition payment experience with the Stripe Reader S700.

🇮🇹 Satispay launches Satispay Pay in 3 service, extends the instalment payment system BNPL to physical shops. Users will be able to pay in three instalments and without interest for purchases over EUR 30 directly from the app without having to fill in forms or present documents, and without waiting, simply through the app.

🇦🇪 Dubai adopts worldwide digital wallets for public payments. The Dubai Department of Finance is rolling this out across all government entities by the end of 2025. Residents, businesses, and tourists can all use it through the DubaiPay and DubaiNow apps.

🇺🇸 Klarna confirms potential customer data leak but won’t reveal extent. An error in its credit application form exposes what appears to be sensitive personal information belonging to other customers. The issue came to light when a customer noticed that several pages of their application form had been pre-filled with details apparently belonging to another user.

🇺🇸 Pay3 launches Agentic Payments Platform to power autonomous AI transactions with stablecoins. Pay3 integrates stablecoin payments, intelligent routing, and real-time settlement across major blockchains. The platform allows AI systems to autonomously manage pricing, billing, and treasury operations, paving the way for scalable, AI-native commerce.

🇧🇷 Pix Installment Payments: Experts advocate for safeguards to prevent credit "stacking". The main concern raised by experts is that obtaining credit "at the speed of a Pix payment" could lead consumers to lose control of their debts. Read more

🇵🇭 Mastercard appoints seasoned payments leader Jason Crasto as Country Manager. Jason will spearhead Mastercard’s efforts to support the Philippines’ national digital payments growth and transformation roadmap, working closely with public and private sector partners to advance smart, secure, and inclusive payments solutions for consumers and businesses.

🇪🇸 Nexi says it no longer commits to buy the Sabadell unit. Sabadell had postponed the completion of the sale after becoming the target of a hostile takeover by BBVA. Nexi is still interested in doing something with Sabadell, but on "completely new terms," CEO Paolo Bertoluzzo said.

🇩🇪 Germany’s Atrya raises €1.5M to build Europe’s first fully compliant stablecoin payment network. Germany's Atrya raises €1.52M to build a blockchain-based payment system using e-money tokens for global transactions. Keep reading

🇧🇷 Nubank launches Pix Protegido, a financial insurance created to protect the user in cases of scams, fraud, and unauthorized transactions made after the theft or robbery of the card or cell phone. The service was developed in partnership with the insurance company Chubb and is beginning to be gradually released to all eligible customers in Brazil.

🇨🇴 Colombian FinTech DRUO raises undisclosed seed round. DRUO provides a B2B payment infrastructure that enables companies to send and receive funds directly from bank accounts. The platform supports instant transactions for payroll, subscriptions, and supplier payments across international accounts.

🇪🇺 ECB’s digital euro plan hits resistance from banks and EU lawmakers. The European Central Bank’s plan to launch a digital euro by 2029 has run into strong opposition from EU lawmakers and Europe’s banking industry. Banks warned that the digital euro could undermine private sector payment systems.

🇰🇪 KCB confirms acquisition of minority stake in digital payments service provider Pesapal. The investment, signed on October 31, 2025, positions KCB to control a ‘full-stack’ financial ecosystem, moving it from a traditional lender to a fully integrated financial technology provider.

🇺🇸 Butter Payments names Sonali Sambhus as Chief Technology Officer to support rapid expansion and platform innovation. Butter Payments CEO Sofya Pogreb said Sonali’s strong technical background and leadership in scaling intelligent platforms will be key to driving the company’s next phase of innovation.

GOLDEN NUGGET

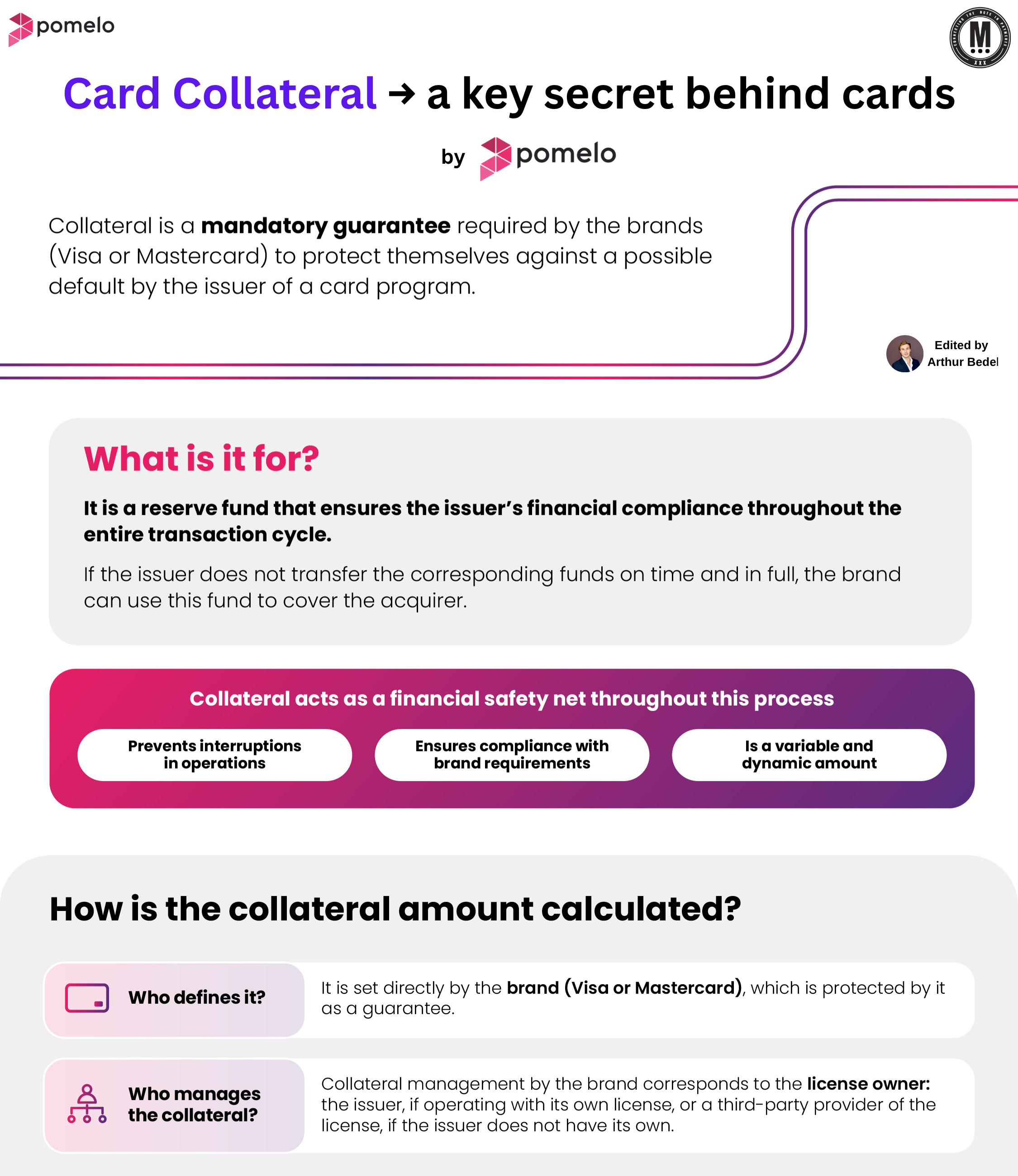

🚨 𝐂𝐚𝐫𝐝 𝐂𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥 → The Secret Behind Cards by Pomelo 👇Created by Arthur Bedel 💳 ♻️

Everyone talks about issuers, networks, and acquirers. But very few know about the invisible safety net that keeps the global card ecosystem running smoothly: Collateral.

Think of it as the silent backbone of every Visa or Mastercard program — a reserve fund that guarantees compliance and reduces systemic risk when billions of transactions move across the globe every day.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐚𝐫𝐝 𝐂𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥?

► A mandatory guarantee set by the networks (Visa, Mastercard).

► It ensures that if an issuer defaults or delays, the network can still settle with the acquirer.

► In practice: it’s the difference between uninterrupted payments… and a broken system.

𝐇𝐨𝐰 𝐢𝐭 𝐖𝐨𝐫𝐤𝐬 — 𝐁𝐞𝐡𝐢𝐧𝐝 𝐭𝐡𝐞 𝐒𝐜𝐞𝐧𝐞𝐬

→ The issuer places collateral (determined by the network) as a safeguard.

→ If funds aren’t transferred correctly, the brand taps into the collateral to cover obligations.

→ This mechanism keeps the merchant whole, even when risks materialize.

𝐊𝐞𝐲 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧𝐬:

✔ Prevents operational interruptions

✔ Ensures compliance with brand requirements

✔ Adapts dynamically as volumes and risks scale

𝐖𝐡𝐨 𝐃𝐞𝐟𝐢𝐧𝐞𝐬 𝐚𝐧𝐝 𝐌𝐚𝐧𝐚𝐠𝐞𝐬 𝐢𝐭?

✔ Defined directly by the brand (Visa, Mastercard)

✔ Managed by the license owner — either the issuer themselves or a third-party provider if the issuer operates under someone else’s license

𝐑𝐞𝐚𝐥-𝐖𝐨𝐫𝐥𝐝 𝐈𝐦𝐩𝐚𝐜𝐭

→ A fintech scaling cross-border may see its collateral requirements spike as transaction volumes grow.

→ A new card program entering a high-risk market may need to lock up larger reserves before launching.

→ For established banks, it acts as a stabilizer that allows merchants and consumers to trust the rails without even thinking about them.

𝐖𝐡𝐲 𝐈𝐭 𝐌𝐚𝐭𝐭𝐞𝐫𝐬

Collateral rarely makes headlines, but it’s one of the most important pieces of global payments infrastructure. It quietly ensures trust, continuity, and resilience in every tap, swipe, and click.

Behind every seamless purchase, collateral is doing its job.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()