Stripe Goes Full Stablecoin Mode: Federal Charter + 4 Big Updates

Hey Payments Fanatic!

Stripe just threw a stablecoin party in NYC yesterday at their annual Sessions event—and let’s just say it wasn’t your average fintech update.

The headline: Stripe is preparing to apply for a federal trust charter (yes, with the OCC) and a New York trust license—clear signals they’re doubling down on stablecoins.

But the real fireworks came with four big product drops:

1️⃣ Open Issuance – a stablecoin-creation platform for businesses (think: your brand, your reserves, your fees).

2️⃣ Onramp API – a mobile SDK to embed fiat-to-crypto onramps directly in apps.

3️⃣ Pay with CASH – Phantom’s new stablecoin, built on Stripe rails, launching first on Solana.

4️⃣ Stablecoin Accounts – U.S. businesses can now hold fiat and stables (like USDC) together in one financial account.

Stripe isn’t (yet) launching its own coin—but with this toolkit, they just positioned themselves as the AWS of stablecoins.

Of course, there’s more payments news below, so scroll on 👇 I know it feels like Stripe took over the FinTech timeline this week (and, honestly, this newsletter too), but I promise tomorrow we’ll spotlight something else 😉

Stay tuned!

Cheers,

PODCAST

🎤 Digital Fraud & Payments: From Card Theft to AI. In this episode, Arthur and Jordan Harris, Head of Fraud and Payments at iHerb and host of the Fraud Boxer podcast, explore the evolution of fraud, from early physical scams to today’s digital threats. He discusses modern tactics like bots and friendly fraud, the strategic role of payments, and future challenges such as deepfakes and biometrics. You can also listen to us on Spotify and Apple Podcasts

Digital Fraud & Payments: From Card Theft to AI

NEWS

🎤 The Future of Money Movement. In this episode, Mark Beresford and Amine Saidi of Edgar, Dunn & Company speak with ACI Worldwide’s Erich Litch and Phil Bruno about how banks can modernize legacy systems without full-scale overhauls. They discuss the rise of payment rail convergence, real-time payments, and the impact of open banking.

🎤 Rethinking Payments with ACI Worldwide and IKEA. In a dedicated session, Paul Skeldon speaks with Anna Pulante, Global Payments Manager at IKEA, and Dan Coates, Global Omnichannel Payments Solution Evangelist at ACI Worldwide, to explore IKEA’s omnichannel payments approach and the evolving retail landscape. The discussion covers how payments and data are transforming retail and the future of payments.

🇦🇷 Pomelo hosted its first Pomethon, a hackathon with 140 participants across 4 countries and 14 teams. In just two days, teams developed innovative projects and pitched them to a top-tier jury, who judged based on impact, feasibility, and originality. The result: 14 new ideas, key learnings, and one winning team.

🇬🇧 Black Friday & Cyber Monday 2025 by Ecommpay, lessons retailers can learn from 2024. A new report from Ecommpay offers key insights from last year’s shopping events. The report highlights trends such as increased email bounce rates, a drop in basket abandonment, and more. Additionally, Ecommpay released the latest edition of Payments Digest, their monthly newsletter filled with updates and highlights.

🇬🇧 CellPoint Digital’s OSO Model in the T2RL Engage event. CellPoint Digital showcased its One Source Orchestration (OSO) model, demonstrating how airlines can optimize the entire payment journey. This evolving dialogue highlights payments as a key driver in the future of travel retail.

🇺🇸 Stripe launches new products to drive stablecoins and agentic commerce into the mainstream. Announcements included Open Issuance, which empowers businesses to launch and manage their own stablecoins with just a few lines of code, and new solutions for agentic commerce, helping businesses and their customers transact via AI tools and agents.

🇺🇸 Stripe plans to apply for a federal charter in a stablecoin push. Stripe is expanding into digital assets with a new stablecoin issuance platform and plans to seek U.S. banking licenses, moves that bring the payments giant closer to traditional financial regulation. The new service is called Open Issuance.

🇨🇳 UnionPay International drives global interoperability via China's cross-border interconnection payment gateway. Guided by public-oriented inclusivity and accessibility, the CPG enables institutions in and outside China's mainland to achieve cross-border QR code interoperability with one point of access.

🇩🇪 Nium launches Global Collections to power cross-border collections for banks. Nium's Global Collections is a white-label solution that enables banks to offer multi-currency collection accounts directly to their customers, powered by Nium's virtual account infrastructure and APIs.

🇪🇺 FinTech SumUp targets EU and UK banking licences. SumUp is preparing to enter the banking space, with plans to apply for an EU banking licence as early as next year, followed by a UK application. The move comes as the company looks to scale its offering and compete more directly with incumbent lenders.

🇧🇷 Pix gets a dispute button against fraud. The feature will allow victims of fraud, scams, or coercion to request a transaction dispute completely digitally, directly through the app of the financial institution where they have an account. Keep reading

🇧🇷 Wise is now directly integrated with Pix. This integration gives Wise full control over the payment process, enabling faster, more reliable, and lower-cost transfers by removing intermediaries. Continue reading

🇺🇸 Powering smarter and more personal advertising with Mastercard Commerce Media. Mastercard is leveraging its permissioned data, trusted reputation, industry-leading technology, and connections to advertisers, publishers, and consumers to power smarter, personalized commerce across the board.

🇰🇿 Kazakhstan launches interbank QR payment service for mobile apps. The service allows clients to make and receive interbank QR payments to any participating bank, expanding the range of payment options available. Continue Reading

🇬🇧 Ant International’s WorldFirst reports 300% transaction growth in emerging markets. The company, which provides cross-border payment and treasury account services, said its banking network now includes eight global systemically important banks, among them J.P. Morgan, Standard Chartered, Barclays, HSBC, and Citibank.

🇨🇭 Nexi Switzerland appoints Bianca End as new Country General Manager. Thomas Spreitzer, CEO of Nexi DACH, stated that Bianca End is an excellent fit for Nexi and its expansion strategy in omnichannel payment solutions, citing her strong focus on growth, collaboration, and proven expertise in digital transformation.

🇺🇸 Mesta secures $5.5 million seed round to redefine cross-border payments. Mesta will deploy this capital to expand its global payment features, strengthen its international teams, and accelerate growth worldwide. Read more

🇵🇪 FinTech Ligo will bring Apple Pay and Google Pay to Peru. More than 186 million monthly transactions were made under this system, which integrates instant transfers, mobile payments, and QR code operations. The company is seeking to consolidate its financial ecosystem and diversify its business lines to integrate two international giants.

🇺🇸 Tether to distribute coins on conservative video platform Rumble. The stablecoin giant recently unveiled plans for a new token named USAT that will comply with US rules, and it’s counting on Rumble’s millions of users to capture market share. Tether holds a 48% stake in Rumble.

🇺🇸 Crypto Wallet Phantom unveils stablecoin and payments service. Phantom designed its own stablecoin, CASH, to underpin its new consumer financial platform, Phantom Cash. It will offer unique features like peer-to-peer transactions, a Visa debit card, and rewards on unspent CASH.

🇬🇧 PhotonPay partners with Thredd to enhance card infrastructure. This collaboration allows PhotonPay to further refine its card product capabilities, providing customers with a more secure, streamlined, and flexible payment experience across virtual and physical cards.

🌍 noon payments and Visa Launch First-Ever Payment Passkey for Merchants Globally. This strategic collaboration introduces Fast Identity Online (FIDO)-based authentication for payments, leveraging the biometric capabilities of consumer devices for e-commerce authentication, designed to create a smoother, more secure, and password-free online checkout experience.

GOLDEN NUGGET

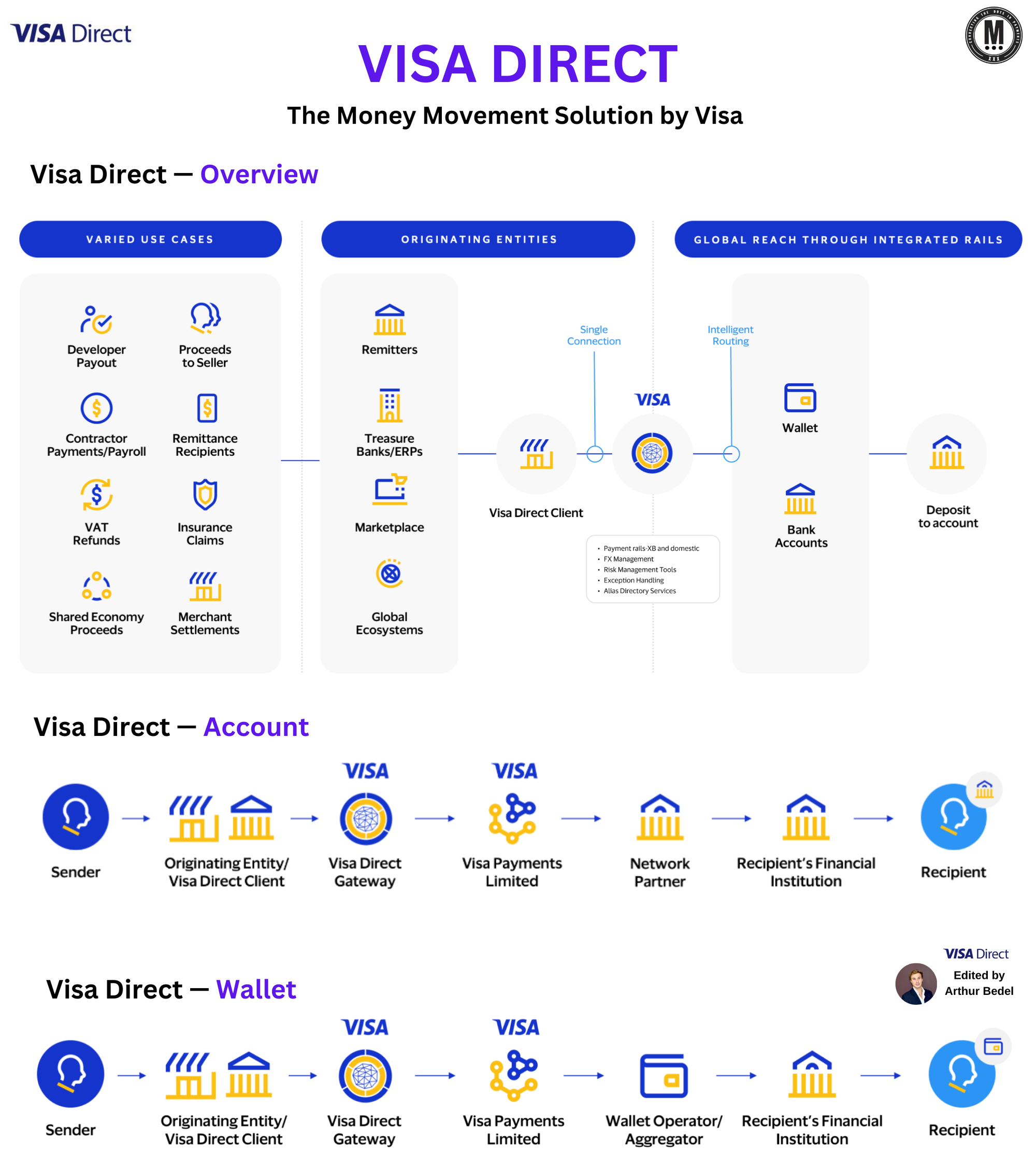

Visa Direct — 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 & 𝐖𝐚𝐥𝐥𝐞𝐭, 𝐭𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐦𝐨𝐧𝐞𝐲 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 by Visa, disrupting how businesses deliver funds to billions of endpoints👇Created by Arthur Bedel 💳 ♻️

Visa Direct is built to help businesses payout worldwide through ACH, and faster payment networks via a single integration, helping companies meet their operational, commercial, and regulatory needs.

You won’t believe me but today, hashtag#checks account for 50% of B2B payments. Crazy...

Visa built a solution that allows Financial Institutions to send funds (payouts) to accounts, wallets and cards in all major global markets.

► 𝐀𝐜𝐜𝐨𝐮𝐧𝐭

Send a payout to bank accounts via the Visa network using its Automated Clearing House (hashtag#ACH) / Real Time Payments (hashtag#RTP) fulfillment method. The push-to-account service is available cross border.

𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬:

1️⃣ - Sender initiates a payment using a visa direct client.

2️⃣ - Visa Direct Client processes the payment through the Visa Direct Gateway.

3️⃣ - Visa Direct Gateway connects to the Visa Payments Limited (VPL) banking network.

4️⃣ - Local funds transfer scheme/network is utilized to identify appropriate network partners.

5️⃣ - After a network partner has been identified, the payment is transferred to the recipients FI.

► 𝐖𝐚𝐥𝐥𝐞𝐭

Send a payout to wallets via the Visa network, available cross-border. Visa offers the service through Visa Payments Limited (VPL) who can use their network of Wallet Aggregators and Wallet Operators to deliver the payout to the Recipient's wallet.

𝐇𝐨𝐰 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬:

1️⃣ - Sender initiates a payment using a visa direct client.

2️⃣ - Visa Direct Client processes the payment through the Visa Direct Gateway.

3️⃣ - Visa Direct Gateway connects to the Visa Payments Limited (VPL) network.

4️⃣ - A network of waller aggregators and operators on the VPL is utilized facilitate the transaction.

5️⃣ - The payment is transferred to the recipients FI.

► 𝐂𝐚𝐫𝐝:

A real-time payout to cards, using Visa’s global payment system. Originating Entities can use the Visa network to send money to over three billion eligible Visa card accounts!

The new innovative payment solution surged 36% in the last year surpassing 5.9 billion transactions (excluding Russia) across 60+ uses, 550+ enablers, 170+ countries and 2000+ programs.

But why Visa Direct? There are 2 main uses:

► 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐏𝐞𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (hashtag#P2P):

🔸Paying friends and family

🔸Splitting bills

🔸Sending remittances

🔸Account transfers

► 𝐅𝐮𝐧𝐝𝐬 𝐃𝐢𝐬𝐛𝐮𝐫𝐬𝐞𝐦𝐞𝐧𝐭:

🔸Reimbursements

🔸Refunds

🔸Rebates

🔸Payouts

🔸Loan distributions

🔸Government disbursements

It simplifies a complex process providing a fast & convenient experience to reach payees worldwide securely and reliably on the Visa Network 🚀

Source: Visa Direct

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()