Stripe & TrueLayer Pay by Bank; Ripple & OpenPayd Lay the Rails

Hey Payments Fanatic!

What's in store for you in today's news? New rails for global trade, everyday payments made seamless, and programmable money replacing legacy plumbing.

Stripe and TrueLayer flipped the switch on Pay by Bank in France and Germany. This means no tedious entries of card details for making payments; just instant, secure debits. This makes merchants (not just consumers) happy too because of improved cash flows as payment delays are reduced.

Meanwhile, Ripple and OpenPayd are rolling out enterprise‑grade stablecoin payments infrastructure that lets corporates make faster, more transparent, and cost-efficient payment flows. The stablecoin payments revolution is underway!

Power moves like these and plenty more shaking up the payments space await you.

Let’s dive into today’s global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

NEWS

🇳🇱 Mollie wins the "Best Payment Solution" category at K5 COMMERCE AWARD, a recognition that highlights the company's commitment and innovation in the e-commerce space. This prestigious honor, presented by K5, Future Retail, reflects the hard work and dedication of the entire Mollie team.

🌎 Meliá Hotels International and Getnet are pioneers in payment security in Latin America and offer P2PE solutions. P2PE solution encrypts sensitive card data at the point of sale and keeps it encrypted throughout the payment journey until processing. This protects cardholder data in transit.

🇪🇺 Bitget launches zero-fee crypto card with Mastercard support. It enables users to spend their crypto at more than 150 million merchants globally. The card will be available through the Bitget Wallet app and supports real-time funding via on-chain swaps and deposits.

🇮🇳 PayGlocal and Banking Circle to simplify cross-border payments for Indian firms. The collaboration aims to meet rising demand from Indian merchants seeking to scale globally, with both companies indicating plans to deepen the partnership further.

🇬🇧 Tink and Chip partner to power seamless account top-ups with open banking. By integrating Tink’s open banking-powered payments, Chip can now offer a top-up experience that’s instant, intuitive, and built for the way users want to manage their money.

🇺🇸 Payments firm Wise seeks a US national Trust Bank Charter to access Fed Payments. Wise aims to increase the staffing of its US trust company by 20% within three years and plans to relocate its primary share listing from London to the US to enhance liquidity.

🇦🇺 Australian banks launch nationwide Confirmation of Payee scheme. Banks have begun the roll-out of a nationwide Confirmation of Payee programme to help protect customers from being tricked into sending money to criminals. Keep reading

🇸🇬 FOMO Pay launches Palm Payment Solution in Singapore. With the integration of the Palm Payment solution, FOMO Pay revolutionizes everyday transactions, offering users a seamless, simple, and no-mobile-required payment option suitable for diverse settings.

🇪🇺 EU Central Bank commits to distributed ledger technology settlement work. The decision is in line with the Eurosystem’s commitment to supporting innovation without compromising on safety and efficiency in financial market infrastructures, the release said.

🌍 New Pan-African card scheme launches with plans to reclaim Africa’s financial autonomy. The African Export-Import Bank has teamed up with the Pan-African Payment and Settlement System and Mercury Payment Services to launch the first pan-African card scheme, with a plan to reclaim the continent’s financial autonomy.

🇮🇳 Bhim gets a big boost as NPCI scales up incentives and offers. Bharat Interface for Money (BHIM) has seen a resurgence, nearly doubling its monthly transactions to 70 million in June after a period of stagnation. This growth is attributed to a user-interface revamp, increased marketing spend by NPCI, and targeted incentives.

🇮🇳 Razorpay unveils Self-Healing tech for in-store payments. The new technology is designed to autonomously detect and resolve common issues that can interfere with payment transactions. Continue reading

🌍 Mastercard has introduced Account Intelligence Reissuance, an advanced fraud prevention service to efficiently manage the card reissuance process in the EEMEA. It streamlines and automates the process, stepping up fraud prevention efforts, addressing both physical and digital card skimming.

🇦🇺 ANZ appoints Peter Barrass to the Worldline Australia Board. Barrass is one of ANZ’s most successful technology executives after he engineered an overhaul of the group’s institutional payments arm. The bank has now tapped him to join the board of its ailing merchant payments joint venture with Worldline.

🇫🇷 Worldline hires an auditor, Oliver Wyman, to assess risky clients. The company hired an external firm to go through its portfolio of risky clients as the payments firm seeks to restore trust following media allegations that it turned a blind eye to fraud pummeled its share price.

🇸🇬 Ant International unveils AI travel assistant built into E-wallets and super apps. It has introduced Alipay+ Voyager to help users plan and manage trips more easily. The tool combines Alipay+’s agentic AI travel capabilities into a single interface that supports itinerary planning, bookings, and local service discovery.

🇺🇸 Yaspa receives $12M investment led by Discerning Capital to fuel US expansion. It enables the company to take its proven technology into a new market at pace, hiring a local team, building strategic partnerships, and adapting its platform to meet the specific needs of operators.

🇦🇪 Ajman Bank and VaultsPay partner to launch co-branded payment processing solution and instant settlement for business clients. Ajman Bank business clients will gain access to VaultsPay's infrastructure, enabling acceptance of credit, debit, and prepaid card payments across a range of retail environments.

🌍 Orbital partners with ClearBank Europe to bridge real-time euro payments across SEPA and stablecoins. The partnership allows Orbital to offer its enterprise customers 24/7 fast and cost-effective payments, with banking-grade compliance, into and across Europe.

🇰🇪 Flutterwave cuts 50% of staff in Kenya and South Africa in major cost-cutting move. The move, which comes less than a year after the company laid off 3% of its workforce, affects multiple departments, with the most significant impact being seen in the compliance, legal, and human resources (HR) teams.

GOLDEN NUGGET

Welcome to 𝐓𝐡𝐞 𝐂𝐚𝐫𝐭𝐞𝐬 𝐁𝐚𝐧𝐜𝐚𝐢𝐫𝐞𝐬 𝐒𝐞𝐫𝐢𝐞𝐬 🇫🇷 — Episode 3 👇 Created by Arthur Bedel 💳 ♻️

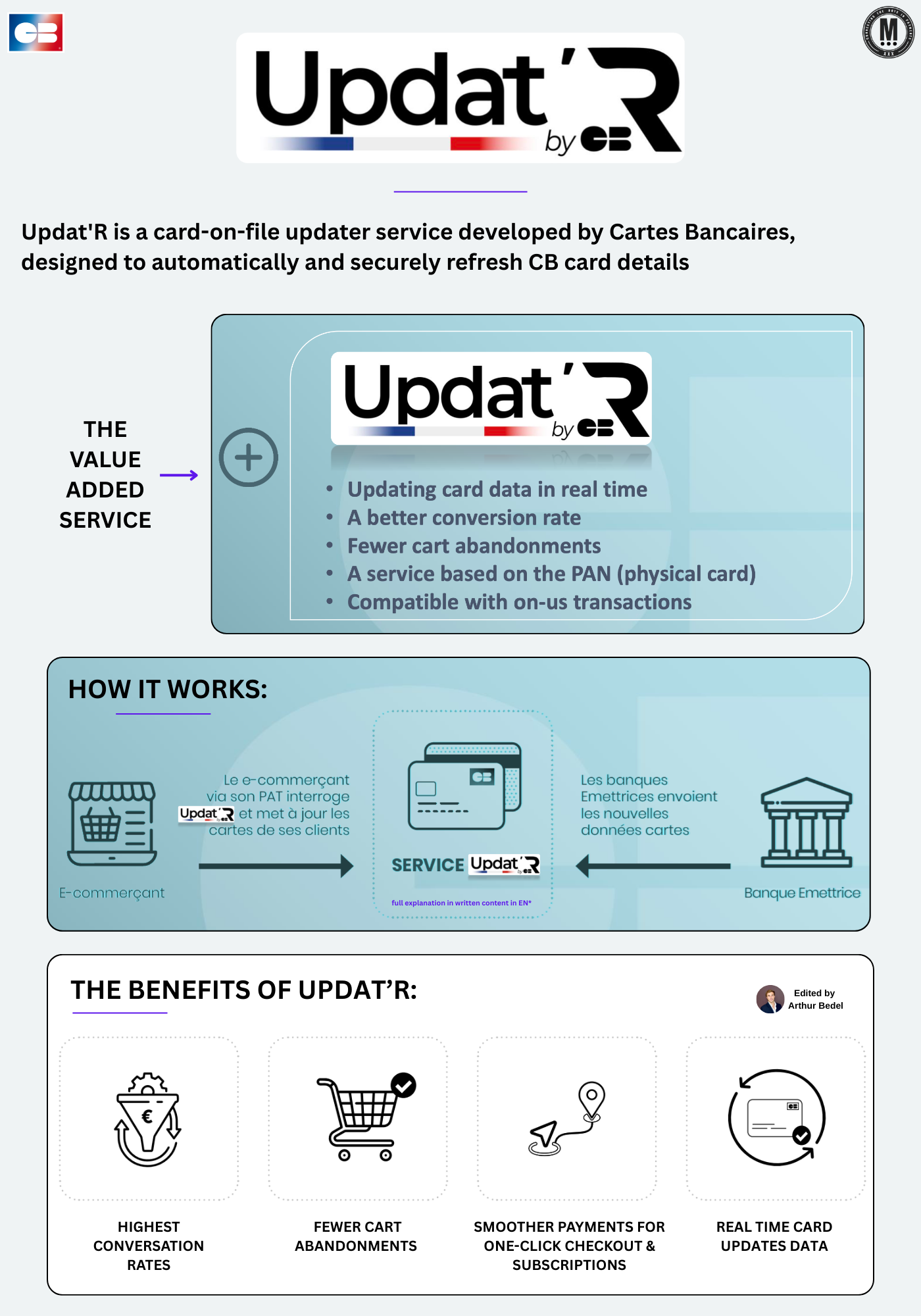

𝐔𝐩𝐝𝐚𝐭’𝐑 by GIE Cartes Bancaires Bancaires is 𝐅𝐫𝐚𝐧𝐜𝐞’𝐬 𝐫𝐞𝐚𝐥-𝐭𝐢𝐦𝐞 𝐜𝐚𝐫𝐝 𝐮𝐩𝐝𝐚𝐭𝐞𝐫 𝐬𝐞𝐫𝐯𝐢𝐜𝐞 — built for recurring payments, one-click checkout, and lower churn.

It automatically refreshes card-on-file (CoF) credentials, ensuring businesses never lose revenue due to expired or replaced cards.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐔𝐩𝐝𝐚𝐭’𝐑?

► A real-time API-based service that updates CB card data linked to the Primary Account Number (PAN)

► Helps merchants retain subscription customers and reduce failed MIT (Merchant-Initiated Transactions)

► Designed to work with on-us flows — boosting performance within the CB ecosystem

► Aims to replace outdated, costly tokenization setups for most domestic needs

→ CB equivalent of Visa Account Updater — but simpler, cheaper, and fully local

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐔𝐩𝐝𝐚𝐭’𝐑 𝐰𝐨𝐫𝐤?

1️⃣ Merchant queries card updates via their PAT (Payment Acceptance Terminal)

2️⃣ Updat’R connects to the issuing bank via the CB rails

3️⃣ Issuer returns refreshed card credentials (e.g. expiry date, PAN update)

4️⃣ Merchant updates its systems without user friction

→ Works at scale, in batch or individual calls

→ Supports recurring billing, subscriptions, and stored cards

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

► +1–2 points conversion rate uplift on MIT payments

► Dramatically reduces involuntary churn

► Fewer payment interruptions → fewer abandoned carts

► Real-time, no-cost model — independent of update volume

► Simpler than full tokenization integration for most use cases

💡 Updat’R also improves lifecycle management and reduces merchant acquisition costs by preserving long-term customer relationships.

𝐖𝐡𝐲 𝐢𝐭 𝐦𝐚𝐭𝐭𝐞𝐫𝐬 𝐢𝐧 𝐅𝐫𝐚𝐧𝐜𝐞

GIE Cartes Bancaires cards represent 2/3 of French consumer spend. With Updat’R, merchants can confidently manage CoF flows without foreign dependency, and with full compliance and GDPR-aligned data residency.

Next Up → Deep dive into 𝐒𝐚𝐟𝐞’𝐑 — Merchant-controlled 3DS authentication with CB

Source: GIE Cartes Bancaires x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()