Stripe’s Back on Top: $106.7B Valuation Confirmed

Hey Payments Fanatic!

Stripe just leveled up again.

The FinTech giant’s valuation has climbed to $106.7 billion, topping its 2021 peak of $95B 🤯

That makes it once again one of the most valuable private companies in the world, still choosing to stay private while names like Anthropic and OpenAI grab the IPO headlines.

Beyond its core payments muscle, Stripe has been quietly doubling down on stablecoin infrastructure—an area to watch as global rails evolve.

And while the company isn’t commenting (yet), I wouldn’t be surprised if next week’s Stripe Sessions in NYC turns into the stage for a big reveal…

What do you think?

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🇨🇴 Colombia’s instant payment leap: Bre-B goes live. The country’s new instant payments infrastructure enables real-time P2P and merchant transfers across banks, FinTechs, and digital wallets. Erika Dietrich from ACI Worldwide highlighted Bre-B as one of Latin America's most ambitious payments modernization projects that sets the stage for financial inclusion, interoperability, and a thriving digital economy.

🇺🇸 Stripe’s valuation rises above its 2021 peak to $106.7 billion. Stripe has opted to remain private as its valuation soared, much to the chagrin of retail investors who have been forced to watch its growth from the sidelines. Continue reading

🇸🇻 Crypto giant Tether seeks funding at $500 billion valuation. Tether’s CEO, Paolo Ardoino, said the company is evaluating a raise from a group of high-profile investors “to maximize the scale of the Company’s strategy across all existing and new business lines”.

🇬🇧 London FinTech TRIVER raises £114M to speed up cash flow for UK small businesses. The fresh capital injection is aimed at accelerating TRIVER’s growth trajectory, expanding its reach through further partnerships with software providers and SME lending brokers.

🇺🇸 Mastercard invests in income verification firm Argyle. CEO Shmulik Fishman emphasized that the funding strengthens Argyle’s ability to streamline verification workflows, helping lenders, FinTechs, and tenant screeners make faster, more accurate decisions through open finance capabilities.

🇺🇸 Mastercard partners with Stripe, Google, and Antom to launch AI-driven agentic payments for global digital merchants. In an effort to advance AI-driven payments, Mastercard is introducing new tools for developers, expanding consulting services, and deepening collaboration with the global tech and finance ecosystem.

🇺🇸 Coinbase leads $14.6 million investment in stablecoin startup Bastion, founded by former a16z execs. Bastion is a white label issuer of stablecoins, which are cryptocurrencies pegged to underlying assets like the U.S. dollar. Rather than hire lawyers to secure regulatory licenses and software developers to write code, companies hire Bastion to more easily spin up their own branded stablecoins.

🇸🇦 Visa and intella partner on Arabic-Language Conversational AI for Financial Institutions. The companies will use intella’s technology to analyze every customer interaction and transform this conversational data into actionable intelligence that will enhance the customer service delivered by Visa’s partner banks.

🇺🇸 FIS acquires Amount to deliver unified digital account origination, empowering financial institutions to accelerate growth and simplify banking. With the addition of Amount, FIS strategically expands its portfolio of innovative solutions that support the world’s money lifecycle, encompassing when money is at rest, in motion, and at work.

🇬🇧 GoCardless to open ‘Northern Hub’ in Leeds. The new GoCardless office will serve as the company’s base in the north of England, with a team of 50 staff employed within the first 12 months of opening. The Leeds location will be the firm’s third, with its headquarters in London and an international site in Riga.

🇮🇳 Walmart-backed PhonePe files for India IPO and targets mid-2026 listing. The application has been filed via the confidential route, which allows firms to keep their filings private until the public issue launches. PhonePe's IPO plan comes against the backdrop of buoyant Indian primary markets, where fundraising is expected to surpass the record $20 billion achieved in 2024.

🇨🇳 HSBC has launched its Tokenised Deposit Service (TDS) in Hong Kong with Ant International as its first client. A blockchain‑based settlement platform that enables instant payment and remittance settlement via digital tokens representing fiat deposits, reinforcing its leadership in digital treasury and liquidity solutions.

🇺🇸 Reap partners with Flagright for real-time transaction monitoring and AML compliance to power expansion. With Flagright, Reap enables its compliance teams to monitor every transaction in real-time, configure rules in minutes, and surface high-risk events through automated risk scoring.

🌍 PayPal commits $100 million to accelerate digital growth across the Middle East and Africa. This strategic investment will be deployed through a mix of minority investments, acquisitions, PayPal Ventures funding, people, and technology deployments that will help local businesses scale, unlock new opportunities for innovators. Additionally, PayPal announces a multi-year relationship for US buy now, pay later receivables with funds managed by Blue Owl Capital.

🇦🇪 Telr partners with Kema to drive payment solutions. The alliance leverages Telr’s payment solutions and Kema’s platform to help merchants build and scale payment experiences in just a few clicks. The alliance contributes to digital payment in the region, unifying innovation and regulatory compliance to drive growth.

GOLDEN NUGGET

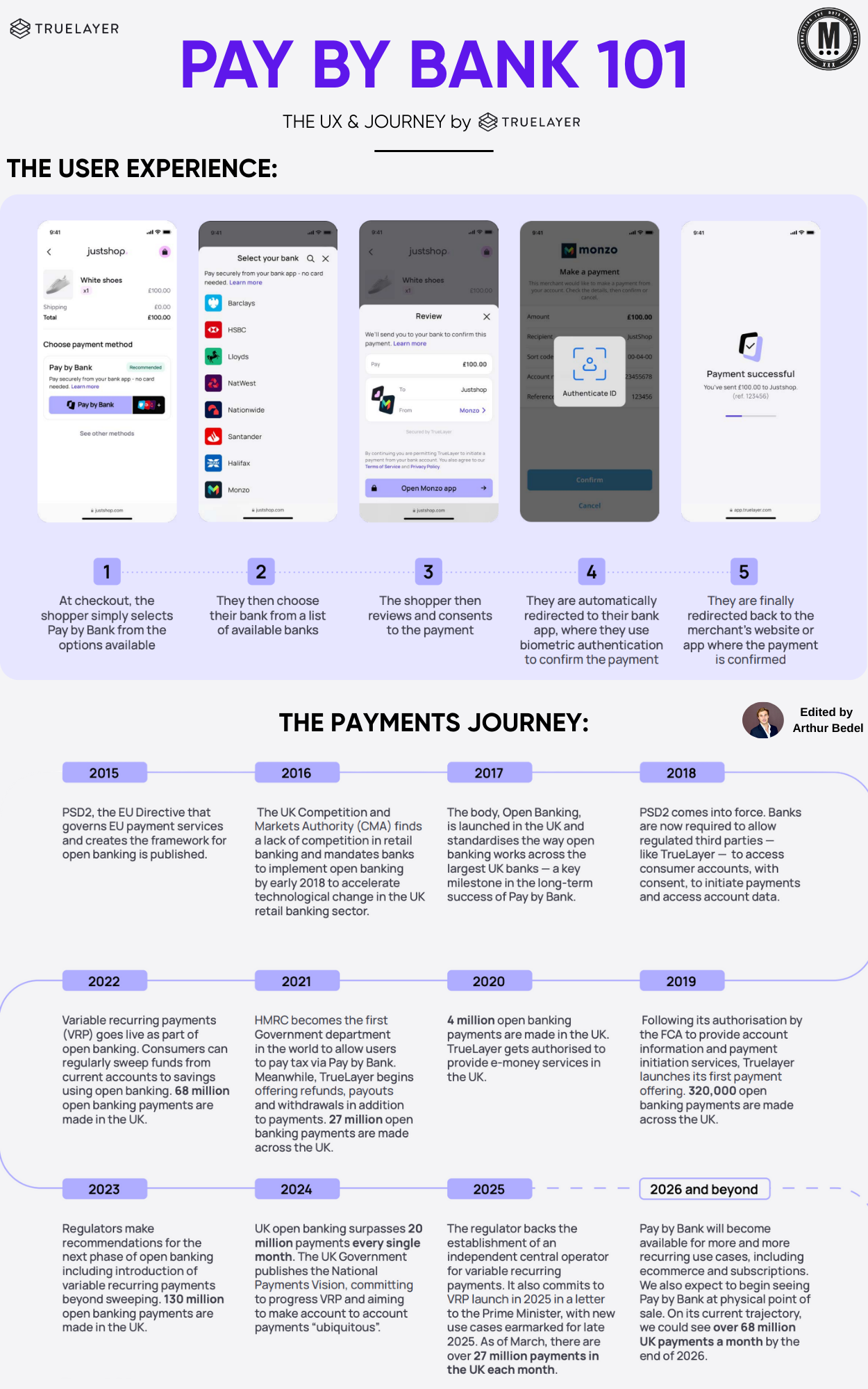

🚨 𝐏𝐚𝐲 𝐁𝐲 𝐁𝐚𝐧𝐤 — 𝐓𝐡𝐞 𝐔𝐬𝐞𝐫 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐉𝐨𝐮𝐫𝐧𝐞𝐲 — by TrueLayer 👇Created by Arthur Bedel 💳 ♻️

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲 𝐁𝐲 𝐁𝐚𝐧𝐤?

Pay by Bank is an Open Banking payment method that enables direct account-to-account (A2A) transfers without cards or intermediaries. Instead of entering card numbers or CVVs, consumers authenticate payments directly through their banking app.

For merchants, it offers lower costs, faster settlement, and fewer chargebacks. For consumers, it provides a secure, seamless, and transparent checkout.

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐏𝐚𝐲 𝐁𝐲 𝐁𝐚𝐧𝐤 𝐖𝐨𝐫𝐤?

1️⃣ 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐓𝐫𝐢𝐠𝐠𝐞𝐫 — Consumer selects Pay by Bank at checkout.

2️⃣ 𝐁𝐚𝐧𝐤 𝐒𝐞𝐥𝐞𝐜𝐭𝐢𝐨𝐧 — They choose their bank from a pre-integrated list.

3️⃣ 𝐑𝐞𝐯𝐢𝐞𝐰 & 𝐂𝐨𝐧𝐬𝐞𝐧𝐭 — Payment details are reviewed, then authorized.

4️⃣ 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 — Strong Customer Authentication (SCA) via biometrics or 2FA.

5️⃣ 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 — Funds move directly from the consumer’s account to the merchant, often instantly.

This provides a card-like experience but without card data, scheme fees, or lengthy settlement times.

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 & 𝐒𝐚𝐟𝐞𝐭𝐲 𝐌𝐞𝐚𝐬𝐮𝐫𝐞𝐬

→ Strong security through bank-grade SCA

→ Lower costs with no interchange or scheme fees

→ Instant settlement, improving cash flow

→ Reduced fraud risk with no sensitive card data exposed

→ Compliance by design through regulated APIs

𝐓𝐡𝐞 𝐉𝐨𝐮𝐫𝐧𝐞𝐲 in Payments

📌 2015 — PSD2 published, laying foundations

📌 2017 — UK Open Banking launches

📌 2018 — APIs mandated for banks

📌 2020 — 4M UK open banking payments

📌 2022 — Variable Recurring Payments (VRP) introduced

📌 2024 — >20M monthly Pay by Bank payments in the UK

📌 2026+ — Forecasted to exceed 68M monthly

𝐖𝐡𝐚𝐭’𝐬 𝐍𝐞𝐱𝐭 𝐟𝐨𝐫 𝐏𝐚𝐲 𝐁𝐲 𝐁𝐚𝐧𝐤?

→ 𝐕𝐚𝐫𝐢𝐚𝐛𝐥𝐞 𝐑𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 (VRP): Automated subscriptions and bill payments.

→ 𝐏𝐎𝐒 𝐄𝐱𝐩𝐚𝐧𝐬𝐢𝐨𝐧: Integration into in-store payments, replacing cards.

→ 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 Use Cases: Lower-cost FX and international transfers.

→ 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐞: B2B treasury, payroll, lending, and wallet integrations.

→ 𝐆𝐥𝐨𝐛𝐚𝐥 𝐆𝐫𝐨𝐰𝐭𝐡: Players such as TrueLayer, Aeropay, Token.io, Yapily, Volt.io, and Trustly are scaling Pay by Bank infrastructure across Europe, the US, and APAC.

Pay by Bank is no longer just an alternative — it’s shaping the next phase of digital payments by combining security, efficiency, and scale.

Source: TrueLayer

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()