Stripe’s Link hits 200M Users 🤯 + AI Shopping Gets Real

Hey Payments Fanatic!

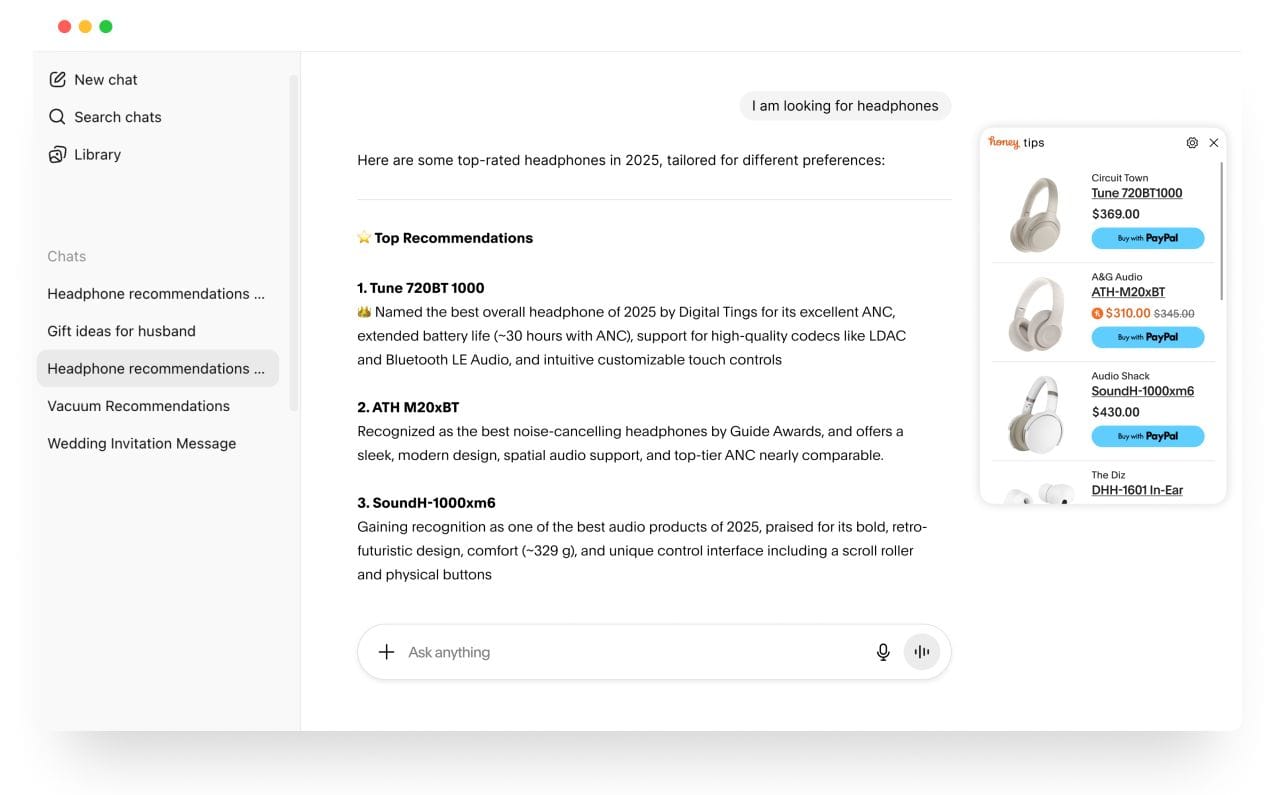

Stripe and OpenAI just dropped a payments bombshell: Instant Checkout inside ChatGPT.

That means when you ask ChatGPT for product recs, you can now buy—directly in the chat—starting with Etsy sellers and soon 1M+ Shopify merchants like Glossier, Spanx, and SKIMS. No tabs. No clicks. Just: “Yes, I’ll take it.”

The engine under the hood? The new Agentic Commerce Protocol (ACP). Stripe + OpenAI built it as an open standard so AI agents and merchants can finally “speak the same payments language.” Businesses keep control of brand + fraud checks, while AI does the selling.

Stripe also flexed at Sessions NYC: Link just crossed 200M users 🤯 and is quietly turning into the “wallet of the 2020s.” Next up: subscription tools, stablecoins, and way more.

And PayPal’s not sitting still. Honey is now embedding into AI chats so when you ask, “best TVs under $500?” you’ll get instant merchant links, real-time pricing, cashback, and discounts.

Basically, closing the conversion gap where AI traffic is booming but carts stay empty.

🎥 BTW, how did I miss this Honey deep-dive video (thanks for sharing this with me Jonathan Bredo!)?

Install Honey

Curious what you think: Honey is…

A) a scam

B) a smart business model

Drop it below 👇

Cheers,

NEWS

🌍 Preparations for MPE 2026 are underway, with sponsors including Payabl, Forter, Shopify, Ecommpay, dLocal, IXOPAY, and more, fueling Europe’s home for merchant payments and the #1 conference for the ecosystem. The event takes place in Berlin, March 17–19, 2026, with further partners to be announced. Be part of it

🇨🇴 Immediate payments from businesses and individuals are growing at a rate of 3,300%. In 2025, real-time payments in Colombia surged, with Transfiya processing over 8.5 million transactions worth 1.7 trillion pesos. The new Bre-B system, built by Banco de la República with support from ACI Worldwide, will enable instant, secure transfers between banks for both people and businesses.

🇪🇺 Airwallex adds support for Nordic currencies. From launch, Airwallex customers based in the EU will be able to transact directly in Danish Krone, Norwegian Krone, Swedish Krona, and Polish Zloty. Now, when card transactions are made in these currencies, amounts will be debited directly from the multi-currency wallets, eliminating unnecessary foreign exchange conversions and delivering cost savings for customers.

🌍 Seamless subscription migration with Ecommpay. Migrating payment data is a challenge for many subscription businesses. Ecommpay offers tools to switch providers without interrupting customer journeys, helping merchants maintain continuity while upgrading infrastructure. Learn more

🇸🇦 Hala partners with Marn POS to support SMEs in KSA with smarter, more efficient payment solutions. This integration streamlines checkout, offers more payment options, enhances security, reduces errors, and helps merchants manage inventory and sales more effectively, saving time and driving business growth.

🇺🇸 PayPal continues to shape agentic commerce with instant product discovery. PayPal announced it is transforming AI-centric shopping queries into seamless buying experiences by adding new capabilities to PayPal Honey. PayPal Honey can provide consumers with additional value directly in their AI-powered conversations.

🇺🇸 Stripe powers Instant Checkout in ChatGPT and releases Agentic Commerce Protocol codeveloped with OpenAI. ChatGPT users in the US can purchase goods from US-based Etsy businesses. Additionally, Stripe is to power the Mercari Global App. By integrating Stripe, Mercari can offer users worldwide a seamless shopping experience with multiple currencies, local payment methods, and consistently high authorization rates for cross-border transactions.

🇺🇸 Visa Direct taps stablecoins to unlock faster funding for businesses. It will launch a stablecoin prefunding pilot through Visa Direct, giving businesses a new way to move money globally, unlocking liquidity and modernizing treasury operations for the digital-first economy.

🇺🇸 Worldpay launches embedded lending, banking, and card issuing. Worldpay’s Embedded Finance Engine is available to partners integrated with Worldpay for Platforms and includes embedded lending, banking, and commercial card issuing products, with plans to expand capabilities rapidly over the coming months.

🇩🇪 Oracle achieves Swift-compatible application for payments 2025. With this achievement, financial institutions can feel confident in leveraging Oracle’s solutions to help meet Swift standards for payment security, interoperability, and regulatory compliance, while benefiting from modern, AI-enabled payment messaging processing.

🇩🇪 German mobile payments startup FLIZpay closes $1M pre-seed funding. The funding will enable FLIZpay to pursue its goal of becoming the preferred mobile payment method in Germany and across the EU. Continue reading

🌍 The European Central Bank and the Swiss National Bank explore the link between instant payment systems. The exploration phase, which will involve assessing the technical, legal, and economic feasibility of the project, will be conducted in collaboration with the SNB and will run throughout 2026.

🇺🇸 Yaspa accelerates US expansion with Intelligent Payments platform. UK-headquartered Yaspa, which last month secured a $12m funding round led by Discerning Capital, has now incorporated a US entity in Atlanta and is in the process of scaling its operations in Georgia.

🇻🇳 Viamericas raises $113.6 million to expand global remittance network serving 95 countries. The funding comes as global remittances continue to grow in importance, playing a vital role in connecting families and supporting economic stability worldwide.

🌍 Deutsche Börse Group and Circle announce collaboration to advance stablecoin adoption in Europe. This first-of-its-kind agreement in Europe aims to deliver new solutions for market participants by connecting token-based payment networks with traditional financial market infrastructure.

🇶🇦 Qatar National Bank taps JPMorgan’s Kinexys to speed up cross-border dollar settlements. The blockchain network allows transactions to settle within minutes, significantly faster than traditional methods. Unlike conventional systems, which rely on manual clearing and limited banking hours, Kinexys provides continuous, round-the-clock settlement.

🇪🇺 EU watchdog pushes multi-issuance stablecoin ban on crash fears. The ECB is winning support for a ban on stablecoins issued jointly in the bloc and other jurisdictions, setting the scene for a clash over how operators like Circle Internet Group Inc. and Paxos Inc. manage their activities across borders.

🇺🇸 Global Payments appoints Nathan Rozof as Head of Investor Relations. Rozof brings more than two decades of experience in finance, capital markets, and investor engagement. He will lead Global Payments’ investor relations strategy, serving as the primary liaison between the company and the investment community.

🇺🇸 FinTech Brex launches stablecoin payment platform amid demand. In the coming months, the firm said its clients will be able to accept and send Circle Internet Group’s dollar-pegged token USDC for payments and disbursements. Brex said it is working with its partner Column Bank N.A. to power its stablecoin offering.

🇺🇸 Fiserv launches Content Next to accelerate AI-driven content management and workflow optimization for financial institutions. Designed specifically for financial services, Content Next supports enterprise content management administrators, bank and credit union employees, and end customers, empowering users with self-serve tools.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()