Stripe’s UPI Glitch Trips OpenAI’s India Launch

Hey Payments Fanatic!

OpenAI launched its ChatGPT Go plan in India this week at ₹399/month, aiming to expand affordable access to GPT-5. But the rollout was marred when global payments giant Stripe failed to process UPI transactions, leaving many users unable to subscribe on day one.

The glitch highlights the critical role of UPI Autopay in India’s subscription economy... so much so that Apple now only allows UPI Autopay for Indian subscriptions.

Scroll down for the full story and today’s top FinTech headlines 👇

And see you back tomorrow!

Cheers,

INSIGHTS

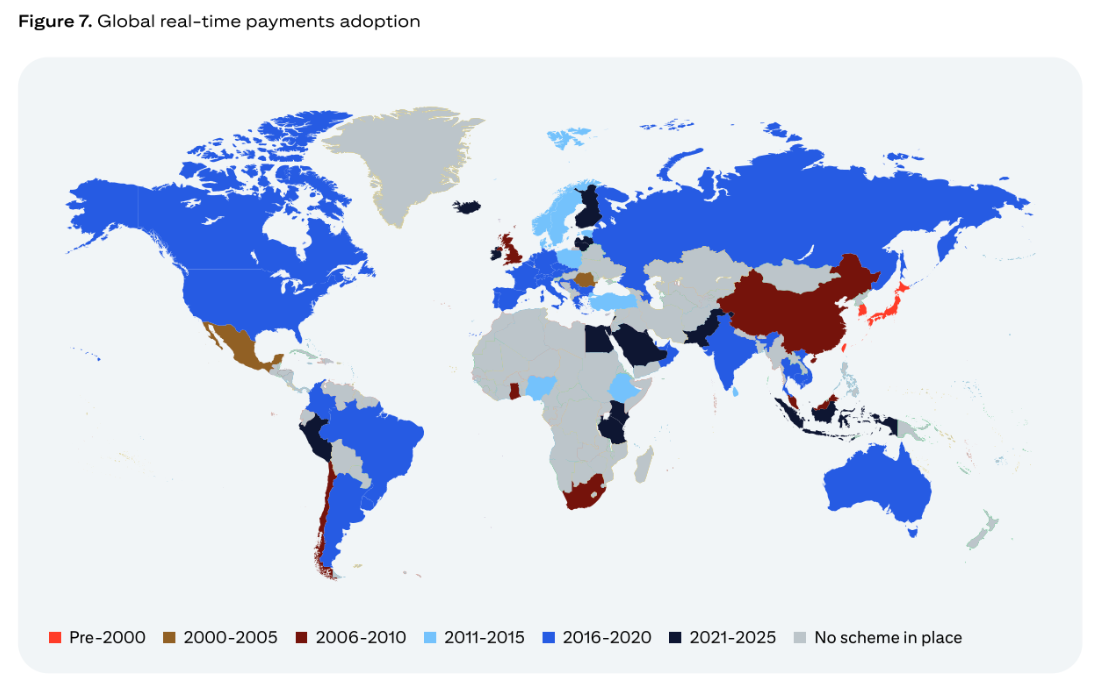

💰 Real Time: 24x7 Finance in an Always-On World. The financial services landscape is rapidly transforming, and real-time payments are already facilitating global commerce.

NEWS

🇮🇳 Stripe’s UPI glitch mars OpenAI's India plan launch. Customers attempting to make payments via UPI were unable to complete their transactions. UPI payments had been temporarily disabled due to ongoing technical issues, and that resolution was expected within 12 to 24 hours, according to a message posted on the website. Meanwhile, Stripe unveils stablecoin, AI upgrades for global businesses at its Stripe Tour Singapore 2025 event on August 20, 2025.

🇺🇸 FIS unveils reconciliation service. Reconciliation Service is a fully managed solution designed to automate the end-to-end reconciliation process for banks, corporations, and financial institutions. Continue reading

🇺🇸 MoonPay and Trust Wallet sign multi-year partnership to expand on- and off-ramp services. The expanded deal makes MoonPay the default provider for buy and sell flows within the wallet, simplifying access to crypto across multiple fiat currencies and payment methods.

🇺🇸 Workday and DailyPay form a strategic partnership to bring on-demand pay to millions of workers. Through this collaboration, employers can give workers, including frontline and hourly workers, real-time access to their money as they earn it.

🇺🇸 Nuvei integrates with Zuora for subscription payments. The partnership enhances Nuvei’s ability to support enterprise recurring revenue at a global scale and provides Zuora’s customers with a robust payments infrastructure to accelerate growth in both established and emerging markets.

🇳🇱 Coda completes acquisition of Recharge, expanding global reach in digital content monetization and distribution. The acquisition creates a single, trusted partner for the global distribution and monetization of digital content and prepaid products across mobile gaming, entertainment, and lifestyle.

🇺🇸 Kinective buys ESQ Data Solutions for ATM tech. Kinective says the acquisition, its fourth in the technology sector this year, brings "real-time device analytics, proactive alerts, and automated monitoring and recovery capabilities" to its banking operations platform.

🇵🇭 Higlobe and Coins.ph launch first stablecoin-powered payment rail for U.S.–Philippines transfers with lowest cost guarantee. New payments solution set to save businesses and professionals tens of millions in fees. It will deliver the guaranteed lowest-cost, most transparent cross-border payment solution for U.S. businesses paying Filipino freelancers, vendors, and remote teams.

GOLDEN NUGGET

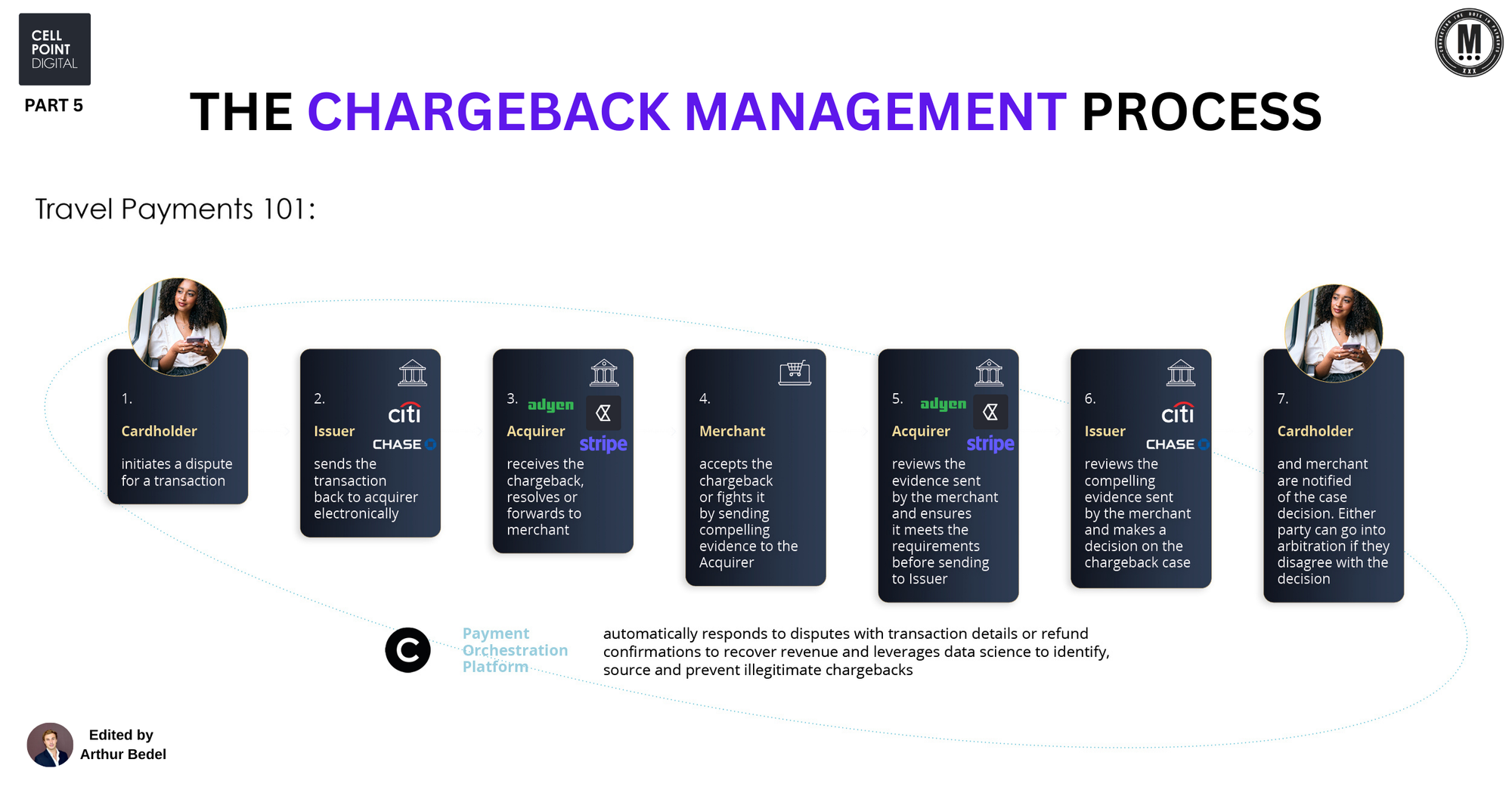

🚨 Part 5: 𝐓𝐡𝐞 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 — by CellPoint Digital👇 Created by Arthur Bedel 💳 ♻️

As digital payments grow, so do disputes. For travel merchants — where booking values are high and transactions often span multiple channels — chargebacks can quickly become a major cost center.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤?

► A chargeback is a forced reversal of a payment initiated by the cardholder through their issuing bank, typically due to suspected fraud, service disputes, or processing errors.

► The scale of the problem is significant: Global chargeback volumes are growing annually, costing merchants billions in lost sales, fees, and operational time.

𝐓𝐡𝐞 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 — 𝐒𝐭𝐞𝐩 𝐛𝐲 𝐒𝐭𝐞𝐩

1️⃣ 𝐂𝐚𝐫𝐝𝐡𝐨𝐥𝐝𝐞𝐫 — Initiates a dispute for a transaction.

2️⃣ 𝐈𝐬𝐬𝐮𝐞𝐫 — Sends the transaction back to the acquirer electronically (i.e. Citi, Santander, Chase...)

3️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 — Receives the chargeback, resolves or forwards to the merchant (i.e. Checkout.com, Getnet, Adyen...)

4️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 — Accepts the chargeback or fights it by sending compelling evidence to the acquirer.

5️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 — Reviews the merchant’s evidence and forwards it to the issuer (i.e. Checkout.com, Getnet, Adyen...)

6️⃣ 𝐈𝐬𝐬𝐮𝐞𝐫 — Reviews the evidence and makes a decision on the case (i.e. Citi, Santander, Chase...)

7️⃣ 𝐂𝐚𝐫𝐝𝐡𝐨𝐥𝐝𝐞𝐫 & 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 — Are notified of the decision; either party may go to arbitration.

→ Throughout, orchestration can automate evidence submission, timelines, and reporting.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐢𝐞𝐧𝐝𝐥𝐲 𝐅𝐫𝐚𝐮𝐝?

► Also known as first-party misuse, friendly fraud occurs when a legitimate customer disputes a valid charge — often claiming the transaction was unauthorized or the service not delivered.

► In travel, this can happen when a guest stays at a hotel or takes a flight, then disputes the payment post-service.

𝐌𝐚𝐢𝐧 𝐈𝐬𝐬𝐮𝐞𝐬:

→ High difficulty in proving service delivery

→ Strains merchant–customer relationships

→ Contributes to higher fraud ratios and acquirer scrutiny

𝐇𝐨𝐰 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐂𝐨𝐦𝐛𝐚𝐭𝐬 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬

✔ 𝐀𝐮𝐭𝐨𝐦𝐚𝐭𝐞𝐝 𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐑𝐞𝐬𝐩𝐨𝐧𝐬𝐞𝐬 — Instantly submit transaction details, receipts, and refund confirmations.

✔ 𝐃𝐚𝐭𝐚 𝐒𝐜𝐢𝐞𝐧𝐜𝐞 & 𝐏𝐚𝐭𝐭𝐞𝐫𝐧 𝐑𝐞𝐜𝐨𝐠𝐧𝐢𝐭𝐢𝐨𝐧 — Identify repeat offenders and suspicious dispute behavior.

✔ 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐯𝐞 𝐒𝐜𝐫𝐞𝐞𝐧𝐢𝐧𝐠 — Integrate fraud tools to reduce invalid transactions before they occur.

✔ 𝐂𝐞𝐧𝐭𝐫𝐚𝐥𝐢𝐳𝐞𝐝 𝐂𝐚𝐬𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 — Manage all disputes from multiple PSPs and acquirers in one platform.

→ 𝐓𝐡𝐞 𝐫𝐞𝐬𝐮𝐥𝐭: faster resolution, reduced loss rates, and better win ratios.

Source: CellPoint Digital | Steven Osei

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()