Tether’s Juventus Stake Ambitions Run into Silence

Hey Payments Fanatic!

You know I’m always tuned into FinTech and Payments, but if you’ve started following me recently, you might not know I’m also a football fan. So today I'm sharing a story that caught my eye and connects both worlds.

Back in February, Tether, the company behind the world’s biggest USD-backed stablecoin, acquired a 10.7% stake in Juventus. That investment is now worth around €128 million, making Tether the 2nd largest shareholder in the club.

Despite the size of that stake, communication between Tether, Juventus, and the club’s majority owner Exor has been "very, very limited," according to Tether CEO Paolo Ardoino.

Juventus is said to be weighing a capital raise of up to €100 million, and Tether has expressed interest in joining the round, along with a request for a board seat. So far, Tether has reportedly been ignored.

In recent months, both sides have exchanged letters to arrange a meeting, but no date has been confirmed. With Juventus currently competing in the Club World Cup in the U.S., a spokesperson said any discussions will have to wait until the season concludes in early July.

Time will tell how, or if, this moves forward...

Read more global payments industry updates below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

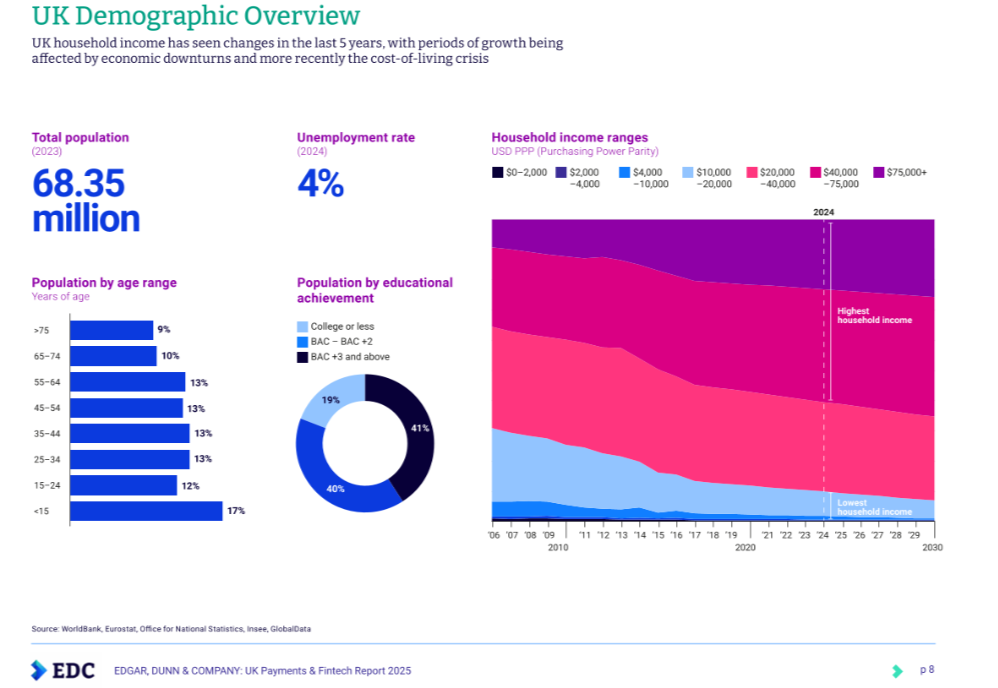

🇬🇧 UK Payments & FinTech Report 2025.

NEWS

🇧🇷 Pomelo participated in Febraban Tech as an official sponsor of the Fintech Arena. Country Manager Rafael Goulart joined top industry leaders in a high-level panel on the future of digital payments in Brazil. Keep reading

🇮🇳 FinTech firm Pine Labs files for India IPO, with the company set to issue fresh shares worth 26 billion rupees ($304 million). Pine Labs offers full-stack payment solutions, including point-of-sale machines, to merchants for card payments and competes with Paytm and Walmart's PhonePe.

🌎 Mastercard expands technology to new markets. After a successful launch in the U.S., Mastercard is expanding its data-driven First-Party Trust program to counter the rise of first-party or “friendly” fraud. Meanwhile, Mastercard Sandbox allows experimentation into the ‘Art of the Possible’ for the UK National Payments Vision. The sandbox will enable banks and FinTechs to implement a “5-leg credit transfer” with confirmation of funds.

🌎 Clara launched Clara TravelPay in Mexico and Colombia, after strong traction in Brazil. Clara TravelPay is a specialized payments infrastructure designed for modern companies managing corporate travel. It offers enhanced capabilities beyond standard transaction data by automatically providing detailed flight and hotel information, streamlining reconciliation processes.

🇬🇧 Spendesk becomes the first profitable spend management platform, redefining finance with AI. As Spendesk enters this next chapter, it remains committed to continuing its double-digit growth by driving the next wave of transformation for finance teams.

🇪🇸 CaixaBank rolls out iPhone Tap to Pay to enable businesses in Spain to seamlessly and securely accept in-person payments with the iPhone, without any additional hardware or payment terminal needed. CaixaBank has become the first financial institution in Spain that allows its business customers to operate easily with their iPhone.

🇮🇳 PhonePe and HDFC Bank launch co-branded RuPay credit card with UPI integration. The card integrates directly with UPI, allowing users to make payments using credit at millions of merchants accepting UPI QR codes. Cardholders can manage their card, track spending, and pay bills through the PhonePe app.

🇮🇹 Sibill raises €12M Series A to modernise financial management for Italy’s SMEs. The capital increase will enable the company to strengthen the development of its platform, introduce new features, and build a network of strategic partnerships to support its growth.

🇩🇪 E-wallet paylado chooses Volt to power real-time top-ups and payouts. Volt will power real-time open banking payments for paylado, EPG’s e-wallet solution. paylado allows users to top up their e-wallets manually using two methods: a network of cash deposit devices across Germany or via bank transfer.

🇫🇷 Worldline Mulls suit over media reports on alleged fraud lapses. The company responded to the publication of those reports, stating that it is“fully committed to strict compliance with regulation and risk prevention standards and to enforce related rules and procedures with zero tolerance strictly.”

🇺🇸 Crypto exchange Kraken debuts peer-to-peer payments app Krak. The move is a bid to expand Kraken's offerings beyond its digital asset trading business, and puts the firm in competition with PayPal, Venmo, and Block's Cash App. Read more

🇺🇸 VISIONA and Visa form a partnership. It will extend the functionality of VISIONA Card Solutions Suite with the possibility to cater for the Visa Direct services, both within the scope of card transfers and transfers to accounts. Additionally, Visa and FIS are to offer financial institutions value-added payment capabilities. They will also offer a digital campaign manager that facilitates the use of new marketing channels, such as augmented reality events and other digital experiences.

GOLDEN NUGGET

How Mastercard and Chainlink Labs enable on-chain crypto purchases using Mastercard's 3.5 billion cards and why it matters.

Chainlink, a company that provides a decentralized oracle network, has partnered with payments provider Mastercard to allow the credit card company’s over three billion cardholders to buy crypto onchain.

The integration could spur crypto adoption by providing a new avenue for people without Web3 exposure to gain experience with digital assets.

The integration is made possible through a series of partnerships with Web3 entities, including Shift4 Payments, Swapper Finance, XSwap Protocol and zerohash, a crypto and stablecoins infrastructure company that will provide the onchain service and liquidity enabling customers to convert fiat currency to crypto.

“The current version of the application available at Swapper Finance is non-custodial and leverages account abstraction to provide users with simplicity and control,” a Chainlink Labs spokesperson told Cointelegraph.

“It was important that this solution was built for everyone, not just for crypto-natives or enthusiasts.”

𝗪𝗵𝘆 𝗶𝘁 𝗺𝗮𝘁𝘁𝗲𝗿𝘀:

► Buying crypto on-chain has historically been complicated by wallet setup, on-ramp limitations, network complexity, and user interface challenges. These obstacles have limited broader participation in the crypto economy.

► Swapper changes that. It’s the first time a major payments network has enabled direct-to-DEX swaps at scale.

► Integrating with leading infrastructure providers delivers a secure and regulated experience.

► Then zerohash handles core compliance, custody and transaction infrastructure, making it possible to convert fiat into crypto for smart contact consumption in a regulated manner. Shift4 enables seamless card processing, while XSwap sources liquidity from DEXs.

► Together, these technologies create a unified, compliant, and intuitive user experience that brings crypto access directly to the payments mainstream.

Source: Mastercard

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()