Thailand Launches TouristDigiPay for Crypto Payments

Hey Payments Fanatic!

Thailand just rolled out TouristDigiPay, a regulated system that lets foreign visitors convert crypto into baht for spending. No cash withdrawals are allowed.

Tourists must register with both a licensed digital asset provider and an e-money provider, ensuring KYC and AML compliance.

Funds sit in a regulated Tourist Wallet, usable mainly via QR codes. The move is designed to revive tourism and position Thailand as a crypto-friendly destination, while keeping strict limits and safeguards in place.

The story everyone’s talking about is still below 👇 Check out the other news stories shaking up the payments landscape.

Enjoy! And see you back tomorrow!

Cheers,

INSIGHTS

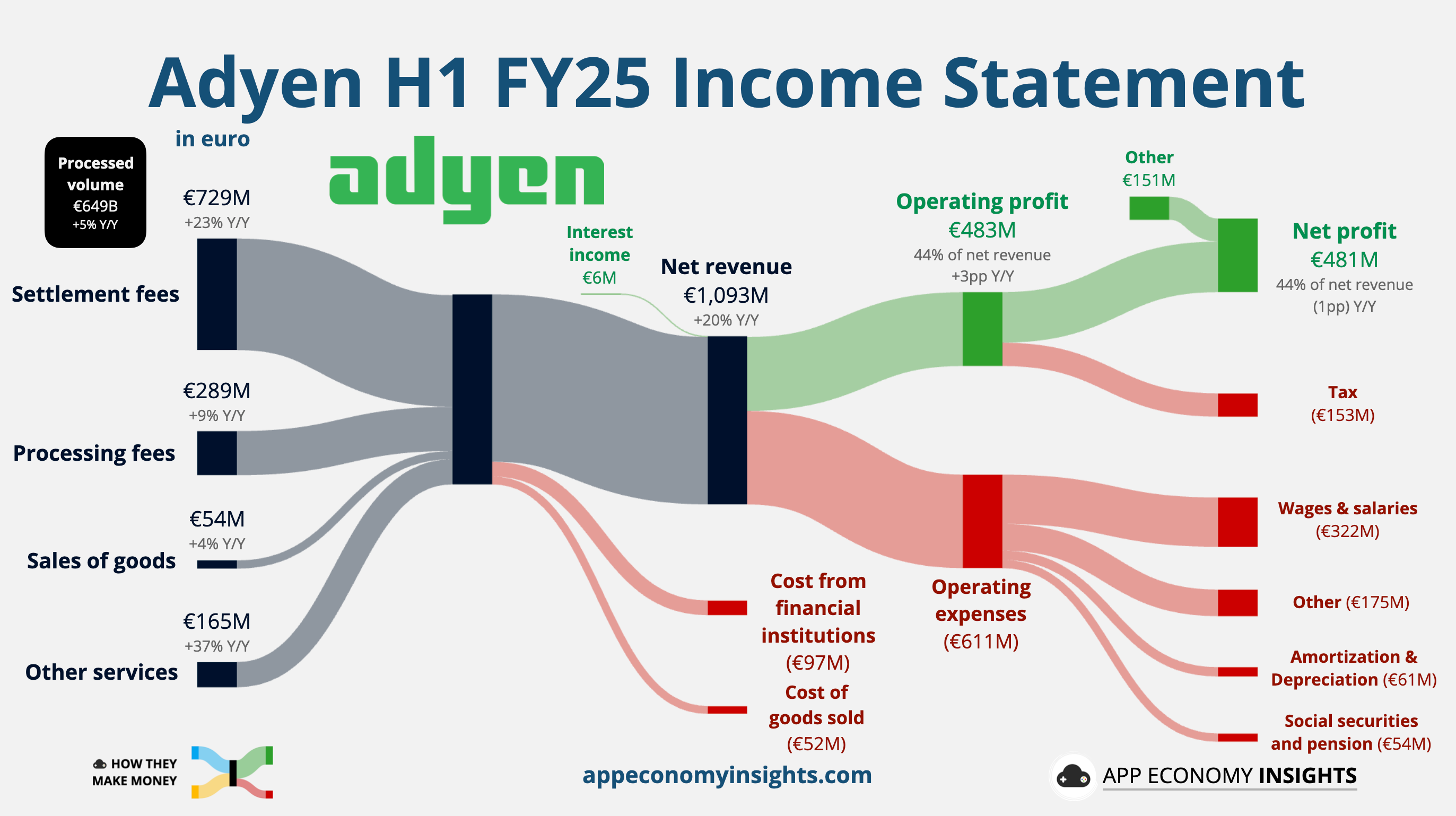

📈 Adyen cuts 2025 forecast amid US pressure and weak Dollar.

Here are the Key Takeaways from Adyen’s H1 financial results:

NEWS

🇦🇺 Airwallex hits $200 billion: FinTech’s overachiever isn’t slowing down. Jack Zhang, Co-founder and CEO of Airwallex, stated that the company's mission is to become the financial operating system for modern businesses, empowering them to scale seamlessly across borders, currencies, and markets, without being held back by the friction of traditional financial systems.

🇬🇧 What is card acquiring & how it affects your payment processes by Andrew Kononenko, Head of Merchant Operations at Solidgate. Kononenko highlights the strategic importance of card acquiring in digital business growth. As digital businesses scale, their payment systems should function as strategic assets rather than mere back-end infrastructure.

🇮🇳 The Unified Payments Interface has truly transformed how money moves across the nation and is now gaining global recognition. As per the ACI Worldwide Report 2024, in 2023, an astounding 49% of all global real-time payment transactions originated in India, highlighting its leadership in digital payment innovation.

🌎 Instant payments replace ACH delays for global merchants. Real-time payments are becoming a global standard, driving investment in modern infrastructure by FinTechs, banks, and central banks. ACI Worldwide has launched ACI Connetic, a cloud-native hub that connects banks to global networks like SWIFT and SEPA Instant, streamlining payments and fraud detection through AI.

🇹🇭 Thailand launches TouristDigiPay to let visitors convert crypto to Baht. By enabling tourists to seamlessly convert crypto into fiat currency under a regulated system, Thailand hopes to position itself as a forward-looking, crypto-friendly destination while maintaining strict financial safeguards.

🇩🇿 Bank of Algeria joins Pan-African Payment and Settlement System. This development is expected to further support cross-border payments and enhance the regulatory framework governing intra-African trade. Read more

🇯🇵 Indonesian QR code payment system now works in Japan as of August 17, 2025, marking its first expansion outside ASEAN. Indonesia's national QR code payment platform can be used at 35 merchants, allowing Indonesian visitors to pay by scanning JPQR Global with their domestic apps.

🇦🇪 Worldpay leverages Mastercard's Move to empower consumers and businesses to send and receive payments quickly and securely in the UAE. Through this collaboration, Worldpay's Push-to-Card solution will enable a wide range of fast, seamless domestic and cross-border payouts to cards.

🇮🇳 IRCTC harbours FinTech ambitions with new payment aggregator entity. With the RBI's in-principle nod for IRCTC Payments, the rail PSU plans to process transactions in-house, cut costs, and expand payment services beyond railways. With about 100 million registered users and more than 1.4 million transactions daily, IRCTC sits on a payments goldmine.

🇺🇸 BNPL FinTech Affirm launches on Stripe Terminal, allowing consumers to pay over time. This integration enables U.S. and Canadian merchants to offer Affirm’s flexible, transparent payment options to in-store shoppers directly through Stripe Terminal, which has over one million devices in use.

🇦🇪 UAE employees can now receive salaries in digital wallets as du launches new platform. Through the multilingual du Pay platform, UAE residents can transfer money globally, pay bills, recharge telco accounts, order a debit card, and make card payments.

🇺🇸 PayLaterr partners with Experian to enhance fraud detection and leverage alternative data for smarter budgeting decisions. With the partnership, PayLaterr will integrate Experian's industry-leading fraud detection tools and alternative credit data solutions into its identity verification and decision-making processes.

🇺🇸 PowerPay partners with Synovus Bank and Nearwater Capital. The partnership is expected to provide PowerPay with the capital needed to continue scaling its originations and serve its growing network of over 12,000 contractors, merchants, and medical professionals nationwide.

🇺🇸 Payoneer and Stripe partner to empower SMBs to accept a broader range of payment methods. Through this partnership, they are enabling enhanced customer conversion rates, improving acceptance rates, helping to reduce fraud, and expanding payment acceptance options for SMBs selling direct-to-consumer via their e-commerce webstores.

🇱🇹 Akurateco partners with PAYSTRAX to expand European payment capabilities. Under this collaboration, PAYSTRAX will serve as one of Akurateco’s provider partners, integrating its acquiring services for Visa, Mastercard, and alternative payment methods.

🇺🇸 Klarna secures $26 billion forward flow deal with Nelnet to expand U.S. Pay in 4. Klarna stated that the deal will provide scalable funding for U.S. growth, strengthen balance sheet flexibility, and support its long-term capital strategy. Read more

🇿🇦 South African FinTech Startup TurnStay secures $2 million seed funding to revolutionize travel payments across Africa. TurnStay’s platform facilitates secure, instant, and cross-border payments, reducing delays and operational friction for hospitality businesses.

GOLDEN NUGGET

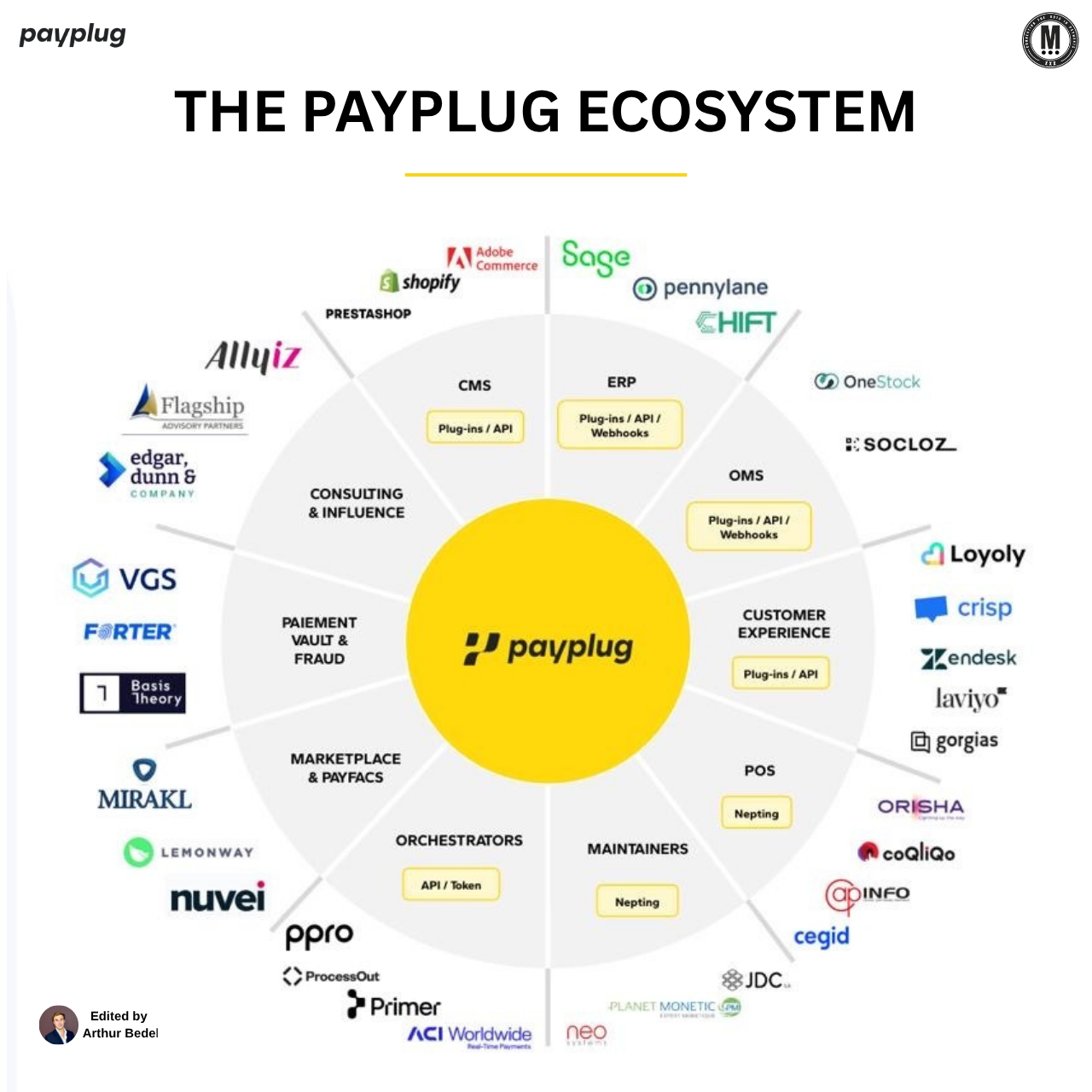

🚨Inside the Payplug's Modular Payment Stack — 𝐚 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐟𝐨𝐫 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 👇 Created by Arthur Bedel 💳 ♻

As payment complexity rises across Europe — from domestic networks to omnichannel requirements — merchants need more than just acceptance. They need flexibility, interoperability, and control.

Payplug, a French-born acquirer and full-stack payment provider, delivers precisely that: a modular, API-first infrastructure powering fast-scaling retailers and digital platforms across the region.

What is Payplug?

► Payplug is a licensed acquirer offering acquiring, fraud prevention, tokenization, orchestration, and omnichannel tools — all delivered via flexible modules.

► With a strong footprint in France, Italy, Spain, and Western Europe — Payplug supports 20,000+ merchants and connects natively into commerce, ERP, and experience platforms.

The Payplug Ecosystem — A Scalable Architecture Built on Interoperability

At its core, PayPlug functions as a payments engine that connects to best-in-class providers across the full commerce stack. Through plug-ins, APIs, and pre-integrations, merchants can assemble the right solution without complexity.

𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 & 𝐄𝐑𝐏 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬

→ PrestaShop, Shopify, Adobe Commerce

→ Sage, Pennylane, Chift

→ Embedded plugins for real-time sync of checkout, billing, and reporting

𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐄𝐱𝐩𝐞𝐫𝐢𝐞𝐧𝐜𝐞 & 𝐋𝐨𝐲𝐚𝐥𝐭𝐲

→ Loyoly.io, Zendesk, Gorgias

→ Integrated tools to support support, retention, and personalization

𝐎𝐫𝐝𝐞𝐫 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 & 𝐎𝐦𝐧𝐢𝐜𝐡𝐚𝐧𝐧𝐞𝐥

→ SoCloz, OneStock

→ Unified solutions for click & collect, inventory sync, and in-store coordination

𝐌𝐚𝐫𝐤𝐞𝐭𝐩𝐥𝐚𝐜𝐞 & 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐄𝐧𝐚𝐛𝐥𝐞𝐦𝐞𝐧𝐭

→ Mirakl, Lemonway, Nuvei

→ Infrastructure support for embedded payments and B2B marketplaces

𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 & 𝐑𝐨𝐮𝐭𝐢𝐧𝐠

→ ProcessOut, Primer, ACI Worldwide, PPRO

→ Local APMs, fallback logic, intelligent retry engines

𝐅𝐫𝐚𝐮𝐝, 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞

→ VGS, Forter, Evervault

→ PCI vaulting, dynamic fraud scoring, and token reuse logic

𝐂𝐨𝐧𝐬𝐮𝐥𝐭𝐢𝐧𝐠 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

→ Flagship Advisory Partners, Edgar, Dunn & Company

→ Go-to-market planning, vendor RFPs, and payment performance audits

𝐖𝐡𝐲 𝐈𝐭 𝐌𝐚𝐭𝐭𝐞𝐫𝐬

European merchants face a fragmented reality of regulation, consumer behavior, and technology. PayPlug’s modular payment stack allows them to:

→ Accept payments across multiple markets and touchpoints

→ Optimize cost and conversion through tokenized routing

→ Evolve their stack with plug-and-play modules — not rewrites

Built for scale. Designed for agility.

Source: Payplug

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()