The One Event Already Locked in on My Calendar…

Hi Payments Fanatic!

Summer’s officially in the rearview mirror, which can only mean one thing in our world: conference season is heating up. My calendar is still a bit of a jigsaw puzzle, but one piece is locked in—FinTech Meetup in Las Vegas, March 30–April 1.

Why am I bringing this up now? Simple. There’s a price break coming up, and nobody likes overpaying (especially not payment people, right?). Grab your tickets before the deadline, save 40%, and we’ll swap payment gossip under the neon lights.

Got other must-attend events on your radar? Hit reply or drop them in the comments. I’m building my schedule as we speak.

Cheers,

INSIGHTS

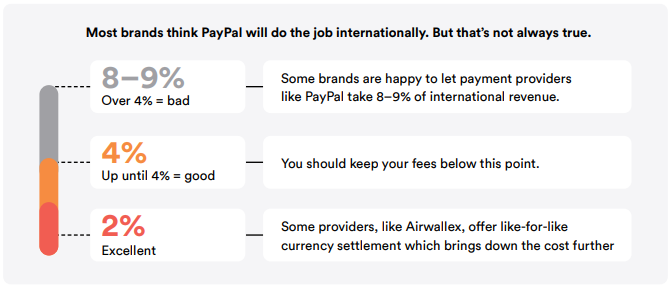

🇬🇧 Peak Season Payment Playbook by Airwallex. Many eCommerce brands enter peak season focused solely on discounts and marketing spend, often overlooking a critical factor for success: their payment infrastructure. Fragile systems, sluggish checkouts, and fragmented data can quickly turn high-intent shoppers into lost sales. This playbook offers a strategic framework to help businesses move beyond survival mode and unlock scalable, profitable growth during seasonal surges.

NEWS

🌎 dLocal and Western Union join forces to boost digital payments in LatAm. The companies have partnered to integrate local payment methods into WU's digital platforms across Latin America, enhancing remittance experiences with cards and bank transfers.

🇴🇲 Oman Air and CellPoint Digital's strategic partnership. Oman Air is accelerating its digital transformation with CellPoint, using smarter payments to boost conversions, reduce fees, and support global expansion. This partnership powers seamless booking experiences and modern retailing as the airline scales across regions.

🇺🇸 How ACI Worldwide plans to take APP scams head-on, Part 2. Part 1 of this two-part series explored the rising threat of APP scams in real-time payments, or RTPs, and the role of network intelligence in containing them. Part 2 focuses on how ACI's network intelligence and AI technology are being deployed to detect fraud.

🇺🇸 Fireblocks and Circle strategically collaborate to accelerate stablecoin adoption for financial institutions. Collaboration combines Circle's established stablecoin network with Fireblocks' institutional-grade custody, tokenization, and payments infrastructure to address banking transformation opportunities.

🇺🇸 Mastercard unveils new tools and collaborations to power smarter, safer agentic commerce. Cardholders will be the first to have the opportunity to experience AI-enabled shopping as agentic commerce providers and enablers like PayOS and other industry players go live.

🇺🇸 Chargebacks911 partners with cside to enhance fraud prevention capabilities. Merchants will be able to use data captured by cside as compelling evidence in dispute resolution cases, specifically referencing new programmes like Visa’s Compelling Evidence 3.0 and Mastercard’s First-Party Trust Program.

🇮🇳 PhonePe launches digital-first Udyam Assist registration for micro businesses. The initiative is aimed at bringing informal micro-enterprises (IMEs) into the formal economy by enabling them to secure Udyam Assist Certificates, which serve as a formal business identity.

🇬🇭 Flutterwave clarifies Bank of Ghana suspension, confirms core services remain operational. The company noted that the directive pertains only to inbound remittances through its SendApp platform. It emphasized that all other services under its Payment Service Provider licence, including Flutterwave for Business, remain fully operational.

🌍 Flutterwave taps Clear Junction to boost cross-border payments. This collaboration aims to reduce costs and delays, ensuring migrants and their families benefit from quicker access to funds and competitive foreign exchange rates. Keep reading

🇬🇧 Global Payments launches Genius™ in the UK. Genius packs all the features in one platform that meets the complex needs of quick service and fast casual restaurants, while also delivering enhanced configurability that enables Global Payments to bring its feature-rich POS platform to customers across a broader range of business needs and sizes.

🇧🇷 OpenFX launches in Brazil. This expansion will dramatically improve the country’s access to the FX markets, supporting its already competitive remittance industry while offering more liquidity to all enterprises that rely on cross-border payments.

🇺🇸 Klarna reaches a $15 billion valuation as its IPO prices at $40 a share, a major milestone for the Swedish FinTech company after tariff-driven market volatility halted its previous attempt to go public. They added that the company raised just under $1.4 billion in an offering that was roughly 26 times oversubscribed.

🇺🇸 Mike Milotich named new Marqeta CEO. Milotich will continue to serve as the company's CFO, alongside his new CEO duties, while a replacement for his former position is sourced by the board. Read more

🇺🇸 Trustly and Episode Six partner on US pay-by-bank adoption. The collaboration is designed to enable U.S. retail merchants to accept pay by bank through their existing card networks, potentially reducing complexity and the need for operational overhauls.

GOLDEN NUGGET

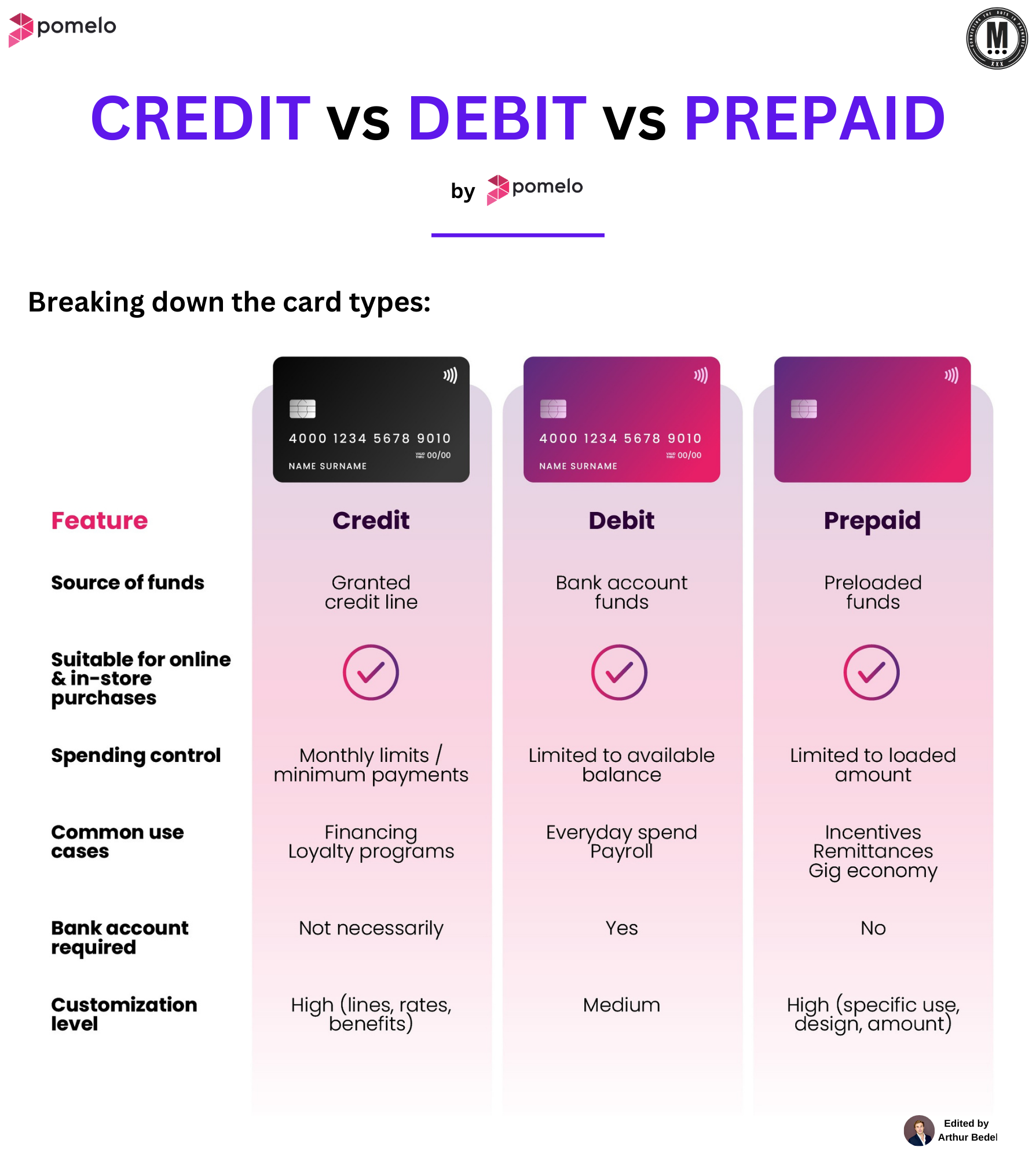

🚨 𝐂𝐫𝐞𝐝𝐢𝐭 vs 𝐃𝐞𝐛𝐢𝐭 vs 𝐏𝐫𝐞𝐩𝐚𝐢𝐝 — the types of cards in payments by Pomelo👇Created by Arthur Bedel 💳 ♻️

Understanding the differences between these three card types is essential for both consumers and businesses. Each has its own funding source, spending rules, and ideal use cases.

𝐃𝐞𝐟𝐢𝐧𝐢𝐭𝐢𝐨𝐧𝐬 101:

𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝 — A payment card that lets you borrow funds from an issuer up to a set limit, repaid later with possible interest or fees.

𝐃𝐞𝐛𝐢𝐭 𝐂𝐚𝐫𝐝 — A payment card that draws directly from your bank account balance at the time of purchase.

𝐏𝐫𝐞𝐩𝐚𝐢𝐝 𝐂𝐚𝐫𝐝 — A payment card preloaded with funds in advance, usable until the balance is depleted.

𝐃𝐞𝐞𝐩 𝐃𝐢𝐯𝐞 𝐢𝐧𝐭𝐨 𝐭𝐡𝐞 3 𝐂𝐚𝐫𝐝 𝐓𝐲𝐩𝐞𝐬:

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝?

→ A card with a granted credit line by the issuer, allowing users to borrow funds up to a limit.

→ Suitable for online & in-store purchases, with monthly limits and minimum payment requirements.

→ Commonly used for financing and loyalty programs.

→ No bank account required.

→ High customization in terms of credit lines, rates, and benefits.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐃𝐞𝐛𝐢𝐭 𝐂𝐚𝐫𝐝?

→ A card linked directly to bank account funds.

→ Works for online & in-store purchases but limited to available balance.

→ Used for everyday spend and payroll.

→ Requires a bank account.

→ Medium customization.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐫𝐞𝐩𝐚𝐢𝐝 𝐂𝐚𝐫𝐝?

→ A card loaded with prepaid funds in advance.

→ Spending is limited to the loaded amount.

→ Commonly used for incentives, remittances, and gig economy payments.

→ No bank account required.

→ High customization for specific use, design, and amount.

𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 — 𝐂𝐨𝐬𝐭 & 𝐒𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞

► 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝: May incur interest charges, annual fees, and penalties if balances are not cleared on time.

► 𝐃𝐞𝐛𝐢𝐭 𝐂𝐚𝐫𝐝: Generally low-cost, with minimal or no maintenance fees; no interest applies as spending is limited to existing funds.

► 𝐏𝐫𝐞𝐩𝐚𝐢𝐝 𝐂𝐚𝐫𝐝: May involve reload, issuance, or maintenance fees, but eliminate interest risk entirely.

𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐂𝐨𝐧𝐬𝐢𝐝𝐞𝐫𝐚𝐭𝐢𝐨𝐧

The choice between credit, debit, and prepaid cards extends beyond convenience — it shapes financial management, risk exposure, and purchasing flexibility. Selecting the right option requires evaluating cost structures, access to funds, and the desired level of spending control. Partners like Pomelo can be extremely helpful in making these complex decisions.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()