The Payments People Top 100

Hey Payments Fanatic!

Today I'm sharing the most interesting Payments Experts to follow, this list spotlights 100+ experts from the Payments industry and are definitely worth a follow.

Figured it was worth resharing to help you freshen up your LinkedIn for the summer season.

Here is a shortlist of friends and industry experts I like to highlight to make it easy for you 😉

And of course, the man in payments, and my business partner in Connecting the dots in payments... : Arthur Bedel!

Give them all a follow if you haven’t already done so. You won't regret it.

A big thank you to NORBr for this recognition and shining a light on some great creators in the industry 👌

Are there any experts missing from this list? If so, please drop them in the comments below 👇 and I’ll follow up and try to shine a well-deserved light on them soon!

I’ll go first: Wouter de Vries is definitely worth a follow! 👌

Now it's time to get your daily dose of global payments news, check it below 👇 I’ll be back with more tomorrow.

Cheers,

INSIGHTS

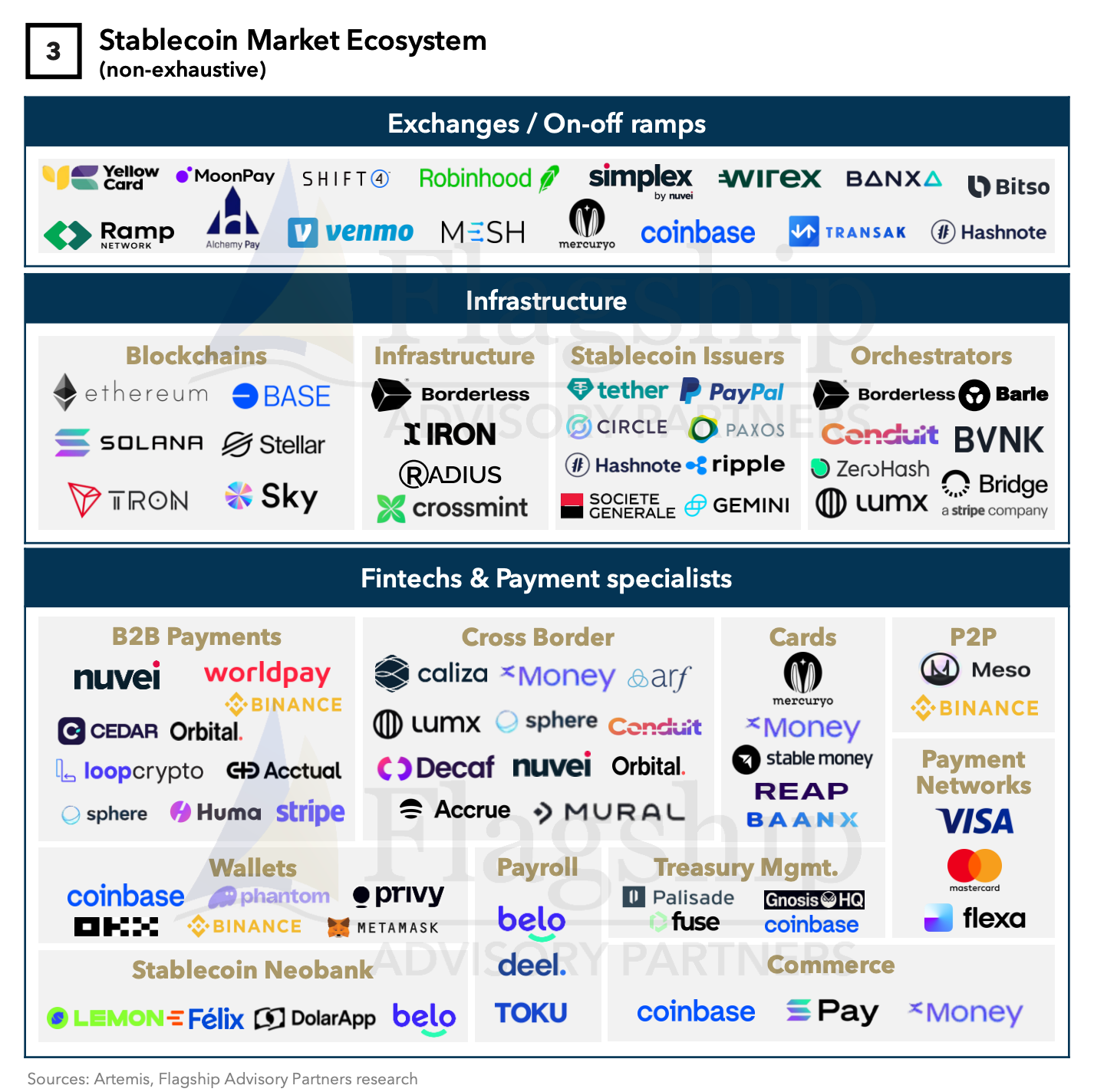

📊 2025 is THE Year of Stablecoins 🤯

With Record Volumes and M&A Momentum👇

NEWS

🌍 Investec simplifies SEPA Connectivity with PagoNxt Payments and Banco Santander. The PagoNxt Payments platform, combined with Santander’s in-house payments expertise, aligns well with Investec's payment infrastructure and business needs.

SEPA | Sponsorship with PagoNxt Payments

🇺🇸 Klarna accelerates shift to digital bank ahead of second IPO attempt. Klarna must prove to investors that it can be sustainably profitable as it prepares a second attempt to list in the US after earlier plans were thwarted in April by market turmoil linked to the US trade war.

🇺🇸 Klarna and Bolt announced a partnership that will see Klarna’s payment options integrated into Bolt’s checkout operating system. This deal means Klarna will show up as a buy now, pay later choice on Bolt devices. Merchants using Bolt can offer Klarna’s Pay in 4 or monthly financing options to shoppers in physical stores, and shoppers can choose that option with a single click.

🇮🇳 Slice rolls out UPI credit card and opens India’s first UPI-powered bank branch. The newly launched Slice Super Card functions like a UPI-based credit card. It has no joining or annual fees and allows users to scan QR codes or make UPI payments directly from a pre-approved credit line.

📈 Trustly reports strong 2024 financial results, driven by growth in both Europe and North America. The company processed a total payment value (TPV) of $87 billion in 2024, marking a 54% increase year-on-year. Net revenue grew by 32% to $239 million, while adjusted EBITDA rose by 50% to reach $73.2 million.

🇰🇷 Naver Pay enters stablecoin race, but liquidity is the key to success. Naver Pay is entering the stablecoin race, becoming the latest South Korean FinTech heavyweight to move into blockchain-based payments. The company announced plans to issue its stablecoin for future use in payments and rewards.

🇸🇬 Singapore launches payments network entity to oversee national payment schemes. The Monetary Authority of Singapore has joined forces with the Association of Banks in Singapore to establish Singapore Payments Network, a new entity which will administer and govern Singapore’s national payment schemes.

🇺🇸 Niural lands $31M to streamline global payroll. Niural offers services like accounts receivable, accounts payable, and cash flow reporting, which reduces the need for managing multiple vendors. Read more

🇨🇦 Nuvei goes live as direct payment acquirer in Canada. This launch empowers Canadian businesses to process domestic transactions locally through Nuvei, eliminating the need for third-party processors and enabling significantly higher payment approval rates.

🌎 Peruvian FinTech Do Payment expands in Latin America. With this innovation, the company addresses two critical challenges for the sector: faster liquidity for clients and eliminating reliance on intermediaries, which translates into unique advantages in speed, costs, and flexibility.

🇳🇱 MPS partners with Salt Edge to launch PSD2-compliant open banking APIs for retail and corporate accounts. Initially available in the Netherlands and France for both retail and corporate accounts, these APIs will be accessible to all licensed third-party providers (TPPs) throughout the European Economic Area.

🇺🇸 Finofo raises $3.3M to transform cross‑border financial operations for mid‑market companies. The platform is especially relevant for energy, manufacturing, and logistics firms with international vendor and customer bases and multi-entity operations.

🇬🇧 Wollette partners with Ordo to optimise the A2A experience. Through Ordo’s infrastructure, WollettePay users can fund their payment accounts instantly and securely from their bank accounts, without needing to enter card details. This enables consumers to enjoy a more efficient and flexible way to pay and manage their money.

🌍 Wave raises $137 million to expand mobile money services across Africa. The funding will scale its mobile money operations and broaden financial access for underserved communities across the continent. Read more

🇺🇸 Alibaba.com taps Balance for flexible B2B ‘Pay Later’ for US SMEs. The collaboration aims to help businesses manage cash flow and access instant credit at checkout. Under the new arrangement, Alibaba.com’s US business customers can now select Balance’s ‘Pay Later for Business’ solution when placing orders.

🇺🇸 Sezzle debuts budgeting and checkout tools amid low consumer confidence. Sezzle has introduced features it says are designed to help customers weather increased financial pressure. Among the new features are Sezzle Balance, designed to simplify the repayment process for consumers through a pre-loadable digital wallet.

GOLDEN NUGGET

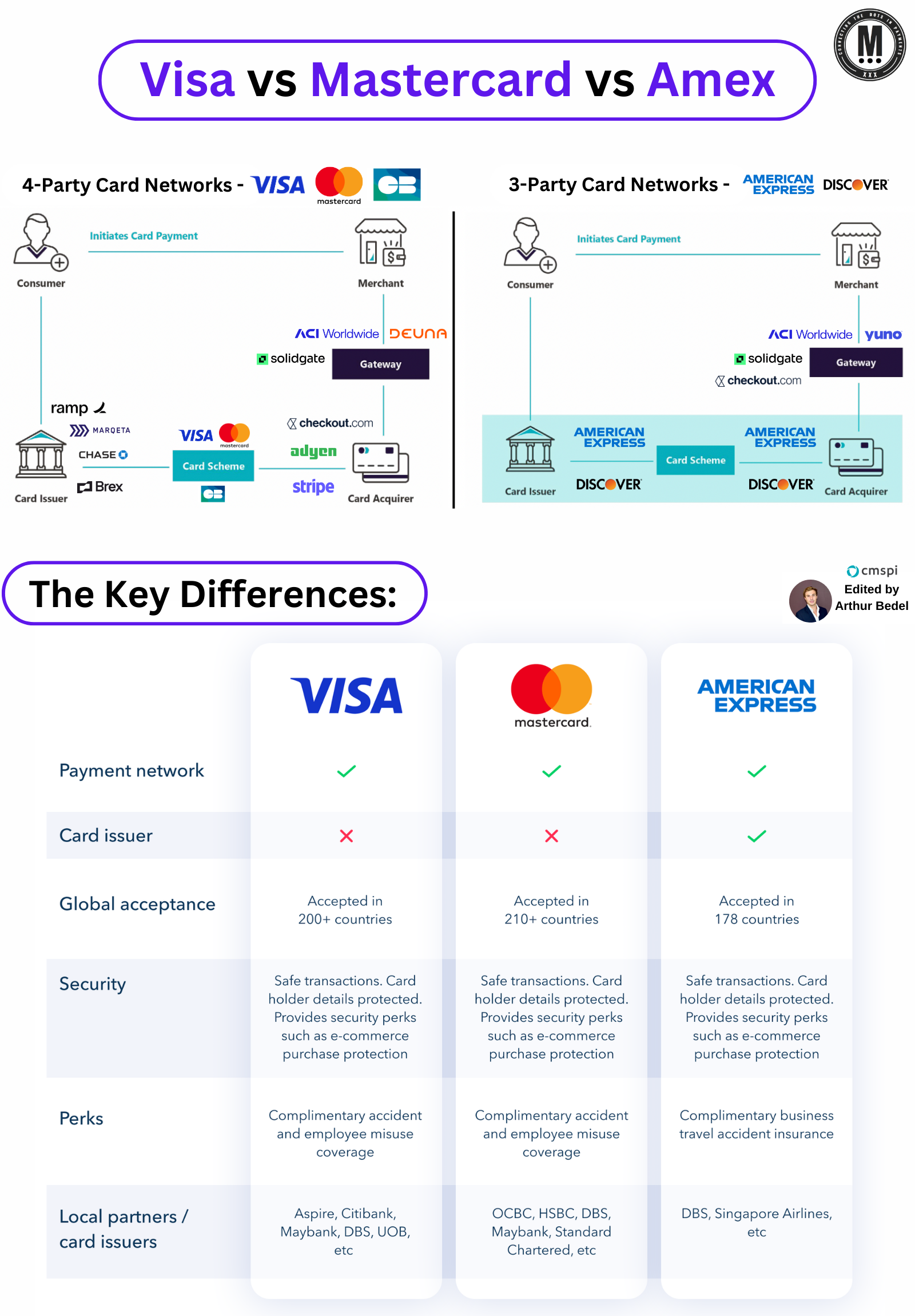

Visa vs Mastercard vs American Express 👇 Created by Arthur Bedel 💳 ♻️

The card networks — Visa, Mastercard, and American Express are the biggest players in the global payments landscape, but they operate differently.

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥𝐬:

► 4-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (Visa, Mastercard, GIE Cartes Bancaires)

This model involves consumers, issuers, merchants, & acquirers. Merchants interact with their customers and acquirers, while card networks serve as intermediaries.

► 3-𝐏𝐚𝐫𝐭𝐲 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (American Express, Discover)

In this model, one entity acts as the issuer, acquirer, & network. Merchants now pay a single fee, often higher compared to the 4-party model.

𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 𝐚𝐭 𝐏𝐨𝐢𝐧𝐭 𝐨𝐟 𝐒𝐚𝐥𝐞 (4-Party vs 3-Party Model)

👉 4-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥

► The Issuing Bank, Issuer, issues a debit/credit cards to its customer.

► The cardholder wants to buy a product and swipes the credit card at the Point of Sale (POS) terminal

► The POS terminal sends the transaction to the Acquirer that provided the terminal (a token is shared)

► The Acquirer sends the transaction to the card network who sends the transaction to the Issuer for approval

► The Issuer freezes the money if the transaction is approved. The approval or rejection is sent back to the acquirer, and POS. Funds are then transferred.

👉 3-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 — The first 3 steps are the same… but not step 4

► American Express and Discover perform here the function of Acquirer, Issuer and Card Network. This is so called closed loop networks are more efficient with all functions processed in one place

► In recent years the closed loop networks have partnered with issuers and acquirers to scale their circulations

► The approval or rejection is sent back to the acquirer, then to the POS terminal. The funds are then transferred

𝐊𝐞𝐲 𝐍𝐮𝐦𝐛𝐞𝐫𝐬:

► In 2023, U.S. merchants paid ~$224B in fees for accepting card payments (interchange, network, and processor fees combined).

► U.S. merchants would have saved $49B in 2023 if fees had remained at 2009 levels.

► In Europe, 45% of the Merchant Discount Rates (MDR) are attributable to interchange fees

𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬:

► Visa & Mastercard are payment networks, not issuers. They partner with banks and financial institutions to offer credit, debit, and prepaid cards.

► Both are widely accepted in over 200 countries. The main difference lies in their rewards and offers (depending on issuer).

► American Express is both a card issuer and a payment network. This gives AMEX more control over customer service and rewards programs, often making it a premium choice

► While AMEX is accepted in fewer locations than Visa and Mastercard, it offers exclusive perks for its users.

Source: CMSPI

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()