Toss Payments Cuts Ties with Chinese Capital… and Tightens Control at Home

Hey Payments Fanatic!

Toss Payments is officially severing its ties with Chinese capital.

Its parent company, Viva Republica, will acquire all Toss Payments shares held by Ant Group, taking Ant’s stake from 38% down to zero.

Ant Group will end up with less than 1% of Viva Republica itself, following a third-party share allotment. Board representation is changing too, with Ant-appointed directors stepping down.

But the context matters. With growing scrutiny around Chinese capital in South Korea, this feels like a proactive move to remove political and regulatory friction before it becomes a real constraint.

For Toss, this is about independence and clarity as it keeps scaling its Payments stack.

Also in today’s edition: Want to know why cross-border payments are so hard in travel?

I just published a deeper piece looking at how cross-border payments can make or break the travel industry. It’s live and sits right below.

The angle is practical: real payment flows and why getting this wrong hurts far more than most people realize.

If you want a read to round out today’s updates, it’s right there waiting for you 👇 Scroll down to see what else is moving in Payments.

Cheers,

INSIGHTS

📰 Why Cross‑Border Payments Can Make or Break Modern Travel: A Case Study from 3S Money. Payments have become a core operational layer in travel rather than a back-office function, as failures directly impact bookings, suppliers, and customer experience. This article examines why payment infrastructure now warrants greater strategic attention and what factors are crucial when it is designed for the realities of travel operations.

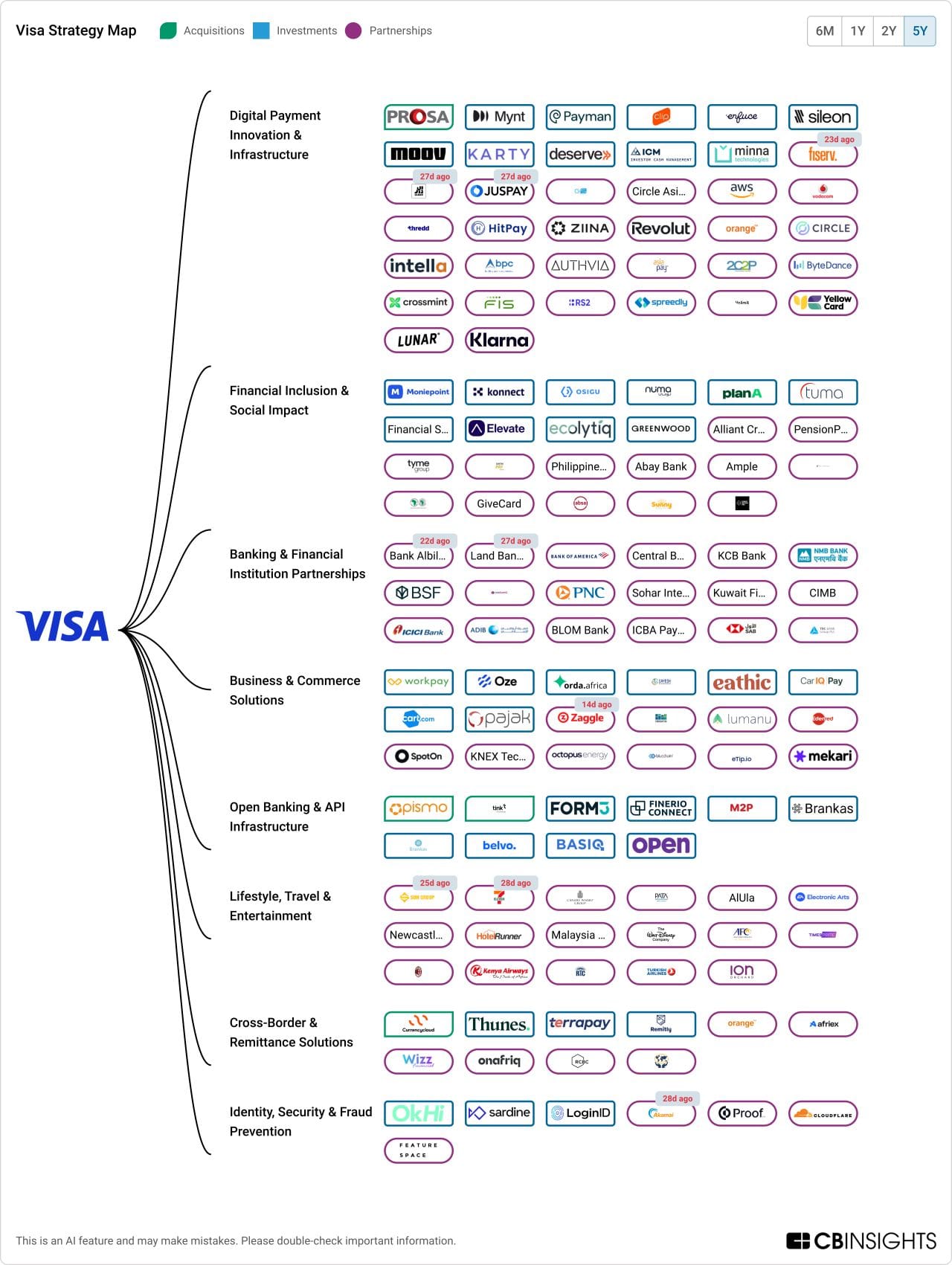

➡️ This is not a payment strategy. This is a hedging strategy:

It’s a hedge for an agentic commerce world👇

NEWS

🇺🇸 PhotonPay secures U.S. MTL license to anchor its global regulatory framework. Through the successful approval of the state-level payment license, PhotonPay strengthens its localized service capabilities and broadens its operational reach, laying a solid foundation for sustained growth across the Americas and global markets.

🇨🇳 Toss Payments parts ways with Chinese capital. Viva Republica announced, “Viva Republica will acquire all shares of Toss Payments held by Chinese Ant Group, while allocating shares of Viva Republica to Ant Group through a third-party allotment of new shares with consideration.”

🇺🇸 Affirm to offer BNPL for rent. Affirm will make those services available through a partnership with Esusu. This New York-based financial technology company offers financial education, credit reporting assistance, and emergency zero-interest loans to tenants.

🇨🇴 Wompi announced that it processed $50 billion and recorded 130% growth. Wompi explained that, thanks to its successful results, it managed to venture into new lines of business by putting its technology at the service of Bancolombia branches, along with processing 60 million transactions for more than $18 trillion in this segment.

🇺🇸 Polygon slashes 30% staff in pivot to stablecoin payments. The move marks a definitive pivot from general-purpose scaling to a vertically integrated, regulated stablecoin payments platform. Continue reading

🇺🇸 Meld secures $7m to expand global stablecoin network. This strategic funding allows the company to expand the Meld Network and make digital assets as accessible as traditional payment methods, while enabling product managers and developers to build the next generation of financial applications.

🇬🇧 Paysafe and Pay.com launch strategic partnership. Pay.com will offer Paysafe as one of its acquirer options for card payments, allowing merchants to benefit from the company’s 30 years of experience as a processor across diverse industry verticals.

🌍 Swift partners with Chainlink to drive multi-bank digital asset settlement solutions. Swift completes a successful trial, enabling seamless tokenized asset transactions across multiple global platforms. Read more

🇺🇾 Xsolla implements Mercado Pago in Uruguay, and now developers can access more than 60 million active users. This new integration strengthens Xsolla's presence in Latin America, enabling developers to offer players reliable payment experiences that prioritize mobile payments in one of the region's most digitally advanced markets.

GOLDEN NUGGET

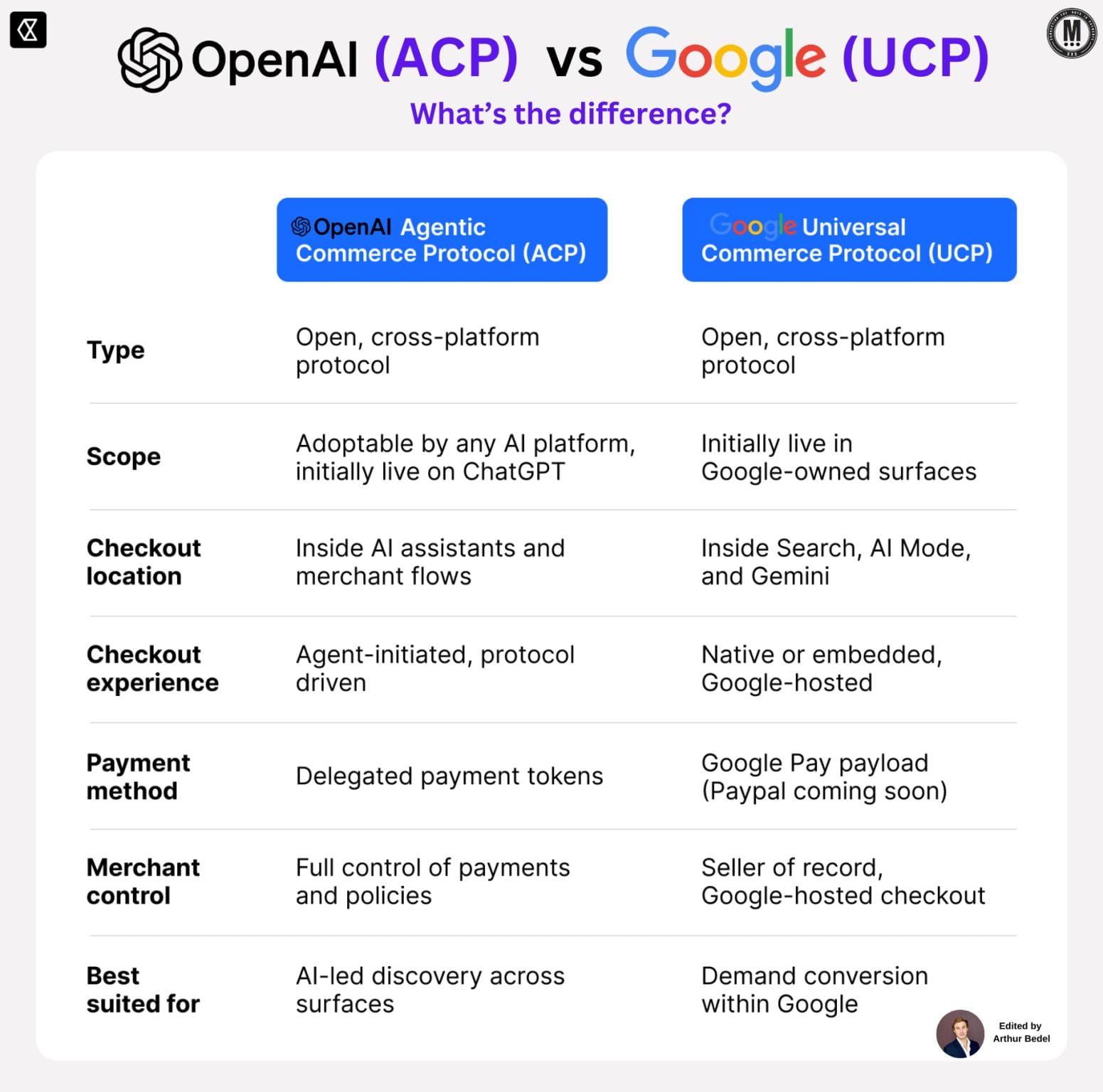

OpenAI (𝐀𝐂𝐏) 🆚 Google (𝐔𝐂𝐏) 👇 Created by Arthur Bedel 💳 ♻️

Two visions for Agentic Commerce:

As AI agents move from recommendation to execution, checkout itself is being redesigned.

Both OpenAI and Google are introducing new commerce protocols that allow AI systems to discover, decide, and complete purchases, but they take very different approaches.

𝐖𝐡𝐚𝐭 𝐭𝐡𝐞𝐲 𝐚𝐫𝐞 (𝐬𝐢𝐦𝐩𝐥𝐲):

OpenAI — 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 (𝐀𝐂𝐏)

ACP is an open, agent-initiated commerce protocol that allows AI agents to transact directly with merchants using delegated payment authority.

The agent acts on behalf of the user, following predefined mandates and policies, while merchants retain control of checkout, payments, and business rules.

Google — 𝐔𝐧𝐢𝐯𝐞𝐫𝐬𝐚𝐥 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 (𝐔𝐂𝐏)

UCP is a Google-native commerce layer embedded across Search, Gemini, and other Google surfaces.

It enables purchases directly inside Google experiences, with checkout and payments largely hosted and orchestrated by Google.

𝐇𝐨𝐰 𝐭𝐡𝐞𝐲 𝐜𝐨𝐦𝐩𝐚𝐫𝐞:

At a high level, both aim to simplify buying in AI-driven interfaces — but the control point is very different.

𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐥𝐨𝐜𝐚𝐭𝐢𝐨𝐧

→ ACP: inside AI assistants and merchant flows

→ UCP: inside Google-owned surfaces

𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐢𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐨𝐧

→ ACP: agent-initiated, policy-driven

→ UCP: user-initiated within Google

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐦𝐨𝐝𝐞𝐥

→ ACP: delegated payment tokens, flexible credentials

→ UCP: Google Pay payloads (with more methods planned)

𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐜𝐨𝐧𝐭𝐫𝐨𝐥

→ ACP: merchants keep full control of pricing, policies, and checkout logic

→ UCP: Google often acts as seller of record with hosted checkout

𝐌𝐚𝐢𝐧 𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 — 𝐩𝐫𝐨𝐬 & 𝐜𝐨𝐧𝐬:

𝐀𝐂𝐏 𝐢𝐬 𝐩𝐫𝐨𝐭𝐨𝐜𝐨𝐥-𝐟𝐢𝐫𝐬𝐭

Designed to be adopted by any AI platform and integrated into existing merchant infrastructure.

→ Pros: openness, merchant control, cross-platform reach

→ Cons: requires merchants and PSPs to adapt their stacks

𝐔𝐂𝐏 𝐢𝐬 𝐝𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧-𝐟𝐢𝐫𝐬𝐭

Built to maximize conversion inside Google’s ecosystem.

→ Pros: frictionless UX, instant scale

→ Cons: reduced merchant control, dependency on Google surfaces

In short:

→ ACP optimizes for openness and programmability

→ UCP optimizes for conversion within a closed environment

𝐓𝐡𝐞 𝐛𝐢𝐠𝐠𝐞𝐫 𝐬𝐡𝐢𝐟𝐭:

Agentic commerce isn’t a single model, it’s a spectrum.

Some merchants will prioritize reach and simplicity through embedded platforms.

Others will prioritize control, data ownership, and long-term flexibility through open protocols.

One thing is clear:

👉 Checkout is no longer just a page — it’s becoming a programmable interface between agents, merchants, and payment rails.

I highly recommend reading this complete source article on this topic by Checkout.com for more interesting info.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()