Tyro Payments Removes Senior Leader From Website Amid Speculation

Hey Payments Fanatic!

Executive pages don’t often speak loudly, but their silences can be telling. In recent weeks, Tyro Payments has quietly entered a period of leadership transition.

Jonathan Davey, Tyro's CEO & Managing Director, announced his departure earlier this month to a leadership role outside of the financial sector. But he stated that he will remain in his current position for up to 6 months as the company searches for a successor.

His exit comes at a sensitive time for the industry, as the Australian government considers tightening rules on payment surcharges, and the Reserve Bank reviews current regulations, both of which could directly impact Tyro’s core business.

But another shift appears to be underway. Deanne Bannatyne, Tyro’s Chief Growth Officer, has quietly disappeared from the company’s website. While her departure hasn’t been formally announced, it follows growing speculation that she may be moving to a rival firm.

At the same time, Tyro’s Board added Steven Holmes in early June, bringing experience from Xplor Technologies and Transaction Services Group. His arrival signals added depth during a period of strategic change.

Get your daily dose of global payments news below 👇 I’ll be back with more tomorrow.

Cheers,

INSIGHTS

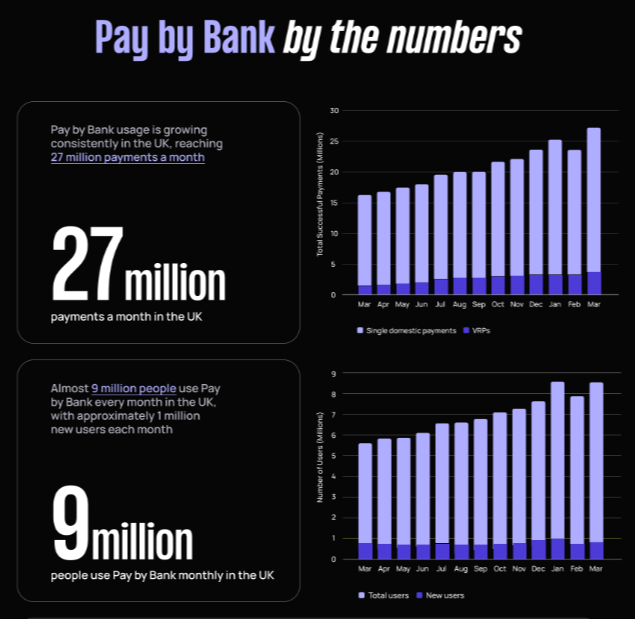

📊The Pay By Bank update 2025 report by TrueLayer.

NEWS

🇬🇧 Ecommpay embraces Visa instalments. Visa Instalments enables merchants to offer consumers the facility to split their purchase amounts into convenient, fixed payments over time using their existing eligible Visa credit cards, which have already been subject to affordability checks.

🇰🇷 KakaoBank targets stablecoin market with 12 trademark filings. It has filed multiple trademark applications related to its stablecoin business in a bid to secure first-mover advantage in the fast-growing market. The applications cover three categories: cryptocurrency-related software, cryptocurrency financial-transaction services, and cryptocurrency mining.

🇳🇱 Payment processor Worldline knowingly protected fraudulent webshops for years. It offers similar services to Adyen or Klarna, mainly enabling payments for online shops, as well as in physical stores. The law requires these payment companies to prevent fraudulent customers from using their systems for criminal money flows.

🇰🇷 South Korea’s central bank wants a gradual stablecoin rollout. Bank of Korea Governor Ryoo Sangdai wants banks to be the primary issuers of stablecoins in the country before gradually expanding to other sectors. “The aim is to establish a safety net, considering the potential for market disruption or consumer harm”, he said.

🇵🇱 Polish FinTech Blik bets on Erste entry to speed up foreign expansion. Blik's founders plan to invite major banking groups to invest in a planned capital increase, which may lead to these banks adding Blik to their platforms and provide a fresh valuation for the FinTech.

🇮🇳 Business-payments platform Pazy raises pre-seed funding round. The proceeds will be used to expand product capabilities, integrate deeper into the ecosystem, and scale the platform to Rs 10,000 crore in annual spend under management over the next year, Pazy said in a press release.

🇲🇾 PayNet partners Alipay+ and Weixin Pay to boost tourist spending in Malaysia. The collaboration involves three summer campaigns linked to the DuitNow QR payment system, which allows users to transact using their existing mobile wallets across a network of more than 2.5 million merchants.

🇮🇳 PhonePe hires JPMorgan Chase, Citigroup, Morgan Stanley, and Kotak as IPO bankers. The UPI payments giant is targeting a $1.5 billion raise in the IPO, potentially pushing its valuation to $15 billion. The company is expected to file its draft red herring prospectus by August, with the listing anticipated later this year.

🇲🇦 VPS and Mastercard team up to advance digital payments in Morocco. The collaboration will seek to improve financial inclusion metrics while offering a raft of upsides to both parties. The partnership will see Mastercard grow its market share in Morocco via the addition of Mastercard-branded cards across several verticals.

🌍 Mastercard unveils AI-powered card reissuance fraud prevention service in EEMEA. Dubbed ‘Account Intelligence Reissuance,’ the new Mastercard product will leverage its AI technology and network purview to crack down on card fraud that costs card issuers and merchants billions of dollars each year.

🇨🇦 Airwallex gains momentum in Canada as demand for global payments grows. The company has significantly grown its Canadian operations with the launch of services in Quebec in May 2025, making it one of the few FinTechs operating in the province, and a rapidly expanding Toronto team that continues to scale.

GOLDEN NUGGET

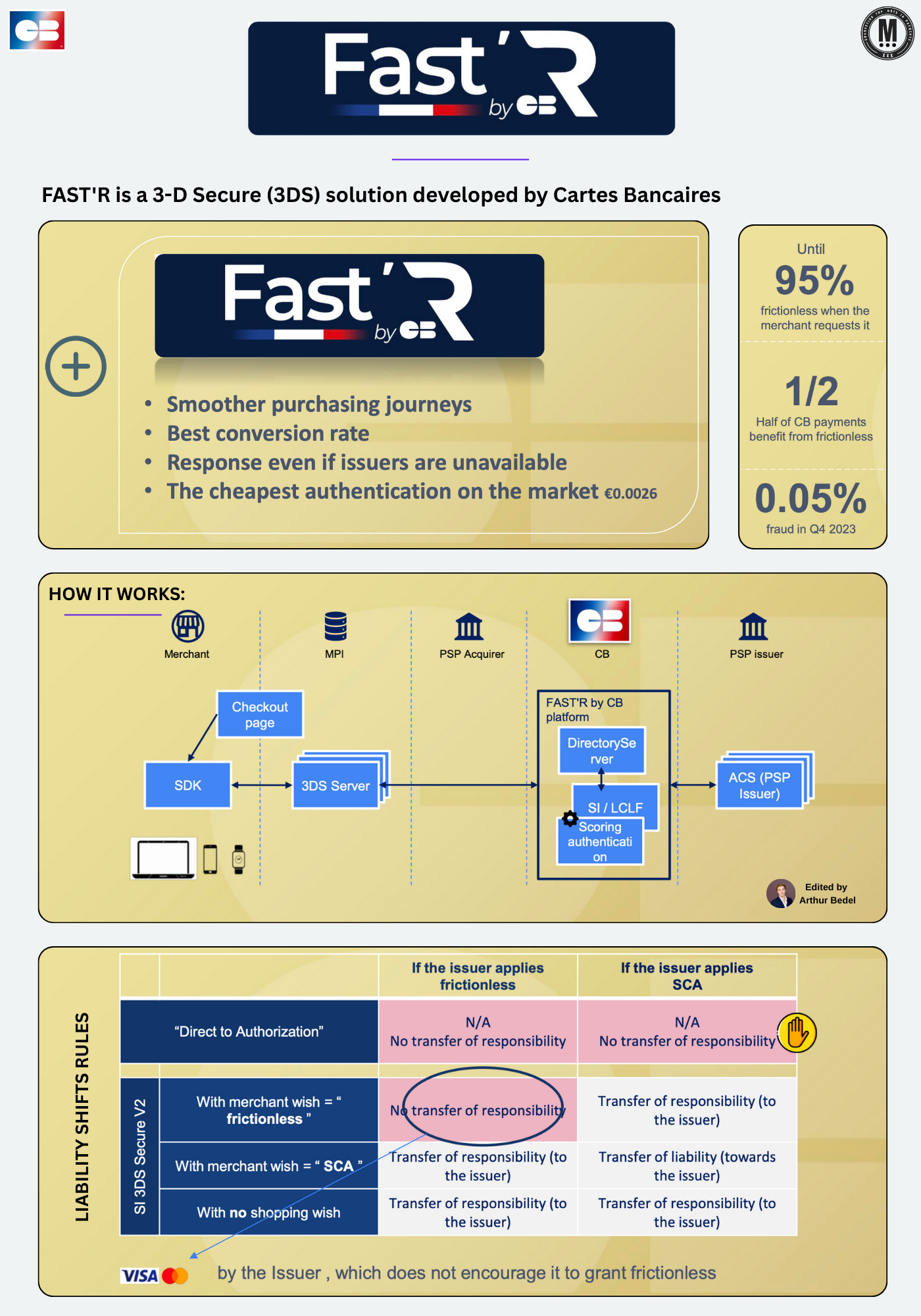

Welcome to 𝐓𝐡𝐞 𝐂𝐚𝐫𝐭𝐞𝐬 𝐁𝐚𝐧𝐜𝐚𝐢𝐫𝐞𝐬 𝐒𝐞𝐫𝐢𝐞𝐬 🇫🇷 — Episode 2 👇 Created by Arthur Bedel 💳 ♻️

𝐅𝐚𝐬𝐭’𝐑 is 𝐂𝐚𝐫𝐭𝐞𝐬 𝐁𝐚𝐧𝐜𝐚𝐢𝐫𝐞𝐬’ 𝐧𝐞𝐱𝐭-𝐠𝐞𝐧 𝟑𝐃 𝐒𝐞𝐜𝐮𝐫𝐞 — designed to optimize user experience, maximize frictionless rates, and keep fraud at industry-low levels.

With 95%+ frictionless auth when requested, it is now France’s benchmark for secure, conversion-friendly authentication.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐚𝐬𝐭’𝐑?

𝐅𝐚𝐬𝐭’𝐑 is a smart authentication platform embedded in the CB ecosystem — combining real-time scoring, issuer-level collaboration, and regulatory compliance to deliver seamless experiences for both merchants and consumers.

► 𝐒𝐂𝐀-𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐭 — aligns with DSP2 and EMVCo

► 𝐒𝐦𝐚𝐫𝐭 𝐒𝐜𝐨𝐫𝐢𝐧𝐠 — risk analysis performed even when the merchant doesn't explicitly request it

► 𝐈𝐬𝐬𝐮𝐞𝐫-𝐭𝐫𝐮𝐬𝐭𝐞𝐝 — fraud rates on Fast’R are among the lowest in issuer portfolios

► 𝐀𝐜𝐭𝐢𝐯𝐞 𝐫𝐞𝐬𝐩𝐨𝐧𝐬𝐞 — Fast’R can step in when issuer ACS is unavailable, ensuring continuity

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐅𝐚𝐬𝐭’𝐑 𝐰𝐨𝐫𝐤?

A 4-step flow built for conversion, protection, and speed:

1️⃣ Transaction initiated by the consumer on merchant checkout

2️⃣ Merchant MPI triggers the Fast’R 3DS service, sending risk-relevant data

3️⃣ Real-time scoring engine evaluates fraud risk using data from PSP, CB, issuers & PATs

4️⃣ Frictionless or challenge decision is made by issuer, with CB supporting fallback in case of failure

→ Works even when issuer systems are down

→ Enables 50%+ of e-commerce payments to go frictionless

→ Response time optimized for conversions and uptime

𝐓𝐡𝐞 𝐋𝐢𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐒𝐡𝐢𝐟𝐭 𝐑𝐮𝐥𝐞𝐬

📌 If issuer grants frictionless (with or without merchant request)

→ Issuer holds liability

📌 If merchant explicitly requests SCA

→ Issuer still holds liability

📌 If issuer initiates SCA on its own

→ Issuer holds liability

💡 Merchants keep control of the 3DS stage while remaining protected.

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬

→ 95%+ frictionless when requested

→ 92% overall success rate across CB issuers

→ Just €0.0026 per auth — 10x cheaper than global peers

→ 0.05% e-commerce fraud vs 0.11–0.14% across other networks

→ Built-in fallback — Fast’R ensures response even when issuers fail

Merchants with eligible profiles and 120K+ annual 3DS transactions can qualify for €0–€250 frictionless range, with no technical overhaul required.

Next Up → Deep dive into 𝐔𝐩𝐝𝐚𝐭’𝐑 — CB’s real-time card updater

Source: GIE Cartes Bancaires x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()