Uber and Checkout.com Partner to Deliver Fast and Reliable Global Payments

Hey Payments Fanatic!

Paying your Uber is now easier. They announced a new strategic partnership with payments provider Checkout.com.

Under the agreement, Checkout.com will bring acquiring and gateway services to Uber’s ridesharing and on-demand delivery platforms across markets worldwide.

Through this partnership, the mobility app can offer its users faster and safer transactions.

In short, Checkout.com will handle millions of daily Uber transactions. With AI-powered optimizations and advanced payment technologies, the goal is simple: faster, secure, and higher-performing payments everywhere Uber🚘 operates.

Now let’s dive into the rest of today’s payments headlines. 👇

Cheers,

INSIGHTS

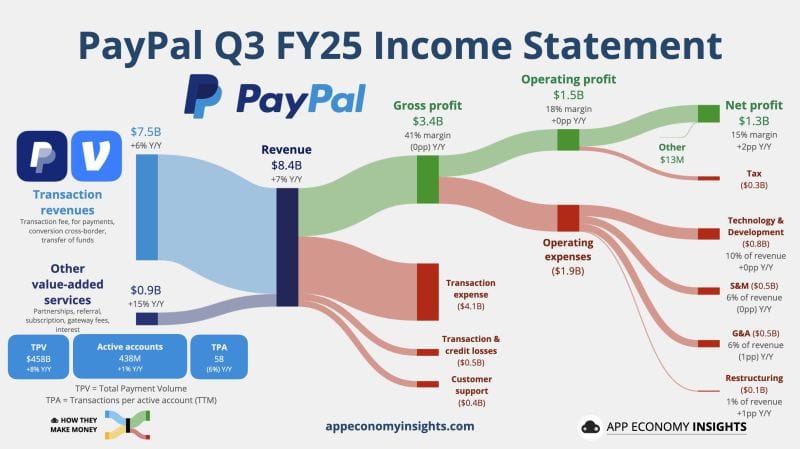

📈 PayPal reports third quarter 2025 earnings, and the stock is on fire 🔥

NEWS

🇬🇧 Uber selects Checkout.com to deliver fast, reliable global payments across its enterprise platform. Through the partnership, Uber will leverage Checkout.com’s global and proprietary acquiring network, as well as advanced payment technologies designed to make transactions faster, safer, and more reliable.

🇳🇱 iDEAL to phase into Wero starting in 2026. For Dutch users, this means they will soon be able to make cross-border online payments as easily and securely as they do at home. Whether ordering a book from a French webshop or booking a hotel in Germany, the experience will be seamless.

🇬🇧 Ecommpay achieves full Digital Accessibility Centre approval for its payment pages and dashboard. Using colours, fonts, and layouts that ensure accessibility for those with visual and hearing impairment and cognitive and physical disabilities, the DAC-certified Ecommpay payments platform and dashboard enable merchants to deliver an inclusive payments experience to their customers.

🇺🇸 OpenAI and PayPal team up to power instant checkout and agentic commerce in ChatGPT. Millions of ChatGPT users will be able to check out instantly using PayPal, and PayPal will support payment processing for merchants leveraging OpenAI Instant Checkout. Additionally, PayPal launches agentic commerce services, a suite of solutions that allow merchants to attract customers and future-proof their success in the new era of AI-powered commerce.

🇺🇸 Venmo announced a partnership with Bilt. The partnership brings rent payments, mortgage repayments, and neighborhood commerce into the Venmo experience, marking a significant step in Venmo's evolution from a peer-to-peer payments app to a comprehensive everyday commerce platform.

🇺🇸 Coinbase and Citi collaborate to build the future of payments. Combining Coinbase’s blockchain infrastructure with Citi’s global payments network, the partnership aims to improve fiat-to-digital conversion systems, enhance stablecoin payment solutions, and develop always-on financial infrastructure.

🇨🇦 Loon raises $3 million to build Canada’s first regulated stablecoin. The funding will accelerate product development, regulatory engagement, and team expansion across engineering and compliance. Read more

🇺🇾 dLocal launches BNPL Fuse. With one API and contract, it connects merchants to multiple local providers across eight countries, reaching over 500 million underbanked buyers. The solution simplifies compliance, boosts sales, and strengthens dLocal’s role in global digital payments.

🇺🇸 Apple Pay eliminates $1 billion in fraud, expands to 89 markets, and reduces fraud rates by 60% to 90% compared to traditional card transactions. The platform also generated over $100 billion in incremental merchant sales globally through higher authorization rates and increased engagement.

🌍 Binance expands crypto access to over 30 African countries with local payments. The exchange aims to lower barriers to digital asset adoption by supporting small businesses and offering remittances without traditional banking fees. Read more

🇺🇸 Thunes announced the launch of its Pay-to-Stablecoin-Wallets solution, part of its single global API enabling instant payouts across more than 130 countries in both fiat and stablecoins. It sets a new global standard for real-time, borderless money movement, powering a future where funds move instantly, anytime, anywhere.

🇺🇸 Visa teams with Alacriti as instant payment use grows. The partnership enables banks and credit unions to offer faster, card-based payments for uses like account funding, payouts, and transfers. The integration gives institutions greater speed, flexibility, and a unified view of payment sources.

🇺🇸 Bottomline announces embedded AI agent to transform treasury and cash management. With a planned rollout in early 2026, this new technology will empower finance leaders with conversational AI and predictive insights, transforming treasury workflows, enhancing cash visibility, and driving faster, smarter decision-making.

🇸🇦 Gulf Startup Tabby nabs $4.5 billion valuation in secondary sale. The new valuation is up from the $3.3 billion price tag Tabby garnered in a $160 million financing round just eight months ago. The deal allowed firms, including HSG and Boyu Capital, to buy shares from existing investors, according to a statement.

🇺🇸 Kite announces investment from Coinbase Ventures to advance agentic payments with the x402 Protocol. The funds used from this investment will help address a critical bottleneck in the AI revolution. Continue reading

🇵🇰 A16z leads $12.9M round for ZAR to bring stablecoins to Pakistan’s unbanked. The company said it hopes this approach will help citizens access dollar-backed digital money without requiring them to understand blockchain or crypto technology.

🇺🇿 Alipay+ and Uzbekistan’s HUMO partner on cross-border QR payments. In the initial phase, HUMO users travelling from Uzbekistan will be able to make payments in China and more than 50 other markets using their home payment apps in Uzbek som across retail, dining, and transport sectors.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()