UnionPay International Extends Partnership with Worldpay to Expand Global Online Acceptance

Hey Payments Fanatic!

Have you been following how global card networks are expanding their online acceptance footprint?! Today’s developments in Payments include a notable expansion in global card acceptance.

UnionPay International is extending its 10-year partnership with Worldpay, adding UnionPay 3DS and ExpressPay to streamline e-commerce transactions worldwide.

The collaboration expands UnionPay’s online acceptance in the US, UK, and Europe across sectors like airlines, retail, and hospitality. With ExpressPay, Worldpay aims to deliver a faster, more secure checkout experience.

Worldpay will now integrate UnionPay as one of its global card networks, strengthening its portfolio of payment methods available to merchants.

The partnership also supports secure issuing and acceptance solutions, with both companies emphasising speed, convenience, and security as core elements of the updated offering.

Now let’s dive into the rest of today’s Payments headlines! 👇 Tomorrow, I'll be back in your inbox with more firsthand updates. Stay tuned!

Cheers,

INSIGHTS

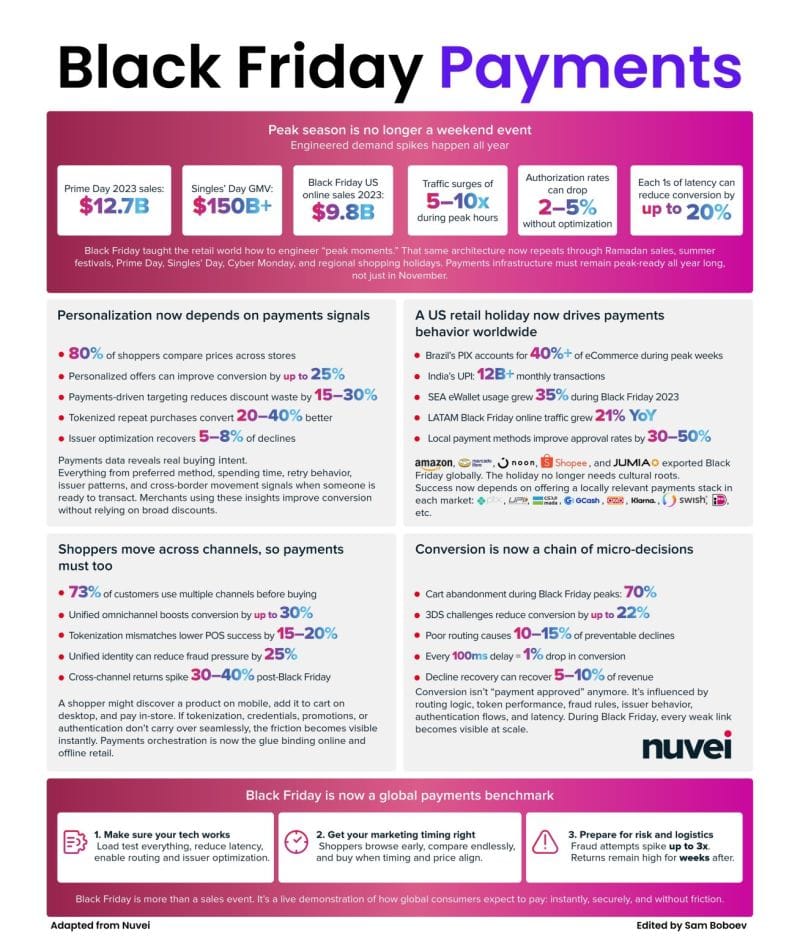

💰 Nuvei just shared a great breakdown of the 5 biggest shifts reshaping online payments.

Here’s what stood out to me the most👇

NEWS

🇦🇷 Reaquila and Pomelo roll out a new worker card in Argentina. This initiative aims to formalise a sector that handles over USD 1 billion annually and could meaningfully increase monthly income for recyclers through digitalisation, transparency and fairer pricing.

🌍 UnionPay International and Worldpay enable express pay and a 3DS e-commerce solution. The new collaboration features UnionPay 3D Secure and ExpressPay solutions, allowing UnionPay cardholders to transact in the US, UK, and Europe, and across various sectors, including airlines, retail, hospitality, and more.

🇧🇹 OxPay clinches a licence in Bhutan and will launch crypto B2B payments. Core offerings planned include merchant payment services that enable businesses to accept payments in the form of credit cards, e-wallets, and cryptocurrencies from a global customer base without ever being exposed to price volatility, OxPay said.

🇹🇭 Online payments player Omise debuts MCP server for agentic payments. With this release, businesses can now allow AI systems to access more than 60 Omise payment tools in a secure, structured, and reliable way, without building custom API integrations.

🇵🇱 PPRO adds Blik Pay Later for BNPL in Poland. This partnership enables online retailers to offer secure deferred payments via a consumer’s banking app, strengthening BLIK Pay Later’s presence in Poland’s domestic e-commerce market.

🇵🇪 Movii enters Peru as a new acquirer, seeking to connect payment aggregators to a 100% technological infrastructure that competes with traditional players. The entity has invested US$2.2 million, which will be used primarily to grow in the world of railway card acquisition and real-time rail payments.

🇩🇰 Dutch FinTech POM strengthens European position through acquisition of Denmark’s FarPay. By bringing FarPay and POM together, POM is creating a leading European platform that offers companies and their customers the best user experience and true peace of mind when paying and collecting outstanding invoices.

🇰🇷 Bithumb to halt Tether-powered order book sharing service, which allowed customers to buy and sell Bitcoin and nine high-cap altcoins using USDT, following regulatory pressure. The crypto exchange said the service was still in Beta mode and involved an order book sharing agreement with the Australian crypto exchange Stellar.

🇿🇦 Crypto Payments Startup Oobit accelerates global expansion strategy with launch in South Africa. Available on iOS and Android, the app is designed to deliver simple and seamless crypto payments, leveraging Visa rails to deliver the same experience as Apple Pay. Oobit allows users to pay with crypto, while merchants receive fiat currency.

🇲🇦 Morocco’s Cash Plus hits $550m valuation as Mediterrania Capital Partners sells down stake in IPO. The deal was structured as a mix of growth capital and shareholder liquidity, marking a partial exit for private equity firm MCP, while the company’s founding families retained their full share count.

🇮🇳 Amazon and Flipkart aim for India's banks with new consumer loan offerings. Amazon is preparing to offer loans to small businesses as part of a broader financial services push, following its acquisition of non-bank lender Axio, which will restart SME lending and add cash-management tools. Additionally, Flipkart is preparing to launch BNPL products through its lending arm, Flipkart Finance, pending final RBI approval, with plans to offer no-cost instalments over 3–24 months and consumer durable loans at 18%–26% interest.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()