🚨 Visa Just Dropped a New Protocol to Secure the AI Shopping Boom

Hey Payments Fanatic!

Meet the Trusted Agent Protocol, Visa’s new framework to verify whether an AI shopping assistant browsing your site is legit or a malicious bot.

AI-driven traffic to U.S. retail websites is up 4,700% in just one year, and merchants are struggling to tell good bots from bad ones.

Visa’s answer? A cryptographic trust handshake that lets merchants instantly verify if an AI agent is approved and authorized to make purchases on behalf of a consumer.

Here’s why this matters:

👉 AI commerce is exploding, but standards are still missing.

👉 Visa’s protocol could become the backbone of “agentic commerce.”

👉 Google, Stripe, and OpenAI are working on their own competing frameworks — meaning the race to define the future of AI payments has just begun.

Now the big question is: Who will win the battle to control AI-driven shopping: Visa, Google, or OpenAI?

Let me know what you think: is Visa securing the future of e-commerce, or just tightening its grip on the ecosystem?

Cheers,

INSIGHTS

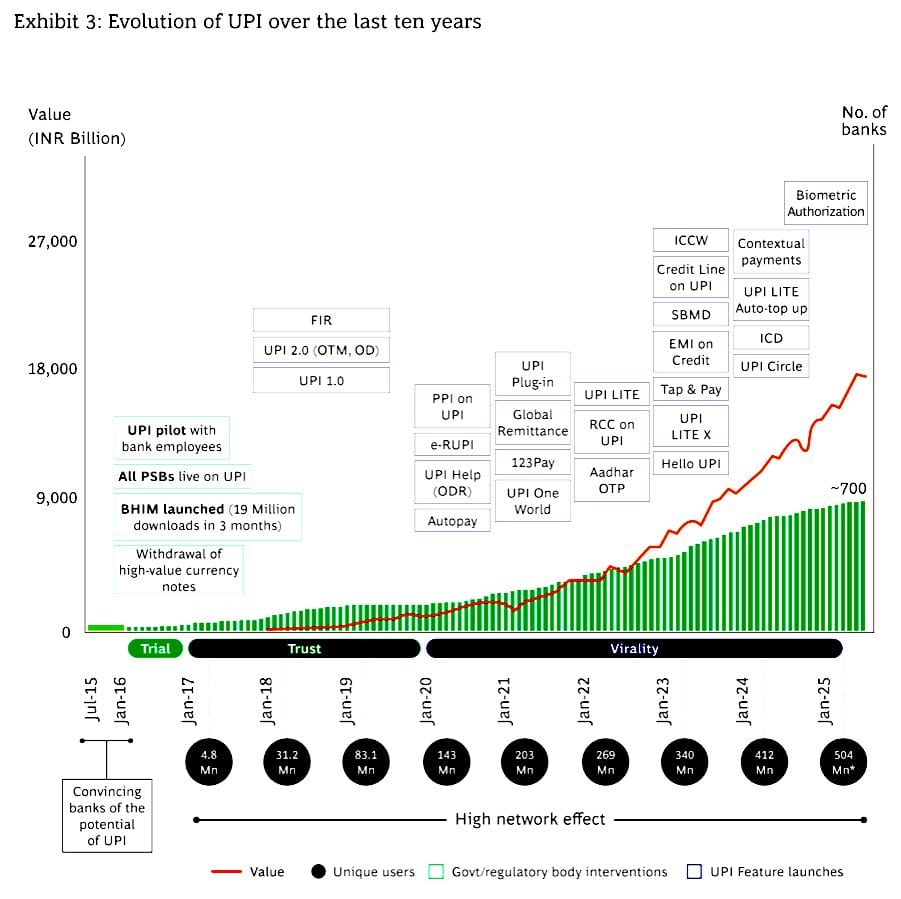

🌍 UPI: The Global Benchmark for Digital Payments.

NEWS

🇬🇧 Ecommpay and Hyvä collaborate to tackle up to 70% cart abandonment rate. The unique combination of Hyvä’s lightweight, high-performance Magento checkout with Ecommpay’s robust global payments platform aims to deliver a better user experience and higher conversions, giving merchants a strategic advantage.

🇬🇧 Checkout.com partners with HelloFresh to power global digital payments. The collaboration will help HelloFresh simplify and optimise its payments across all of its global markets, making it easier than ever for customers to enjoy fresh, home-cooked meals. Through this partnership, HelloFresh will benefit from Checkout.com’s global presence and local acquiring expertise in every market it operates.

🇨🇦 Nuvei supports Visa Trusted Agent Protocol to advance agentic commerce. Nuvei's integrated payments ecosystem, aligned with Visa Intelligent Commerce, is designed to help merchants adopt agent-driven payments seamlessly, moving beyond legacy checkout models dependent on human interaction or virtual card numbers.

🇺🇸 Mastercard Payment Optimization Platform uses the power of data to drive more approvals. POP is designed to improve approval rates for merchants using data to make intelligent decisions about transactions. Mastercard continues to roll out POP with Adyen, NEOPAY, Tap Payments, and Worldpay, which will use the service to provide an optimal payment experience.

🇺🇸 PayPay's valuation could exceed $20 billion in its planned December US IPO. SoftBank is preparing to take Japanese payments app operator PayPay public in the U.S. as early as December, with investors expecting a valuation that could exceed 3 trillion yen ($20 billion).

🇧🇷 Automatic Pix is now mandatory for payments to unauthorized institutions. Starting last Monday (the 13th), the use of Automatic Pix will be mandatory for debit transactions between different banks where the recipient is a legal entity or an entity not authorized to operate by the Central Bank (BC).

🇦🇪 Wise secures final approval from the Central Bank for stored value facilities and retail payment services licenses in the UAE. Wise has received licence approvals from the Central Bank of the UAE for Stored Value Facilities and Retail Payment Services, marking a key milestone in its plans to expand services to personal and business customers.

🇳🇱 Adyen first to market with launch of SAP’s open payment framework, streamlining payment setup for retailers. This new payment solution is designed to eliminate manual payment integrations and streamline the setup and payment service providers. The Open Payment Framework allows retailers to accelerate time to market with fully integrated e-commerce payment capabilities.

🇧🇭 NBB adopts Kinexys by J.P. Morgan solution to pioneer programmable payments in the region. NBB will leverage Kinexys Digital Payments (KDP) to deliver real-time programmable payment capabilities that support more complex, conditional, and automated financial flows.

🇦🇪 Crypto.com granted in-principle approval to settle Dubai government payments in stablecoins. It brings the exchange a step closer to processing stablecoin and dirham payments for Dubai government services. The approval allows the exchange to expand into regulated digital payments in the region once final authorization is granted.

🇮🇳 Breeze by Juspay and super.money announces checkout partnership to serve 500M+ shoppers. With this, brands can tap into a high-intent, high-conversion audience with frictionless checkout flows, seamless reward experiences, and a logistics optimisation suite.

🇦🇪 Payments FinTech Capitalixe opens in Dubai. Lissele Pratt, Co-Founder of Capitalixe, emphasized that Capitalixe’s presence in Dubai allows the company to build trust through face-to-face interactions, accelerating client onboarding and enabling the delivery of reliable multi-currency banking solutions for businesses in these rapidly growing sectors.

🇸🇬 Hong Kong's Reap secures MPI license from MAS. The firm said in a statement that the license authorizes Reap Singapore to provide regulated services under the payment services, namely account issuance service, domestic money transfer service, and cross-border money transfer service.

🇬🇧 Paysend launches Instant Global Transfers. The new instant global transfer service is designed to be the fastest and simplest way to send and receive money across borders. This new service is powered by real-time global peer-to-peer (P2P) payments, allowing instant money transfers between individuals anywhere in the world using nothing more than a smartphone.

🇺🇸 Walmart announced a partnership with OpenAI that lets customers shop and check out directly within ChatGPT. Through this integration, customers can plan meals, restock essentials, or find new products by chatting with the system, and Walmart will handle the transaction from start to finish.

🇧🇪 Ebury appoints Andy Dierens as the New Country Manager in Belgium to drive the next phase of growth. Andy will lead Ebury’s Belgian operations, set the strategic direction, deepen relationships with Belgian businesses with international growth aspirations, and drive the next phase of growth.

🇬🇧 Ryft secures Series A Follow-on Investment from Ingenii VC and Pembroke VCT. With the launch of our omni-channel payment platform, Ryft will enable businesses operating online and in-store to efficiently process, manage, and monetise payments at scale in a secure and compliant way.

🇺🇸 Bridge, a subsidiary of Stripe, has applied to the Office of the Comptroller of the Currency for a charter to become a national trust bank. This move would enable Bridge to operate under a unified federal framework aligned with the GENIUS Act. If approved, the bank would offer services including custody, stablecoin issuance, and management of stablecoin reserves.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()