Visa, Mastercard Near Settlement in Merchant Fee Fight

Hey Payments Fanatic!

Visa and Mastercard are nearing a settlement with merchants by lowering the fees stores pay and giving them more power to reject certain credit cards, according to The Wall Street Journal.

The deal would trim interchange fees by an average of about a tenth of a percentage point over several years, said the Journal's sources.

They would also ease rules that currently require merchants accepting one network credit card type to accept all of them.

The agreement would mark the latest development in a prolonged journey in which credit card companies have proposed several settlements over the past decade, yet none have succeeded in ending the dispute.

Retailers have fought for decades to slash their share of the cost for accepting card payments, also known as interchange fees.

Interchange fees, which total over $100 billion annually, fund premium credit card rewards. Some retailers want more control to decline expensive cards with higher fees while still accepting basic Visa and Mastercard cards.

A lively start to the week across the Payments space. Scroll for the latest earnings from Visa and Mastercard and more important headlines 👇

Cheers,

INSIGHTS

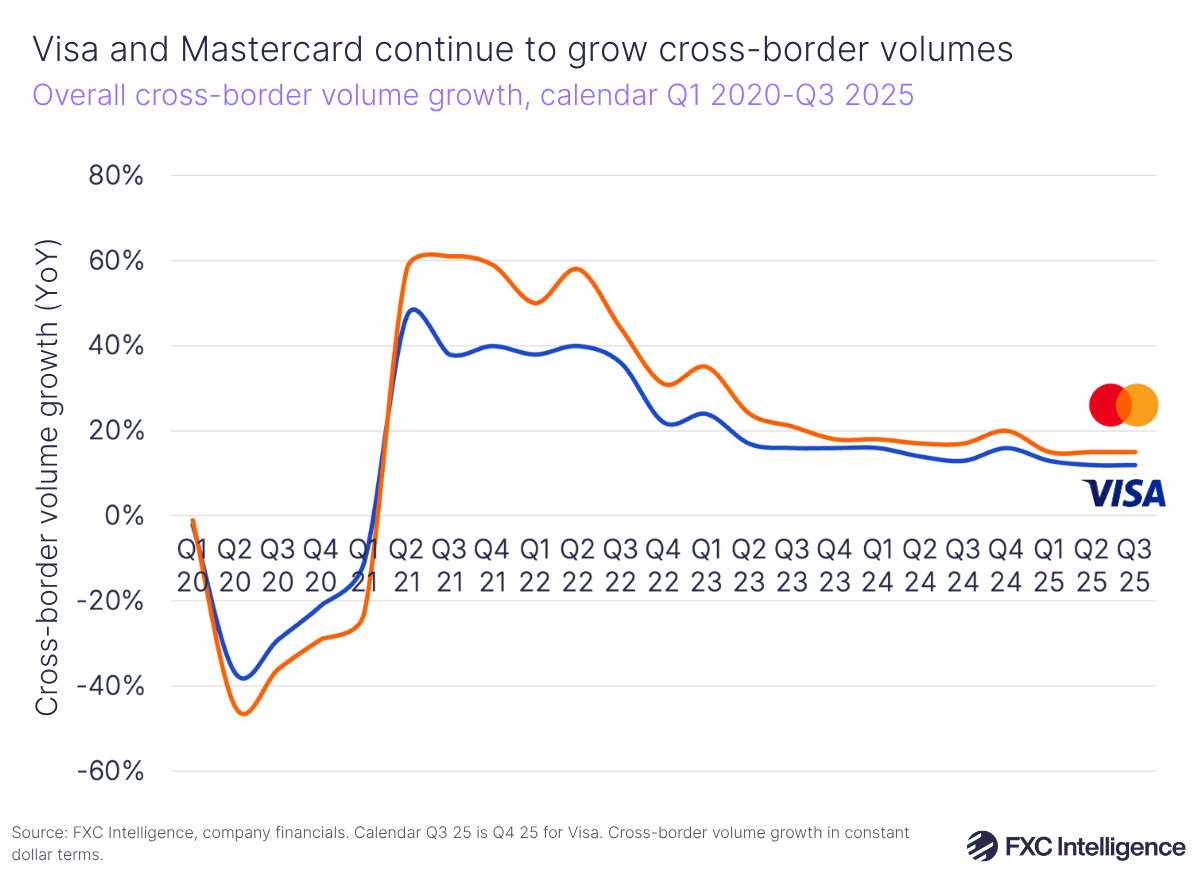

💰 Visa and Mastercard have shared their latest earnings, with cross-border volume continuing to be a key driver for both businesses.

NEWS

🇺🇸 Leapfin partners with Airwallex. The partnership combines Airwallex’s world-class financial infrastructure with Leapfin’s AI-powered revenue accounting platform to help global businesses unify payments, accounting, and revenue recognition. The two companies give finance teams the automation and accuracy they need to scale without compromise.

🌍 Click to Pay reduces abandonment rates for Ecommpay merchants across the UK and Europe. Peter Stearn, Director at Wellbeing Escapes, highlighted that the feature has eliminated the need to manually collect card details, allowing clients to pay instantly from any device. He described the integration as simple and seamless, even for complex bookings.

🇺🇸 ACI Worldwide appoints Todd Ford and Didier Lamouche as Independent Directors. Ford brings to the company extensive financial and operational leadership experience in SaaS and cloud-based software companies, while Lamouche offers deep international technology and digital payments expertise.

🌍 Stripe-backed startup Tempo leads $25 million raise for crypto infrastructure firm Commonware. The Stripe-backed project will work with Commonware to develop methods to process blockchain payments more quickly, Paradigm general partner and CTO Georgios Konstantopoulos said.

💰 Visa and Mastercard are near a deal with merchants that would change the rewards landscape. Visa and Mastercard are nearing a settlement with merchants that aims to end a 20-year-old legal dispute by lowering fees stores pay and giving them more power to reject certain credit cards.

🇮🇹 TPG said to make €1 billion binding bid for unit of Italy’s Nexi. After months of talks, the investment fund submitted the binding bid to the firm, giving it until mid-December to decide whether to proceed with a transaction. Read more

🇺🇸 Internal messages reveal how Klarna scrambled to fix a glitch that exposed customer data. Internal Slack messages, seen by Business Insider, show the Sweden-based company dealt with a problem caused by the absence of login protections for recycled phone numbers, when mobile carriers reassign a number after a previous owner gives it up.

🇩🇪 Klarna and Sparkassen-Finanzgruppe introduce Variable Recurring Payments. This innovation enables all Klarna users with current accounts at participating savings banks to make recurring payments directly from their bank accounts, quickly, easily, transparently, and securely.

🇮🇹 Bancomat announces EUR-BANK stablecoin to combat European payments fragmentation. The stablecoin will be designed to be used in cross-border payments, instant liquidity management, and secure tokenised savings such as government bonds.

🇪🇸 Madrid’s Devengo raises €2 million as EU Instant Payments Regulation accelerates A2A innovation. The funding will allow Devengo to accelerate its geographic expansion across the SEPA zone (Single European Payments Area) and strengthen its position amid growing demand for instant payments in Europe.

🇧🇷 Central Bank authorizes Stone to have an investment distribution company. The new license comes at a time when FinTech is seeking to diversify its funding sources. Continue reading

🇹🇷 Türkiye advances digital lira with legal framework and pilot tests. The Turkish Central Bank is accelerating development of a digital Turkish lira, with plans to conduct simulations and establish regulatory guidelines in 2026. The project aims to create a national digital currency that will strengthen the country's financial technology ecosystem.

🇳🇬 Flutterwave’s payment superhighway. At CNN’s Global Perspectives Summit, Flutterwave CEO GB Agboola urged the creation of a “payment superhighway” to unify Africa’s fragmented financial systems. Through a partnership with Polygon to build a stablecoin payment network, Flutterwave aims to make cross-border transactions seamless and position Africa as a global FinTech leader.

🇨🇦 KOHO has officially become a registered Payment Service Provider with the Bank of Canada. Under the Bank of Canada, KOHO now operates within a nationally recognized framework designed to safeguard user funds, manage operational risks, and ensure ongoing accountability and reporting compliance.

🇮🇳 RBI grants in-principle approval for PPI license to Junio Payments. Junio’s new Prepaid Payment Instruments authorization expands its ability to deliver secure, innovative financial solutions for teens and young adults. The license allows users to scan QR codes, make payments, and transact without a bank account.

🇺🇸 MoneyGram partners with Oscilar to build the future of AI-powered risk intelligence for global payments. Through its partnership with Oscilar, MoneyGram is enhancing its platform with real-time, adaptive risk intelligence to stay ahead of the evolving threat landscape and set a new industry standard among global financial institutions.

🇨🇦 Nuvei expands Payout offering with Visa Direct for account integration. The new functionality expands Nuvei's portfolio of faster payout solutions, enabling businesses to provide customers with quick, reliable, and convenient access to money wherever they are.

🇮🇳 Paytm partners with Groq to power real-time AI for payments and platform intelligence. Integration of Groq’s purpose-built LPU technology will enable faster and more cost-efficient AI inference compared to traditional GPU-based alternatives, strengthening Paytm’s data-driven decision-making and product intelligence

🇺🇸 American Express and Emburse announce expanded partnership and new ways to automate expense management for Emburse Enterprise customers. Customers can quickly issue Amex Virtual Cards within Emburse’s platform, and finance teams gain increased visibility into spend as it happens.

🇺🇸 Visa and Transcard collaborate to deliver advanced embedded working capital solutions in Freight & Logistics. This alliance puts embedded credit and working capital solutions in the hands of freight forwarders and airline carriers on WebCargo by Freightos.

🌍 Hawala raises $3m to launch its app and power financial infrastructure across MENA. The fund will be specifically deployed to reawaken the platform and power the Hawala app. The platform allows users in more than 200 countries to create a U.S. account and routing number or a European IBAN.

🇺🇸 Upward announces Seed+ investment round to redefine FinTech infrastructure; announces strategic partnership with Mastercard. The investment will fuel Upward's mission to make it radically faster and easier for businesses to launch and operate financial products, reducing the cost and complexity that have slowed innovation in financial services.

GOLDEN NUGGET

How many parties are involved when you make an 𝐨𝐧𝐥𝐢𝐧𝐞 𝐩𝐚𝐲𝐦𝐞𝐧𝐭?

(it's more than you might think..)

Here we go:

1️⃣ 𝐂𝐚𝐫𝐝𝐡𝐨𝐥𝐝𝐞𝐫 (𝐜𝐮𝐬𝐭𝐨𝐦𝐞𝐫)

First, a customer enters their card details (PAN, expiration date, CVV) on a merchant’s website or app to buy something.

2️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭

The merchant collects card info via a checkout form and sends a payment request—including order details, amount, and currency—to a Payment Orchestrator.

3️⃣ 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐨𝐫/𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 (e.g. Solidgate)

The Payment Orchestrator links merchants and providers, routing transactions efficiently by validating card data, choosing optimal acquirers, handling retries, and managing 3DS if needed.

4️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 (e.g. Adyen, Worldpay)

The acquirer enables card payments by receiving and forwarding requests through card schemes, acting as the merchant, and settling funds once authorized.

5️⃣ 𝐂𝐚𝐫𝐝 𝐒𝐜𝐡𝐞𝐦𝐞 (Visa, Mastercard)

Card schemes serve as the “payment rails” linking acquirers and issuers, routing transactions via the card BIN and performing risk, fraud, and compliance checks.

6️⃣ 𝐈𝐬𝐬𝐮𝐞𝐫’𝐬 𝐁𝐚𝐧𝐤 (e.g. 𝐂𝐡𝐚𝐬𝐞, 𝐁𝐚𝐫𝐜𝐥𝐚𝐲𝐬)

The cardholder’s bank steps in to do a quick background check: Is the card real? Are there enough funds or credit? Does anything look suspicious?

If all’s clear, it gives the green light with an authorization code. If not, it shuts it down with a reason.

The merchant gets the answer—approved or declined—and if it’s a yes, the order moves ahead. The actual money follows behind, settling in the next couple of business days.

🔁 𝗧𝗵𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗙𝗹𝗼𝘄: Cardholder → Merchant → Orchestrator → Acquirer → Scheme → Issuer → Scheme → Acquirer → Orchestrator → Merchant

💵 𝗦𝗲𝘁𝘁𝗹𝗲𝗺𝗲𝗻𝘁 𝘁𝗶𝗺𝗲 can range from 𝟭 𝘁𝗼 𝟯𝟬 𝗱𝗮𝘆𝘀, depending on:

► Payment method: Cards settle faster than bank transfers or ACH.

► Acquirer/Processor: Some process payments quicker than others.

► Card scheme: Visa, Mastercard, Amex vary, especially for cross-border transactions.

► Country & currency: International payments take longer due to conversions and regulations.

► Merchant account type: High-risk or new merchants may face delays from compliance checks.

► Transaction type: Refunds, chargebacks, and disputes take longer.

► Weekends/holidays: Most banks and processors don’t settle payments during these times.

► Clearing time: Depends on the bank’s processing speed.

Source: Solidgate

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()