Visa Rules the Olympics as Europe Wants Control of Its Money Back

Hey Payments Fanatic!

At the Milano Cortina Winter Games, there’s one card accepted at official stores: Visa. No Mastercard. No local schemes. Just Visa.

Cash is still accepted, but most people don’t carry it anymore. Some visitors were literally walking away to find ATMs after seeing the “Visa only” signs.

This isn’t just about sponsorship. It’s about dependency.

International card networks like Visa and Mastercard account for roughly two-thirds of card transactions in the euro area. That’s a strategic concern for the ECB.

The digital euro suddenly looks less theoretical. The ECB wants it to be live by 2029. Offline. Online. Retail. Wholesale. A public alternative to private rails.

As Piero Cipollone, ECB board member, put it: "if we lose control of our money, we lose control of our economic destiny".

An Olympic souvenir really becomes a geopolitical case study...

Watching how infrastructure quietly becomes an economic strategy?

Scroll down 👇 I’ll be back tomorrow with more signals shaping Payments.

Cheers,

INSIGHTS

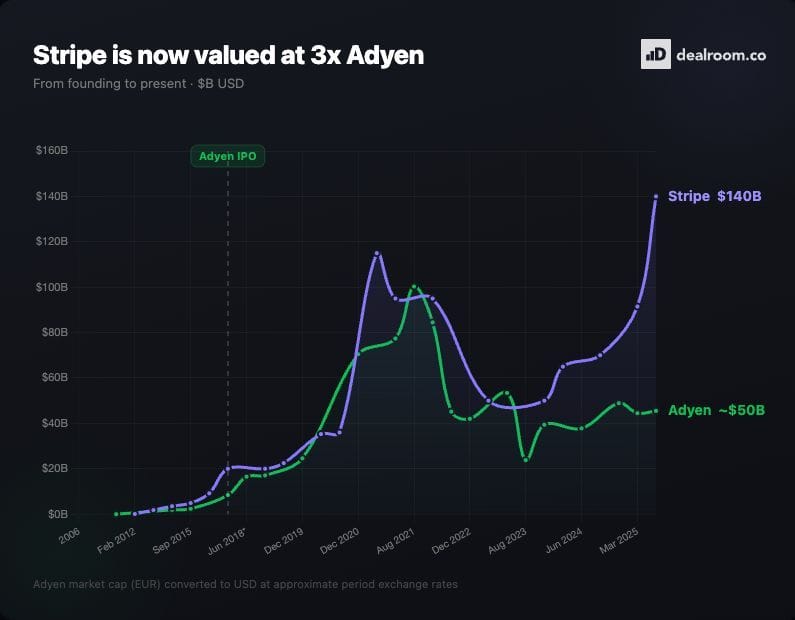

🤯 Stripe is now valued at 3x Adyen??

Same industry. Very different story. Let's dive in👇

NEWS

🇦🇿 Mastercard and ABB launch Azerbaijan’s first corporate travel & expense card. The new ABB Corporate T&E Card powered by Mastercard is designed to help companies digitize business travel and operational spending, replacing cash and fragmented processes with a secure, transparent, and efficient payment solution.

🇵🇭 PNB and Mastercard roll out tokenized e-wallet payments. The partnership will help to accelerate the rollout of tokenized digital wallet payments, a move aimed at strengthening transaction security while making everyday payments more seamless for Filipino consumers.

🇰🇪 Visa and I&M Bank partner to accelerate digital payments in Kenya. The partnership is expected to have a notable impact throughout the region, supporting both economic growth and financial inclusion. Its goals include upgrading payment systems in underserved areas and improving options for cross-border payments.

🇬🇧 Klarna launches on Google Pay in the UK. Users will be able to manage their purchases seamlessly in the Klarna app, tracking deliveries, handling returns, and managing repayments, all in one place. The integration will make flexible payment options even more accessible for Google Pay users.

🇪🇹 Ethiopia launches national instant payments. EthSwitch now connects 32 banks, 12 MFIs, three PSO and three PII, providing modern card-switch hosting, centralized automated reconciliation, and modern card and shared e-wallet services to its members.

🇲🇹 BVNK secures MiCA licence in Malta. This licence will allow BVNK to offer digital asset services across all EEA member states from our base in the country, where it is already authorised as an e-money institution. Keep reading

🇦🇪 Apaya and NymCard partner to bring open finance–powered real-time payments to UAE Merchants. Through this partnership, Apaya enables merchant adoption through its no-code orchestration platform, while NymCard provides the licensed Open Finance payment infrastructure required to support secure, consent-driven A2A transactions in real-time.

🌏 DBS is the first bank in the Asia Pacific to pilot Visa intelligent commerce for everyday payments. Through this collaboration with Visa, DBS is marking a significant step in translating agentic commerce from concept to reality, as well as establishing the foundations for safe and scalable adoption across the region.

🇪🇺 OKX snags European payments license for stablecoin and crypto card expansion. The license allows OKX to continue offering stablecoin-related payment services across the EU in full compliance with the Markets in Crypto-Assets (MiCA) regulation and the Second Payment Services Directive (PSD2), the company said in a press release.

🇬🇧 TerraPay partners with Sabre Direct Pay to expand instant cross-border payment solutions for travel suppliers. Under the agreement, Sabre Direct Pay will enable agencies, airlines, and hotels to send instant bank transfers through TerraPay’s network.

🇦🇪 AEC Wallet enables users to top up AE Coin directly with crypto. Pursuant to this approval, clients of Emirates Currency Investment Company, licensed by the Capital Market Authority, will be able to open accounts within the AEC Wallet and make payments in UAE Dirhams following direct cryptocurrency settlement.

🇧🇷 Agibank suffers a security incident involving approximately 5,300 Pix keys. Protected data remained outside the scope of the incident, the authority reported. There was no access to passwords, balances, statements, transaction history, or other information covered by banking secrecy.

🇸🇦 Madfu raises $25.5 million pre-series A round to expand Sharia-Compliant BNPL Payment Solutions. The newly secured funding will play a central role in executing Madfu’s strategic roadmap for 2025 and beyond. The company plans to accelerate its operational expansion across Saudi Arabia.

🌎 Tether invests in Hyperliquid frontend Dreamcash, offering perps markets for TSLA, gold, and more using USDT0 collateral. The move comes in the wake of the first USDT0-collateralized real-world asset perpetual markets going live on the popular DEX.

🇦🇪 Changpeng Zhao said privacy remains the “missing link” preventing wider adoption of crypto payments, arguing the industry must prioritise stronger privacy features. Read more

🇸🇪 Brite Payments appoints Robin Paulsson as CFO as Fredrik Strömqvist departs. Paulsson is a former finance manager at Klarna, and also brings industry experience from Lendify, KPMG, Movestic, and Nordic management consultancy Capacent, where he served as CFO between 2016 and 2018.

GOLDEN NUGGET

𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 — 𝐭𝐡𝐞 𝐧𝐞𝐱𝐭 𝐠𝐨-𝐭𝐨-𝐦𝐚𝐫𝐤𝐞𝐭 𝐬𝐡𝐢𝐟𝐭 𝐟𝐨𝐫 𝐚𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬 & 𝐏𝐒𝐏𝐬 👇Created by Arthur Bedel 💳 ♻️

We’re moving from a world where consumers click and pay…

to a world where AI agents discover, decide, negotiate, and execute purchases on behalf of humans. And that changes everything for payments infrastructure.

Getnet just put out a strong view on the market opportunity — and more importantly, what it means for merchants and PSPs operating at scale.

A few signals that stood out:

↳ Agentic Commerce is forecasted to become a $3–5T market opportunity by 2030

↳ 30% of global e-commerce value could be influenced by agentic AI

↳ $17.5T in GMV could be enabled through agent-led commerce

↳ 70% of consumers would explore agentic AI in at least one payments use case

But the biggest shift is simple: 𝐓𝐡𝐞 𝐬𝐡𝐨𝐩𝐩𝐢𝐧𝐠 𝐣𝐨𝐮𝐫𝐧𝐞𝐲 𝐢𝐬 𝐜𝐨𝐥𝐥𝐚𝐩𝐬𝐢𝐧𝐠 𝐢𝐧𝐭𝐨 𝐚 𝐬𝐢𝐧𝐠𝐥𝐞 𝐢𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐭 𝐚𝐠𝐞𝐧𝐭.

From discovery → to checkout → to post-purchase.

So for acquirers, “acceptance” becomes more than processing. It becomes agent-readiness.

𝐖𝐡𝐚𝐭 𝐦𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐰𝐢𝐥𝐥 𝐧𝐞𝐞𝐝 𝐭𝐨 𝐰𝐢𝐧 𝐢𝐧 𝐚𝐧 𝐚𝐠𝐞𝐧𝐭-𝐥𝐞𝐝 𝐰𝐨𝐫𝐥𝐝

1) Machine-readable commerce

Agents can’t buy what they can’t understand. Product catalogs, pricing, availability, and policies need to be structured so agents can interpret them instantly.

2) A new trust layer: “Know Your Agent”

If “human-not-present” becomes real, then identity + intent + authorization needs to be validated at the agent level — not only at the consumer level.

3) Payments that stay invisible, but controlled

Consumers will want convenience and guardrails (spend limits, approval rules, preferences).

Merchants will want traceability, reliability, and performance.

Getnet’𝐬 𝐚𝐩𝐩𝐫𝐨𝐚𝐜𝐡: 𝐛𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐒𝐮𝐢𝐭𝐞

1️⃣ MCP AI Tool Kit

Agent-ready checkout + unified APIs, aligned with network protocols and secure agent-initiated payments.

2️⃣ Shopping Agent

A configurable AI “digital salesperson” for discovery → recommendation → conversion.

3️⃣ Managing Agent

An operational co-pilot for merchants: analytics, monitoring, pricing, inventory, financial ops.

4️⃣ MCP Inventory Management

Turns operational data into real-time insights: inventory control, sales trends, pricing decisions.

And the key point: this isn’t only for “AI-native” merchants.

They’re clearly designing for two realities:

↳ advanced merchants that just need agent-ready payments infrastructure

↳ more traditional merchants that need a full suite to become agent-operable

Agentic Commerce won’t replace traditional commerce.

But it will redefine how demand is created and how transactions are executed.

And the PSPs / acquirers that become the “agent-ready layer” will sit right in the middle of that value shift.

Source: Getnet

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()