Walmart-Backed PhonePe Eyes $1.5Bn IPO

Hey Payments Fanatic!

A decade after launching as a UPI payments app, PhonePe is about to go public. The company is expected to file its draft red herring prospectus by August, aiming to raise up to $1.5bn at a valuation of around $15bn.

Backed by Walmart, PhonePe has become India’s largest digital payments platform, with +610 million registered users and +310 million daily transactions.

What began in 2015 as a simple way to send and receive money, has now become a full-scale financial services platform spanning insurance, investments, and e-commerce.

PhonePe’s journey toward an IPO started years back. It was acquired by Flipkart in 2016 (just a year after launch), and became part of Walmart’s portfolio when Flipkart was bought in 2018.

A $100m funding round in 2023, led by Ribbit Capital, Tiger Global, and others, valued the payments company at $12bn helped set the stage.

In February this year, the company officially confirmed its IPO plans. Now, with Kotak Mahindra, JPMorgan, Citi, and Morgan Stanley leading the process, PhonePe is moving closer to a listing in India.

Get your daily dose of global payments news below 👇 I’ll be back with more tomorrow.

Cheers,

INSIGHTS

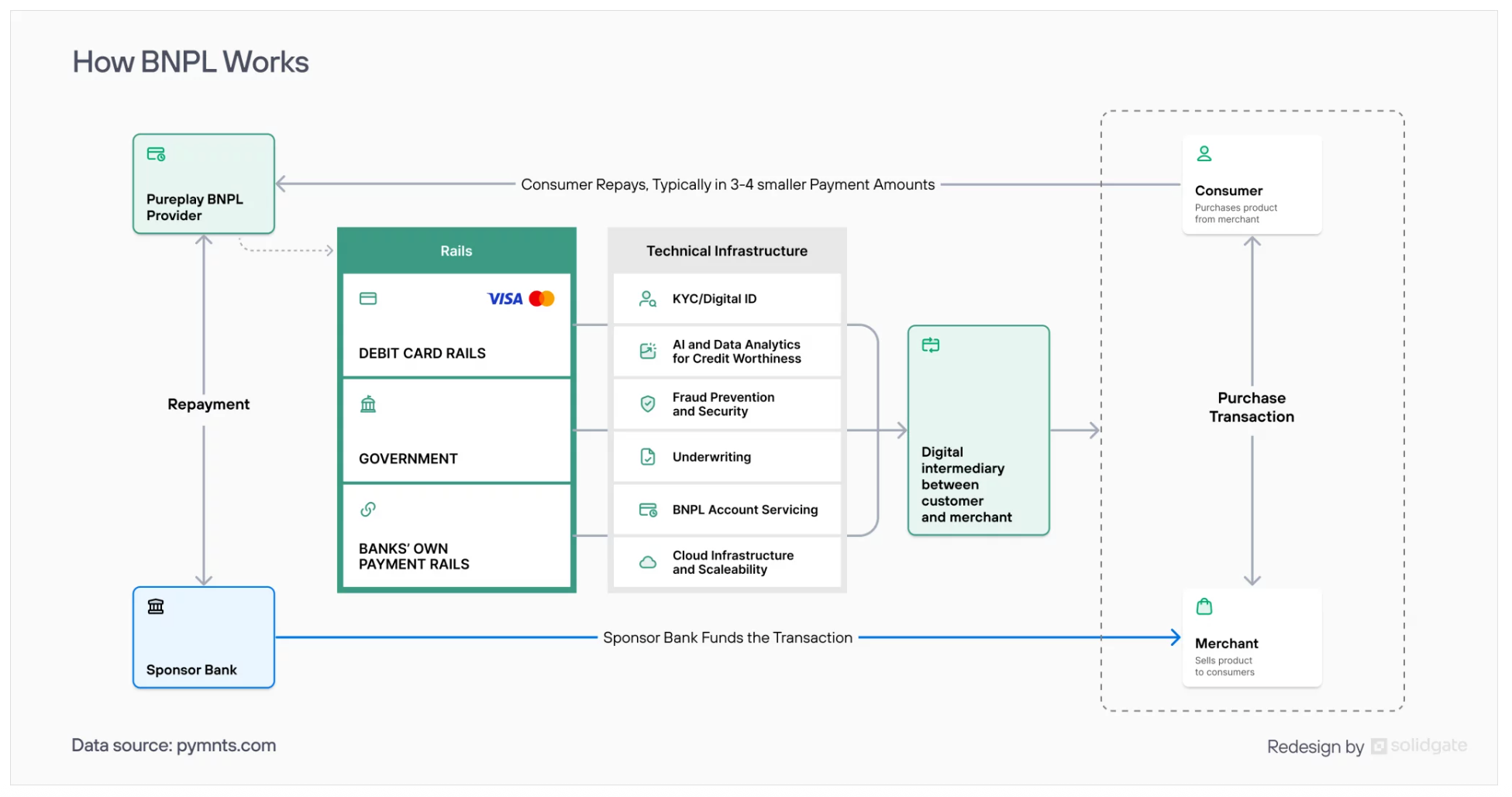

🇬🇧 Buy Now, Pay Later for businesses: A merchant’s guide in 2025 by Solidgate. In this guide, Solidgate breaks down how the BNPL ecosystem operates, whether adding BNPL to your payments stack aligns with your business objectives, and provides practical tips for choosing the right BNPL provider to drive real results.

NEWS

🇰🇷 KakaoPay shares jump over 200% as stablecoin anticipation grows. This rise is linked to speculation regarding potential stablecoin developments associated with the company. KakaoPay's stock rose 208% to 94,700 Korean won ($68.6) from 30,800 won ($22.25) on May 23.

🇦🇺 Shift4 to acquire Australian payments leader Smartpay. Smartpay sells tailored payment solutions through an extensive distribution network across Australia and New Zealand, supporting a diverse base of more than 40,000 merchants in the region. The acquisition is expected to close in the fourth quarter of 2025.

🇨🇲 Flutterwave secures Cameroon licence as part of Africa-wide expansion. The move expands its footprint to over 30 African countries. It follows recent licences in Ghana, Zambia, and Uganda. The licence enables digital payments for global and regional merchants in Cameroon.

🇺🇸 Klarna is now available on Google Pay. By joining forces with one of the most widely used digital wallets in the country, Klarna continues to accelerate its growth in the U.S. market. This integration builds on Klarna’s commitment to responsible spending and empowers consumers with more choices in how they shop.

🇮🇳 Prosus delays Indian payments firm PayU IPO to enhance business operations. While Prosus hoped to list PayU by 2025, "that is not going to be our focus in the next year. Our focus is going to be to improve that business," Nico Marais, Prosus's Chief Financial Officer, said.

🌍 Bizum and European banks agree to enable cross-border payments in 15 countries. EuroPA and EPI have agreed to begin a collaboration with the aim of "exploring solutions to quickly address the challenge of European sovereignty in the field of payments" and to accelerate the implementation of cross-border instant transfers compatible with all platforms belonging to both alliances.

🌏 SAP Taulia partners with PayMate for improved business payments. This aims to support both cross-border transactions and local payments, allowing businesses to use their existing credit lines to improve working capital, supplier payments, and financial efficiency.

GOLDEN NUGGET

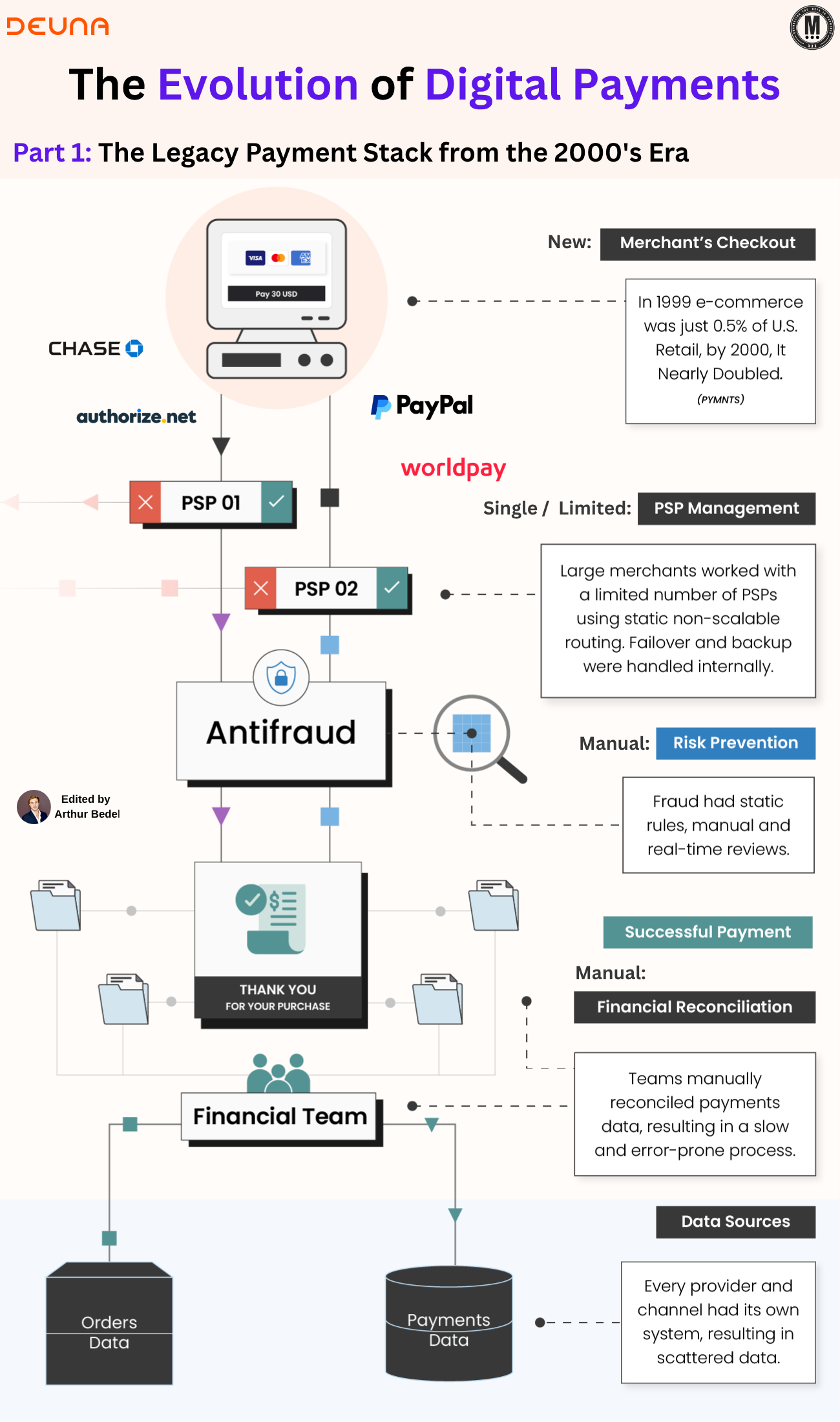

New Series: 𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by DEUNA — Part 1: 𝐓𝐡𝐞 𝐋𝐞𝐠𝐚𝐜𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐭𝐚𝐜𝐤 𝐟𝐫𝐨𝐦 𝐭𝐡𝐞 𝟐𝟎𝟎𝟎’𝐬 𝐄𝐫𝐚 👇 Created by Arthur Bedel 💳 ♻️

Before orchestration platforms, AI optimization, or tokenized rails—digital commerce ran on rigid, manual infrastructure.

In this first installment, we examine how payments operated during the early 2000s, and the operational constraints that shaped a generation of commerce.

𝐄𝐚𝐫𝐥𝐲 𝐄-𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞: 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐕𝐨𝐥𝐮𝐦𝐞, 𝐇𝐢𝐠𝐡 𝐂𝐨𝐦𝐩𝐥𝐞𝐱𝐢𝐭𝐲

→ 𝐄-𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐞 represented just 0.5% 𝐨𝐟 𝐔.𝐒. 𝐫𝐞𝐭𝐚𝐢𝐥 𝐬𝐚𝐥𝐞𝐬 𝐢𝐧 1999.

→ By 2000, online transaction volume had doubled — yet infrastructure lagged behind.

Merchants integrated with single PSPs, minimal fraud systems, and fragmented data environments — creating operational fragility at scale.

𝐄𝐚𝐫𝐥𝐲 𝐁𝐢𝐫𝐝𝐬:

→ PayPal, Authorize.net, Worldpay, and Cybersource set the early PSP blueprint, enabling the first wave of online commerce but with significant technical and data limitations.

𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐜𝐤, 𝐌𝐚𝐱𝐢𝐦𝐮𝐦 𝐄𝐟𝐟𝐨𝐫𝐭

1️⃣ Single PSP Dependency

No routing logic or failover. A failed transaction was a lost transaction.

2️⃣ Checkout: A Nascent Experience

Conversion optimization was not a priority; UX was static and untested.

3️⃣ Manual Fraud Mitigation

Risk was addressed internally via rule-based logic—no dynamic scoring or third-party tools.

4️⃣ Reconciliation = Labor-Intensive

Finance teams matched line items manually, often across portals and spreadsheets.

5️⃣ Data Fragmentation Across the Stack

No unified source of truth. Payment data remained trapped in silos with little operational insight.

𝐓𝐡𝐞 𝐀𝐛𝐬𝐞𝐧𝐜𝐞 𝐨𝐟 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

► No dynamic routing

► No error feedback / feedback loop

► No orchestration or routing logic

► No visibility into failure causes

► No fraud engine

𝐀 𝐒𝐲𝐬𝐭𝐞𝐦 𝐁𝐮𝐢𝐥𝐭 𝐭𝐨 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭 — 𝐍𝐨𝐭 𝐭𝐨 𝐋𝐞𝐚𝐫𝐧

The lack of adaptability wasn’t a flaw—it was foundational. And that’s exactly what began to change in the next decade.

𝐍𝐞𝐱𝐭 𝐢𝐧 𝐭𝐡𝐞 𝐬𝐞𝐫𝐢𝐞𝐬

The 2010s → The Rise of Multi-PSP Environments, Fraud Automation, and the First Signs of Optimization

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()