Western Union to Launch USDPT Stablecoin on Solana by 2026

Hey Payments Fanatic!

Western Union has announced plans to launch USDPT, a US dollar-backed stablecoin built on the Solana blockchain, with rollout expected in the first half of 2026.

The token will be issued by Anchorage Digital Bank, a federally regulated institution, and made accessible to users through partner exchanges.

According to the company, USDPT will combine Western Union’s global digital reach, Solana’s blockchain infrastructure, and Anchorage’s issuance and custody solutions.

In parallel, Western Union is developing a Digital Asset Network to enable cash off-ramps for crypto. Through partnerships with wallet providers, users will be able to convert crypto holdings into fiat at Western Union retail locations worldwide.

After a 6% drop in revenue in Q1, the company is seeking to reignite growth. CEO Devin McGranahan said this initiative will allow the company to “own the economics” of stablecoins.

Do you think they are on the right path? Let me know. Meanwhile, here are today's top payments news 👇

Cheers,

INSIGHTS

💰 Every time a card payment is processed, three main types of fees are involved.

Here’s a simple breakdown of the Three Core Fees:

NEWS

🇵🇹 How people prefer to pay in Portugal by Getnet. Portugal’s payments mix is evolving, and cash still matters, but digital methods like MB WAY, Multibanco, and cards now lead. Getnet helps merchants stay ahead by enabling acceptance of all major local and global payment options for seamless, trusted transactions.

🌏 Getnet Appoints Darren Bi as Head of Global Account Asia, highlighting his leadership as crucial to strengthening connections between Asian companies and markets in Europe and Latin America. The appointment marks a key step in Getnet’s mission to bridge businesses across these fast-growing regions and drive its next phase of global expansion.

🇦🇷 Pomelo has partnered with Western Union and Pago Fácil to launch a new way to move money in Argentina. Together, the three companies aim to provide a secure, fast, and cashless solution that simplifies sending, receiving, and paying money, improving access to financial services for millions of users across the country.

🇺🇸 Western Union announces USDPT stablecoin on Solana and Digital Asset Network. It is designed to bridge the digital and fiat worlds, enabling real-world utility for digital assets. Western Union aims to launch USDPT, expanding the ways to move money for customers, agents, and partners, and to support the company’s treasury capabilities.

🇺🇸 Visa adds four stablecoins on four chains as stablecoin spend surges. Visa’s latest move aims to increase the ways of settling payments and moving money across its network. Visa’s CEO Ryan McLnerney stated that the stablecoins will represent two currencies that Visa can accept and convert to 25 traditional fiat currencies. Additionally, Visa earnings top estimates as consumers spend on cards. Visa reported strong fiscal fourth-quarter results, with adjusted net income rising 7% to $5.8 billion ($2.98 per share) and revenue up 12% to $10.7 billion, both exceeding estimates.

🇧🇷 Alchemy Pay launches fiat payment rails solution, debuts with Brazil’s PIX payment system. The new solution allows Alchemy Pay’s partners to accept user deposits and process withdrawals directly in Brazilian reais (BRL), streamlining the entire pay-in and payout process.

🌍 Mastercard announced Mastercard Threat Intelligence. The solution brings together Mastercard’s fraud insights and global network visibility with curated cyber threat intelligence from Recorded Future's platform to help payment fraud and merchant compliance teams at issuing and acquiring banks proactively detect, prevent, and respond to cyber-enabled fraud.

🇦🇪 Ziina debuts its first digital card with Visa to turn payments into instant spending power. By partnering with Visa, Ziina ensures global acceptance, robust security, and access to exclusive rewards, reinforcing its mission to make money movement in the UAE faster, simpler, and more contextual.

🌍 Thunes and Ecobank Group to power Africa's instant payments for the next billion users. The alliance empowers entrepreneurs to trade beyond borders, families to support loved ones instantly, and communities to take part in a more dynamic, digital African economy.

🇬🇧 Barclays and Visa extend partnership. As part of the expansion, Barclays and Visa will explore new opportunities to innovate across a broad spectrum of payment types, channels, and technologies. Visa will provide Barclays with access to enhanced services supporting both issuing and acquiring.

🇺🇸 Adyen tops revenue estimates despite the end of the US tariff exemption for low-value packages. The company posted net revenue of 598.4 million euros ($697.9 million) for the third quarter, a 23% year-on-year rise on a constant currency basis, surpassing analysts' average forecast for 21.1% growth.

🇺🇸 PayPal is developing LLM-powered agentic commerce services using NVIDIA’s Nemotron™ open models to enhance global commerce experiences. By leveraging open models, PayPal can fine-tune AI systems for specific business needs, ensuring greater control, scalability, and security.

🇬🇧 Clear Junction appoints Teresa Cameron as Group CEO. With over four years at Clear Junction and a strong background in finance and leadership, Cameron aims to expand the company’s international reach, strengthen client trust, and drive further growth while maintaining its established strategy and culture.

🇨🇱 Chilean ProntoPaga boosts its regional expansion with the addition of senior executives from Apple, Phillips, and Nexus. The company incorporated high-level executives in strategic positions, such as Carolina Pérez as Commercial Manager, Tomás Koch as Compliance Director, and Francisca Raffo as Chief Technology Officer of ProntoPaga.

🇺🇸 Fiserv announces updates to the leadership team and board refreshment. Fiserv named Takis Georgakopoulos and Dhivya Suryadevara as Co-Presidents, effective December 2025. Paul Todd, former Global Payments CFO, will become Fiserv’s CFO on October 31. CEO Mike Lyons said the new leaders bring the expertise needed to drive growth and strengthen execution.

🇲🇽 FEMSA delays OXXO's banking license application by one year; it will first strengthen its credit business. The decision is because they seek to first consolidate their credit division and maximize the use of data from their Spin by OXXO financial platform.

🇺🇸 WisdomTree appoints BNY for banking-as-a-service infrastructure for digital assets. WisdomTree Prime is the first app to provide access to tokenized funds to U.S. retail investors with stablecoin on and off-ramps via WisdomTree’s stablecoin conversion service.

GOLDEN NUGGET

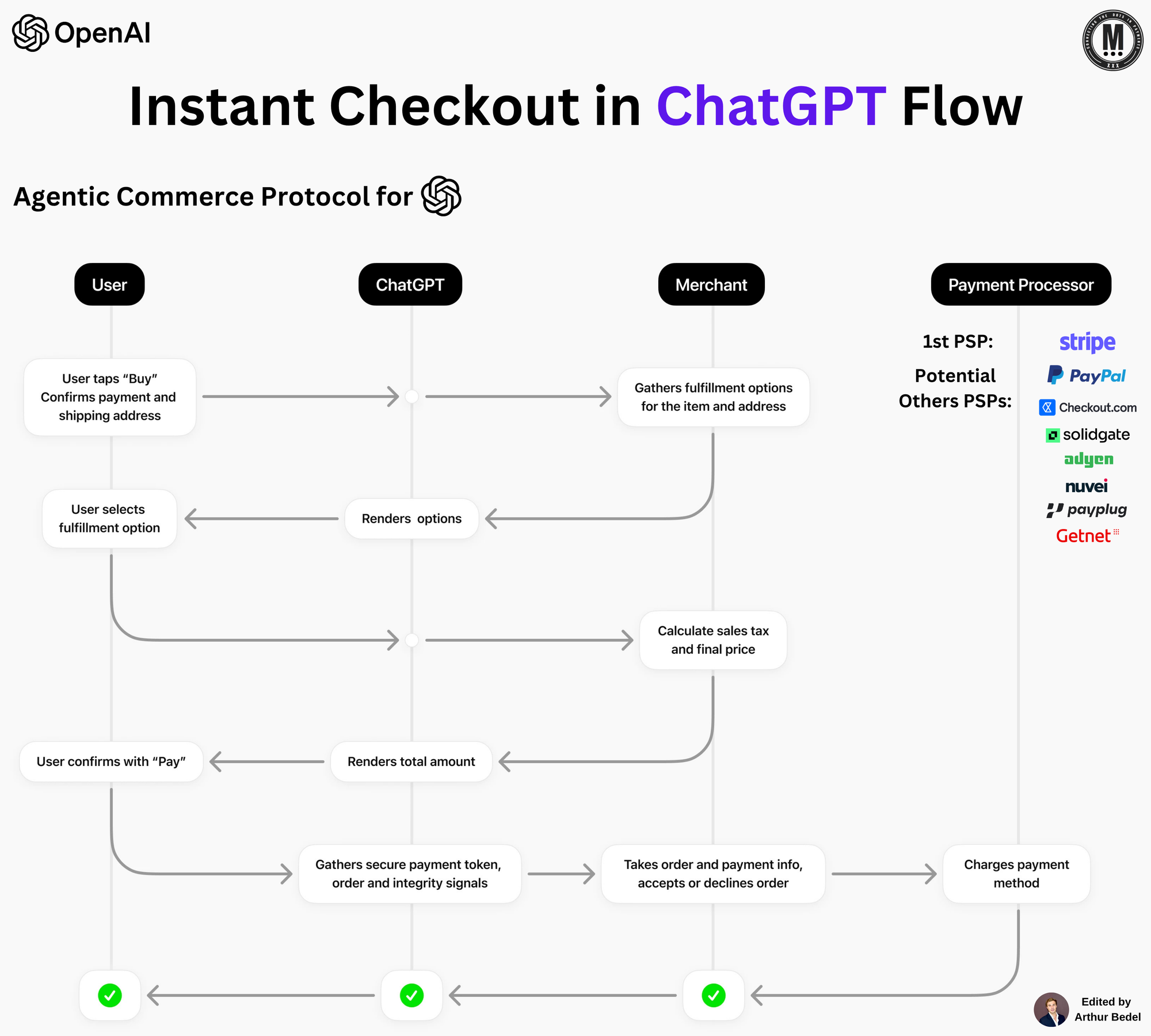

🚨 𝐁𝐮𝐲 𝐢𝐭 𝐢𝐧 ChatGPT — Instant Checkout & Agentic Commerce Protocol by OpenAI 👇Created by Arthur Bedel 💳 ♻️

𝐖𝐡𝐚𝐭’𝐬 𝐧𝐞𝐰?

► OpenAI has launched “Instant Checkout,” letting people complete purchases directly inside ChatGPT. It’s powered by an open standard — 𝘁𝗵𝗲 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗖𝗼𝗺𝗺𝗲𝗿𝗰𝗲 𝗣𝗿𝗼𝘁𝗼𝗰𝗼𝗹 — co-developed with Stripe so AI agents, users, and merchants can coordinate orders securely without merchants changing their payments stack. U.S. users can buy from Etsy sellers today, with over a million Shopify merchants coming next; multi-item carts and more regions are on the roadmap.

𝐇𝐨𝐰 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐰𝐨𝐫𝐤𝐬 (step-by-step, per diagram)

1️⃣ 𝐔𝐬𝐞𝐫: Taps “Buy,” confirms shipping & payment.

2️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Returns fulfillment options (e.g., delivery choices).

3️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓: Renders those options; user selects.

4️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Calculates taxes, fees, and final price; sends back totals.

5️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓: Shows the all-in amount; user confirms “Pay.”

6️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓 → 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Sends a secure payment token plus order & integrity signals (only what’s needed to fulfill).

7️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 → 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫: Authorizes & charges using the merchant’s existing provider; merchant remains the Merchant of Record and handles fulfillment, returns, and support.

𝐓𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 (ACP) by OpenAI

► 𝗢𝗽𝗲𝗻 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱: Open-sourced so anyone can integrate agentic buying flows.

► 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀-𝗮𝗴𝗻𝗼𝘀𝘁𝗶𝗰: Works across processors. Stripe merchants can enable with minimal code; others can use Stripe’s Shared Payment Token API or ACP’s Delegated Payments spec—no processor swap required.

► 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗰𝗼𝗻𝘁𝗿𝗼𝗹: You keep your stack and customer relationship end-to-end.

Note: This protocol is agnostic of Payment Processors. Checkout.com, Adyen, Nuvei, PayPal, Payplug, Getnet and all others are able to join. Game on.

𝐓𝐫𝐮𝐬𝐭 & 𝐬𝐚𝐟𝐞𝐭𝐲 — 𝐛𝐮𝐢𝐥𝐭 𝐢𝐧 (most important)

✔ 𝗘𝘅𝗽𝗹𝗶𝗰𝗶𝘁 𝘂𝘀𝗲𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁 at each step.

✔ 𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗲𝗱 𝗽𝗮𝘆𝗺𝗲𝗻𝘁𝘀 authorized only for a specific amount & merchant.

✔ 𝗠𝗶𝗻𝗶𝗺𝗮𝗹 𝗱𝗮𝘁𝗮 𝘀𝗵𝗮𝗿𝗶𝗻𝗴—only what’s required to fulfill the order.

𝐖𝐡𝐲 𝐭𝐡𝐢𝐬 𝐢𝐬 𝐚 𝐫𝐞𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧

► 𝗙𝗿𝗼𝗺 𝗿𝗲𝗰𝗼𝗺𝗺𝗲𝗻𝗱𝗮𝘁𝗶𝗼𝗻 𝘁𝗼 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲, 𝗶𝗻 𝗰𝗵𝗮𝘁: ChatGPT already helps hundreds of millions weekly discover products—now the same interface completes the buy with a few taps.

► 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗰𝗼𝗺𝗺𝗲𝗿𝗰𝗲, 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗮𝗹𝗹𝘆: AI coordinates options, price, taxes, and payment signals—then hands off to the merchant’s existing rails.

► 𝗢𝗽𝗲𝗻 𝗲𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺: With ACP open-sourced, any merchant or platform can adopt agentic checkout without ceding data or control.

Source: OpenAI

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()