Wise Just Landed Its First African Licence… and It’s a Solid Milestone

Hey Payments Fanatics!

Wise just secured its first licence on the African continent, opening South Africa after conditional approval from the Reserve Bank.

It’s a Category 2 FX Dealer licence. This approval is foundational for future service expansion.

South Africa is the largest economy in Africa and a G20 member, pushing to modernize cross-border flows.

Wise starts with personal transfers. More products roll out as they build their local footprint.

Nadia Costanzo, Director of Banking Operations and Expansion at Wise, says the mission is simple: cut costs and eliminate the slow, unclear processes still hitting consumers.

Stay up to date: PIX broke another record...

Pix hit 297.4M transactions on Friday.

R$166.2B moved in one day.

The Central Bank called it “another demonstration of Pix as public digital infrastructure”.

You’ll see exactly what they mean below 👇

Keep scrolling and get straight to today’s Payments highlights!

Cheers,

Marcel

INSIGHTS

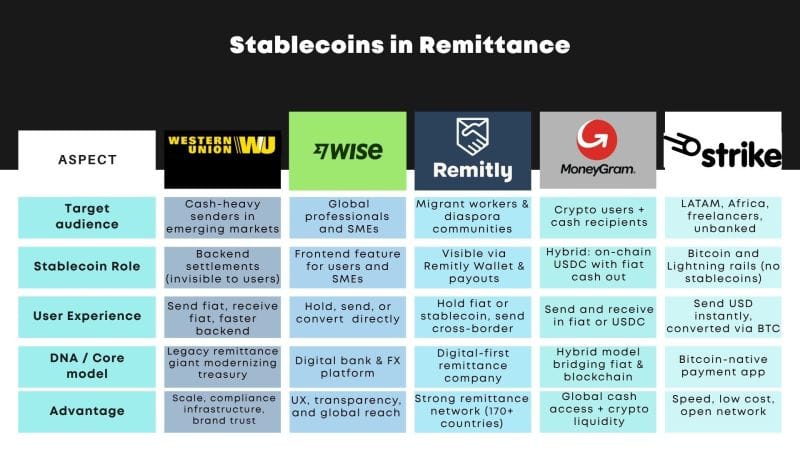

➡️ Stablecoins in Remittance 👇

NEWS

🇦🇷 Western Union and Pago Fácil launch their card powered by Pomelo in Argentina. This new offering aims to provide a safer, more convenient, and cashless alternative for those who currently rely on cash. The card, powered by Pomelo, allows users to receive remittances or loans directly into a digital account, eliminating the need to handle banknotes or carry large sums of money.

🇿🇦 Wise marks its first expansion to Africa with the new licence. With its approval secured, the group aims to begin operations in South Africa. With Wise’s expansion into the country, the firm can offer transfers for personal customers, with further ambitions to bring its full product suite to the market over time in line with these ambitions.

🇧🇷 Pix reaches a record mark of 297.4 million daily transactions, according to the Central Bank. "The result is yet another demonstration of the importance of Pix as a public digital infrastructure for the functioning of the national economy," says the Central Bank in a statement.

🇬🇧 Sokin raises $50m series B following 100% year-on-year growth. The company will further build out its global infrastructure and secure additional regional licenses and banking partnerships, further extending Sokin’s global reach in markets across Asia, the Middle East and South America.

🇸🇦 Mastercard Gateway gains SAMA certification. This certification will enable Mastercard Gateway to process e-commerce transactions through the New E-commerce Payments Interface locally and securely, providing local routing, tokenisation, fraud prevention, and direct integration with the national payment scheme (Mada).

🇸🇬 Ripple gains regulatory Nod to expand payment services in Singapore. The company announced that its Singapore-based subsidiary, Ripple Markets APAC, has been approved by MAS to broaden the scope of its regulated payment activities under its Major Payment Institution (MPI) license.

🇮🇹 BANCOMAT and Visa announce pilot project for BANCOMAT Pay expansion. The new functionality will allow users of the BANCOMAT Pay service, available within the BANCOMAT wallet, to make secure, contactless payments, even abroad.

🇲🇾 Tencent to expand WeChat mini programme ecosystem in Malaysia as it ramps up regional expansion. The mini programme allows payment and e-commerce functions and customer engagement tools to work within the WeChat app without requiring separate installations of stand-alone mobile applications.

🇩🇪 FIS inks deal with BMW Bank. Through this deployment, FIS is helping BMW Bank provide more efficient and meaningful financial transactions and customer service in its lending and deposits business, giving the bank greater opportunities to unlock growth and gain a competitive advantage.

🇬🇧 PayDo introduces a direct acquiring feature. The new acquiring service allows merchants to process VISA and Mastercard transactions through PayDo’s system without external intermediaries. This change improves processing speed, increases approval rates, and significantly simplifies the settlement process.

🇦🇺 EML Payments appoints Stuart Will as its new CFO to drive growth strategy. Will, who has extensive experience in the FinTech, financial services, and retail sectors, will work alongside James Georgeson to ensure a smooth transition. Will leverages his expertise to enhance the company’s global operations.

🇺🇿 Stablecoins become legal payment in Uzbekistan starting in 2026. Tokenised shares and bonds will be allowed, with a dedicated trading platform under regulatory oversight. The move includes a controlled regulatory sandbox and an open banking framework to support FinTech growth.

🇺🇸 S&P downgrades Tether’s assets to the lowest level. Tether’s ability to maintain its peg to the US dollar has been called into question by S&P Global Ratings, which downgraded the stablecoin operator’s reserves to its lowest measure due to rising exposure to high-risk assets.

🇨🇱 Mercado Pago Chile is betting on being the primary provider, not on banking. Mercado Pago wants to distance itself from any local banking model, but its growth, efficiency, and business plans are pushing it to operate like one. The Head of Legal said that becoming a bank is not a priority for the company, but that financial authorities and its market share could force it into that role.

🇧🇭 EazyPay partners with Optty to launch unified payment orchestration for Merchants. The collaboration enables EazyPay’s merchants to process transactions through a single interface that supports nine major payment types, consolidating payment acceptance into one seamless, centralised platform.

🇺🇸 Sony Bank plans to launch USD stablecoin by 2026. The token will be used across Sony’s entire entertainment ecosystem, including PlayStation, streaming services, and anime platforms, to offer faster, cheaper, and borderless digital payments.

GOLDEN NUGGET

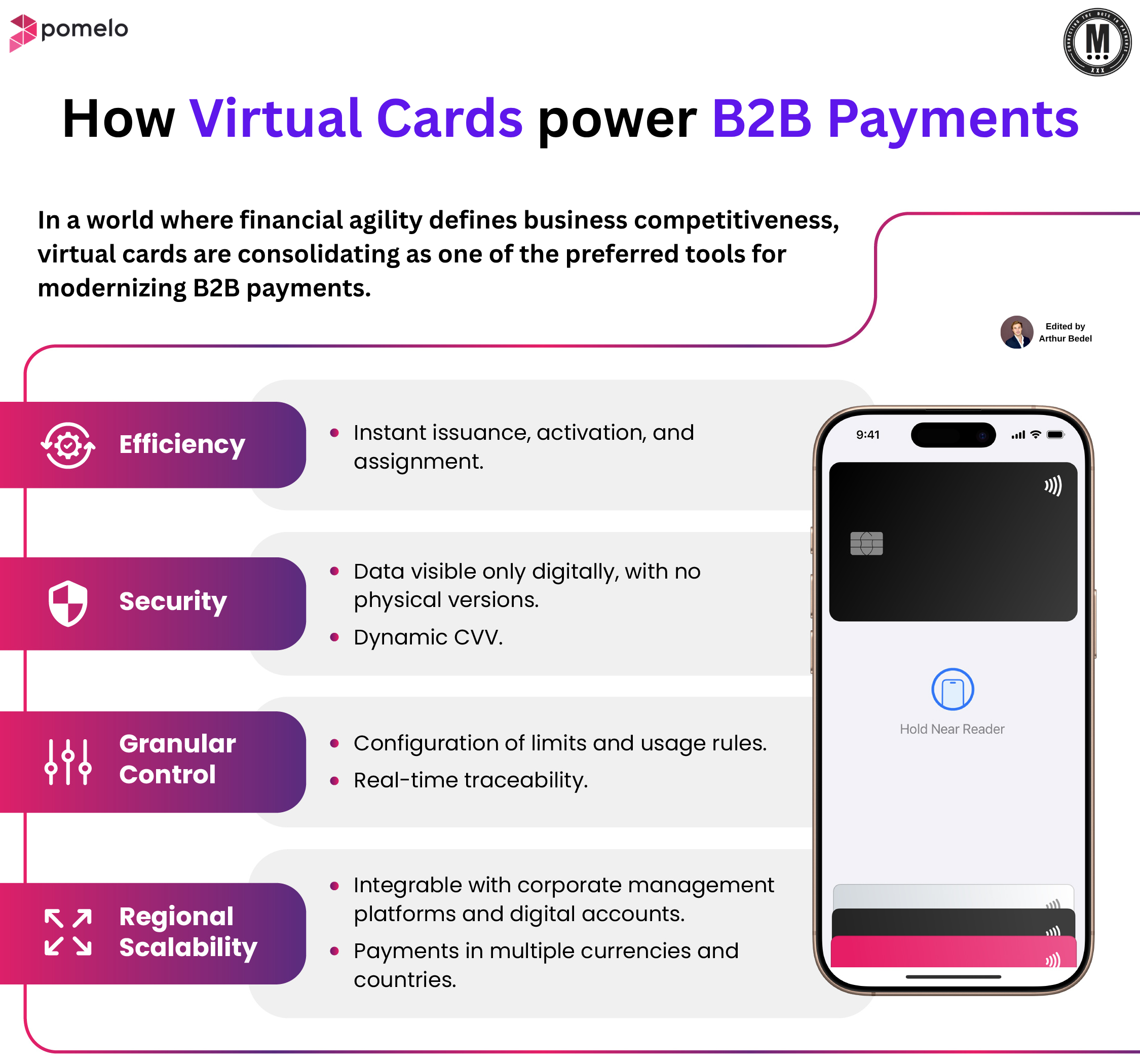

🚨 𝐇𝐨𝐰 𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐂𝐚𝐫𝐝𝐬 𝐚𝐫𝐞 𝐫𝐞𝐝𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐁2𝐁 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — by Pomelo 👇Created by Arthur Bedel 💳 ♻️

In today’s business world, speed, security and control aren’t nice-to-haves — they’re essential. 𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐂𝐚𝐫𝐝𝐬 are rapidly becoming the modern rail that global companies rely on, replacing the limitations of traditional physical cards.

Instead of waiting days for a card to be issued or managing manual expense reports, firms can now issue a virtual card instantly, set spending and usage rules in real time, and monitor activity as it happens. With no physical card to lose and dynamic security features like changing CVVs, the fraud surface is significantly reduced.

Here are real-life examples of this in action:

→ 𝐒𝐚𝐚𝐒 & 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 – A global software firm uses virtual cards to manage each vendor subscription separately. If one vendor is compromised, only that card is affected.

→ 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐓𝐫𝐚𝐯𝐞𝐥 – A multinational travel management company issues trip-specific virtual cards to employees, each with a geo- and category-restricted budget, providing finance teams with full real-time visibility.

→ 𝐌𝐚𝐫𝐤𝐞𝐭𝐩𝐥𝐚𝐜𝐞 & 𝐆𝐢𝐠 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 – A global delivery platform pays its courier pool instantly via virtual cards, eliminating bank transfer delays and lowering payment friction.

→ 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 & 𝐌𝐮𝐥𝐭𝐢-𝐂𝐮𝐫𝐫𝐞𝐧𝐜𝐲 𝐒𝐩𝐞𝐧𝐝 – A digital marketing team operating in LATAM issues virtual cards in local currencies across Brazil, Argentina and Mexico, bypassing wire delays and costly FX mark-ups.

The outcome is clear: greater agility, stronger fraud protection, tighter spend control, and genuine global scalability.

Virtual cards aren’t just another payment method—they are becoming the operating system for B2B payments in a digital economy.

💡 What's the future of B2B Payments - Stablecoins? Virtual Cards? Hybrid? other? 😉

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()