yetipay Secures £3.5M to Enter US Market

Hey Payments Fanatic!

A fresh boost for yetipay this week. The London-based FinTech has secured £3.5 million in new funding to grow its all-in-one payments platform, backed by re:cap’s Capital OS and a group of well-known angel investors.

“We focused on raising the minimum amount required and selecting investors that bring valuable deep payments industry experience,” said Oliver Pugh, Founder of yetipay.

The company has raised over £6 million since its founding in 2017 and is active in the UK, Italy, and Spain. The new funding will support expansion into the US, Australia, and New Zealand, while also helping to roll out new products for its growing hospitality and retail client base.

But the story doesn’t end here. Scroll down for more details 👇

See you on Monday!

Cheers,

INSIGHTS

🌎 The LatAm Stablecoin Payment Landscape

NEWS

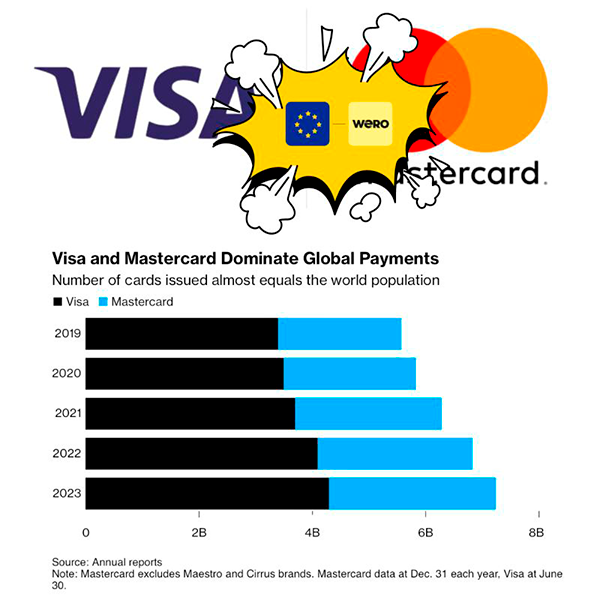

🇧🇪 Five Belgian Banks are preparing to launch Wero, expanding the European Payments Initiative’s footprint and accelerating efforts to unify the continent’s digital payments environment.

🇬🇧 yetipay raises £3.5M to expand its all-in-one payments platform. The funds will be used to continue the expansion of yetipay’s all-in-one payments platform and introduce new products to its growing base of independent and enterprise hospitality and retail customers.

🇬🇧 Paddle raises $25M to accelerate growth and international expansion. The funding will be used to support Paddle’s continued global expansion, accelerate growth, and drive rapid product development to further support its enterprise customers.

🇸🇬 Ant International expands merchant payment AI functions with Antom Copilot 2.0. New features include the industry-first Chargeback AI Assistant, automated payment method recommendation, AI-assisted onboarding, and risk management strategy configuration.

🇬🇧 Wise ends Q1 FY26 with 11% jump in income. Wise generated income of £362 million between April and June, marking an 11% increase year over year. The company expects its full-year growth to remain in line with its medium-term guidance of 15-20% on a constant currency basis.

🇬🇧 CAB Payments confirms James Hopkinson as new CFO. Hopkinson brings extensive experience from his previous roles. This appointment is expected to strengthen the company’s leadership team and enhance its financial strategy, potentially impacting its operations and market positioning positively.

🇬🇧 payabl. launches SEPA Direct Debit capabilities for business payment services. This will facilitate the automatic collection of recurring euro payments for companies operating across the 36 SEPA countries. The newly introduced functionality allows merchants to accept recurring payments from customers through payabl.’s gateway.

🇲🇽 Global Payments and Banamex renew strategic partnership. Extending the strategic alliance enables both companies to serve the full spectrum of merchants, from small and medium-sized businesses to enterprises, including both digital native and brick-and-mortar establishments.

🇳🇱 Coda accelerates global expansion with acquisition of European payments platform Recharge. The acquisition accelerates Coda's expansion beyond gaming and strengthens its ability to serve the broader digital content economy by extending its presence in Europe and building on its direct-to-consumer capabilities.

🇺🇸 TerraPay and XanderPay launch payment models for hotel brands. The solution is designed to simplify cash flow management, reduce the costs and friction associated with cross-border transactions, and eliminate the complexity of processing third-party bookings.

🌎 Thredd and Payblr partner to power seamless cross-border FinTech expansion across Latin America. By combining Thredd’s modular technology stack and global processing expertise with Payblr’s cross-border card issuing capabilities, the partnership eliminates the traditional complexity associated with launching in LAC markets, offering a seamless pathway.

🌍 PAX and Lunu Pay enable crypto payments at 80 million terminals globally. The partnership allows merchants using PAX’s Android-based POS terminals to accept over 30 cryptocurrencies, including Bitcoin and Ethereum, without needing any new hardware.

🇳🇴 MiniPay surpasses 8 million wallets and 200 million transactions, with a 255% activation surge in Q2. MiniPay's rapid growth comes from solving real user needs in regions where financial volatility is high and access to a stable currency can be life-changing.

🇺🇸 Noah and Gnosis partner to deliver global stablecoin payment infrastructure. The collaboration allows users to transact in USD and stablecoins with full regulatory confidence. For users in emerging markets, it unlocks new access to U.S. dollar-denominated accounts and seamless payments to and from the U.S.

🇺🇸 GENIUS stablecoin bill clears House and heads to Trump's desk. The US House of Representatives voted 308–122 to pass S. 1582, the GENIUS Act, a sweeping bill designed to establish a national regulatory framework for payment stablecoins.

🇺🇸 Some big US banks plan to launch stablecoins, expecting crypto-friendly regulations. Stablecoins, a type of cryptocurrency designed to maintain a stable value, are typically pegged to a fiat currency, such as the U.S. dollar, and are commonly used by crypto traders to transfer funds between tokens.

🇦🇺 Change at the top of ANZ Worldline after CEO resigns. John Collins has been appointed interim chief executive of ANZ's merchant acquiring joint venture with Worldline following the departure of Steve Aliferis. Read more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()