Your Brand, in Front of FinTech Leaders. Every Single Day.

Hi Payments Fanatic!

In just two weeks, one of the biggest FinTech event of the year, Money20/20 Las Vegas, kicks off. I’ll be there catching up with industry friends, and no doubt, so will you.

Events like this are invaluable. But here’s the truth: for brands, visibility shouldn’t peak only a few days a year.

The real impact comes from staying in front of decision-makers every single day.

That’s where Connecting the Dots in FinTech comes in. My newsletters and social channels now reach hundreds of thousands of industry leaders—founders, execs, and investors who shape the future of finance. They don’t just read. They engage, share, and act.

And we’re not stopping there.

For 2026, I’m building something this industry hasn’t seen before—an entirely new way to connect brands with the global FinTech community. Something bigger than anything we’ve done to date.

Early partners will have a front-row seat.

If you believe in being more than just “seen” at events, if you want your brand to be remembered year-round, then let’s talk.

Reply to this email, or reach out here, and I’ll be in touch with you soon.

Let’s make it a productive Monday! Here’s your FinTech rundown 👇

Cheers,

INSIGHTS

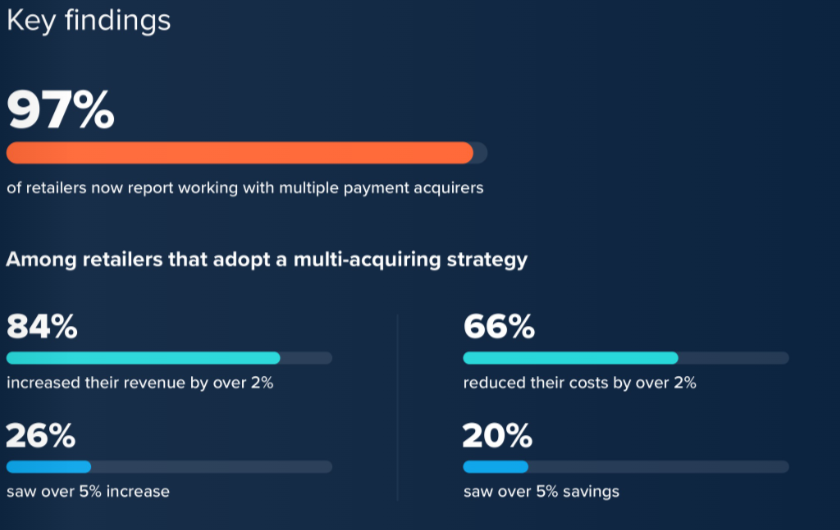

📊 Unlocking Opportunity: How Payments are Powering Merchant Growth by ACI Worldwide. The report reveals that 97% of global retailers are already working with multiple acquirers, and that 96% of those using two or more acquirers report an increase in revenue. The research also highlights the surge in alternative payment methods (APMs). Read the complete report here

NEWS

🇪🇸 PagoNxt Payments automates €150M+ in annual cross-currency invoice payments for Gesban. The shift eliminated manual checks and approvals, cutting processing time from 15 minutes to seconds while improving FX margins by 2–3% and reducing operational risk. Supporting multiple currencies and already handling €13M in a pilot phase, the system is scaling across global entities.

🇺🇸 Coinbase and Mastercard are in talks to buy stablecoin startup BVNK. The terms and winning bidder haven’t been finalized, but the sale price ranges between $1.5 billion and $2.5 billion, according to some of the sources. The talks may not result in a final deal, but at present, Coinbase appears to have the inside track over Mastercard.

🇨🇱 Pomelo partnered with MetroMuv to power its FinTech expansion in Chile through next-generation payment infrastructure. The collaboration enables a faster, safer, and more scalable experience for thousands of metro users while building an integrated mobility and payment ecosystem.

🇺🇸 Getnet welcomed Michelle Wong as the new Head of US Global Accounts. Michelle joins to help US-based merchants expand and operate across these regions. Part of the Santander Group, Getnet is a leading FinTech and Latin America’s largest acquirer, offering unified, omnichannel payment solutions that connect technologies, markets, and growth opportunities.

🇲🇽 In response to fraud, banks rethink strategy in the face of criminal AI. By 2025, at least 50% of financial frauds are expected to be linked to AI attacks, according to estimates by ACI Worldwide. Given this scenario, Cleber Martins, the company's Head of Payments Intelligence and Risk Solutions, warned that banks will have to rethink their strategy to stay one step ahead of cybercriminals.

🇺🇸 Splitit launches Partner Program to power installments for agentic commerce. The Splitit Agentic Commerce Partner Program will bring card-linked installment capabilities to autonomous shopping agents, AI systems that can search, recommend, and make purchases on behalf of consumers and businesses.

🇺🇸 Klarna and Google Cloud enter strategic AI partnership to bring more creative and engaging shopping experiences to millions of Klarna users worldwide. Through this collaboration, Klarna will leverage Google Cloud's complete AI stack, from infrastructure to platform to models, to accelerate the development of innovative, consumer-centric products and creative campaigns.

🇸🇬 Ant International’s Antom eyes more Singapore merchants as it grows payments and digitalisation services. The merchant payment and digitalisation services provider sees an opportunity to provide a one-stop shop for merchants, especially those in the retail and food and beverage sectors.

🇮🇪 Stripe opens new headquarters in Dublin as Ireland's internet economy surges. The new dual headquarters will house expanding teams in engineering, product, operations, and sales, and bolster Stripe's efforts to help its users adopt frontier technology, including AI and stablecoins, to grow faster.

🇷🇴 Rhuna raises $2M seed round led by Aptos Labs to build stablecoin payment infrastructure for entertainment. The new funding will strengthen Rhuna’s payments and settlement rails, expand organizer tooling and integrations (including POS, ticketing, and mobility partners), and accelerate the launch of Rhuna’s consumer app, which brings discovery, access, and wallet-native checkout into one seamless experience.

🇦🇺 Afterpay launches commerce media solution ‘Curate’ powered by Magnite. Afterpay Curate will allow brands and agencies to tap into Afterpay’s shopper insights, layered onto premium, brand-safe publisher inventory across the DSP of their choice. Keep reading

🇱🇺 Luxembourg banks confirm instant payments are now possible. Luxembourg’s six main retail banks have confirmed they are offering instant euro payments, complying with new EU rules requiring all euro-area banks that provide standard credit transfers to also enable transactions settling within ten seconds, 24/7.

🇬🇧 Zilch eyes ‘hot’ FinTech IPO market amid product launch. Zilch CEO Philip Belamant hinted at a unique upcoming IPO, inspired by Klarna’s strong debut, and reaffirmed plans to list in London. As Zilch expands with “Zilch Pay” and an AI data platform, Belamant highlighted the firm’s strong lending foundation and rapid tech innovation.

🇩🇪 German banks turn to US financial firm BNY for international money transfers to help customers with international payments, a move aimed at fending off upstart low-cost competitors that has raised concerns over the sovereignty of Europe's financial services.

🇺🇸 U.S. Bank selected to provide custody services for reserves backing payment stablecoins from Anchorage Digital Bank. Anchorage Digital CEO Nathan McCauley said that partnering with U.S. Bank highlights the increasing convergence of traditional and digital finance and the momentum behind mainstream adoption of dollar-backed stablecoins.

🇺🇸 Bank of North Dakota and Fiserv partner to launch Roughrider Coin. The Roughrider coin will aim to increase bank-to-bank transactions, encourage global money movement, and drive merchant adoption. The coin will be available to banks and credit unions in North Dakota in 2026.

🇧🇷 Pagaleve FinTech raises USD 30 million in new funding round in Brazil. This round gives Pagaleve the resources to accelerate innovation and launch products that transform the consumer shopping experience while strengthening its retail partners. Read more

🇺🇸 Cross-border payments FinTech Routefusion raises $26.5M. The latest funding will be used to expand Routefusion's partner network, broaden its liquidity and compliance capabilities, and grow its product, engineering, and go-to-market teams. Keep reading

GOLDEN NUGGET

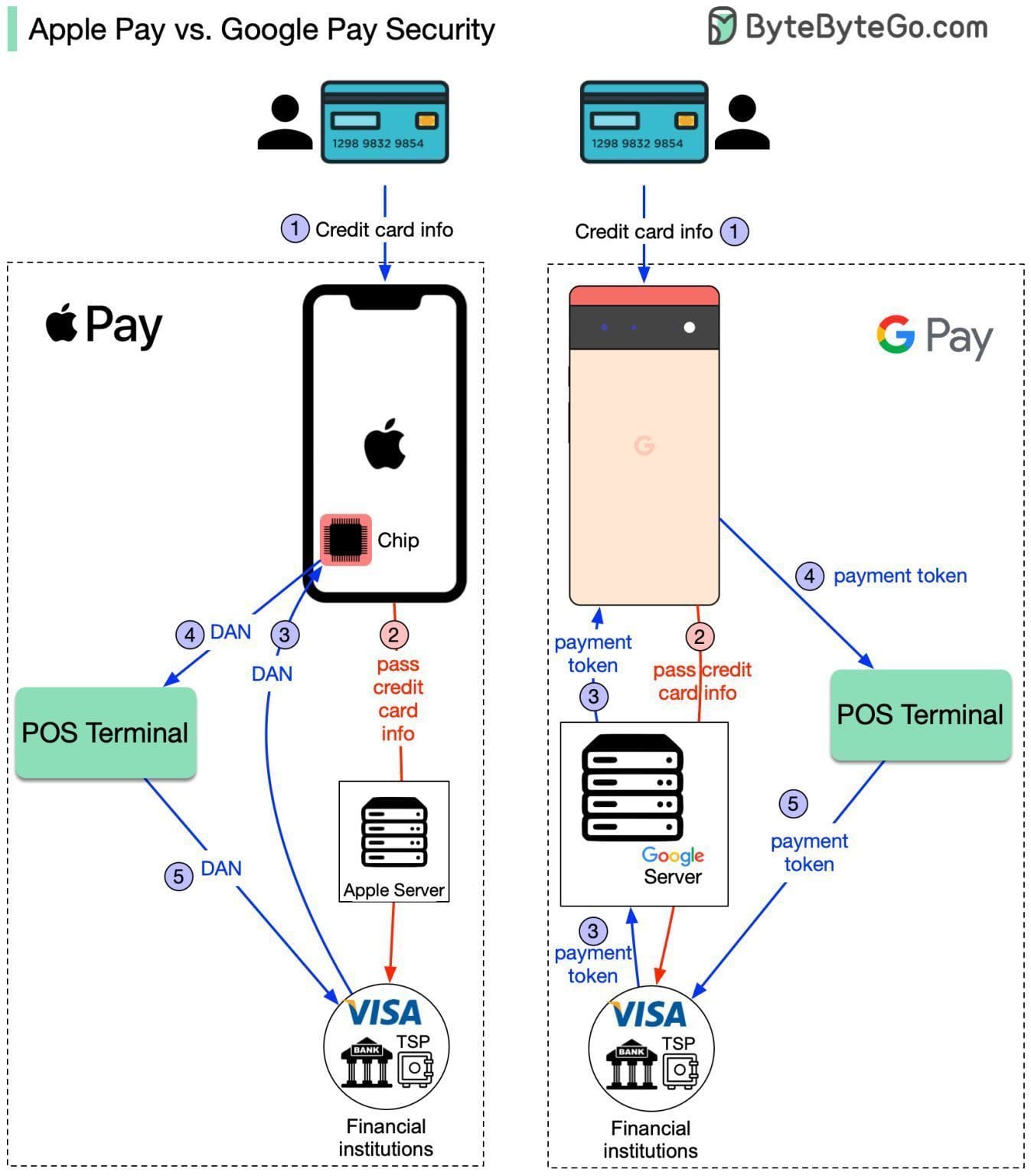

Apple Pay 🆚 Google Pay

Here is how it works:

The diagram by Alex Xu from ByteByteGo above shows the differences.

To make it easier to understand, he breaks down the process into two flows.

1. Registering your credit card flow

2. Basic payment flow

Check out the great explainer video for more

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()