Zelle's Secret Roadmap to the Next Trillion

Hi Payments Fanatic!

Over the weekend, I came across a fantastic podcast I highly recommend. 🎧 It’s from Rex Salisbury, featuring Denise Leonhard, Head of Zelle at Early Warning.

Zelle´s Secret Roadmap to the Next Trillion

She talks about her journey from Amex and PayPal to running one of the largest real-time payment networks in the U.S., Zelle, now a $1 trillion powerhouse. Denise dives into what sets Zelle apart from other P2P networks, how it’s expanding into SMB payments, tackling fraud, and what’s next on the roadmap. She also shares candid insights on team building, product innovation, and the future of real-time payments.

👉 Give it a listen and let me know what you think! And if there’s another FinTech podcast I should check out, let me know and drop it in the comments.

Cheers,

INSIGHTS

💰 SHAREPay: Pays You Back With Every Tap. From Ski Dubai penguins to instant loyalty points, MAF is blending mall payments with SHAREPay and a credit card that works across all its stores. Explore the full article

NEWS

🎤 Zelle's Secret Roadmap to the Next Trillion. In this episode, Denise Leonhard, Head of Zelle at Early Warning, shares her journey from leadership roles at American Express and PayPal to overseeing one of the largest real-time payment networks in the U.S. She discusses how Zelle grew into a $1 trillion platform, what sets it apart from other peer-to-peer networks, and its expansion into small business payments.

🇮🇳 UPI crosses 20 billion monthly transaction milestone in August. The platform recorded 20.01 billion transactions in August compared to 19.47 billion transactions in July. The digital payments platform also saw its total transaction value for August at Rs 24.85 lakh crore, marginally lower than the Rs 25.08 lakh crore it recorded in July.

🇮🇳 India taps homegrown digital payments network to widen access to credit. The National Payments Corporation of India has started making its infrastructure available to banks to deliver short-term loans to small businesses such as vegetable vendors and food stall operators.

🇬🇧 Verto unveils the Atlas Suite: API-first embedded finance solutions to transform global payments for FinTechs, marketplaces, platforms, and white label brokers. This allows customers to enjoy faster, more reliable, and compliant financial services across multiple currencies and markets.

🌍 EuroPA and EPI prepare to expand cross-border payments in Europe. The exploratory phase of the partnership is nearing completion, and the next step will be to finalize the feasibility study by December 2025, preceding the implementation phase. The implementation will follow a phased approach, starting with peer-to-peer transfers and gradually expanding to other use cases.

🇺🇸 Klarna readies IPO marketing to start as soon as Tuesday. The Sweden-based FinTech and its bankers will seek to drum up investor demand for the IPO shares during the marketing period, which is expected to kick off following the Labor Day holiday. That effort will lay the groundwork to price the issue later this month and list shares in New York.

🇨🇳 HK FinTech firm Obita secures $10M to expand stablecoin payment. The company said the funds will be used for system development, compliance infrastructure, and global expansion, with a focus on stablecoin-based cross-border payments.

🇨🇭 Ripple partner Amina Bank deepens Circle alliance ties to advance regulated stablecoins. Amina emphasized its intent to strengthen client confidence in stablecoin transactions, noting: “As Circle continues to lead the way in stablecoin utility, Amina enables individuals and institutions to transact with confidence across a global infrastructure. We’re proud to stand alongside Circle in this journey.”

🇫🇷 Worldline appoints Anika Grant as new Chief People Officer. She has over 30 years of experience helping organisations transform through strategic talent management. She was most recently the CPO at Ubisoft, where she successfully navigated a period of pivotal change for the organisation and transformed the HR function.

🇱🇹 Lithuania's Perlas Finance taps Amlyze for compliance tech upgrade. The deployment of Amlyze's Software-as-a-Service solutions will equip Perlas Finance with customer risk assessment tools, real-time transaction monitoring, anti-money laundering investigation capabilities, and screening services for politically exposed persons, sanctions, and adverse media.

🌎 Bitso Business expands into new markets and unveils new products. According to Bitso Business, the expansion aims to provide financial services to assist businesses in managing cross-border operations across Latin America. Read more

🇮🇳 BharatPe and Unity Bank unveil new credit card. The card is available on the RuPay network and can be linked to UPI, allowing users to make payments across numerous merchants in India. It features a “zero-fee structure”, with no joining charges, annual fees, or processing charges, and customers can prepay their EMIs at any time without facing penalties.

🇰🇷 Korea’s Kbank partners with blockchain firm BPMG to launch cross-border stablecoin. The deal is for a blockchain wallet, platform development, and stablecoin consulting. Kbank has 14 million clients and is known as the partner bank for Upbit, the country’s largest cryptocurrency exchange.

GOLDEN NUGGET

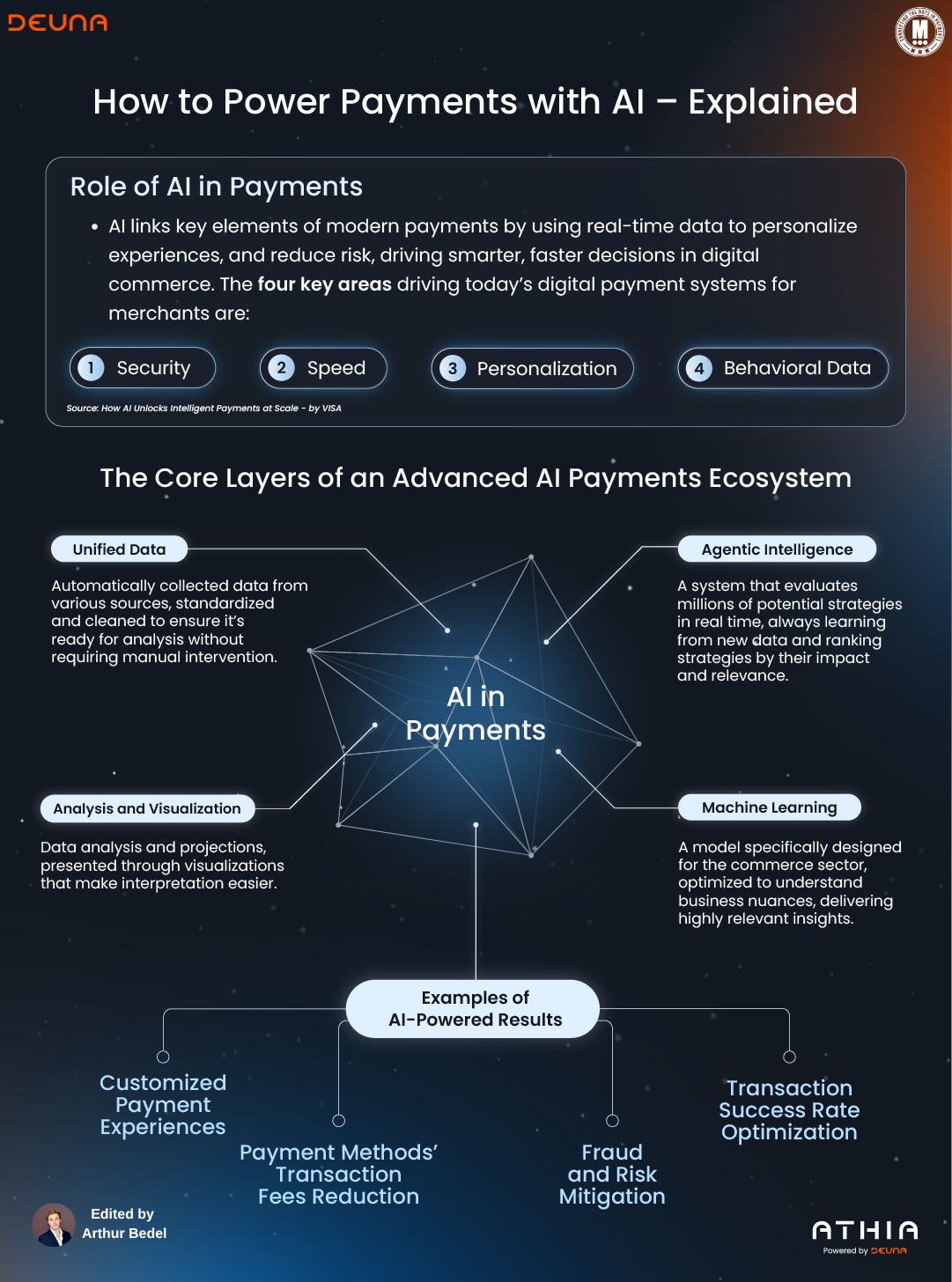

🚨 𝐓𝐡𝐞 𝐂𝐫𝐢𝐭𝐢𝐜𝐚𝐥 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐃𝐚𝐭𝐚 𝐂𝐨𝐧𝐭𝐞𝐱𝐭𝐮𝐚𝐥𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐀𝐈 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — by DEUNA 👇Created by Arthur Bedel 💳 ♻️

At PaymentsEd last week, I was amazed by the 𝐟𝐨𝐜𝐮𝐬 𝐨𝐧 𝐀𝐈 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬. Many thought leaders trying to understand together the impact of this technology on the Payments industry:

1. The issues it will solve

2. Opportunities it will unlock

3. Risks to watch out for

4. Readiness to leverage AI

One of the most common mistakes when implementing AI in payments is assuming the impact begins with the algorithm. In reality, the foundation for success is laid much earlier — with how data is prepared and contextualized.

Clean, unified data is essential, but on its own it is only the starting point. Contextualized data transforms AI from a technical feature into a strategic capability — one that drives smarter decisions, optimizes performance, and enables measurable growth.

𝐖𝐡𝐲 𝐂𝐨𝐧𝐭𝐞𝐱𝐭 𝐌𝐚𝐭𝐭𝐞𝐫𝐬 𝐢𝐧 𝐀𝐈-𝐏𝐨𝐰𝐞𝐫𝐞𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

𝐓𝐚𝐫𝐠𝐞𝐭𝐞𝐝 𝐎𝐛𝐣𝐞𝐜𝐭𝐢𝐯𝐞𝐬

→ Without a clearly defined success metric — whether improving approval rates, reducing fraud, or increasing revenue recovery.

Checkout.com merchants targeting a 5% approval uplift in MENA markets use contextual objectives to direct AI-driven routing

𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭-𝐎𝐰𝐧𝐞𝐝 𝐃𝐚𝐭𝐚

→ Internal data such as buying frequency, customer segmentation, and product categories contains critical signals for decision-making.

eBay leverages purchase frequency and category insights to fine-tune fraud detection rules without disrupting high-value customers.

𝐄𝐱𝐨𝐠𝐞𝐧𝐨𝐮𝐬 𝐕𝐚𝐫𝐢𝐚𝐛𝐥𝐞𝐬

→ External factors such as seasonality, regional holidays, and major events can materially shift purchasing patterns. AI must incorporate these elements in real time to avoid blind spots.

Getnet merchants in Brazil adjust routing and authentication rules during seasonal peaks such as Black Friday

𝐂𝐨𝐧𝐭𝐞𝐱𝐭𝐮𝐚𝐥 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

→ Industry-specific payment logic varies significantly across verticals. What works in quick-service restaurants may fail in SaaS subscription models.

Microsoft applies differentiated retry logic for enterprise SaaS license renewals versus Xbox consumer transactions, reflecting distinct customer and issuer behaviors.

𝐓𝐡𝐞 𝐈𝐦𝐩𝐚𝐜𝐭: 𝐅𝐫𝐨𝐦 𝐑𝐞𝐚𝐜𝐭𝐢𝐯𝐞 𝐭𝐨 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜

When these contextual layers are integrated, AI is a strategic enabler:

→ Decisions informed by both internal and external realities

→ Optimized performance across markets, channels, and payment methods

→ Faster, better-aligned actions across business and technical teams

→ Reduced false declines and improved fraud mitigation

In payments, AI without context produces noise.

With context, it becomes a precision instrument for sustainable growth.

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()