Alipay Enables QR Payments on Rokid’s AR Glasses

Hey Payments Fanatic!

Rokid has spent years developing AR glasses that feel easy to wear and even easier to use. The latest versions, Rokid AR Spatial and Rokid Glasses, project a giant virtual screen, offer real-time translation, and can recognize the world around you.

These glasses have already found their place in museums, tourist attractions, and gaming setups around the world. Now they’re stepping into something even more everyday, and that brings us to today’s topic: payments.

Through a new partnership with Alipay, Rokid is adding QR code payment features directly into the glasses. More than 250,000 units are already on order with this new functionality built in.

To use it, people just link their Alipay account, scan a merchant’s QR code using the glasses, and confirm the payment with their voice. Alipay says it takes only a few seconds, compared to the usual 20 to 30 seconds on a phone.

But it’s not just about saving time. As Rokid founder and CEO Zhu Mingming puts it, “Equipping Rokid Glasses with payment capabilities brings users a smoother and more intuitive experience, while also ushering the AI glasses industry into the era of payment.”

What’s next goes even further. Rokid and Alipay are already testing ways to let users pay simply by looking at or gesturing toward a product, while accessing tailored information in real time.

I recently covered biometric palm payments, and just when it seemed seamless payments couldn’t go much further, now there’s this. Let’s see where it goes from here…

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

🌎 Powering the Future of E-commerce across the Globe with Roberto Kafati, CEO of DEUNA. In this episode, the discussion explores the company’s mission to simplify online payments, the unique challenges of operating in the regional market, and the innovative ways DEUNA is transforming the digital consumer experience.

Powering the Future of E-commerce in LATAM with DEUNA

NEWS

🇬🇧 Solidgate launches Treasury. Solidgate Treasury is a new solution for digital businesses to send, receive, and manage money without limits, allowing them to operate like a global business from day one. Treasury is built to scale with the customer's needs, streamlining payouts and global money movement worldwide.

🇦🇪 Stake Transforms Payout Experience with Checkout.com Pay to Card Integration. The new solution enables investors to receive their dividends and returns directly to their bank cards, often in just minutes, marking a major step forward in delivering faster, frictionless investing experiences.

🇺🇸 JPMorgan to pilot deposit Token JPMD on Coinbase-linked Blockchain. JPMorgan will move a fixed amount of JPMD from the bank’s digital wallet to the biggest US crypto exchange, Coinbase, Naveen Mallela, global co-head of the bank’s blockchain division Kinexys by JPMorgan, said in an interview.

🇺🇸 JPMorgan Chase unveils new Sapphire Reserve card perks and $795 annual fee. Users will now get more than $2,700 in annual benefits when the updated card launches. That includes most of its previous benefits, along with new ones tied to how customers earn and spend points on travel and dining.

🇮🇳 Razorpay picks up majority stake in Pop for $30 million. Pop will use the funding to strengthen product innovation, enhance the value proposition for consumers via Popcoins-led rewards, and build deeper merchant partnerships across D2C and lifestyle categories.

🇪🇬 EGBANK partners with Mastercard to expand digital payment services, to improve financial accessibility, promote the use of digital payments, and extend its card portfolio to include new customer segments. Mastercard will assist EGBANK in developing its range of debit, credit, and commercial cards, providing customised financial solutions with additional benefits.

🇦🇪 SaturnX raises $3m to bring stablecoin-based payment infrastructure to global remittance markets. The capital will be used to accelerate SaturnX's expansion into new payment corridors in Southeast Asia, including the Philippines, Bangladesh, Indonesia, Pakistan, strengthen regulatory infrastructure, and continue building its end-to-end API platform for enterprise-grade stablecoin payments.

🇰🇼 Kuwait Central Bank tightens rules on e-payment providers to boost oversight. The circular mandates strict compliance with regulations governing the use of the Electronic Payment Services Gateway System, as part of the Central Bank’s ongoing efforts to enhance governance, operational oversight, and risk mitigation in the digital payments sector.

🌏 Octane secures $5.2 million to transform fleet payments across MENA. The new capital will accelerate the expansion of Octane’s acceptance network, deepen its technology stack, and support the company’s growth across Egypt and the wider Middle East and North Africa (MENA) region.

🇻🇳 Visa rolls out Flex Credential in Vietnam for flexible payment options, allowing cardholders to choose between debit, credit, and other payment options using a single card. Beyond debit and credit, it can also support loyalty point redemption and, in some markets, access to multiple currency accounts through a single card.

🇬🇧 OpenPayd and Circle partner to deliver global fiat-stablecoin infrastructure at scale. Leveraging Circle Wallet's infrastructure, this partnership will enable OpenPayd’s enterprise clients to move and manage money globally across both traditional banking rails and blockchain-based networks, at scale and in real time.

🇺🇸 Thiel-Backed fund invests in Ex-Citi Banker’s stablecoin startup. Ubyx is building a clearing system for connecting stablecoin issuers with banks and FinTechs, aiming to reduce friction for users seeking to use the crypto tokens for payments. Read more

🇳🇿 Worldline NZ has officially launched Direct Pay, a revolutionary in-person account-to-account payment method built on open banking technology. It is the leading in-person payment solution in New Zealand to leverage open banking APIs from all four major NZ banks and is now available for merchants to use.

🇬🇧 UK FinTech Paddle pays $5M fine following allegation it abused US credit card system. The regulator stated that the London–based FinTech facilitated schemes that allegedly utilized fake virus alerts and pop-up messages to impersonate familiar brands, such as Microsoft or McAfee.

🇻🇳 Bitget Wallet becomes the first crypto wallet to support national Vietnam QR payment, allowing users in the region to scan the VietQR code and directly pay in crypto. The integration makes Bitget Wallet the first self-custodial wallet to natively integrate itself into a country’s national QR code payment system.

🇺🇸 Payabli lands $28M Series B to accelerate payments infrastructure innovation for software companies. The new funding will accelerate Payabli's product development, with a targeted focus on AI-driven features designed to deliver personalized experiences for customers.

🇪🇸 Bizum appoints Fernando Rodríguez as its new Deputy General Manager of International Expansion, strengthening its organizational structure for the company's ongoing European interconnection process. Continue reading

🌍 Unzer rolls out with Wero from EPI. With the collaboration, Unzer aims to support the launch of Wero, a new European digital payment method. Wero is a mobile wallet offering instant A2A payments, aiming to deliver a secure and sovereign way for people to pay and shop across Europe.

🇫🇷 Stripe rolls out 15 new features to boost France’s digital economy. The new offerings focus on simplifying online payments, expanding financial services, and integrating advanced technologies such as AI and stablecoins. Continue reading

GOLDEN NUGGET

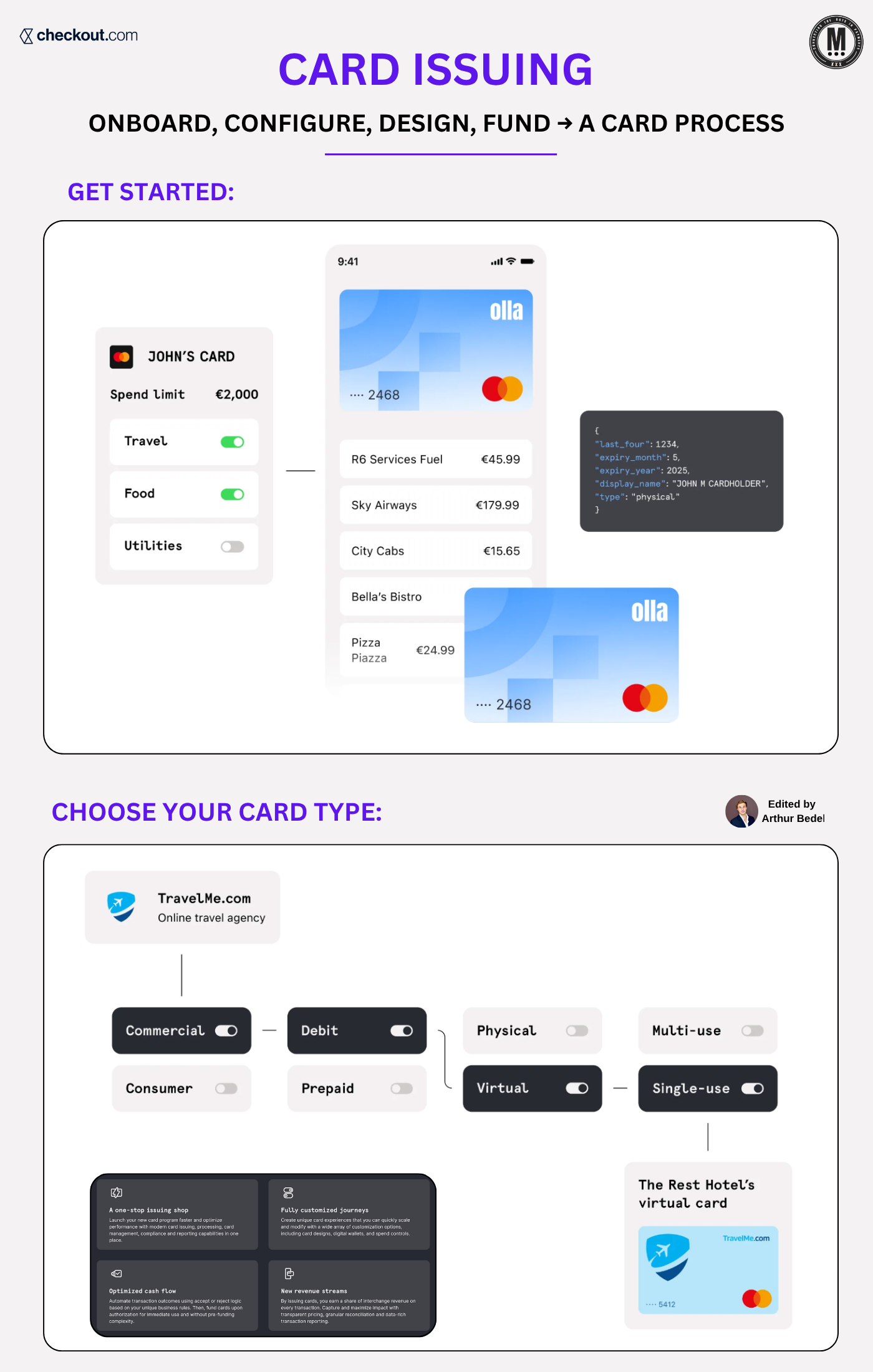

𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com, Episode 18 → 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐢𝐧𝐠: from 𝐒𝐞𝐭𝐮𝐩 to 𝐒𝐜𝐚𝐥𝐞, 𝐁𝐮𝐢𝐥𝐝 𝐘𝐨𝐮𝐫 𝐎𝐰𝐧 𝐏𝐫𝐨𝐠𝐫𝐚𝐦👇 Created by Arthur Bedel 💳 ♻️

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐢𝐧𝐠?

Card issuing allows businesses to create and control custom card programs—whether for consumers, employees, or platforms. From onboarding and configuring spend controls to funding logic and reporting, issuing is now programmable via API.

𝐆𝐞𝐭 𝐒𝐭𝐚𝐫𝐭𝐞𝐝 𝐰𝐢𝐭𝐡 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐢𝐧𝐠

► 𝐃𝐞𝐟𝐢𝐧𝐞 𝐲𝐨𝐮𝐫 𝐮𝐬𝐞 𝐜𝐚𝐬𝐞: expense management, travel, fintech apps, gig economy, or rewards

► 𝐃𝐞𝐜𝐢𝐝𝐞 𝐜𝐚𝐫𝐝 𝐭𝐲𝐩𝐞: physical or virtual, single-use or multi-use

► 𝐒𝐞𝐥𝐞𝐜𝐭 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞: pre-funded, just-in-time (JIT), or linked to wallet/account

𝐒𝐞𝐭 𝐔𝐩 𝐚 𝐂𝐚𝐫𝐝 𝐏𝐫𝐨𝐠𝐫𝐚𝐦

► Configure spend rules (MCC filters, geo-restrictions, velocity controls)

► Enable dynamic limits and usage permissions

► Design branded cards with real-time activation

► Tokenize cards for Apple Pay, Google Pay, and wallets

𝐈𝐬𝐬𝐮𝐞 𝐚 𝐂𝐚𝐫𝐝: 𝐓𝐡𝐞 𝐏𝐫𝐨𝐜𝐞𝐬𝐬

1️⃣ 𝐏𝐫𝐨𝐯𝐢𝐬𝐢𝐨𝐧𝐢𝐧𝐠 → Create cardholder and card profile

2️⃣ 𝐂𝐚𝐫𝐝 𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧 → Issue physical or virtual card via API

3️⃣ 𝐀𝐜𝐭𝐢𝐯𝐚𝐭𝐢𝐨𝐧 → Enable card with spending controls and funding logic

4️⃣ 𝐅𝐮𝐧𝐝𝐢𝐧𝐠 → Load cards in real time based on transaction context

5️⃣ 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 → Enable secure mobile wallet access instantly

𝐌𝐚𝐧𝐚𝐠𝐞 𝐂𝐚𝐫𝐝𝐬 𝐰𝐢𝐭𝐡 𝐏𝐫𝐞𝐜𝐢𝐬𝐢𝐨𝐧:

→ Pause, resume, or revoke cards in real time

→ Monitor usage by user, merchant, or spend category

→ Automate reporting and reconciliation

→ Detect anomalies with granular control across the lifecycle

𝐖𝐡𝐲 𝐢𝐬 𝐈𝐬𝐬𝐮𝐢𝐧𝐠 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜?

✅ Unlock new monetization via interchange and FX

✅ Improve control over spend, fraud, and limits

✅ Embed payments into product flows natively

✅ Serve use cases from corporate cards to embedded finance

𝐅𝐫𝐨𝐦 𝐟𝐥𝐞𝐱𝐢𝐛𝐥𝐞 𝐢𝐬𝐬𝐮𝐢𝐧𝐠 𝐫𝐮𝐥𝐞𝐬 𝐭𝐨 𝐩𝐫𝐨𝐠𝐫𝐚𝐦𝐦𝐚𝐛𝐥𝐞 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 — issuing is now an API.

Source: Checkout.com x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()