Brazil Rolls Out Pix Automático to Streamline Subscriptions

Hey Payments Fanatic!

The Central Bank of Brazil has introduced a new layer to its instant payment system. The awaited feature is called Pix Automático (Automatic Pix), which brings automation to one of the country’s most widely used financial rails. In 2024 alone, Pix processed +64 billion transactions.

Pix Automático is built for recurring payments like utility bills, streaming services, gym memberships, and school tuition. It works without the need for prior agreements between companies and banks. A single in-app authorization from the user is enough to activate it. After that, users set the terms themselves, like frequency, limits, and cancellation options remain fully in their control.

Though the official launch is scheduled for June 16, some banks and Fintechs have already started offering the service. Early adoption points to a high level of confidence in both infrastructure and user readiness.

Pix has followed a fast-moving path since its debut in 2020, growing into a low-cost, real-time, and widely accessible payment solution. With Pix Automático, the platform expands beyond instant transfers to sustained, scheduled ones. This offers new possibilities for smaller businesses that had limited access to direct debit arrangements in the past.

Crypto made its way into Pix through the integration with Binance Pay. Then came contactless payments via Pix por Aproximação (Contactless Pix). Before that, third parties had already enabled access to Pix transfers in several European countries. And more features are on the horizon, including BNPL Pix, Bolepix, International Pix, and Offline Pix.

Pix keeps transforming. Who knows if the version we see today may look very different from the one we see in 2 years.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

NEWS

🇬🇧 ASOS finds the perfect fit with Checkout.com. This partnership will help ASOS further enhance the online shopping experience for its customers by increasing acceptance rates across key markets, reducing the risk of failed payments, and ensuring the checkout experience.

🇺🇸 Mastercard and PayPal to partner on Mastercard One Credential to supercharge choice at checkout. Whether shopping online or in store, shoppers will be able to use a single credential, no more juggling between multiple cards or payment methods.

🇬🇧 Stablecoin Connector BVNK partners with Chinese cross-border payments firm LianLian. Through this partnership, LianLian Global's merchants can transform idle digital assets into instant cross-border payment fuel. Keep reading

🇺🇸 Venmo adds debit card perks and checkout options in push to catch rival Cash App. The changes include upgraded rewards for Venmo Debit Mastercard users, expanded checkout options at major retailers, and a new brand campaign aimed at positioning Venmo as a full-service commerce platform.

🇸🇬 Ant International rolls out AI-as-a-service for FinTechs and superapps. The company has launched its new artificial intelligence platform, Alipay+ GenAI Cockpit, as part of a broader AI strategy aimed at helping FinTech companies and super apps develop more secure and efficient financial services.

🇬🇧 FIS and Episode Six launch the FIS International Issuing Hub to power the next era of payments. It is the answer for banks and issuers looking to navigate complex business environments, rising competitive pressure, and growing demand for seamless digital experiences. This new platform gives institutions the tools to innovate and scale without being held back by existing systems.

🇺🇸 Palla raises $14.5M Series A to expand payments platform. The platform will use the funding to expand its existing payment corridors and open new ones, both for sending and receiving transfers. It also aims to launch new products and money-movement solutions.

🇺🇸 Carta partners with Ramp. By integrating Ramp’s automated, real-time expense management with Carta’s fund admin, the platform helps firms modernize their finance stack so they can spend time on strategic decisions that drive returns. Read more

🇶🇦 QIB and Visa partner to facilitate B2B cross-border payments. The partnership signifies QIB’s continued commitment to collaborate with its partners to facilitate trade across various international payment corridors by giving customers cost-effective, efficient, reliable, and secure money transfer services.

🇨🇷 Banco de Costa Rica selects Finastra to transform its international transaction automation processes. The two solutions will enhance foreign trade and international payments practices, driving innovation and operational excellence. Additionally, the project will fully automate BCR’s international transaction processes.

🇺🇸 CAB secures a license to operate a US representative office in New York City. The New York representative office will act as a regional business hub for CAB, enabling the Group to continue to serve its existing clients while driving new client business in the region.

🇳🇱 XTransfer to open European HQ in Amsterdam. The agreement signals the firm's strategic move to expand its footprint in the European cross-border payments sector. The signing marks a continuation of XTransfer’s international growth strategy. Continue reading

🇩🇪 Worldline initiates the launch of Wero in e-commerce starting this summer. This enables its merchants to accept Wero for online commerce in Germany. Wero is a cross-border payment facility with built-in buyer protection and is based on a scheme layered on the instant bank transfer.

🇺🇸 Global Payments and Sage launch embedded vendor payments solution. The new solution is designed for ease, security, and control, addressing the complexity of managing payables across disconnected systems. AP teams can eliminate syncing delays and the need for separate logins.

🇺🇸 Thunes secures money transmission licenses to operate in the United States. The licence allows Thunes to deliver its comprehensive Pay and Accept suite of services directly to corporates, merchants, and digital platforms. By leveraging the new regulatory approvals, it gains the ability to contract directly with American businesses for real-time cross-border payments.

🇬🇧 Ecommpay simplifies payment processing for Travelopedia. The updated checkout experience provides customers with a variety of local and international payment options, including Apple Pay and Google Pay, ensuring they can select their preferred payment method regardless of their location.

GOLDEN NUGGET

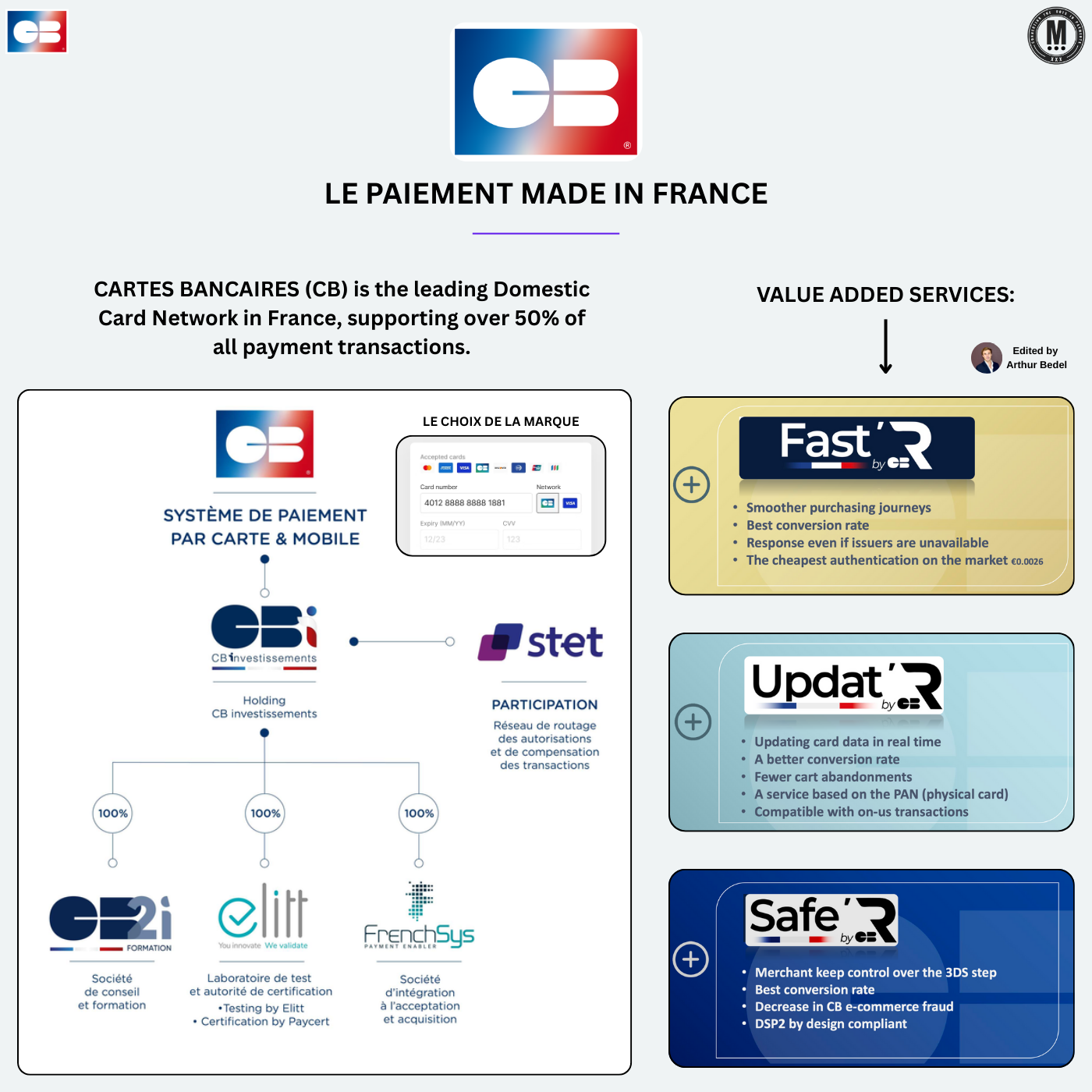

Welcome to 𝐓𝐡𝐞 𝐂𝐚𝐫𝐭𝐞𝐬 𝐁𝐚𝐧𝐜𝐚𝐢𝐫𝐞𝐬 𝐒𝐞𝐫𝐢𝐞𝐬 🇫🇷 — Episode 1 👇 Created by Arthur Bedel

𝐂𝐚𝐫𝐭𝐞𝐬 𝐁𝐚𝐧𝐜𝐚𝐢𝐫𝐞𝐬 (𝐂𝐁) is 𝐅𝐫𝐚𝐧𝐜𝐞’𝐬 𝐝𝐨𝐦𝐞𝐬𝐭𝐢𝐜 𝐜𝐚𝐫𝐝 𝐧𝐞𝐭𝐰𝐨𝐫𝐤 — powering over 50% of all payments and processing 14.5B+ transactions annually. CB is more than a scheme. It’s a national infrastructure — built by banks, for banks — delivering performance, privacy, and sovereignty at scale.

𝐓𝐡𝐞 𝐊𝐞𝐲 𝐭𝐨 𝐭𝐡𝐞 𝐅𝐫𝐞𝐧𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭:

► 77M+ CB cards in circulation

► 7.2B contactless payments

► 94.2% CIT (Cardholder Initiated Transaction) conversion rate

► 0.05% e-commerce fraud — lowest in Europe

► Among the cheapest auths in Europe at €0.0026

CB handles ~2/3 of household consumption in France and ~20% of all EU card volumes — making it essential for any issuer or merchant entering the market.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐁 & 𝐡𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐰𝐨𝐫𝐤?

CB is a not-for-profit, bank-owned network with full-stack infrastructure:

• GIE CB → Scheme governance

• STET → Routing and clearing

• CB2I Consulting, ELITT, FrenchSys → Testing, integration & compliance

It’s a closed-loop ecosystem — processing, securing, and scoring transactions entirely within France — fully GDPR-aligned, with no third-party data monetization.

𝐖𝐡𝐲 𝐦𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐥𝐨𝐯𝐞 𝐂𝐁

→ 𝐍𝐨 𝐜𝐨𝐦𝐦𝐞𝐫𝐜𝐢𝐚𝐥 𝐜𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬 — payments are irrevocable

→ 𝐁𝐞𝐬𝐭 𝐜𝐨𝐧𝐯𝐞𝐫𝐬𝐢𝐨𝐧 at checkout and the highest frictionless rates

→ 𝐍𝐨 𝐡𝐢𝐝𝐝𝐞𝐧 𝐟𝐞𝐞𝐬 𝐨𝐫 𝐩𝐞𝐧𝐚𝐥𝐭𝐢𝐞𝐬 — CB collaborates with PSPs to solve issues

→ 𝐂𝐚𝐩𝐩𝐞𝐝 𝐢𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 (0.2% debit / 0.3% credit)

→ French data, French support, French infrastructure

𝐓𝐡𝐞 𝐕𝐚𝐥𝐮𝐞-𝐀𝐝𝐝𝐞𝐝 𝐒𝐮𝐢𝐭𝐞 → 𝐅𝐚𝐬𝐭’𝐑, 𝐔𝐩𝐝𝐚𝐭’𝐑, 𝐒𝐚𝐟𝐞’𝐑

► 𝐅𝐚𝐬𝐭’𝐑 — frictionless-first 3DS

• 95%+ frictionless when requested

• Response fallback if issuers are down

• €0.0026 cost per auth

→ CB equivalent of Visa Secure

► 𝐔𝐩𝐝𝐚𝐭’𝐑 — card data updater

• Real-time card refresh

• Boosts recurring conversion by 1–2 points

• No usage-based fees

→ CB equivalent of Visa Account Updater

► 𝐒𝐚𝐟𝐞’𝐑 — merchant-controlled 3DS

• Direct control over SCA

• Fraud reduction + DSP2 compliance

→ CB equivalent of EMVCo delegated authentication

Next Up → Deep dive into 𝐅𝐚𝐬𝐭’𝐑 — CB’s secret to 95%+ frictionless auth

Source: GIE Cartes Bancaires x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()