BVNK Powers Visa Direct’s Stablecoin Push… and This One Is About Scale

Hey Payments Fanatic!

BVNK just landed a big one. The company will power stablecoin payments for Visa Direct, Visa’s $1.7T money movement network.

BVNK processes more than $30B in stablecoin volume annually. Now that infrastructure plugs directly into Visa Direct’s rails. For businesses, this means faster payouts. Weekend and holiday availability. Less friction when banks are closed.

This isn’t theoretical. BVNK will enable stablecoin pre-funding for Visa Direct and allow payouts directly in stablecoins. Digital dollars straight into recipients’ wallets.

What stands out to me is continuity. Visa Ventures invested in BVNK earlier this year. This integration is the next step, moving stablecoins from pilots into real money movement.

According to Visa, stablecoins are becoming a core part of how global payments modernize. This partnership makes that intent very concrete.

If you’re watching how Payments infrastructure is evolving, scroll down and see what else is moving 👇

Cheers,

Marcel

INSIGHTS

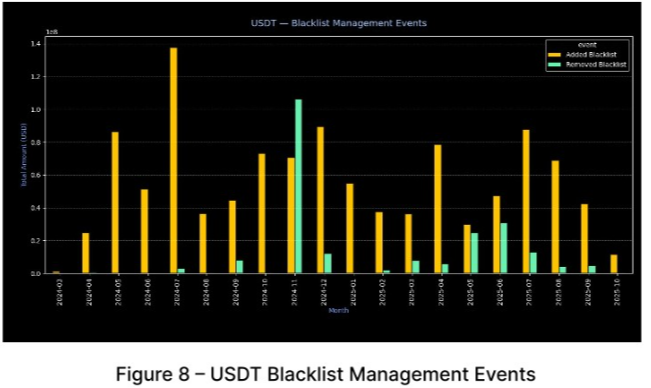

📊 Stablecoin Freezes 2023-2025: A Data-Backed Analysis of USDT vs USDC.

NEWS

🇸🇬 Agoda and Mastercard collaborate to modernize loyalty programs with flexible travel rewards. Through this collaboration, banks connected to Mastercard’s rewards ecosystem can embed the Agoda-powered travel redemption solution into their own loyalty programs, where points can be redeemed instantly and applied directly to Agoda’s global inventory of accommodations and flights.

🇺🇸 BVNK to deliver stablecoin infrastructure for Visa Direct pilot programs. BVNK will help power Visa Direct’s stablecoin services in select markets, enabling certain select business customers to fund Visa Direct payouts using stablecoins instead of only fiat, and payouts to end recipients in stablecoins, putting digital dollars directly in recipients’ wallets.

🇺🇸 Chainalysis and BVNK extend partnership to power compliance in self-hosted digital asset payments. This deepening collaboration allows businesses using Layer1’s self-hosted payments infrastructure to seamlessly monitor and manage transaction risk, embedding Chainalysis’ industry-leading data directly into their core operations.

🇳🇬 Paystack moves beyond payments with Ladder Bank acquisition. The newly acquired institution will be rebranded as ‘Paystack Microfinance Bank (Paystack MFB). The deal allows the FinTech company to hold customer deposits and provide loans, which are capabilities it previously lacked under its payments-only licence.

🇺🇸 Affirm updates underwriting with enhanced signals to reflect consumers’ real-time finances better. These enhanced signals are already helping Affirm Card users who’ve linked a third-party bank account or have an Affirm Money Account.

🇳🇱 FinTech firm PayU Payments' loss narrows to Rs 248 crore in FY25. The company had posted a loss of Rs 429.51 crore in the same period a year ago. The consolidated revenue from operations of PayU increased by about 23% to Rs 5,562.98 crore in FY25, from Rs 4,527.39 crore in FY24.

🇬🇧 Klarna expands digital bank offer with peer-to-peer payments. The new feature enables Klarna customers to send money to friends and family, whether splitting bills or gifting cash, directly from the Klarna app: as simple as handing someone cash, with the protection of a regulated bank.

🇬🇧 PayDo introduces Dedicated C2B Open Banking Collections Ecosystem to revolutionize high-volume merchant payments. This innovation addresses operational bottlenecks by providing automated reconciliation and real-time tracking for Open Banking transactions, rendering them as reliable and scalable as traditional card payments.

🇸🇪 Pay. expands its payment mix with Brite. The integration gives merchants immediate access to a fast and secure payment method that allows consumers to pay directly from their own bank environments, reaching around 350 million users across more than 3,800 banks in Europe.

🇵🇪 Bybit Pay links with digital wallets Yape and Plin to offer crypto payments in Peru. Users can spend stablecoins and major cryptocurrencies, which are automatically converted into Peruvian soles at the point of sale. Read more

🇸🇬 Tether-Backed Oobit expands Visa payments by adding Phantom Wallet. This update allows Phantom users to make real-time crypto payments through Visa-supported merchants without transferring assets to custodial services. According to Oobit, the platform’s “DePay” payment layer enables instant crypto-to-fiat conversions at the point of sale.

🇺🇸 MagicCube raises $10m to scale payments security platform, and expand into biometrics. The company says the capital will be used to accelerate product development, scale international commercial operations, and broaden the scope of its software-defined trust technology.

🇱🇺 Ripple expands European regulatory footprint with preliminary EMI approval in Luxembourg. This license represents a significant step in Ripple's efforts to scale its cross-border payments infrastructure across Europe, and to support institutions there as they move from legacy technology to seamless, real-time, 24/7 payments.

🇺🇸 ACI Worldwide appoints JP Krishnamoorthy to lead technology innovation. Krishnamoorthy joined ACI in December 2025 and assumes full technology leadership as the company accelerates its shift toward smarter payments orchestration, embedded AI capabilities, and faster time to market for banking, biller, and merchant clients.

🇳🇱 Lovable turns to Stripe to accelerate its growth. Lovable now uses Stripe Billing to charge customers based on AI token consumption for its Lovable Cloud and Lovable AI services, aligning revenue with actual usage and underlying AI costs.

GOLDEN NUGGET

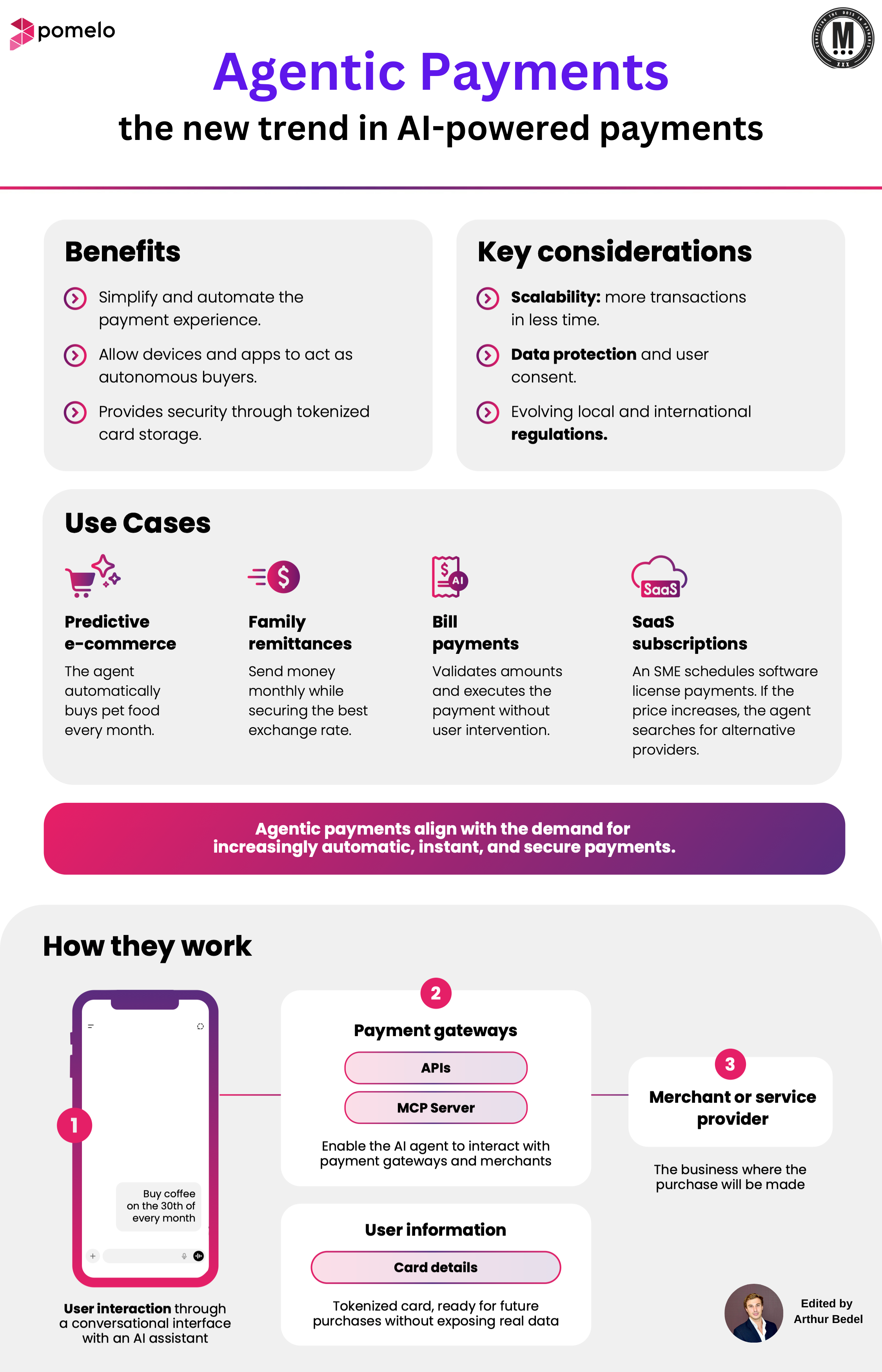

𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬: the next infrastructure shift in AI-powered commerce 👇Created by Arthur Bedel 💳 ♻️

𝐀𝐈 𝐢𝐬 𝐧𝐨 𝐥𝐨𝐧𝐠𝐞𝐫 𝐣𝐮𝐬𝐭 𝐚𝐬𝐬𝐢𝐬𝐭𝐢𝐧𝐠 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — 𝐢𝐭’𝐬 𝐞𝐱𝐞𝐜𝐮𝐭𝐢𝐧𝐠 𝐭𝐡𝐞𝐦. The industry is shifting from recommendation engines to autonomous payment agents capable of making purchases, comparing prices, optimizing timing, and paying bills.

This is the foundation of Agentic Payments, and companies like Pomelo, VGS, Stripe, Checkout.com, Mastercard, Visa, PayPal, Apple, and others are actively building toward this new paradigm.

𝐖𝐡𝐚𝐭 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐚𝐫𝐞?

They are AI-driven, rule-based, tokenized transactions that run autonomously, but under explicit user instructions and consent.

Pomelo’s framework outlines 4️⃣ foundational components:

1️⃣ Conversational interfaces where users instruct the AI (“Buy coffee on the 30th of every month”).

2️⃣ Tokenized card credentials stored securely for agent-initiated payments (various type of credentials could be used actually).

3️⃣ API-native payment infrastructure — gateways, MCP servers, and card networks — enabling the agent to interact directly with merchants (part of the handshake process).

4️⃣ Merchant endpoints where the agent executes the transaction.

→ This marks the beginning of true agent-to-merchant commerce.

Real use cases emerging today (live or in development):

𝐏𝐫𝐞𝐝𝐢𝐜𝐭𝐢𝐯𝐞 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞

The AI detects inventory patterns and reorders recurring items such as pet food (Chewy) without user intervention.

𝐅𝐚𝐦𝐢𝐥𝐲 𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞𝐬

Agents send monthly transfers and time the transaction to secure optimal FX rates on platforms like Wise and Revolut.

𝐒𝐚𝐚𝐒 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭

An SME’s AI renews software licenses; if pricing changes, it evaluates alternatives and optimizes spend.

These illustrate how autonomous financial behaviors are expanding across consumer, SME, and cross-border scenarios.

𝐖𝐡𝐚𝐭 𝐰𝐢𝐥𝐥 𝐚𝐜𝐜𝐞𝐥𝐞𝐫𝐚𝐭𝐞 𝐭𝐡𝐢𝐬 𝐭𝐫𝐞𝐧𝐝?

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

I CANNOT stress this point enough, this is the core payment component behind agentic. Merchants need to be EXPERTS at Network Tokenization as most transactions will be leverage them. Companies like VGS, Checkout.com and others will provide secure, reusable tokens that AI agents can operate with across devices.

𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐚𝐧𝐝 𝐃𝐞𝐯𝐢𝐜𝐞 𝐁𝐢𝐧𝐝𝐢𝐧𝐠

Strong ID&V, biometrics, secure elements, and platform wallets enable high-trust autonomous actions.

𝐒𝐡𝐢𝐟𝐭 𝐟𝐫𝐨𝐦 𝐔𝐬𝐞𝐫 𝐀𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐔𝐬𝐞𝐫 𝐈𝐧𝐭𝐞𝐧𝐭

Users no longer “perform” payments. They authorize ongoing patterns, and the agent executes them securely and contextually.

This is why Agentic Commerce has become a top strategic thesis across the payments industry.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()