Cardtonic Raises $2.1M… as Crypto Payments Rethink the “Messy Middle”

Hey Payments Fanatic!

Cardtonic just closed a $2.1M seed round to build Pil, a new business spending and expense management platform.

Cardtonic is moving from consumer products into enterprise financial infrastructure, targeting how African businesses manage spend, controls, and day-to-day operations.

From virtual dollar cards to bill payments, the rails were already there. Pil turns that foundation into something built for scale.

It’s a familiar pattern: start with consumers and build rails. Then move upstream into higher-value, stickier infrastructure...

Crypto payments may finally be ready for real-world checkout

WalletConnect Pay is betting that crypto payments can finally scale at checkout, now that the focus is shifting away from blockchains and toward real payment infrastructure.

Settlement isn’t the hard part. Payments are. Authorization, capture, refunds, and disputes sit in that messy middle, and that’s the gap crypto payments are finally starting to address.

A recent post from Jess Houlgrave, CEO of WalletConnect Pay, crossed 676K impressions on X and sparked deeper analysis from people like Nik Milancovic, which is why this story is resurfacing now.

Scroll down to see what else is moving in Payments today 👇 Back tomorrow with more updates.

Cheers,

Marcel

INSIGHTS

📰 Payment analytics: KPIs every merchant should track by Ecommpay. This handbook explains how to use payment data to identify checkout drop-offs, spot underperforming payment methods, improve approval rates, reduce declines, and turn raw data into clear, actionable growth strategies. Download the handbook here

NEWS

🇳🇬 Nigerian FinTech Cardtonic secures $2.1m seed funding to launch Pil Business Spending Platform. The new platform provides businesses with labeled multi-card management, live transaction monitoring, and unified spend dashboards, along with multi-currency funding options including naira, cedis, and stablecoins.

🇰🇾 WalletConnect Pay CEO Jess Houlgrave bets crypto payments can finally scale at checkout. The WalletConnect-Ingenico partnership extends crypto payments into physical retail without forcing merchants to hold digital assets. Watch the full interview

🇪🇺 Revolut to enable frictionless checkout across all agentic commerce platforms for the UK and EEA. This strategic focus will help position Revolut Pay as both the secure, universal, 1-tap payment solution for consumers and a powerful sales booster for Revolut Business merchants in conversational and automated shopping environments.

🇦🇪 NEO PAY and Wio Bank collaborate to launch PoS lending solution for merchants across the UAE. This partnership between NEO PAY and Wio Bank empowers SMEs with seamless access to funding, enabling them to overcome financial barriers and drive growth.

🇫🇷 Worldline and YouLend launch Cash Advance to unlock fast, seamless capital for Europe’s SMBs. The innovative financing solution is designed to empower small and medium-sized businesses (SMBs) with fast, data-driven access to capital.

🇺🇸 Veem and Coins.ph expand partnership for cross-border payments. The collaboration aims to improve the efficiency of corporate payouts and contractor payments by introducing new settlement methods, including stablecoins. Continue reading

🇺🇸 Gusto and Zerohash pilot stablecoin-based payrolls, aiming to shorten cross-border payroll settlement times from days to minutes. The initiative also comes amid intensified competition among stablecoin issuers and service providers following regulatory developments such as the US GENIUS Act.

🇱🇰 Akurateco and Aquanow join forces to power the next generation of crypto payments. This collaboration empowers Akurateco’s clients to access a broader range of crypto payment options and liquidity services, strengthening their ability to operate seamlessly across both traditional and digital financial ecosystems.

🇵🇪 Bybit Pay brings crypto payments to Peru’s most popular digital wallets, Yape and Plin. This expansion brings real-world crypto payment capabilities to millions of Peruvian digital wallet users, marking another milestone in bridging traditional finance with the digital economy in Latin America.

🇨🇳 China-led cross-border digital currency platform sees surge. According to the Atlantic Council, signaling growing traction for alternatives to dollar-based payment systems. The platform reflects a strategy of building parallel settlement rails that could gradually reduce reliance on the dollar.

🇳🇬 Sterling Bank joins Thunes’ Direct Global Network to transform cross-border payments for Nigerian expatriates. The collaboration means new and existing Sterling Bank account holders can now benefit from seamless, instant cross-border payments.

🇸🇩 Network International partners with the Saudi Sudanese Bank to accelerate Digital Transformation in Sudan’s banking sector. Network International will provide Saudi Sudanese Bank with a full suite of end-to-end digital payment processing services, prepaid issuing, and a range of value-added services designed to support the bank’s digital ambitions.

🇸🇸 South Sudan ends cash payments for passports, launches digital system to curb leakages. Under the new setup, applicants pay digitally through an on-site commercial bank, with receipts automatically linked to the immigration system, allowing documents to be processed without staff handling cash.

🇺🇸 DriveCentric and Dealer Pay announce a strategic partnership to enable payments within the CRM. The partnership is designed to bring payment capability into the natural flow of customer engagement inside the CRM, allowing dealerships to complete the workflow from conversation to revenue without introducing disconnected systems or manual handoffs.

GOLDEN NUGGET

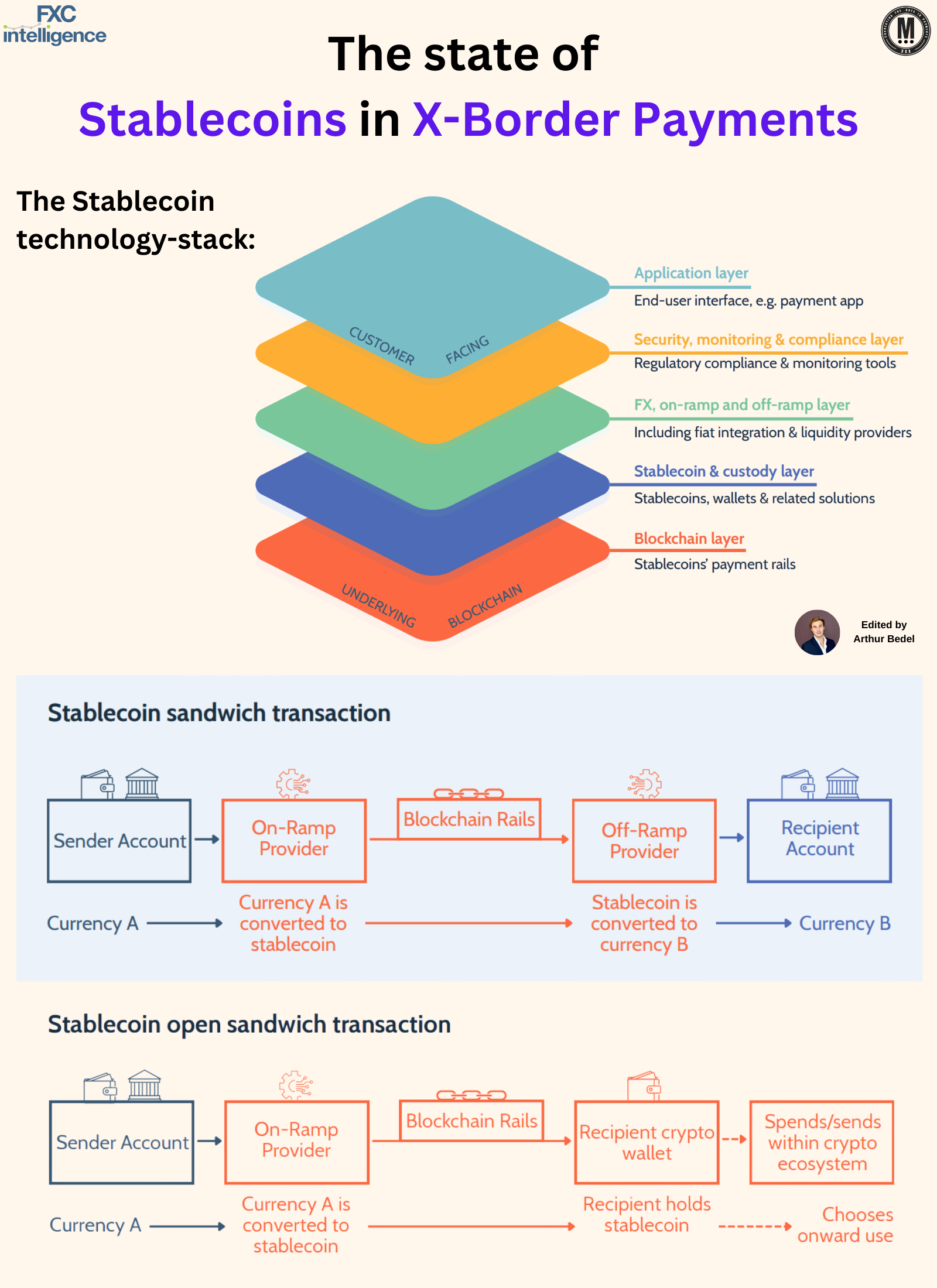

𝐓𝐡𝐞 𝐒𝐭𝐚𝐭𝐞 𝐨𝐟 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐢𝐧 𝐂𝐫𝐨𝐬𝐬-𝐁𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — the infrastructure 👇 Created by Arthur Bedel 💳 ♻️

For decades, cross-border payments ran on correspondent banking: slow settlement, layered intermediaries, opaque pricing.

"Stablecoins are changing the rails, not the money." — FXC Intelligence, stablecoins still represent <1% of global cross-border volume, yet already unlock a $16.5T–$23.7T TAM.

𝐓𝐡𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐓𝐞𝐜𝐡 𝐒𝐭𝐚𝐜𝐤:

Stablecoin payments are not “just tokens” — they rely on a full stack:

→ 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐥𝐚𝐲𝐞𝐫

Payment apps, payout tools, treasury dashboards

→ 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲, 𝐦𝐨𝐧𝐢𝐭𝐨𝐫𝐢𝐧𝐠 & 𝐜𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞

KYC, AML, sanctions — increasingly identical to TradFi

→ 𝐅𝐗, 𝐨𝐧-𝐫𝐚𝐦𝐩 & 𝐨𝐟𝐟-𝐫𝐚𝐦𝐩 𝐥𝐚𝐲𝐞𝐫

Liquidity providers converting local fiat ↔ stablecoins

→ 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 & 𝐜𝐮𝐬𝐭𝐨𝐝𝐲 𝐥𝐚𝐲𝐞𝐫

This is becoming critical infrastructure. Platforms like Dfns enable enterprises to securely manage programmable wallets, policy controls, and large transaction volumes.

→ 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐥𝐚𝐲𝐞𝐫

The settlement rails — Ethereum, Solana, Base, Tron — where value actually moves.

𝐓𝐡𝐞 “𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐒𝐚𝐧𝐝𝐰𝐢𝐜𝐡” 𝐢𝐧 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐞

Instead of routing through chains of correspondent banks:

→ Sender pays in fiat

→ On-ramp converts fiat to USDC/USDT

→ Stablecoin settles globally in minutes

→ Off-ramp converts to local currency

→ Recipient receives funds faster, cheaper, and with full traceability

In many cases, the last step disappears entirely. Recipients keep and use the stablecoin directly — the “open sandwich” model now powering payroll, merchant settlement, treasury ops, and crypto-native commerce.

𝐓𝐡𝐞 𝐒𝐜𝐚𝐥𝐞 𝐢𝐬 𝐀𝐥𝐫𝐞𝐚𝐝𝐲 𝐑𝐞𝐚𝐥

→ $5.7T stablecoin transaction volume in 2024

→ $4.6T already processed in H1 2025

→ Over 80% of supply concentrated in USDT & USDC

→ B2B dominates the opportunity (up to $18.8T TAM)

This isn’t hype — it’s live volume.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐭𝐨 𝐅𝐨𝐥𝐥𝐨𝐰:

→ 𝐂𝐮𝐬𝐭𝐨𝐝𝐲 & 𝐖𝐚𝐥𝐥𝐞𝐭 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞: Dfns, BitGo, Fireblocks

→ 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 & 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬: BVNK, Conduit, Orbital, Mural Pay

→ 𝐍𝐞𝐰 𝐌𝐨𝐝𝐞𝐥𝐬: Breeze, redefining the Merchant-of-Record with programmable, blockchain-native settlement

→ 𝐈𝐬𝐬𝐮𝐞𝐫𝐬 & 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲: Circle (USDC), Tether.io (USDT)

→ 𝐍𝐞𝐱𝐭-𝐠𝐞𝐧 𝐑𝐚𝐢𝐥𝐬: Plasma, purpose-built for stablecoin payments and high-throughput settlement

Each layer matters. No single player replaces the system — together, they upgrade it.

↳

🚨 Banks are becoming wallet providers.

🚨 Settlement is moving from days to minutes.

🚨 Money is becoming programmable.

Stablecoins are emerging as a new global liquidity layer, embedded inside the financial system.

Source: FXC Intelligence

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()