Checkout.com Finds Direct Connection Between Trust in Payments and GDP Growth

Hey Payments Fanatic!

Trust goes beyond feelings, it’s a form of confidence, a belief that someone or something will act in your best interest. In the digital world, where most transactions are unseen and silent, trust becomes the hidden infrastructure behind every click, tap, and swipe.

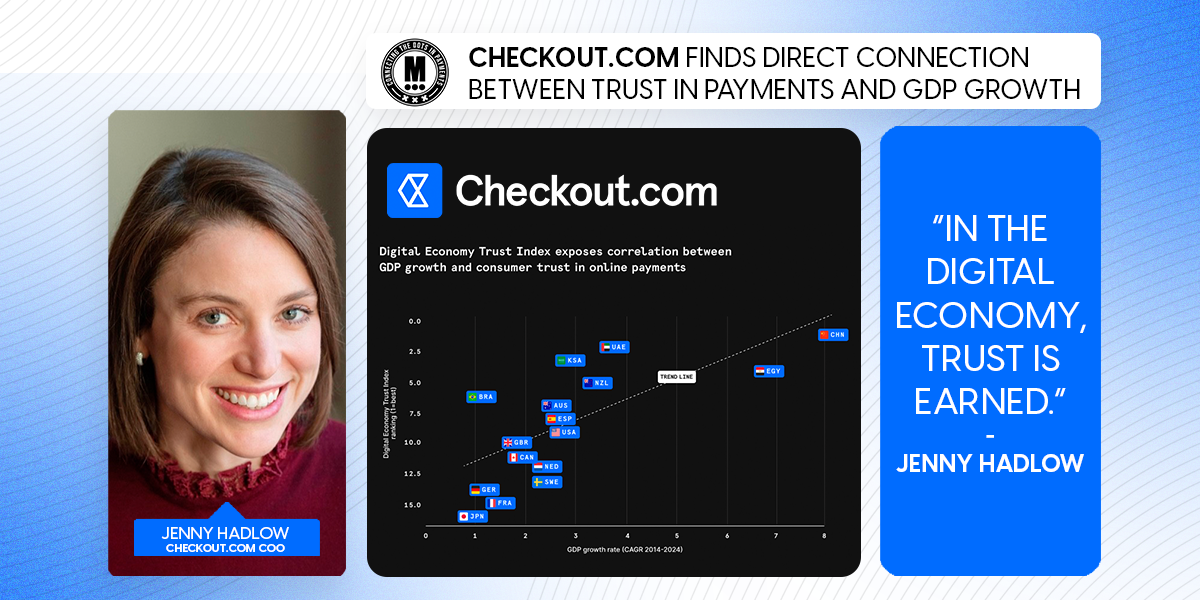

This week, Checkout.com launched its inaugural Digital Economy Trust Index, measuring consumer confidence across 16 countries. The Index evaluates digital trust across three key dimensions: security, transparency, and user experience.

China takes the top spot, with the UAE, Saudi Arabia, and Egypt close behind. Europe and North America, despite high levels of digital adoption, show persistent doubts, especially when it comes to AI, biometrics, and blockchain.

The data shows that trust in new payment technologies, like digital wallets, biometric verification, and AI-driven tools, is closely linked to broader economic outcomes. From 2014 to 2024, countries with higher digital trust also saw faster GDP growth. In essence, where people trust digital platforms, economies move faster. This isn’t just about payments or platforms, it’s about belief in the systems that underpin every economy.

The Middle East demonstrates this dynamic clearly, with strong digital strategies and high trust in payment methods. Egypt scores high on trust in AI and digital identity, even with lower payment volumes. Meanwhile, Brazil’s widespread use of Pix and New Zealand’s steady embrace of digital ID suggest that smaller economies can lead quietly through focused innovation and consumer alignment.

As Checkout.com COO Jenny Hadlow states, “In the digital economy, trust is earned.” As payment rails evolve and digital tools multiply, the shift from physical to virtual raises new questions and makes trust harder to gain. I highly recommend you explore Checkout.com’s Index for a closer look at where digital trust is strongest and what it may mean for the future.

Read more global Payments industry updates below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

🇳🇱 The rise of vertical SaaS by Mollie. Discover how vertical SaaS platforms are driving growth and unlock new revenue streams with embedded finance. Businesses using vertical SaaS get a simpler, more connected experience that’s tailored to the industry. Read the complete article

PAYMENTS NEWS

🇦🇪 Checkout.com and du Pay announce strategic partnership to power wallet top-ups supporting FinTech services. This collaboration enables du Pay to leverage Checkout.com’s robust and scalable payments infrastructure to deliver high-performance payments and elevate its core offerings.

🇺🇸 Aeropay is now powering Bally Pay, the new embedded wallet experience from Bally’s Corporation. This feature allows users to instantly link their bank accounts to perform key transactions, such as adding playable funds, withdrawing winnings, and conducting in-app purchases.

🇺🇸 Mastercard to roll out new stablecoin cards in latest crypto push with MoonPay. This integration will enable stablecoin payments across 150 million merchants. Transactions will be automatically converted into fiat. Read more

🌍 CaixaBank and BBVA process the first requests to pay between banks in Europe. BBVA and CaixaBank claim it will transform how citizens and companies manage their payments in Europe, providing a safe and efficient digital alternative for B2B invoicing, such as paying taxes and public sector charges.

🇺🇸 Brex receives bond rating upgrade to AAA from Kroll Bond Rating Agency, achieving the highest possible rating. The AAA rating unlocks substantial benefits for Brex, including optimizing its cost financing and improving the liquidity of its securitization shelf, ensuring greater financial flexibility and stability.

🇬🇧 iplicit extends partnership with GoCardless with in-app direct debit functionality. This will bring GoCardless’s Direct Debit capabilities to customers using its cloud accounting platform. Continue reading

🇺🇸 Nekuda raises $5m in funding. The company intends to use the funds to accelerate its operations and development efforts. Nekuda provides an infrastructure that helps agents handle payment credentials securely, execute transactions, and capture user intent with transparent mandates.

🇬🇧 Paysafe reports first quarter 2025 results. Reported revenue for the first quarter of 2025 was $401.0 million, a decrease of 4%, compared to $417.7 million in the prior year period, reflecting a decrease of 6% from the Merchant Solutions segment, driven by the business disposal.

🇲🇽 Koin invests $5 million to strengthen anti-fraud strategy in e-commerce. The investment will be allocated to technological development, operational expansion, and the evolution of its anti-fraud platform, to consolidate a key position in the prevention of digital fraud in the region.

🇧🇷 Brazil’s new crypto regulation framework targets foreign stablecoin transfers. Brazil is making massive strides in the cryptocurrency space, from becoming the first country in the world to launch a spot XRP ETF to planning its stablecoin and embracing a Bitcoin reserve strategy.

🇸🇬 PayPal launches ‘Complete Payments’ solution in Singapore. Merchants can display prices in local currencies and allow customers to securely store multiple payment methods for future purchases. Keep reading

🇸🇬 DCS and Visa roll-out micro credit card allowing stablecoin conversion for everyday use. Users can fund the card through Singapore dollar transfers or, for those already active in digital finance, by converting stablecoins such as USDT and USDC.

🌍 Digital euro central to ECB plan for payment sovereignty. The ECB Executive Board Member made the case that Europe’s payments market is structurally dependent on foreign providers, a condition he argued must be addressed not just for competitiveness, but for sovereignty.

🇪🇺 Apple is placing warnings on EU apps that don’t use App Store payments. The company is trying to dissuade Europeans from using iOS apps that support alternative payment options by making them look scary. A red exclamation mark icon is being prominently displayed, with a message warning.

🌍 Nuvei joins the EPI to launch Wero for e-commerce. The collaboration will enable Nuvei merchants to integrate this European payment solution through the use of their existing connection to the company’s core payments platform. Businesses will be enabled to accept Wero payments.

🇬🇧 SCRYPT selects OpenPayd to power Euro payment infrastructure. The collaboration expands SCRYPT’s Euro (EUR) payment capabilities, reinforcing its commitment to delivering fast, seamless, and compliant settlement services to its institutional clients.

🌍 Juuli partners with Visa and Stripe to launch the Juuli Visa Corporate Card. The newly launched corporate card was developed to respond to documented challenges freelancers face in the financial sector. It was designed with multiple benefits, including both physical and virtual corporate card options without the need for activation or annual fees.

GOLDEN NUGGET

Open Banking 🆚 Card Payments

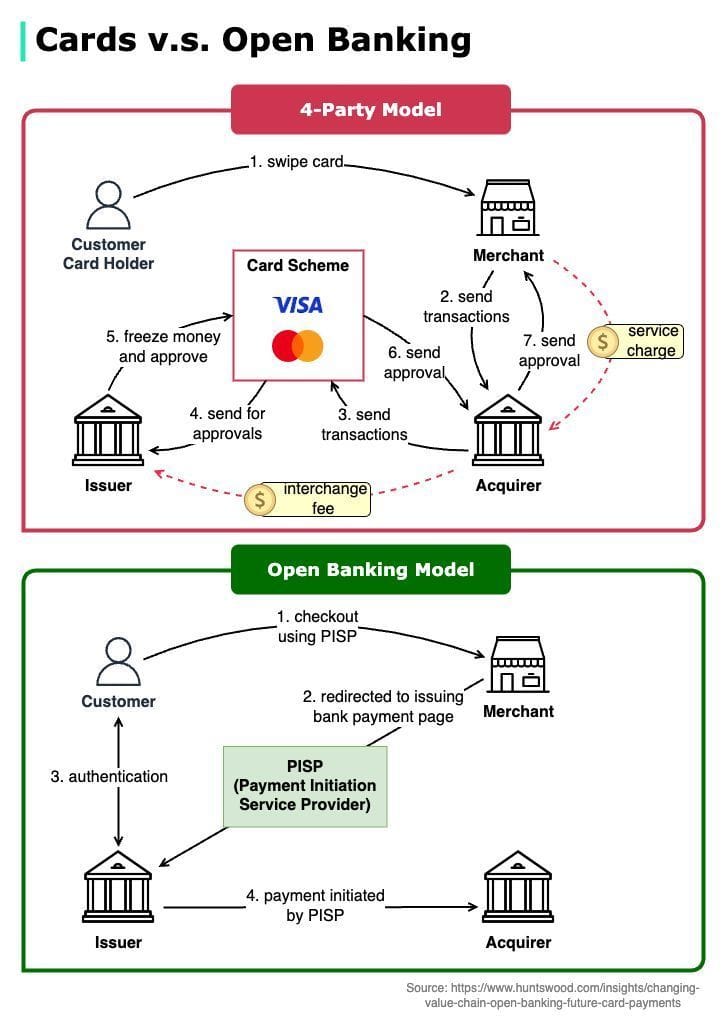

The diagram below by Hua Li shows the differences 👇

Will open banking replace card payments?

The diagram above compares the information flows of the two and imagines a simplified payment model with open banking.

First, 𝗖𝗮𝗿𝗱𝘀.

A typical 4-party card model works like this:

Step 1️⃣ - The customer swipes the credit card in a merchant’s shop.

Steps 2️⃣ and 3️⃣ - The transaction is sent to the acquiring bank and then to the card scheme (Visa, Mastercard).

Steps 4️⃣ and 5️⃣ - The transaction is sent to the issuing bank for approval. Upon approval, the money in the customer’s account is frozen and the approval is sent back to the card scheme.

Steps 6️⃣ and 7️⃣ - The approval is sent back to the acquiring bank and then to the merchant.

In this workflow, the merchant is charged with a service fee, which is allocated between the acquirer, card scheme, and issuer who contribute a significant amount of effort in the process.

Second, 𝗢𝗽𝗲𝗻 𝗕𝗮𝗻𝗸𝗶𝗻𝗴.

What does open banking bring to this model?

Open banking allows us to access the customer’s bank account with the customer’s consent. It might not be necessary for the transactions to go through the acquirers and the card scheme.

This could fundamentally change the value chain of card payments. Payment companies can offer PISP (Payment Initiation Service Provider) services, which bypass card schemes.

However, the reality is, that the card scheme does more than settlement. It also clears massive amounts of transactions. So PISP eventually will settle among banks in batches too.

Source: Hua Li

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()