Checkout.com Gets the Georgia Green Light… and This Supercharges Its US Play

Hey Payments Fanatic!

Checkout.com just secured approval for a Georgia bank charter, clearing a major hurdle in its US expansion.

This isn’t symbolic. It means Checkout.com can operate as its own acquirer in the US, integrate directly with card networks, and build faster without leaning on sponsor banks.

US volumes grew around 70% in 2025, now it's fastest-growing region. The timing lines up.

Atlanta also matters here. Anchoring banking operations in the US payments capital, alongside New York and San Francisco, signals a long-term infrastructure bet.

"With our MALPB charter now approved, the ‘definitive catalyst’ we identified in October is officially activated. This milestone paves the way for a new era of payment performance”, commented Jordan Reynolds, MALPB CEO and Head of North American Banking at Checkout.com.

Curious to stay ahead of what’s shaping Payments right now? Scroll down and catch today's story 👇

Cheers,

INSIGHTS

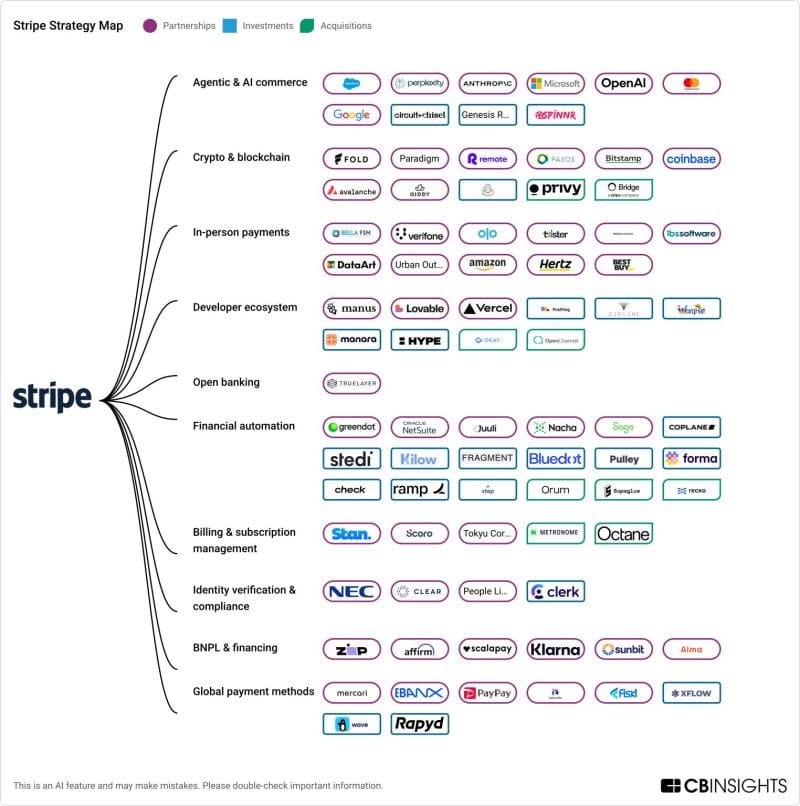

➡️ Stripe Strategy Map 👇

Stripe’s latest strategy signals one thing clearly:

NEWS

🇺🇸 Checkout.com secures approval for Georgia Bank charter, accelerating US expansion. The milestone supports deeper US expansion, direct card network integration, and faster innovation for merchants, with operations anchored in Atlanta alongside existing offices in New York and San Francisco.

🇬🇧 Airwallex to power Arsenal hospitality payments and enhance supporter experience. The upgrade brings a single, fully integrated payments system to Arsenal’s hospitality operation, which will streamline every transaction across premium seating, corporate boxes, and VIP experiences.

🇯🇴 MEPS introduces Click to Pay through Mastercard Gateway in Jordan. Through this partnership, MEPS will enable licensed banks, payment service providers, money exchange houses, and FinTechs to deliver secure and convenient cross-border payment solutions. Additionally, Al Ahli Bank of Kuwait - Egypt and Mastercard announce a strategic collaboration to advance digital innovation in Egypt. Mastercard will equip ABK-Egypt with advanced digital solutions that simplify payment processes and enhance security, enabling consumers and businesses to transact seamlessly.

🇦🇪 Botim Money collaborates with Mastercard to expand and accelerate embedded cross-border payments. The integration enables botim money users to send money from the UAE to over 150 countries, with payouts delivered to a bank account, mobile wallet, or cash pickup, depending on the market, directly from the botim app.

🇨🇳 UnionPay International and Samsung Wallet launch global mobile payment collaboration, debuting in Hong Kong, China. This partnership will significantly expand the global reach of UnionPay's mobile Pay service among Android users worldwide and accelerate local digital card issuance.

🇮🇳 PhonePe Payment Gateway adds Bolt to secure Visa and Mastercard payments via app. The solution utilises device tokenisation to provide a secure and efficient in-app checkout experience for PhonePe platform users and merchant partners, the company said in a statement.

🇺🇸 PayPal supports trusted AI checkout with Google. The collaboration aims to create an open, secure, and interoperable commerce infrastructure, allowing merchants to make products purchasable directly through AI-driven experiences, marking a key step toward agentic, AI-powered commerce.

🇺🇸 Rokid and Ant International announce the integration of smart glasses payment capability. The integration allows users to complete payments through Rokid AI&AR products using supported digital wallets connected via Alipay+, enabling hands-free, AI-powered AR transactions.

🇺🇸 Bilt and Verifone partner to transform the customer experience across neighborhood merchants. Delivered via the Verifone gateway, the solution offers a pre-certified, enterprise-grade integration path across a broad set of acquirers, reducing deployment risk and accelerating time to launch for merchants.

🇺🇸 Paychex and PayPal team up to bring direct deposit alternatives into Paychex Flex® Perks. Through this collaboration, employees of Paychex customers have the ability to easily set up PayPal Direct Deposit, providing up to two-day early access to their paychecks.

🇷🇴 Vista Bank integrates RoPay Alias. RoPay Alias complements the RoPay services offered by Vista Bank to individuals. The new service allows individual clients to send and receive amounts in RON directly from their mobile banking apps, without needing additional account details such as IBAN or account holder name.

🇬🇷 IRIS expands limits for instant mobile payments in Greece. Greece’s IRIS payment system will allow both individuals and businesses to transfer larger sums directly via mobile devices, bypassing cards and traditional bank transfers, with immediate settlement.

🇺🇸 Klarna boss backs Trump’s interest rate cap on credit cards. The Chief Executive of the ‘buy now, pay later’ lender, Sebastian Siemiatkowski, who wants to lure customers from big banks, says the move will make the market more competitive.

🇦🇪 Zand adopts XDC Network to advance blockchain-powered payments. With this integration, corporate and institutional clients would be able to custody assets with XDC Network, through Zand’s institutional-grade digital asset custody service, subject to applicable regulatory approvals.

🇺🇸 FIS completes strategic acquisition of global payments’ issuer solutions business and sale of Worldpay stake. With this acquisition, FIS now processes a comprehensive data set across consumer and commercial card portfolios, creating a data intelligence engine that few in financial services can match.

🇺🇸 FIS launches industry-first offering enabling banks to lead and scale in agentic commerce. Through collaboration with global payment networks, AI-initiated transactions are executed within existing authorization, authentication, and dispute frameworks trusted by banks, merchants, and consumers worldwide.

🇺🇸 VelaFi raises $20 million in Series B to expand stablecoin payments infrastructure. The funds will be used to expand licensing, banking connectivity, and operations in the U.S. and Asia. The company provides stablecoin-based payment and treasury infrastructure for enterprises operating across multiple regions.

🇧🇷 BlackOpal secures $200m to tokenize Brazilian credit card receivables. BlackOpal has launched GemStone, designed to provide emerging-market yields without direct credit risk. GemStone acquires receivables through true sale with ownership registered via Brazil’s central registry and automated collections through Visa and Mastercard rails.

GOLDEN NUGGET

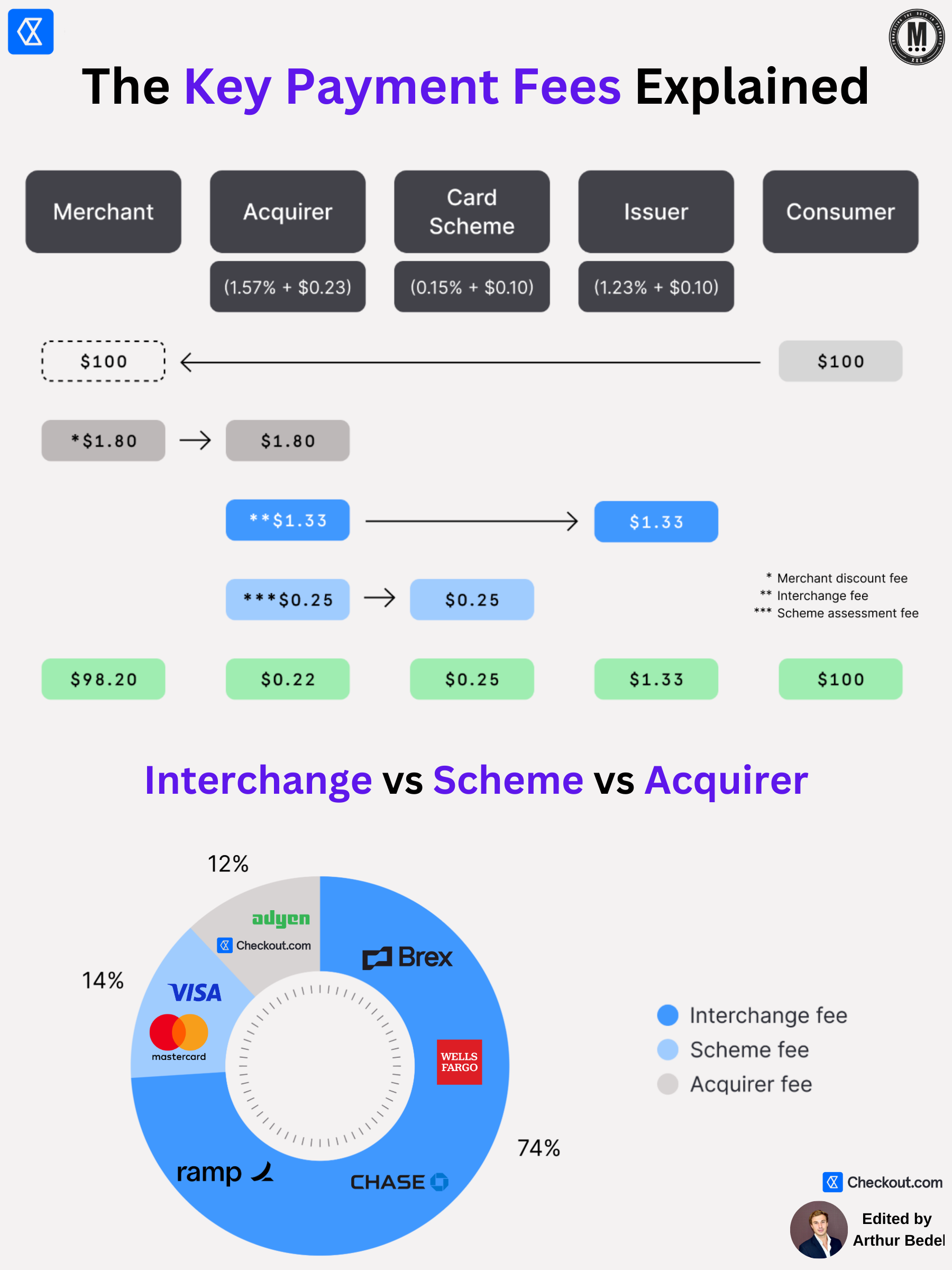

𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 👇 Created by Arthur Bedel 💳 ♻️

In light of the recent changes agreed by Visa and Mastercard — including adjustments to interchange caps, cross-border fees, and digital wallet transaction rates — let’s revisit the key fees that make up card payments

► Interchange fees are a critical part of card payments, representing the fee paid by the acquiring bank to the issuing bank for processing a transaction. They are set by card schemes (Visa, Mastercard, etc.) and vary based on factors like card type, transaction method, and region.

Merchants indirectly pay interchange fees as part of their total Merchant Discount Rate (#MDR), which includes:

✔ Interchange Fees → Paid to the issuing bank

✔ Card Scheme Fees → Paid to the card networks

✔ Acquirer Fees → Paid to the acquiring bank or PSP

𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝:

► $100 transaction

1️⃣ The customer pays $100.

2️⃣ The acquirer (Checkout.com) deducts fees before settling the funds with the merchant.

1.57% + $0.23 → $1.80 goes to the Acquirer to be distributed across all parties.

3️⃣ Interchange fees (paid to the issuing bank, Chase) are deducted:

1.23% + $0.10 → $1.33 goes to the Issuer (deducted from $1,80)

4️⃣ Card scheme fees (paid to Visa, Mastercard...) are deducted:

0.15% + $0.10 → $0.25 goes to the card scheme (deducted from $1,80)

5️⃣ The merchant receives the remaining amount: $98.20.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐡𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐢𝐦𝐩𝐚𝐜𝐭 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

The 4-party model is the foundation of card payments, involving the Cardholder and:

1️⃣ Merchant

2️⃣ Acquirer (Merchant’s Bank)

3️⃣ Issuer (Cardholder’s Bank)

4️⃣ Scheme (Card Network)

𝐖𝐡𝐚𝐭 𝐀𝐟𝐟𝐞𝐜𝐭𝐬 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► Card Network — Visa, Mastercard, American Express have different rates

► Card Type — Debit, credit, premium, commercial cards have varying fees.

► Transaction Type: Card Present or Card Not Present

► Merchant Category Code (MCC) — Different Industry Types

► Geography — Fees vary by region due to regulation (EU has capped interchange fees)

𝐇𝐨𝐰 𝐝𝐨 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐏𝐚𝐲 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐏𝐥𝐮𝐬 (IC+) → A transparent pricing structure, where merchants pay, here is an concrete example for $100:

👉 Interchange fee (Chase) → $1.33

👉 Scheme fee (Visa, Mastercard) → $0.25

👉 Acquirer fee (Checkout.com, Adyen) → $0.22

👉 Total Fees for Merchant: $1.80

👉 Merchant receives: $98.20

► 𝐁𝐥𝐞𝐧𝐝𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 → A simpler, fixed-rate model where the merchant pays one flat percentage per transaction, covering everything: ~ 2.6% + $0.15

While easier to manage, blended pricing can be more expensive than Interchange Plus, as it bundles all costs into a higher flat rate.

Source: Checkout.com

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()