Circle Pulls Ahead of Tether Again… Here’s What’s Fueling USDC’s Growth

Hey Payments Fanatic!

Circle’s USDC just outpaced Tether’s USDT growth for the second year in a row. And the reason is becoming pretty clear.

USDC’s market cap jumped 73% in 2025 to about $75B. USDT still grew, but at a slower 36%. Same pattern last year, too.

What stands out to me the most, especially lately, is that if you look closely, you’ll notice the market has moved past retail hype. You are now seeing institutional demand built on regulated dollars, clear rules, and predictable reserves.

USDC is fully backed by cash and short-term Treasuries and operates under U.S. state licenses and Europe’s MiCA framework. USDT doesn’t have that regulatory footing in the U.S. or Europe.

Combined, USDC and USDT still control more than 80% of the stablecoin market. But the growth gap tells you where regulated payment rails are heading next.

Want to stay ahead of where stablecoins and Payments are converging? Scroll down and catch today's stories 👇

Cheers,

Marcel

SPONSORED CONTENT

Don't miss out on the most valuable event in FinTech. Get your ticket today!

NEWS

🇦🇺 Airwallex names James Teodorini as new ANZ head & records volume. The FinTech said Teodorini will oversee its regional strategy and commercial activities in the two markets. The business has reported annualised transaction volume of more than USD $235 billion, an increase of 127% year on year.

🇺🇸 Circle's USDC outpaces the growth of Tether's USDT for the second year running, driven by increased demand for dollar-pegged tokens that meet regulatory requirements. Continue reading

🇳🇬 Sterling Bank joins Thunes' direct global network to transform cross-border payments for Nigerian expatriates. By leveraging Thunes' Direct Global Network, Sterling Bank is rolling out this enhanced capability across multiple European markets, giving customers abroad a more consistent way to support their families and manage finances.

🇲🇽 Clara boosts growth leadership by appointing Jorge de Lara as President for Mexico. As President for Mexico, Jorge will play a cross-functional role, leading growth and acquisition strategies in the Mexican market, where the company was founded before expanding regionally.

🌍 Mylapay raises $1m to expand payment infrastructure. Mylapay plans to use the funding to strengthen its core infrastructure, expand its product suite, deepen partnerships with banks and payment aggregators, and support its geographic expansion across the Middle East, Africa, and the US markets.

🇺🇸 Remittix to launch global crypto payments platform next month. In a statement, the company said the Remittix Platform is scheduled to go live on 9 February 2026, making the core platform layer available to users worldwide. The February launch is intended to expand access to services that facilitate crypto payments.

🇮🇳 GlobalPay launches prepaid card suite and expands push into cross-border travel payments. According to the company, the cards support tokenisation on Samsung Wallet and Google Wallet, allowing users to make contactless payments across international markets.

🇦🇪 Network International partners with MBank to launch regulated stablecoin payments. The partnership will see the integration of AE Coin into Network’s POS and E-commerce payment platforms, enabling merchants to accept AE Coin seamlessly across physical and digital channels.

🇬🇧 Wirex launches TRON-Native payment infrastructure for agentic payments. By combining TRON's massive user base and sophisticated technology with Wirex's payment rails, the collaboration delivers the speed, affordability, and reliability to bring blockchain payments further into everyday use.

🇺🇸 Blink Charging adds cryptocurrency payments at DC fast charging sites. The company plans to expand crypto payment availability to additional Blink-owned sites throughout 2026. Read more

🇺🇸 Stablecoin neobank Kontigo hit by $340K USDC hack, vows 100% reimbursement. The company stated that it will fully reimburse affected users on a case-by-case basis, following user reports of unauthorized access attempts and coming shortly after Kontigo closed a $20 million seed funding round.

🇦🇪 Ziina introduces Violet, every day benefits from the UAE’s most loved brands, plus zero currency fees. Designed around the habits that shape life in the UAE, Ziina Violet provides practical, recurring value through benefits that fit naturally into how people already eat, shop, commute, exercise, and live.

🇧🇷 Pix will accelerate its expansion to other countries this year. PagBrasil CEO and co-founder Alex Hoffmann said Pix’s flexibility and private-sector innovation are driving its global adoption, noting that dozens of countries have drawn inspiration from the system and that momentum is unlikely to slow.

🇮🇳 Amazon Pay rolls out fixed deposits to deepen its financial service offerings. Amazon Pay would allow customers to open FDs starting from INR 1,000, without the need to open separate savings accounts with its partner institutions.

🇮🇳 Zepto rolls out in-app UPI as delivery platforms bring payments in-house. The move comes as large consumer internet platforms increasingly seek to bring payments in-house to streamline checkout flows, reduce transaction failures, and lower dependence on external UPI apps.

🌍 Citi and CredAble launch a platform to digitize trade finance. This platform aims to streamline business operations and bring efficiency through technological advancements in trade finance. By implementing a digital approach, Citi seeks to enhance operational transparency and efficiency for its corporate clients.

🇫🇷 Ledger reveals payments partner leaked customer names, contact information in new data breach. These attacks involve scammers using fake emails, texts, or calls to trick customers into revealing sensitive information, clicking links that install crypto-stealing malware, or inadvertently sending them their crypto.

🇹🇷 Turkey’s central bank has granted iyzico and Ödeal authorization to expand into open banking. The approval enables users to initiate payments directly from their bank accounts and access consolidated account information across multiple banks, marking the companies’ formal entry into a key growth area of the financial ecosystem.

🇮🇪 Forex.com owner StoneX adds crypto offering under MiCA Licence. The authorisation allows the firm to provide digital asset execution and custody services across the European Union. These services will operate under the MiCA regulatory framework.

🇺🇸 Solutions by Text acquires Triple Play Pay. This strategic acquisition will combine SBT's trusted communication expertise with TPP's modern payment orchestration platform to deliver a unified, compliant, and seamless payment experience for consumer finance businesses and their customers.

GOLDEN NUGGET

💳 Navigating the Complex World of Tokenization in Retail Payments.

Tokens can vary in format, but generally, they fall into 𝙩𝙝𝙧𝙚𝙚 categories:

1️⃣ Non-Format Preserving:

The token doesn't look like the original data. For instance, a social security number could be represented as "T@%3N5."

2️⃣ Format Preserving:

The token retains the format of the original data but scrambles the numbers.

3️⃣ Selective Masking:

A hybrid approach, some original numbers are left unchanged for verification purposes, such as the last four digits of a credit card.

𝗦𝗶𝗻𝗴𝗹𝗲-𝘂𝘀𝗲 𝘃𝘀. 𝗠𝘂𝗹𝘁𝗶-𝘂𝘀𝗲 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens can be transient or enduring. Single-use tokens expire after a single transaction, whereas multi-use tokens can be used for multiple transactions over an extended period.

𝗦𝗮𝗳𝗲𝘁𝘆 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 𝗼𝗳 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens are secure because they're infeasible to reverse-engineer.

Even if a data breach occurs, what is stolen are merely tokens, which are useless without access to the token vault. Industry standards like point-to-point encryption (P2PE) and PCI DSS guidelines add an extra layer of security.

𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝘃𝘀. 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗶𝗼𝗻

While both methods aim to protect data, tokenization offers an edge in compliance and security. If sensitive information is encrypted rather than tokenized, the data could potentially be decrypted, bringing it back into the PCI DSS scope and increasing risks.

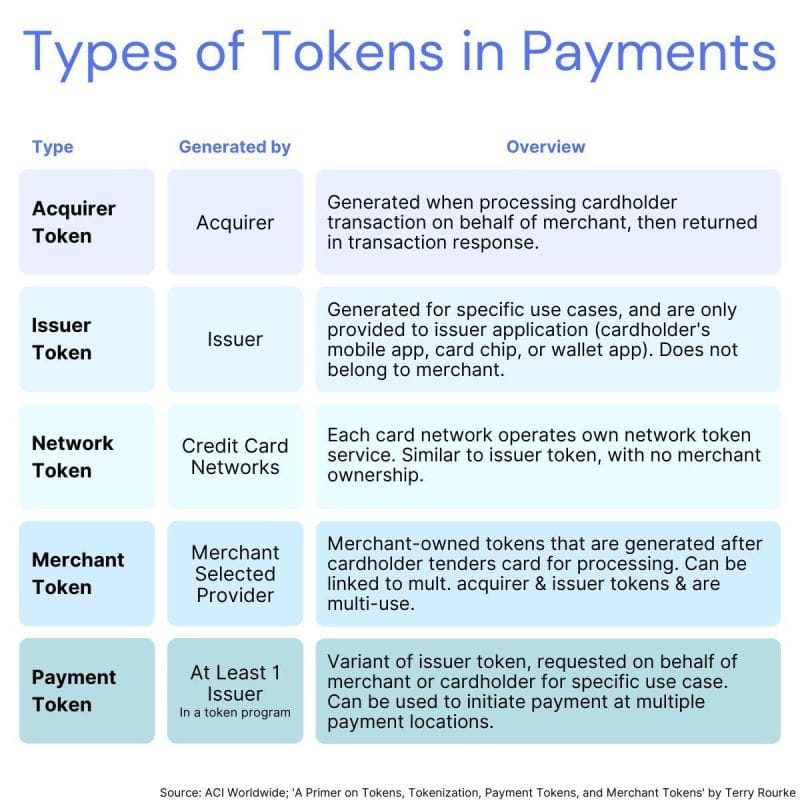

𝗧𝘆𝗽𝗲𝘀 𝗼𝗳 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀:

‣ 𝗔𝗰𝗾𝘂𝗶𝗿𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Generated by transaction processors, usually restricted to specific merchants.

‣ 𝗜𝘀𝘀𝘂𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Created by card issuers, like Visa or Mastercard, often for digital wallets such as Apple Pay or Google Pay.

‣ 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀: Produced by credit card networks themselves, not bound to specific issuers.

‣ 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: A newer category generated on behalf of issuers and merchants, usable across multiple locations.

‣ 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: Tailored for individual merchants, these can be integrated into a merchant's specific customer journey and can link to multiple other types of tokens.

I highly recommend reading the complete source article by Terry Rourke from ACI Worldwide to learn more.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()