EIB Backs Scalapay With €70M… and It’s a Big Signal for Europe’s BNPL Champions

Hey Payments Fanatics!

Scalapay just secured €70 million in Scale-Up Debt financing from the European Investment Bank.

This is the first time the EIB has ever financed an Italian unicorn directly. The money goes straight into tech and product expansion.

Faster rails. Simpler UX. More flexibility for customers across both online and in-store payments.

It is also part of TechEU, the EIB Group’s push to mobilise €250 billion for European innovation. Clear message here: they want their FinTech champions to grow and stay in Europe.

Scalapay’s CEO Simone Mancini says the deal helps them scale product lines and deepen their footprint in the markets where they already lead.

Strong validation for one of Europe’s biggest BNPL names.

Curious to stay on top of today’s Payments moves? Scroll down and catch the highlights 👇

Cheers,

INSIGHTS

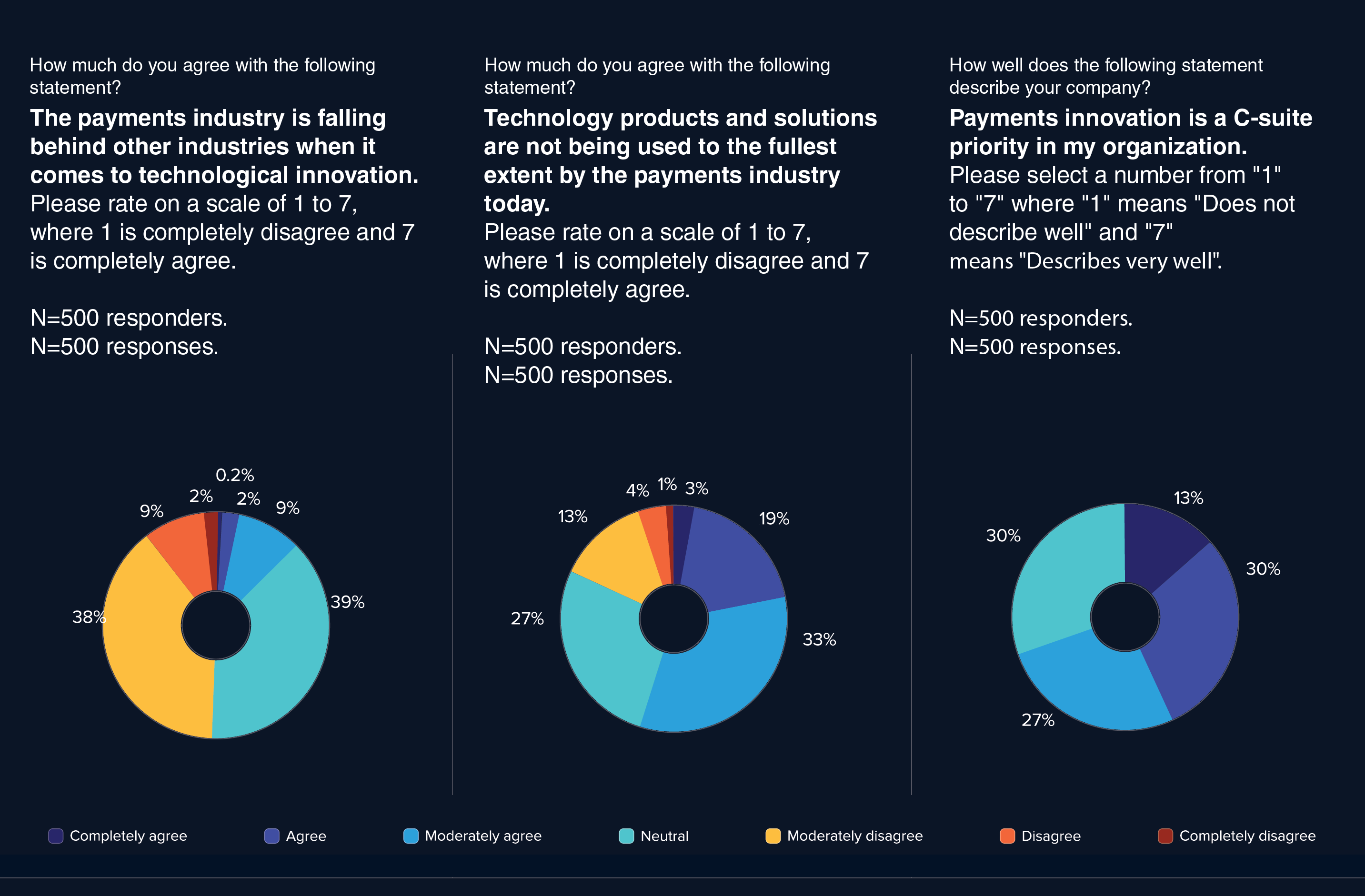

📊 Payments Modernisation: Gap Between Confidence and Readiness Among Industry Leaders Widens, ACI Worldwide Study Finds. The report "Payments in Transition: Leadership in an Era of Transformation," based on a survey of 500 industry leaders, shows that while69% of executives consider their organizations to be payments leaders, fewer than half (44%) say payments innovation is a C-suite priority.

NEWS

🇮🇩 Airwallex accelerates Asia-Pacific growth with the acquisition of a majority ownership of an Indonesian PJP Category 1 licensed payments company. The acquisition allows Indonesian merchants looking to expand overseas to tap into Airwallex’s global financial infrastructure.

🇨🇭 SwissBorg has partnered with Mastercard to launch the SwissBorg Card, a crypto debit card enabling users to spend digital assets at over 150 million locations worldwide. Each payment converts crypto to fiat in real time through the SwissBorg Meta-Exchange to secure optimal rates.

🇬🇧 Blackstone-Backed Mollie nears takeover of UK FinTech GoCardless. Dutch payments firm Mollie is expected to announce it has completed its acquisition of British FinTech unicorn GoCardless, boosting its capabilities in payment processing.

🇮🇹 EIB invests €70 million in Scalapay to accelerate technological innovation in Europe. The EIB funds will help bolster Scalapay’s range of payment sector products and services, making the end-user experience simpler and more comprehensive.

🇮🇳 FinTech Skydo set to expand to the US after $10 million Series A round. Apart from the utilisation of funds to expand globally, the firm is planning to roll out features to its existing product suite, expansion of its distribution network, and products development.

🌍 Mondu secures €100m debt facility from J.P. Morgan Payments and announces strategic collaboration to expand B2B payment solutions across Europe. This collaboration will provide J.P. Morgan Payments’ clients with seamless access to Mondu's flexible payment options, helping them to improve cash flow, increase sales, and streamline their payment processes.

🌍 Pan-African FinTech Ezeebit raises $2.05 million. The funds will support expansion in South Africa, Kenya, and Nigeria, and help strengthen partnerships with banks and telecom operators. Ezeebit aims to reduce the cost and processing time of digital payments across the continent.

🌎 dLocal and Yuno expand partnership to simplify global expansion for modern enterprises in emerging markets. By combining Yuno and dLocal’s capabilities, from their direct APIs and access to 1000+ payment methods to strong orchestration and deep local expertise, the expanded partnership provides global merchants with streamlined access to emerging market payment ecosystems.

🇫🇷 Lyzi expands payments to Porsche and Lamborghini dealerships, as Doctors of the World gets donations and support. The dealerships are expected to see instant euro conversion without exposure to cryptocurrency volatility. Read more

🇺🇸 LemFi secures 14 new US Money Transmitter Licenses. The new licenses give LemFi the ability to move money for customers directly under state regulatory oversight, giving the company more control over how transfers are processed and enabling a smoother, more transparent experience.

🇸🇬 Razorpay Singapore enables merchants to steer users to cheaper payment methods. The new feature integrates into existing checkout flows without additional engineering work and is aimed at helping businesses manage high payment acceptance costs and reduce cart abandonment.

🇹🇷 Turkey seizes FinTech Payco as e-money prosecution campaign widens to seventh target. Payco is accused of money laundering in relation to illegal betting and schemes involving fraudulent FX trading. Eleven suspects have been detained.

🇬🇧 SumUp expands banking capability as it gets ready for listing. “We’re in the process of preparing. When the time is right, we want to obviously be able to react and go quickly,” said Luke Griffiths, CCO and UK CEO, in an interview. Starting this month, small businesses using SumUp’s platform can deposit cash at certain retailers in the UK, Italy, Spain, and France.

🇮🇹 Salt Edge rolls out bulk payments to help businesses handle high-volume payouts quickly. The solution is fully compliant with open banking regulations and strong customer authentication (SCA) requirements, providing complete transparency, real-time tracking, and detailed reporting for every transaction.

🇬🇧 PayAdmit partners with Yaspa to integrate Pay by Bank on its payments platform. The partnership aims to bring Pay by Bank to its payments orchestration platform, giving merchants a faster, more secure, and cost-effective way to accept real-time bank payments with instant confirmation and improved conversion.

🇺🇦 Monobank co-founder launches new POS system for small and medium-sized retail. Posbox.ai POS system combines everything needed for the development of small and medium-sized retail: a program for trade, accounting, personnel management, and AI analytics.

🇺🇸 Cross River expands its card program capabilities with the launch of an in-house card processing engine. Developed in-house, Cross River’s processing expands client flexibility with a unified, end-to-end solution. It strengthens the Company’s current offerings by enabling companies to scale, manage, and customize their payments ecosystem.

🇬🇧 FinTech unicorn Zilch lands payments licence from City watchdog. The licensing move will be hailed by Zilch as an important milestone for the company ahead of the full-scale launch of Zilch Pay next year, which is aimed at capturing a greater chunk of consumers' spending through a one-click checkout process.

🇲🇦 Cash Plus IPO sets record with 80,759 investors, 64x oversubscription. The $40 million capital increase will support wider territorial coverage, a full-scale digital transformation via mobile services, and targeted external growth opportunities within the company’s strategic roadmap.

🇨🇴 Ualá has added Bre-B to its platform, completing a key component of Colombia’s instant payments ecosystem by allowing customers to send and receive money instantly, free of charge, and without using account numbers; users simply register a Bre-B key, enabling transfers to be completed in seconds and significantly enhancing the overall payment experience.

🇵🇰 NayaPay launches global QR payments for Pakistanis via Alipay+. With NayaPay, Pakistanis can now scan and pay securely worldwide with lower costs, less friction, and a seamless checkout experience wherever they go. Keep reading

GOLDEN NUGGET

What is 𝐏𝐚𝐲𝐅𝐚𝐜 𝐚𝐬 𝐚 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 (PFaaS) — by Mastercard👇

► A 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐚𝐜𝐢𝐥𝐢𝐭𝐚𝐭𝐨𝐫 (PayFac) is a model that enables businesses to simplify the merchant onboarding process by allowing a master merchant to process payments for multiple sub-merchants under a single account. This eliminates the need for each merchant to establish their own acquiring relationship.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐅𝐚𝐜 𝐚𝐬 𝐚 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 (𝐏𝐅𝐚𝐚𝐒)

► #PFaaS is the next evolution of the PayFac model, providing businesses with a ready-to-use infrastructure. Instead of building and managing complex risk, compliance, and payment processing systems, PFaaS allows companies to leverage an end-to-end service.

𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐏𝐚𝐲𝐅𝐚𝐜𝐬 𝐚𝐧𝐝 𝐏𝐅𝐚𝐚𝐒

► 𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐢𝐧𝐠: Businesses had to work directly with acquirers, leading to long onboarding processes and high setup costs

► 𝐓𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐏𝐒𝐏𝐬: Payment Service Providers (PSPs) streamlined payment acceptance by allowing businesses to process transactions under one umbrella account, but underwriting and onboarding were still complex.

► 𝐓𝐡𝐞 𝐏𝐚𝐲𝐅𝐚𝐜 𝐌𝐨𝐝𝐞𝐥 𝐄𝐦𝐞𝐫𝐠𝐞𝐬: By the early 2010s, PayFacs enabled faster onboarding of sub-merchants, lowering compliance risks and simplifying payments.

► 𝐏𝐅𝐚𝐚𝐒 𝐓𝐚𝐤𝐞𝐬 𝐎𝐯𝐞𝐫: The model evolved to offer PayFac capabilities as a service, helping platforms, ISVs, and software providers integrate payments effortlessly.

𝐓𝐡𝐞 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐏𝐚𝐲𝐅𝐚𝐜 𝐌𝐨𝐝𝐞𝐥:

1️⃣ Acquirers

► Financial institutions that provide merchant accounts and settle funds for transactions.

2️⃣ Payment Facilitators

► The master merchants that onboard sub-merchants, handle transactions, and ensure compliance with regulatory requirements.

3️⃣ Sub-Merchants

► Businesses or individuals that process payments through the PayFac’s infrastructure.

4️⃣ Independent Software Vendors (ISVs)

► Software platforms and SaaS companies that integrate embedded payments into their services using PFaaS.

5️⃣ Card Networks (Visa, Mastercard)

► Facilitate the authorization, clearing, and settlement of card transactions.

6️⃣ Regulators & Compliance Bodies

► Oversee AML (Anti-Money Laundering), KYC (Know Your Customer), PCI DSS, and other financial regulations.

7️⃣ Risk & Fraud Management Providers

► 3-party services that help detect and mitigate fraud risks in transactions.

𝐏𝐅𝐚𝐚𝐒 𝐒𝐞𝐭𝐮𝐩 𝐓𝐢𝐦𝐞𝐥𝐢𝐧𝐞:

1️⃣ Research & Selection (1-2 months)

2️⃣ Integration Planning (3-4 weeks)

3️⃣ Technical Integration (1-3 months)

4️⃣ Compliance & Security (2-4 weeks)

5️⃣ Soft Launch (2-4 weeks)

𝐓𝐨𝐭𝐚𝐥 𝐓𝐢𝐦𝐞 𝐭𝐨 𝐌𝐚𝐫𝐤𝐞𝐭: 4-8 months (compared to 12-24 months for a traditional PayFac setup).

Payments, they never stops...

Source: Mastercard

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()