Google Pay Expands Capabilities with UPI Circle and ClickPay QR

Hey Payments Fanatic!

Google Pay has announced six new features at the Global FinTech Fest 2024, aimed at enhancing user convenience.

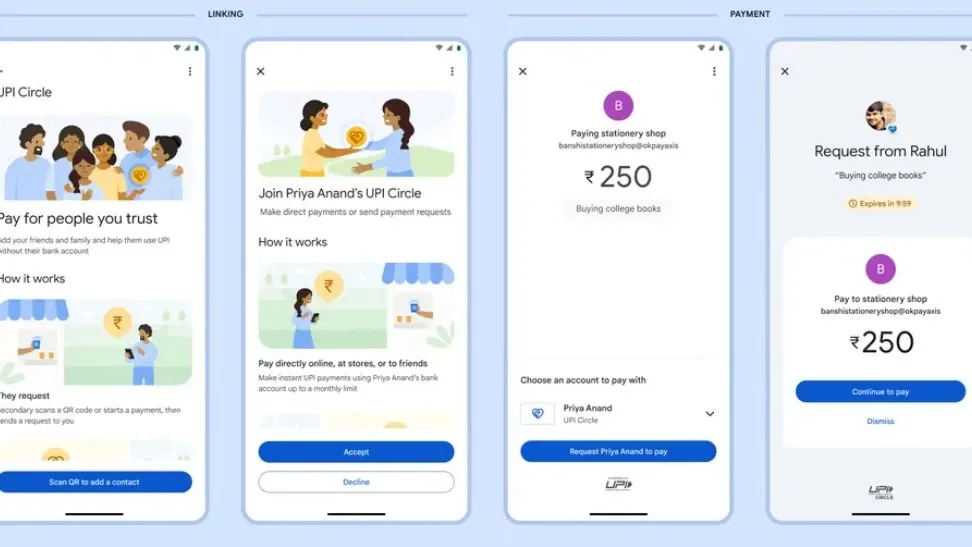

These include UPI Circle, UPI Vouchers, ClickPay QR, prepaid utilities payment, Tap & Pay with RuPay cards, and Autopay for UPI Lite.

The UPI Circle feature allows transactions without linking a bank account, offering partial or full delegation for payments.

UPI Vouchers enable payments via prepaid vouchers without bank account linkage.

ClickPay QR simplifies bill payments by allowing users to scan QR codes to pay bills without remembering account details.

Other features include prepaid utilities, Tap & Pay with RuPay cards, and Autopay for recurring payments, boosting digital payment convenience in India.

Enjoy more payments industry updates below and I'll be back tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

PAYMENTS NEWS

🇺🇸 ACI Worldwide collaborates with Red Hat to deliver enterprise payments for the cloud era. The collaboration will help ACI customers simplify payment operations, allowing them to deploy ACI’s enterprise payments platform on any cloud infrastructure and offering enhanced resiliency and scale while reducing operating costs.

📊 Payment Orchestration Vendor Evaluation by Datos Insights. This report explores key trends in payments orchestration. It discusses new market needs and challenges and provides high-level provider market analysis and projections. Check out full report here

🇬🇧 Mastercard and Visa face £4 billion lawsuit over multilateral interchange fees. The Competition Appeal Tribunal has approved the action, allowing UK businesses to seek compensation for losses due to unlawfully high multilateral interchange fees (MIFs) on commercial card transactions.

🇬🇧 UNIPaaS and American Express Partner to Boost B2B Card Payments for SaaS Platforms. The partnership will enable more small and medium-sized businesses (SMBs) to offer their customers the option of paying invoices with Amex Cards through its platform.

🇦🇪 Middle Eastern open banking platform Tarabut has acquired UK FinTech Vyne, a real-time account-to-account (A2A) payments platform for online businesses, for an undisclosed sum. The acquisition was completed on 1 August following the approval of the Saudi Central Bank (SAMA) and the Financial Conduct Authority (FCA) in the UK.

🇬🇧 ClearCourse acquires retail Eftpos vendor CSY Retail Systems (“CSY”). Following the acquisition, CSY will become part of the ClearCourse Retail & Hospitality division, significantly strengthening the group’s integrated offering in this sector.

🇨🇿 Twisto founder joins Malcom Finance (formerly 4Trans). The FinTech company specialising in financial services for supply chain and logistics SMEs, has appointed the founder of Twisto, Michal Šmída, as a Non-Executive Director.

🇮🇱 Nayax, a global commerce enablement payments and loyalty platform designed to help merchants scale their business, announced that Keren Sharir has been appointed to the newly created role of President in addition to her current role of Chief Marketing Officer (CMO), effective immediately.

🇺🇸 Jack Henry and Moov to simplify digital payments for small business. The cloud-native service will allow SMBs to accept payments with the tap of a phone, receive same-day funds for payments accepted, and automate reconciliations to accounting software packages.

🇺🇸 U.S. Bank works to simplify SMB banking, payments. A recent survey by the bank is leading it to bring its payments and banking tools together to work for small and mid-size business clients in a more simplified way. Read more

🇬🇧 Revolut is launching 𝗕𝗶𝗹𝗹𝗣𝗮𝘆, which automates payments and is designed to save businesses time managing and paying bills. BillPay integrates with major accounting software packages, including QuickBooks, Xero, and FreeAgent and will enable users to manage and pay bills to suppliers in over 150 countries, the company says.

GOLDEN NUGGET

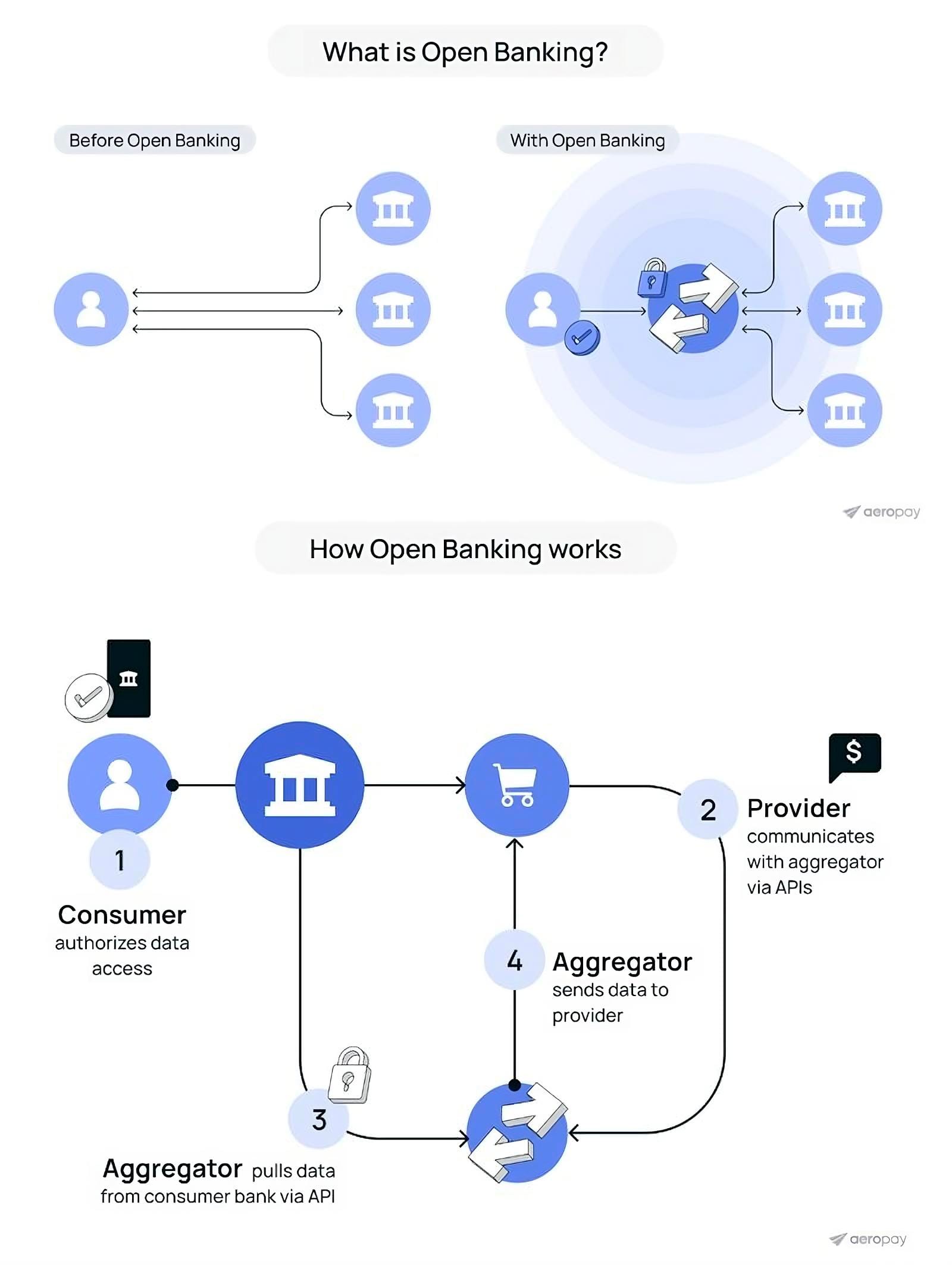

What is Open Banking? And how does it work?

Here's a quick explainer:

Open banking decentralizes traditionally fragmented banking industry data, enabling seamless connectivity for financial services.

Open banking creates standardized data formats and secure communication protocols for FIs and TPPs.

This levels the playing field for third-parties to integrate with any and all banks / FIs under uniform rules, regulations, and technical standards.

Open banking works by enabling TPPs to access consumer payment, transaction, identity, and other financial data from banks and non-bank financial institutions through Application Programming Interfaces (APIs).

This granular access is provided with the consent of the consumer, creating a more connected and competitive financial ecosystem.

Here’s a look at the process:

► Consumer consents to share their financial data with a third-party provider through a secure app or service.

► APIs securely exchange data between the consumer's bank and the third-party provider.

► The TPP can access banking data such as account/routing numbers, account balances, and transaction history to offer personalized financial services or initiate payments.

See the pictures below for more info👇

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Aeropay

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()