Handwave Raises $4.2M to Launch Palm Payments in US & Europe

Hey Payments Fanatic!

Palm payments are coming to Europe and the US!

After gaining ground in Asia through platforms like Alipay and WeChat, biometric checkout is heading west.

Handwave, a Latvian FinTech founded by Jānis Stirna and Sandis Osmanis-Usmanis, has secured $4.2 million to roll out its palm-based payment system across Europe and the US.

With one gesture, users can pay, verify age, check in, and earn loyalty points—no wallet, phone, or app involved.

Keep scrolling to explore how Handwave works, plus your daily dose of Payments news 👇

Cheers,

P.S. Taktile just unveiled its Top Voices in Risk 2025, spotlighting standout leaders across four key categories: Innovation, Impact, Progress, and Leadership. Here’s the official list of voices worth following.

INSIGHTS

📈 Wise’s FY2025 results highlight strong growth and major momentum for its infrastructure arm, Wise Platform. The results show strong growth, with £1.2B in revenue (+15% YoY), £564.8M in profit before tax (+17%), and £21.5B in deposits (+33%). The company now serves 14.9 million individuals and 700,000 businesses, processing £145.2B in cross-border volume.

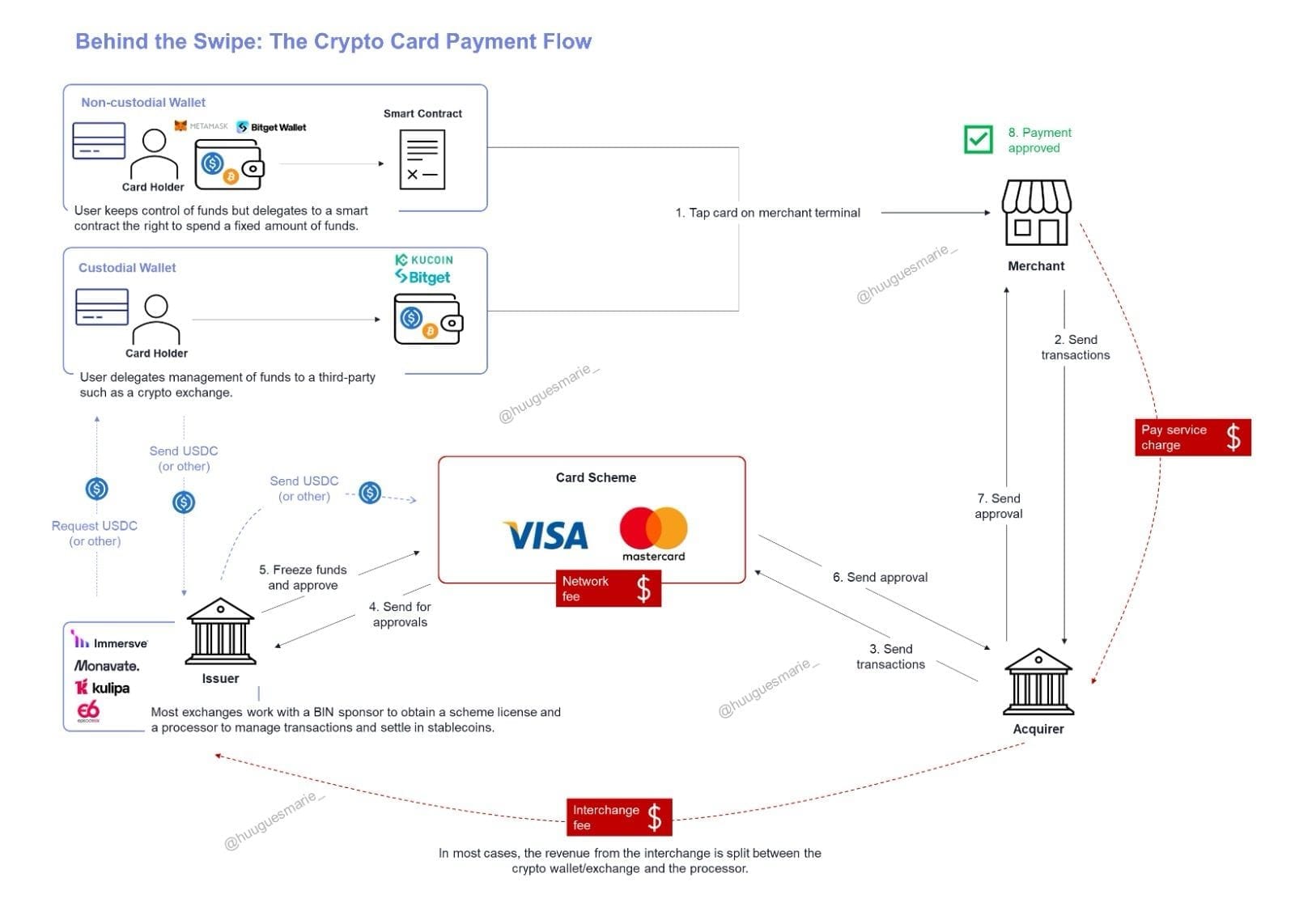

➡️ How do crypto payment cards really work?

NEWS

🇨🇴 Instant payments by Sonia Gómez, Director of Solutions Consulting at ACI Worldwide. To combat rising fraud, financial institutions must adopt a data-driven approach. This includes leveraging the ISO 20022 messaging standard, using industry-wide information to close security gaps, and applying AI and machine learning for real-time fraud detection. ACI supports this strategy through its concept of "payment intelligence".

🇬🇧 The Money Platform deploys open banking tech from Ecommpay. The company has enabled TMP to increase the breadth of pay-in methods and use API instructions for outward payment initiation using Faster Banking. The Money Platform provides a crowd-funded peer-to-peer lending platform.

🇦🇪 PAY10 processes the UAE’s first open finance transaction under the Central Bank of the UAE's framework. The transaction was executed on Al Tareq, the CBUAE’s Open Finance platform established under the Financial Infrastructure Transformation (FIT) Programme to enable secure, consent-driven access to financial data and services.

🇺🇸 Visa brings Google Pay integration to Fleet Cards, enabling tokenization and push-to-wallet across the digital wallet ecosystem. Now, fleet data tags can be configured by the issuer, FinTech, or processor, allowing custom data tags to be dynamically provisioned during the tokenization process.

🇺🇸 J.P. Morgan Payments launches cutting-edge supply chain finance solution with Oracle. J.P. Morgan Payments SCF is now integrated into Oracle Cloud ERP, enabling FedEx to accelerate working capital access and liquidity management. This Oracle ERP integration gives vendors early payment options and streamlines setup.

🇺🇸 Payroc to purchase payment orchestrator BlueSnap. The acquisition aims to expand Payroc's service offerings by incorporating BlueSnap’s global and enterprise capabilities. Payroc said the integration will facilitate the acceptance of various payment methods, including card-not-present transactions and electronic checks.

🇦🇪 UAE Central Bank set to launch Digital Dirham in phases. Once launched, Digital Dirham, which is the digital alternative to physical money, will allow the public to use it for a wide range of payments, including online, in-store, commercial, and peer-to-peer transactions.

🇧🇦 Apple Pay lands in Bosnia and Herzegovina, revolutionizing digital payments. Users in the country can now leverage their Apple devices for secure and convenient contactless transactions, integrating seamlessly with supported banks. Continue reading

🇮🇳 UPI sets an all-time high with 19.47 Bn transactions in July. This marked a 5.8% rise in transaction volume and a 4.3% increase in value compared to June 2025, when UPI logged 18.40 billion transactions totaling Rs 24.04 lakh crore. Year-on-year, UPI maintained its strong growth momentum.

🇺🇸 Handwave raises $4.2M to launch palm-based payments in Europe and the US. Using proprietary technology, the solution enables customers to easily onboard themselves, scan their palm using their phone camera, and link payment and loyalty cards, as well as identity credentials, to a secure digital wallet.

🇦🇺 Thunes and EzyRemit team up to enhance cross-border payments for expatriate communities. Through its direct integration into Thunes’ Network, EzyRemit now offers customers access to real-time payouts to billions of mobile wallets, bank accounts, cards, and cash pickup locations in over 45 countries.

🇦🇪 Spare receives in-principle approval from the Central Bank of the UAE for an open finance license. Spare provides merchants a secure and unified API platform for financial account-to-account payments and data access, enabling capabilities such as recurring payments, future-dated payments, account aggregation, identity verification, risk assessment, and many more.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()