Here's How India’s PhonePe Just Made Checkout Frictionless

Hey Payments Fanatic!

Big moves from India’s payments giant PhonePe today, and they’re all about making checkout friction a thing of the past.

At the Global FinTech Festival in Mumbai, PhonePe teamed up with Mastercard to roll out device tokenisation across its payments gateway.

That means customers can now save their card once on the PhonePe app and use it securely across merchants. no more re-entering card numbers or waiting for OTPs.

It’s a major step toward a “save once, pay everywhere” experience, blending Mastercard’s global security tech with PhonePe’s massive merchant network.

For businesses, this means fewer drop-offs. For users, faster, safer payments — all verified with a fingerprint or face scan.

And that’s not all.

PhonePe also unveiled its SmartPOD, an all-in-one terminal combining card, UPI, and smart speaker functionality, designed for India’s millions of small merchants.

Scroll down for more of today’s payments updates I picked for you, and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

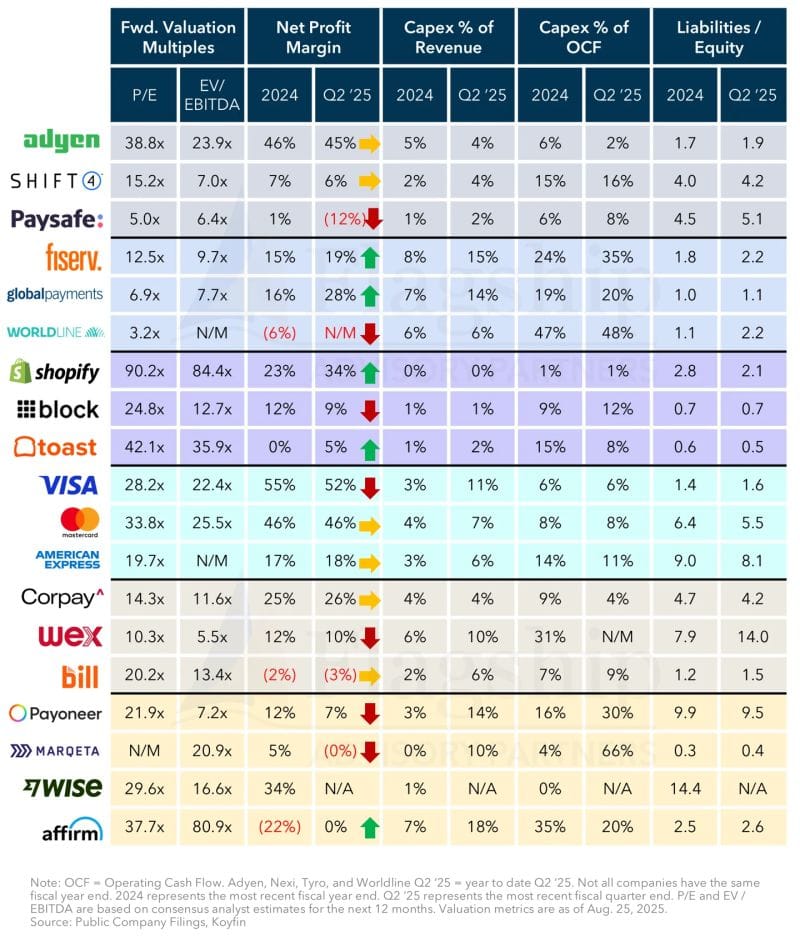

📈 A closer look at Public FinTech health & efficiency.

NEWS

🇬🇧 Ecommpay adds ekko climate action to Hosted Payment Page. The integration of ekko’s features into the Ecommpay Hosted Payment Page will empower customers to turn everyday payments into a measurable environmental impact. Critically, the process is delivered seamlessly at checkout for a frictionless customer experience. ekko works with a range of organisations across key environmental issues, including the oceans, nature, wildlife, birdlife, and climate.

🇬🇧 Ecommpay partners with humm to meet demand for online finance for travel and high-value retail sectors. UK and Ireland merchants using Ecommpay as their payment services provider will be able to offer online finance for goods and services up to £3,000 through humm, benefitting from a potential uplift in conversions as well as the value of sales.

🌎 Solidgate partners with Bamboo to boost reach in Latin America. Through this integration, merchants gain broader regional access, more payment options, and faster market entry with improved infrastructure support. The partnership reinforces Solidgate’s commitment to helping global merchants scale and grow in one of the world’s most dynamic e-commerce regions.

🇬🇧 Checkout.com launches Flow Remember Me, an extension of Flow that allows shoppers to save their card details once and then have them immediately available for use across Checkout.com’s global network of merchants. By eliminating the need to re-enter information, Flow Remember Me makes transactions faster and more likely to convert.

🇮🇳 PhonePe launches next-gen SmartSpeaker with integrated card payments. PhonePe has launched its new SmartPOD, a device merging POS and smart speaker functions, enabling small merchants to accept both UPI and card payments. Designed in India, it supports major card networks and offers features like dual displays and celebrity voice confirmations.

🇮🇳 PhonePe partners with Mastercard to launch device tokenisation. This collaboration makes online payments more secure and seamless for users. Customers can now save their card details once on the PhonePe app and use them across various merchants. This initiative aims to simplify the checkout process.

🇮🇳 UK's Revolut to launch India payments platform, eyes 20 million users by 2030. Revolut will let Indian users make domestic and international payments via its tie-ups with the UPI and Visa, starting with 350,000 waitlisted customers later this year before opening to others. Additionally, Revolut introduces Pay by Bank payment method in Finland to its payment processing service, offering businesses a new tool that enables fast and secure payments directly from a customer’s bank account.

🇮🇳 Amazon Pay introduces UPI Circle. UPI Circle now enables primary UPI account holders to securely add family members to their payment circle with either one-time approval or transaction-by-transaction authorisation. Keep reading

🇮🇳 UPI reaches 500 million consumers and 65 million merchants. UPI has evolved from a digital payment platform into a daily habit, driving financial inclusion, enabling access to credit, and fuelling growth for micro and small enterprises across India, according to a report released. UPI’s presence now spans 99% of India’s more than 19,000 pin codes, catalysing economic momentum nationwide.

🇬🇧 GoCardless records first profitable quarter. According to co-founder and CEO Hiroki Takeuchi, this achievement reflects the discipline, focus, and strategic scaling the business has executed over the past 18 months. With this momentum, the company now aims to sustain profitability over a full year while continuing to pursue its ambitious growth objectives.

🇺🇸 Stablecoin startup Coinflow raises $25 million to challenge Stripe. The funds will be used to help merchants use stablecoins to achieve faster money movement. Coinflow is a payment service provider, or PSP, going head-to-head against competitors amid the race to remake global transactions with blockchain technology.

🇩🇪 Bullish and Deutsche Bank partner to deliver seamless fiat integration for institutional crypto trading. Through this partnership, Deutsche Bank will provide comprehensive corporate banking services to Bullish, including the seamless facilitation of fiat deposits and withdrawals for customers of Bullish Exchange’s Hong Kong SFC and German BaFin-regulated businesses.

🇮🇳 BharatPe launches BharatPeX, the online PAPG with an X-factor: AI-guided, in-app UPI first, and implementation-led. It combines a modern online payment gateway with an implementation-first model that helps clients ship in-app UPI experiences faster, keep customer data within their own apps, and materially lift success rates.

🇶🇦 Ooredoo FinTech to join PayPal World, expanding global digital payment access. This integration will provide users with expanded access to millions of businesses, the ability to pay international merchants using their preferred domestic payment methods and local currencies, and smoother cross-border money transfers.

🇪🇸 ID Finance and myTU Partner to deliver instant loan payouts with programmable banking infrastructure. The partnership enabled ID Finance to deploy instant loan payouts within a single business day, avoiding a potentially costly disruption. Keep reading

🇺🇸 Fiserv, PayPal ex-CEOs, Frank Bisignano, grab new roles. Bisignano, who earlier this year was appointed by President Donald Trump to lead the Social Security Administration, has now also been named CEO of the Internal Revenue Service. Treasury Secretary and acting IRS commissioner said that Bisignano is a “natural choice” for the role.

🇬🇧 Thredd launches first-to-market fraud solution in collaboration with Featurespace. According to the companies, the solution eliminates the need for fraud analysts to log into separate systems for cards and payments. Continue reading

🇬🇧 Big Issue partners with fumopay to roll out a new way for vendors to take cashless payments via open banking. Big Issue sellers taking part in the fumopay pilot have been able to accept instant payments from customers by displaying a QR code to accept instant payments, all without the need for WiFi or charging card readers.

🇬🇧 Moniepoint reports $1.2million loss in first year of UK operations and acquires FCA-regulated Bancom Europe. The company did not generate any revenue between February and December 2024, with operations continuing to be funded by its parent company. In July 2025, it completed the acquisition of Bancom Europe.

GOLDEN NUGGET

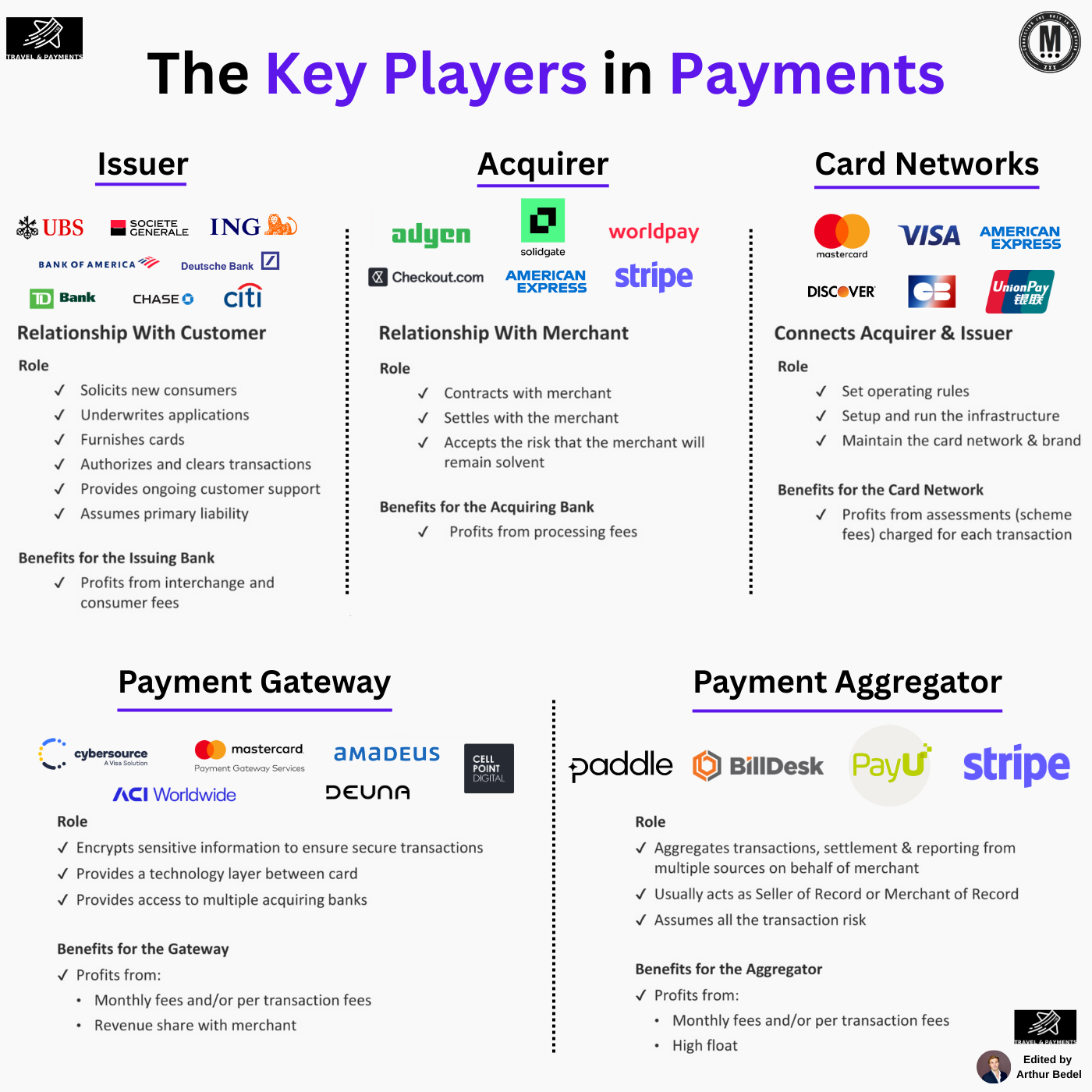

𝐓𝐡𝐞 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by Travel & Payments 👇Created by Arthur Bedel 💳 ♻️

Behind every card transaction is a coordinated set of players — each with a unique role in enabling seamless, secure, and scalable payments.

𝐈𝐬𝐬𝐮𝐞𝐫𝐬:

Issuers are banks or financial institutions that provide cards directly to consumers.

► Key Functions:

→ Underwrite and approve new cardholders

→ Furnish credit, debit, or prepaid cards

→ Authorize and clear transactions in real-time

► How They Make Money:

From interchange fees, annual card fees, interest on revolving credit, and FX markups.

► Examples:

Citi, UBS, ING, TD, Deutsche Bank, Chase

𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬

Acquirers are responsible for enabling businesses to accept card payments.

► Key Functions:

→ Set up and manage merchant accounts

→ Process card transactions and settle funds to merchants

→ Manage chargebacks and fraud risk

► How They Make Money:

Through processing fees, gateway charges, and often value-added services (fraud protection, analytics)

► Examples:

Checkout.com, Worldpay, Nuvei, Payplug, Getnet, Solidgate

𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬

Card networks serve as the central infrastructure layer between issuers and acquirers.

► Key Functions:

→ Route transaction requests between issuer and acquirer

→ Establish dispute resolution protocols

→ Set interchange and assessment fees

→ Manage card branding and acceptance standards

► How They Make Money:

Card networks earn scheme fees, cross-border fees, and fraud assessment charges

► Examples:

Visa, Mastercard, American Express, GIE Cartes Bancaires

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲𝐬

Gateways act as the secure portal through which card data travels from the consumer to the acquiring bank.

► Key Functions:

→ Route transactions to the appropriate processor

→ Offer tools for fraud prevention, 3DS, and retry logic

→ Provide dashboard and reconciliation interfaces to merchants

𝐍𝐨𝐭𝐞: The tokenization process may be performed by 3rd Party vault VGS, Acquirer Checkout.com, Gateway DEUNA, and Merchant...

► How They Make Money:

Gateways charge monthly platform fees, per-transaction fees, and revenue-sharing arrangements

► Examples:

DEUNA, CellPoint Digital, Amadeus

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐀𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐨𝐫𝐬

Aggregators combine payment services into a single offering, especially for smaller merchants

► Key Functions:

→ Act as Merchant of Record (MoR), processing under their own MID

→ Aggregate transactions across merchants

→ Handle onboarding, settlement, and risk management

► How They Make Money:

Profit from higher per-transaction fees and managing float

► Examples:

Paddle, Stripe, PayU, BillDesk

Source: Travel & Payments & Vishal Mehta

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()