Juspay Raises $50M… and Quietly Joins India’s Unicorn Club

Hey Payments Fanatic!

Juspay just raised $50M from WestBridge in a Series D follow-on round.

That pushes the company’s valuation to $1.2B, officially putting Juspay into unicorn territory. A big step for one of India’s most infrastructure-heavy payments players.

What I find notable is the structure. This round includes a secondary component, giving early investors and employees liquidity for the second time in just a year.

Juspay has always sat deep in the stack. Invisible to most users, critical to scale. This round feels less about hype and more about reinforcing that role.

Meanwhile, Payments Get Easier for China-Bound Travelers

Tinaba, together with Banca Profilo, is extending its partnership with Alipay+ to enable payments across mainland China.

Tinaba users can now pay at more than 80 million merchants by scanning QR codes directly in the app, without installing local wallets or opening a Chinese bank account.

This move strengthens Tinaba’s positioning as a platform built for global mobility. In a market where cash has largely disappeared, that access really matters.

Scroll down to see what else is moving in Payments today 👇 I’ll be back in your inbox tomorrow with more updates.

Cheers,

INSIGHTS

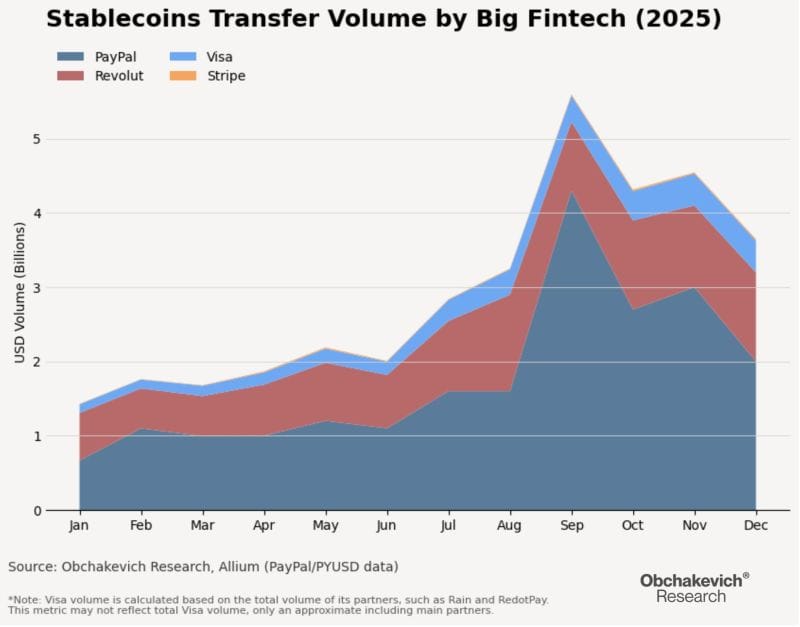

📈 Stablecoins officially went mainstream in 2025.

Q4 numbers tell the real story:

NEWS

🌎 MasterCard expands its security focus with a new monitoring center for Latin America. The newly launched unit offers 24/7 support in Spanish, Portuguese, and English for the entire región, real-time monitoring closer to regional customers, and greater resilience for payment operations in the región.

🇮🇳 Juspay raises $50 million from WestBridge and enters the unicorn club. Juspay said the secondary component will provide liquidity to early investors and employees holding employee stock ownership plans, marking the second such liquidity event enabled by the company within a year.

🇨🇳 Tinaba extends Alipay+ Pact, enabling payments in China. The new service enables Tinaba users to pay at over 80 million merchants across China. Customers can complete these transactions by simply scanning a QR code directly within the app.

🇺🇸 Capital One is acquiring FinTech Brex for $5.2B. The deal, split evenly between cash and stock and expected to close in mid-2026, would expand Capital One’s presence in business banking, with Brex continuing to operate under its own brand and CEO Pedro Franceschi remaining in charge.

🌎 Navro develops payroll services that handle all statutory and tax requirements across 95 countries. Statutory & Tax will enable three of Navro’s core client segments to manage all aspects of workforce and pension payouts in 95 countries through one provider.

🇺🇸 Corpay appoints European Operating Executive David Bunch to its Board of Directors. “David is an accomplished, practical global operator. His deep experience in managing massive scale, platforming digital offers, and navigating international regulatory environments will be additive to our board as we continue to expand our global payments footprint,” said Ron Clarke, Chairman and CEO of Corpay.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()