Mastercard & JPM Join Forces on B2B Settlement

Hey Payments Fanatic!

A major move in the cross-border payments space today as two industry giants join forces! Mastercard's Multi-Token Network (MTN) is now connecting with J.P. Morgan's Kinexys Digital Payments, creating a solution for B2B payments settlement.

Mastercard's MTN provides a unified platform with API-enabled, blockchain-based tools and standards, while Kinexys Digital Payments operates as a next-generation payment rail offering real-time value transfer using commercial bank money. Together, they're addressing key challenges in cross-border payments: transparency, settlement speed, and time zone friction that typically impacts international transactions.

"We believe our solutions can play a transformative role in the ecosystem for digital global commerce and digital assets," says Naveen Mallela, Co-Head of Kinexys by J.P. Morgan, pointing to their commercial bank payment rails' ability to integrate with any digital marketplace or platform.

Raj Dhamodharan, Executive Vice President, Blockchain and Digital Assets at Mastercard, adds they're "unlocking greater speed and settlement capabilities for the entire value chain." This builds on both companies' track records in digital asset and commercial infrastructure innovation.

How might this integration reshape B2B cross-border payments? Share your thoughts in the comments below 👇

Enjoy the read, and I'll catch up with you on Monday with more tales and updates.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

FinTech & Advanced Payments Report 2025. This report examines 14 key areas transforming the industry, driven by technological innovations, regulatory changes, and evolving consumer preferences. Link here

PAYMENTS NEWS

🇺🇸 Collections vs Payouts: Risks of using a single provider for both, by PayQuicker. In the complex world of business finance, understanding the nuances between collections, or pay-in, and payouts is crucial for maintaining healthy cash flow. Dive deeper into the topic by reading the full article

🇸🇬 Crypto.com and Triple-A simplify crypto payments for online shopping. This service, starting in Singapore, will enable users pay with crypto from their Crypto. com wallet without the need to convert it to local currency, and also earn crypto rewards on their purchases.

🇬🇧 CellPoint raises $30 Million for travel sector payment orchestration. The company states the new funding will allow it to intensify its focus on optimizing payment and money movement service for clients while expanding its alternative payment method hub.

🇫🇷 Worldline to raise new debt after tumultuous year hurts earnings. Worldline SA, the French payments firm formerly part of Atos SE, completed a refinancing effort to secure cash for upcoming debt maturities, despite raising its interest costs. The company issued a five-year bond at a 5.375% yield, according to a source.

🇸🇳 Senegal-based FinTech company New Africa Technology (NAT), joins forces with Mastercard to introduce a virtual and physical prepaid card for individuals through NAT’s existing digital wallet solution, ‘’Flash’’. This collaboration aims to transform the payment landscape in Senegal, Côte d’Ivoire, and Benin.

🇺🇸 Shift4 has been named the payments partner for Barclays Center, handling ticketing, food, beverage, and retail transactions. The partnership aims to enhance the customer experience at one of Brooklyn's top sports and entertainment venues. Read on

🇪🇺 Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution. Worldline has partnered with GarantiBBVA International N.V. to implement its cloud-based instant payments solution. This multi-year agreement will help the bank meet regulatory requirements and advance its digital transformation.

🇺🇸 Stripe becomes Nacha’s preferred partner. Nacha, which operates the US ACH network, has named Stripe as its new Preferred Partner for ACH Experience. The ACH network facilitates electronic funds transfers (EFT), and this partnership aligns with Nacha's goal to expand the network's reach.

🇿🇦 Universal Digital Payments Network and Forus Digital co-operate on CBDC testing environment. This partnership is set to empower African communities, governments, and businesses, and represents a significant step toward realising the shared goal of financial inclusion and economic advancement across Africa.

🇺🇸 Klarna’s planned IPO sets the stage for more FinTech listings. The company’s planned initial public offering is fueling hopes that a long drought of FinTech listings may be coming to an end, heralding a wave of debuts for the sector over the next couple of years.

🇺🇸 CFPB expands oversight of digital payments services including Apple Pay, Cash App, and PayPal. The CFPB announced it will soon supervise nonbank firms, including tech giants and payments companies with 50 million+ transactions annually. The new rule ensures these firms follow the same regulations as banks and credit unions.

🇺🇸 Apple will now be treated like a Bank, says US Consumer Financial Protection Bureau, finalizing a proposal from last year with several changes. The popularity of Apple Pay will now see the Cupertino company regulated by the US CFPB, a watchdog whose role is normally limited to banks and financial services companies. Discover more

🇧🇷 The race of banks and FinTechs to get ahead of Automatic Pix. The Central Bank plans to launch Automatic Pix on June 16, 2025, but players like Santander and FinTech Ebanx are already moving to implement it seven months ahead. Keep reading

🇳🇿 Adyen goes live with Tap to Pay on iPhone with launch partner NewStore in New Zealand. By partnering with NewStore for the launch, businesses can now accept contactless payments using only an iPhone and the NewStore Associate iOS app. Read more

GOLDEN NUGGET

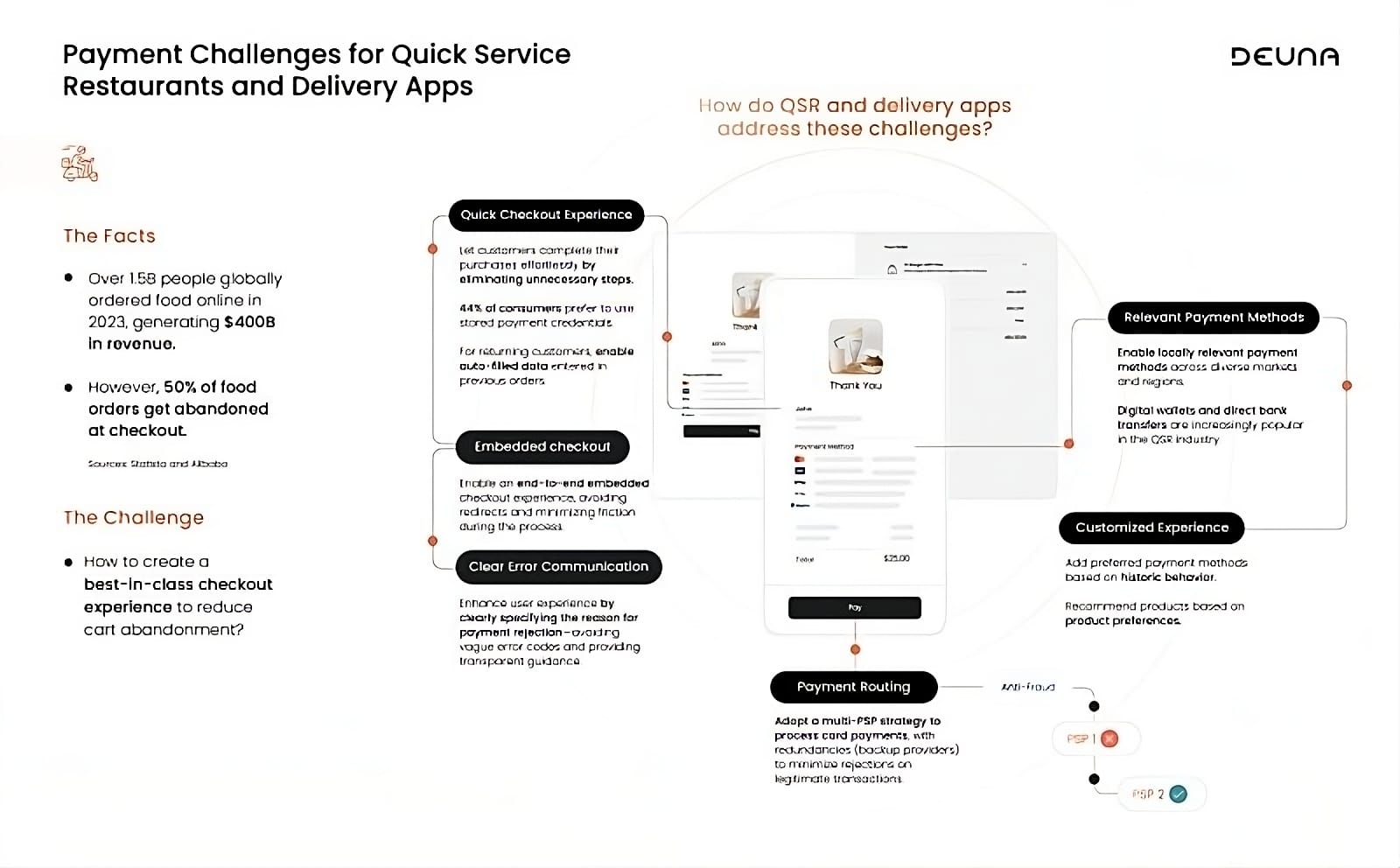

Over 𝟭.𝟱 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 people globally ordered food online in 2023, generating $𝟰𝟬𝟬𝗕 in revenue. However, 𝟱𝟬% (!) of food orders get abandoned at checkout 🤯

𝗧𝗵𝗲 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲:

How can QSR and delivery apps create a best-in-class checkout experience to reduce cart abandonment?

𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻𝘀 𝘁𝗼 𝗔𝗱𝗱𝗿𝗲𝘀𝘀 𝗖𝗵𝗲𝗰𝗸𝗼𝘂𝘁 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀:

1️⃣ Quick Checkout Experience

Allow customers to complete purchases effortlessly by eliminating unnecessary steps.

44% of consumers prefer using stored payment credentials.

For returning customers, enable auto-filled data from previous orders.

2️⃣ Embedded Checkout

Create an end-to-end embedded checkout experience, avoiding redirects and minimizing friction during the process.

3️⃣ Clear Error Communication

Improve user experience by clearly specifying reasons for payment rejection.

Avoid vague error codes and provide transparent guidance.

4️⃣ Relevant Payment Methods

Support locally relevant payment methods across different regions and markets.

Digital wallets and direct bank transfers are increasingly popular in the QSR industry.

5️⃣ Customized Experience

Offer preferred payment methods based on historic behavior.

Recommend products based on customer preferences.

6️⃣ Payment Routing

Adopt a multi-PSP strategy for card payments with redundancies (backup providers) to minimize rejections on legitimate transactions.

These solutions help reduce cart abandonment, optimize payment processes, and enhance the overall customer experience in the competitive food and delivery app market.

I highly recommend the complete deep dive article by DEUNA for more interesting info on this topic.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()