Mastercard Pushes Agentic Commerce Live… and Australia Goes First

Hey Payments Fanatic!

Mastercard just completed Australia’s first fully authenticated agentic transactions on its network.

The transactions ran through Mastercard’s Agent Pay framework, with issuers, acquirers, and merchants all able to see that an agent initiated the payment, with cardholder consent.

A Commonwealth Bank debit card was used to buy cinema tickets. A Westpac credit card handled a travel booking. Different use cases, same principle. Agents inside the rails, not around them.

Under the hood, the transactions flowed through IPSI and were powered by Maincode’s sovereign LLM, Matilda. Proof that agentic payments can work across banks, merchants, and models.

Back on April 30, 2025, I flagged this first when Mastercard embraced stablecoins, invested in Corpay, and introduced Agent Pay. At the time, it was positioning.

👉 You can revisit the context I shared last year here.

Today, it’s execution. Agentic payments are no longer a concept on a slide. They’re running live, on real rails, with real cards.

What else is quietly reshaping Payments right now? Scroll down 👇 Catch up, and I’ll be back tomorrow in your inbox.

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇦🇺 Mastercard accelerates AI-powered commerce with Australia’s first authenticated agentic transactions using Agent Pay. By enabling fully recognized and authenticated agentic transactions, Mastercard’s trusted agentic framework process brings AI agents into the payment flow as visible, governed participants, ensuring that every transaction is secure, transparent, and trusted.

🇩🇪 Berlin plans to introduce the European payment system Wero. The aim is to enable digital payments for administrative services in Berlin via Wero. This is intended to help the relatively new service gain wider acceptance. Wero is a project of several European banks and is intended to become a European alternative to the US payment service provider PayPal.

🌍 OKX Card launches in Europe to remove friction from everyday crypto payments at retailers worldwide. The OKX Card enables direct stablecoin payments anywhere in the world where Mastercard is accepted, with zero fees and instant crypto rewards of up to 20% on eligible purchases.

🇪🇬 Valu secures $64m credit line from National Bank of Egypt. The new facility will support Valu’s growth plans and follow its recent market entry into Jordan. The company said the funding will provide additional liquidity to scale operations and expand its product offering.

🇬🇧 Sokin secures $100m in growth financing from Oxford Finance. The facility will accelerate Sokin's expansion across North America, Asia, the Middle East, and South America, and fast-track the acquisition of further regional licenses, banking partnerships, and global infrastructure scaling.

🇬🇧 Scoro acquires expense management FinTech Envoice. Scoro says this integration will make it significantly easier to capture accurate cost data through its professional services automation platform, which consolidates estimating, resourcing, project tracking, billing, and reporting functions for project managers.

🌍 Circle expands USDC payments network to Europe and India. The company announced that EU and India payouts are now live through a partnership with Saber Money. The new corridors allow businesses and users to settle locally without navigating multiple integrations or complex banking arrangements.

🇱🇰 Pine Labs expands its footprint in Sri Lanka by deploying an API-first Card Issuing and Processing Platform for Pan Asia Bank. Under this partnership, Pine Labs will deploy a full-stack Credit Card Management System for Pan Asia Bank. This platform will support high transaction concurrency and uptime, giving the bank flexible and scalable product configurations.

🇲🇾 Razorpay Curlec brings PayPal Payments to Malaysian SMEs, expanding international payments through a single platform. The integration allows merchants using Razorpay Curlec to accept cross-border payments via PayPal alongside local payment options already available on the platform.

🇺🇸 Elavon is collaborating with Microsoft to introduce Elavon Live Payments. Elavon Live Payments enables businesses and professional service providers to securely send invoices and collect customer payments with just a few clicks on a computer or mobile device.

🇬🇧 TerraPay partners with MilX to power global payouts for content creators. TerraPay’s partnership with MilX addresses these challenges head-on, enabling creators to receive earnings instantly in local currencies across 70+ markets via bank accounts, wallets, and cards.

🇵🇹 Bison Bank advances with first Portuguese stablecoin. Bison Bank plans to issue Portugal’s first bank-backed stablecoin, expand asset tokenization, and become the country’s first cryptobank, enabled by the EU’s MiCA framework. The bank aims to launch the services in the first half of the year, according to CEO António Henriques.

🇺🇸 Ripple moves into corporate finance. Following Ripple's acquisition of GTreasury, we're proud to introduce Ripple Treasury, Powered by GTreasury: a unified platform that gives CFOs, Treasurers, and Accounting teams complete control over both traditional and digital treasury operations.

🇺🇸 Gemini unveils Gemini Credit Card, Zcash Edition. Zcash Edition allows users to endorse the Zcash ecosystem. Customers can stack Zcash, an established privacy-focused token that’s gained notoriety for offering users the ability to send shielded crypto transfers.

🇫🇷 Stablecoin player Fipto achieves dual authorisation status. This dual-authorisation status allows Fipto to manage the entire payment value chain, bridging the gap between traditional fiat currencies and digital assets under a single compliance framework.

🌍 Ex-Revolut duo Joao Alves and Guilherme Gomes raise $6 million seed round to expand on-chain finance app Bleap. The company plans to deploy the fresh capital toward yield vaults, on-chain trading expansion, and growth across Latin America and Europe.

GOLDEN NUGGET

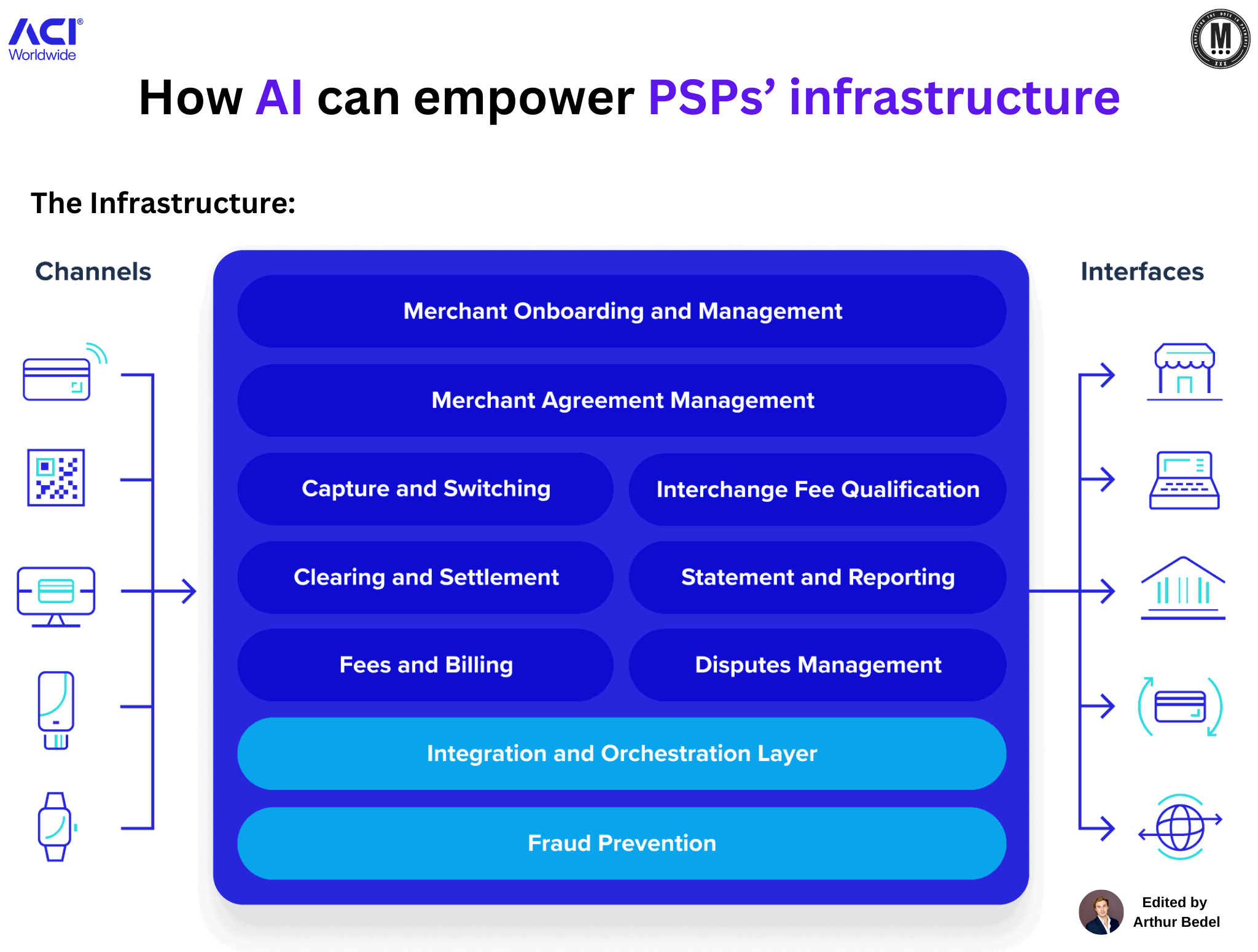

𝐇𝐨𝐰 𝐀𝐈 𝐜𝐚𝐧 𝐞𝐦𝐩𝐨𝐰𝐞𝐫 𝐏𝐒𝐏𝐬 & 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫𝐬 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 by ACI Worldwide 👇Created by Arthur Bedel 💳 ♻️

PSPs and Merchant Acquirers are entering a new era. The traditional stack — onboarding, routing, settlement, billing, fraud, and reporting — is being rebuilt around AI-native infrastructure.

AI removes manual work, increases approvals, reduces fraud, automates compliance, improves margins, and enables real-time decisioning across the entire acquiring chain.

Below is a clear view of where AI is reshaping the PSP infrastructure model.

𝐓𝐡𝐞 𝐀𝐈 𝐋𝐚𝐲𝐞𝐫𝐬 𝐚𝐜𝐫𝐨𝐬𝐬 𝐭𝐡𝐞 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐒𝐭𝐚𝐜𝐤:

1️⃣ AI-Driven Fraud, Risk & Trust Infrastructure

→ Role: Real-time fraud detection, behavioral analysis, adaptive risk scoring, and automated decisioning.

↳ ACI Worldwide’s machine learning engine continuously retrains on billions of transactions to reduce false positives and increase trust.

2️⃣ Smart Authorization & Routing Engines

→ Role: Predictive issuer logic, L2 routing intelligence, scheme preference modeling, and dynamic retry strategies.

↳ Checkout.com leverages AI-driven issuer insights to optimize approval rates across global markets.

3️⃣ Merchant Onboarding & Underwriting Automation

→ Role: Automated KYC/KYB, document intelligence, AML screening, and risk-based onboarding workflows.

↳ Alloy uses ML-based identity intelligence to reduce onboarding friction and improve underwriting accuracy.

4️⃣ AI-Powered Disputes, Chargebacks & Compliance

→ Role: Case classification, evidence generation, dispute automation, fraud pattern clustering, and scheme-rule intelligence.

↳ Forter applies AI to categorize disputes and automate representments across issuers, acquirers, and PSPs.

5️⃣ AI for Merchant Reporting, Analytics & Personalized Insights

→ Role: Revenue intelligence, anomaly detection, pricing insights, & merchant-level optimization.

↳ Pagos delivers issuer and BIN-level intelligence that PSPs use to optimize routing, revenue, and merchant performance.

6️⃣ AI in Payments Orchestration & Optimization

→ Role: Traffic shaping, cost optimization, retry logic, scheme selection, FX intelligence, and routing automation.

↳ DEUNA uses AI-driven orchestration to unify acceptance, routing, and optimization into a programmable commerce layer.

7️⃣ AI-Powered Account, Wallet & Embedded Payments Infrastructure

→ Role: Balance forecasting, settlement optimization, automated treasury ops, and embedded finance logic.

↳ Dfns provides secure, policy-controlled wallet infrastructure that powers automated treasury and embedded payment flows.

Some PSPs do perform in all of those buckets:

↳ ACI Worldwide, Checkout.com, DEUNA and few others 😉

AI is not an add-on for PSPs — it is becoming the intelligence layer inside onboarding, routing, pricing, fraud, settlement, and merchant operations.

Source: ACI Worldwide

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()