Mastercard Sets the Rules for Agentic Commerce… Before Things Break

Hey Payments Fanatic!

Mastercard is moving fast to define how agentic commerce should actually work.

The company just joined Google’s Universal Commerce Protocol and is pushing to bring Agent Pay into Microsoft Copilot Checkout. Same message everywhere: speed without trust doesn’t scale.

This is about rules: clear intent, verified agents, and secure credentials. The boring but critical stuff that turns AI commerce from demos into real infrastructure.

Mastercard is working across the ecosystem with players like OpenAI and PayPal on intent and identity. It’s also expanding Start Path to pull startups into this next phase...

And Another Signal from Asia...

Apple Pay is reportedly gearing up to launch in India by the end of 2026.

Talks are underway with regulators, banks, and card networks to bring tap-to-pay to iPhones and Apple Watches in one of the world’s most competitive payments markets.

If it lands, it gives Apple users a true wallet replacement. And adds a premium player into an ecosystem already dominated by UPI.

Scroll down to see what else is moving in Payments today 👇 See you tomorrow with more updates.

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🌎 Mastercard is helping set the rules for agentic commerce, partnering with Google and Microsoft to scale secure AI-driven payments. Through open protocols, Agent Pay, and Start Path, the focus is clear: speed with trust, interoperability, and standards that enable AI commerce to grow safely.

🇦🇪 Aafaq launches World Elite Mastercard credit card, a new premium Islamic finance product. The innovative product has been designed to deliver upgraded features that elevate customer lifestyle experiences. Additionally, Mastercard said to weigh Zerohash investment after ending takeover talks worth billions. Mastercard is considering making a strategic investment in blockchain infrastructure firm Zerohash after acquisition talks collapsed when the crypto company opted to remain independent.

🇧🇭 Floward introduces the Floward Card in Bahrain with SimpliFi, INFINIOS, and Mastercard. The launch leverages Bahrain’s digital-first FinTech ecosystem, positioning the Floward Card as a modern alternative to cash gifts that fits seamlessly into everyday spending.

🇰🇷 Airwallex acquires Paynuri to unlock global opportunities for Korean businesses. With the acquisition, Airwallex has secured key financial licenses in South Korea, enabling Korean enterprises to scale internationally while helping global brands operate more seamlessly in the local market.

🇺🇸 Stripe’s John Collison says no rush for payment firm to go public. In an interview, Collison noted that Stripe is operating in what he described as the fastest-moving period the payments industry has seen since the company’s founding.

🇮🇳 Pine Labs to fully acquire RBI-licensed Agya Technologies through Setu. Pine Labs currently holds around a 25% stake in Agya Technologies and intends to acquire the remaining shares in the near term, potentially in multiple tranches, according to the filing.

🇺🇸 Credit Key closes $90m in growth capital to scale B2B payments platform. The new capital will be invested in scaling growth and strengthening Credit Key's continued product innovation as B2B eCommerce merchants, marketplaces, and FinTech platforms increasingly seek solutions.

🇮🇳 Apple Pay is set to debut in India by the end of the year. According to the reports, Apple is in active discussions with regulators, banks, and card networks to finalise commercial arrangements and secure the necessary clearances. If all goes to plan, the service could go live toward the end of 2026, marking a major step in Apple’s efforts to expand its financial services footprint.

🇫🇮 TrueLayer and Stripe power pay-by-bank payments in Finland with Kustom Checkout. Through this collaboration, thousands of Kustom merchants can now offer shoppers a localised, instant bank payment option at checkout, enabled by TrueLayer’s open banking technology and Stripe’s global payments infrastructure.

🇺🇸 OnePay introduces Swipe to Finance, powered by Klarna. The feature will allow eligible OnePay Cash customers to convert recent purchases into fixed-term payment plans directly within the OnePay app. The offering will be available for eligible debit transactions.

🇯🇵 Fiserv and Sumitomo Mitsui introduce the Clover suite of products, enabling digital commerce for millions of merchants. This collaboration will bring an integrated payments and business management platform to millions of retail, food & beverage, and professional service small businesses (SMBs) in Japan.

🇦🇪 Saudi Sudanese Bank taps Network International to power digital payment processing. Through the partnership, Network International says it will provide the bank with a full suite of end-to-end digital payment processing services, including Mastercard Sponsorship, prepaid issuing, and a range of value-added services designed to support the bank's digital ambitions.

🇻🇳 9Pay opens a green corridor for U.S. FinTechs via stablecoin-to-QR payments in Vietnam IFC Sandbox. Through its Stablecoin-to-QR Payment Gateway, U.S. users can pay seamlessly by scanning local QR codes using their existing e-wallets or stablecoin applications, without friction or currency conversion complexity.

🇬🇧 London FinTech Guavapay founder quits ahead of Mastercard court battle. Orkhan Nasibov, who launched the company in 2017, has stepped back from his role at the helm of the company due to “fatigue and health-related reasons,” a spokesperson said.

🇵🇭 Visa and RCBC launch debit partnership for more payment options. With Visa debit credentials, RCBC customers now have more secure, seamless ways to pay while maintaining the familiar control of transacting directly from their bank accounts.

🇬🇧 Acquired.com partners with Visa to unlock transparent, trusted, and flexible payment experiences. The collaboration introduces an alternative to Direct Debit and card-on-file, designed to deliver a smarter way to make recurring payments. Continue reading

GOLDEN NUGGET

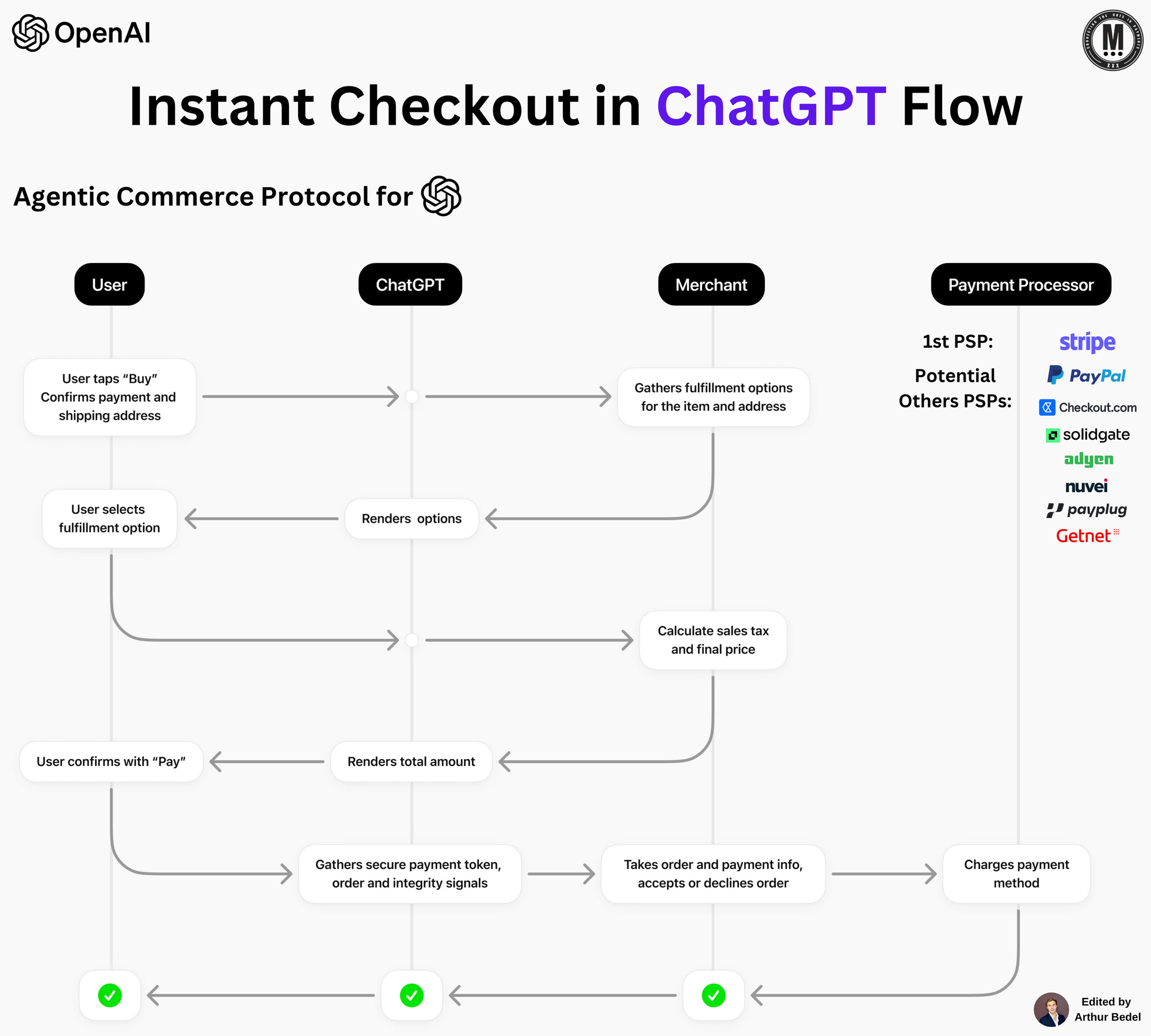

🚨 𝐁𝐮𝐲 𝐢𝐭 𝐢𝐧 ChatGPT — Instant Checkout & Agentic Commerce Protocol by OpenAI 👇Created by Arthur Bedel 💳 ♻️

OpenAI has launched “Instant Checkout,” letting people complete purchases directly inside ChatGPT. It’s powered by an open standard — 𝘁𝗵𝗲 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗖𝗼𝗺𝗺𝗲𝗿𝗰𝗲 𝗣𝗿𝗼𝘁𝗼𝗰𝗼𝗹 — co-developed with Stripe so AI agents, users, and merchants can coordinate orders securely without merchants changing their payments stack. U.S. users can buy from Etsy sellers today, with over a million Shopify merchants coming next; multi-item carts and more regions are on the roadmap.

𝐇𝐨𝐰 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 𝐰𝐨𝐫𝐤𝐬 (step-by-step, per diagram)

1️⃣ 𝐔𝐬𝐞𝐫: Taps “Buy,” confirms shipping & payment.

2️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Returns fulfillment options (e.g., delivery choices).

3️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓: Renders those options; user selects.

4️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Calculates taxes, fees, and final price; sends back totals.

5️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓: Shows the all-in amount; user confirms “Pay.”

6️⃣ 𝐂𝐡𝐚𝐭𝐆𝐏𝐓 → 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭: Sends a secure payment token plus order & integrity signals (only what’s needed to fulfill).

7️⃣ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 → 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫: Authorizes & charges using the merchant’s existing provider; merchant remains the Merchant of Record and handles fulfillment, returns, and support.

𝐓𝐡𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥 (ACP) by OpenAI

► 𝗢𝗽𝗲𝗻 𝘀𝘁𝗮𝗻𝗱𝗮𝗿𝗱: Open-sourced so anyone can integrate agentic buying flows.

► 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀-𝗮𝗴𝗻𝗼𝘀𝘁𝗶𝗰: Works across processors. Stripe merchants can enable with minimal code; others can use Stripe’s Shared Payment Token API or ACP’s Delegated Payments spec—no processor swap required.

► 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗰𝗼𝗻𝘁𝗿𝗼𝗹: You keep your stack and customer relationship end-to-end.

Note: This protocol is agnostic of Payment Processors. Checkout.com, Adyen, Nuvei, PayPal, Payplug, Getnet, and all others are able to join. Game on.

𝐓𝐫𝐮𝐬𝐭 & 𝐬𝐚𝐟𝐞𝐭𝐲 — 𝐛𝐮𝐢𝐥𝐭 𝐢𝐧 (most important)

✔ 𝗘𝘅𝗽𝗹𝗶𝗰𝗶𝘁 𝘂𝘀𝗲𝗿 𝗰𝗼𝗻𝘀𝗲𝗻𝘁 at each step.

✔ 𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗲𝗱 𝗽𝗮𝘆𝗺𝗲𝗻𝘁𝘀 authorized only for a specific amount & merchant.

✔ 𝗠𝗶𝗻𝗶𝗺𝗮𝗹 𝗱𝗮𝘁𝗮 𝘀𝗵𝗮𝗿𝗶𝗻𝗴—only what’s required to fulfill the order.

𝐖𝐡𝐲 𝐭𝐡𝐢𝐬 𝐢𝐬 𝐚 𝐫𝐞𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧

► 𝗙𝗿𝗼𝗺 𝗿𝗲𝗰𝗼𝗺𝗺𝗲𝗻𝗱𝗮𝘁𝗶𝗼𝗻 𝘁𝗼 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲, 𝗶𝗻 𝗰𝗵𝗮𝘁: ChatGPT already helps hundreds of millions weekly discover products—now the same interface completes the buy with a few taps.

► 𝗔𝗴𝗲𝗻𝘁𝗶𝗰 𝗰𝗼𝗺𝗺𝗲𝗿𝗰𝗲, 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗮𝗹𝗹𝘆: AI coordinates options, price, taxes, and payment signals—then hands off to the merchant’s existing rails.

► 𝗢𝗽𝗲𝗻 𝗲𝗰𝗼𝘀𝘆𝘀𝘁𝗲𝗺: With ACP open-sourced, any merchant or platform can adopt agentic checkout without ceding data or control.

Source: OpenAI

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()