Mollie Joins EPI… and Wero’s Pan-European Push Just Got Real

Hey Payments Fanatic!

Mollie just became a Principal Member of the European Payments Initiative, committing to offer Wero and help scale a unified, bank-based payment method across Europe from 2026.

That move puts Mollie right at the center of Wero’s rollout. Merchants using Mollie will be able to accept Wero directly through the platform, without new integrations or heavy lifting.

Wero is designed to harmonize digital payments across Europe through real-time. The ambition is clear. One European standard, replacing fragmented national schemes like iDEAL. There’s a deeper write-up I put together waiting for you below.

What stands out to me is the distribution. Mollie brings a large, fast-growing merchant base, and that’s exactly what Wero needs at this stage. Acceptance drives usage. Usage drives relevance.

Martina Weimert, CEO of Wero, says it is already live for P2P in Germany, France, and Belgium, with e-commerce rolling out next. This is another signal that European Payments sovereignty is moving from vision to execution.

If you want to keep track of how Payments stack is coming together, scroll down and see what else is moving today 👇

Cheers,

Marcel

Q&A

📰 The secret sauce behind payment performance. A conversation with Checkout.com’s Daniel Linder. Arthur Bedel speaks with Daniel, Senior Product Director at Checkout.com, about why real payment performance is about maximizing value for merchants, not just approvals, and how Checkout.com combines technology, data, and issuer relationships to do it at scale.

INSIGHTS

📰 The iDEAL to Wero Transition: What 2026 Will Teach Us About Building Payment Infrastructure in Europe. While policymakers and regulators warn that reliance on non-European players poses strategic and data-sovereignty risks, the transition exposes a core challenge: consumers prioritize familiarity and trust over abstract notions of sovereignty. Read the full article here

NEWS

🌍 Mollie joins EPI Company, accelerating Wero adoption as the pan-European payment method. This development marks a significant milestone in the rollout of Wero and underscores Mollie’s commitment to enabling the next generation of pan-European payment experiences for merchants and consumers alike.

🇺🇸 JPMorgan to replace Goldman as Apple Card issuer. The deal would cement JPMorgan's position in the credit cards segment and mark another win for CEO Jamie Dimon, under whose leadership the bank has become a dominant force in retail and investment banking.

🇺🇸 Fiserv collaborates with Microsoft to accelerate AI-driven innovation. The two firms will work together to embed AI into Fiserv platforms, equipping its global workforce with advanced tools and driving intelligent capabilities to deliver greater value to Fiserv clients.

🇮🇹 Satispay launches three new funds and inaugurates investment section. With the new products, Satispay inaugurates the new Investments section of the app, "designed," for a clear and simple experience, and to provide access to all the information needed to monitor the progress of one's choices.

🇺🇸 Aevi and Verifone partner to simplify and scale in-person payments globally. Together, the companies address the fragmentation, proprietary integrations, and operational complexity that have historically slowed international in-person payment expansion.

🇪🇺 BVNK secures direct SEPA access for 24/7 instant euro payments. As a result, customers gain 24/7 instant euro payments settling in seconds, with greater resilience and visibility, as payments are delivered directly by BVNK rather than through partner banks.

🇪🇬 Arab Financial Services launches SoftPOS in Egypt following central bank approval. The new solution is designed to transform any NFC-enabled Android smartphone into a secure, fully functional payment terminal. AFS aims to simplify digital commerce and foster a more inclusive financial landscape by lowering the barriers to entry for merchants.

🇺🇸 Marqeta appoints Patti Kangwankij as CFO. Ms Kangwankij will oversee all aspects of Marqeta’s financial operations, supporting the Company’s strategy to drive rapid growth and enhanced profitability. Ms Kangwankij is an experienced finance executive with over 20 years of experience.

🇺🇸 Polygon Labs unveils ‘Open Money Stack’ to power borderless stablecoin payments. The stack is designed to work with different blockchains and be customizable, allowing financial institutions and FinTech firms to integrate components such as on-chain settlement, fiat access, and compliance tools.

🇺🇸 Volante Technologies unveils Low-code Studio. New solution empowers financial institutions to modernize at record speed by deploying and maintaining high-quality payment workflows and processing systems with greater autonomy, reduced costs, and accelerated time to market

🇲🇦 Moroccan FinTech Woliz raises $2.2M pre-seed to digitize small retailers, sets up chari showdown. Woliz plans to use the funds to expand its team and accelerate the onboarding of merchants across various Moroccan cities. Read more

🇺🇸 Stripe helps power a new shopping experience in Microsoft Copilot. Copilot users in the US will be able to buy products from Etsy businesses and retailers like Urban Outfitters and Anthropologie, all without leaving the chat. Keep reading

GOLDEN NUGGET

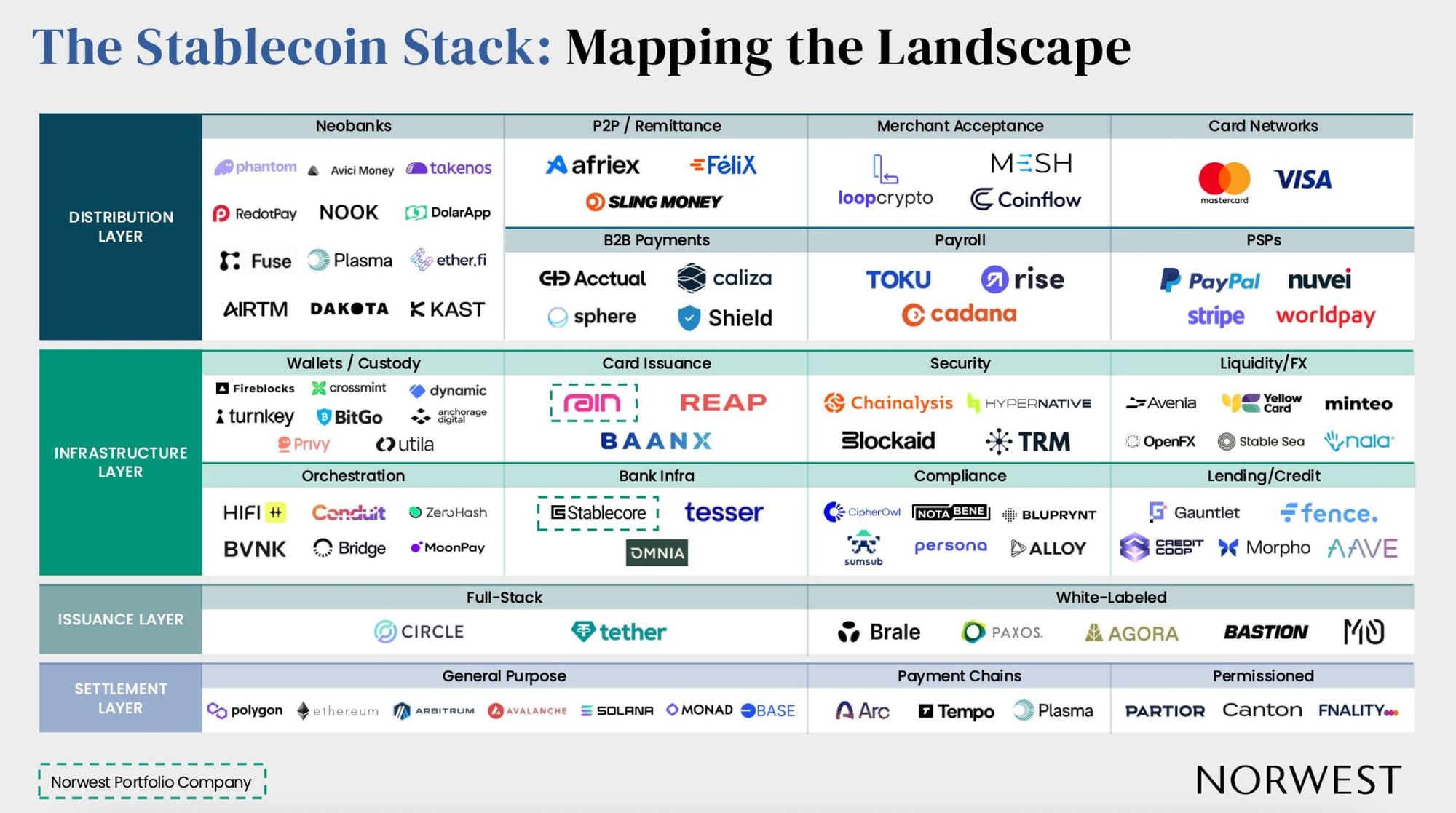

Stablecoins aren’t just tokens. They’re an entire technology stack.

Issuance. Settlement. Infrastructure. Distribution.

And here’s the real shift:

Companies are no longer picking a single layer, they’re moving up and down the stack.

👉 New payment-native settlement chains are emerging.

👉 Stablecoin issuance is becoming a product choice, not a side experiment.

👉 Infrastructure is abstracting away blockchain complexity (custody, compliance, cards, orchestration).

👉 Distribution makes stablecoins completely invisible to the end user.

The winners won’t be the ones launching yet another coin.

They’ll be the ones connecting the stack end-to-end, and moving money instantly, globally, and compliantly.

Source: Norwest

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()